Visa Direct has announced the appointment of Vira Platonova as its new Global Head. Daniel Webber leads the first interview with the brand’s former Chief Revenue Officer to find out more about her plans for the money movement giant.

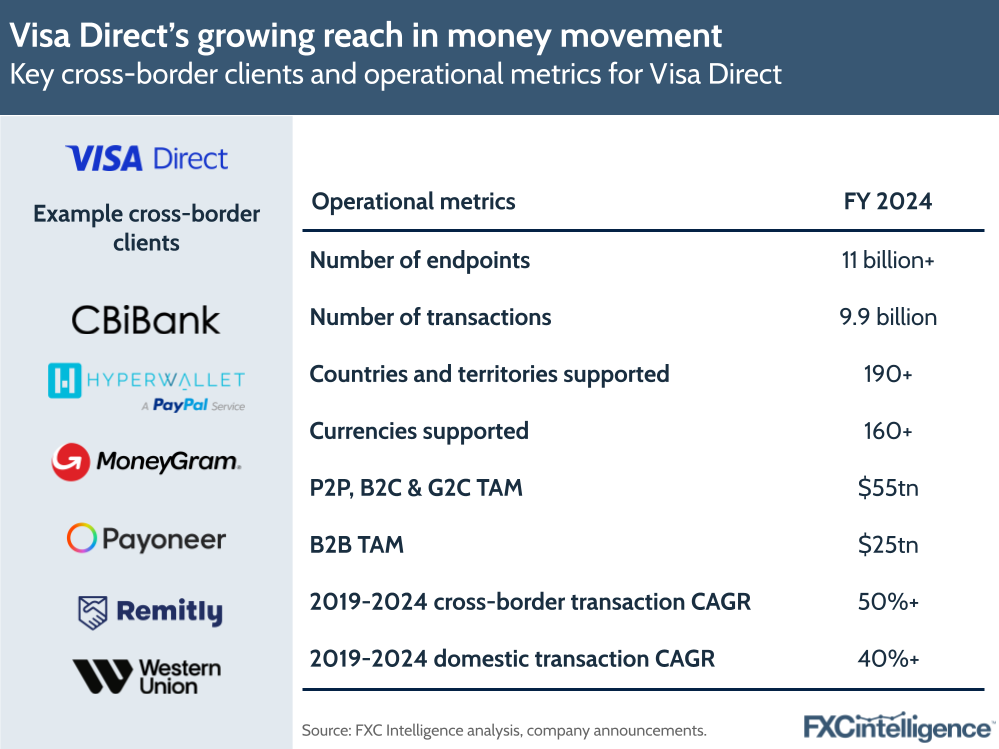

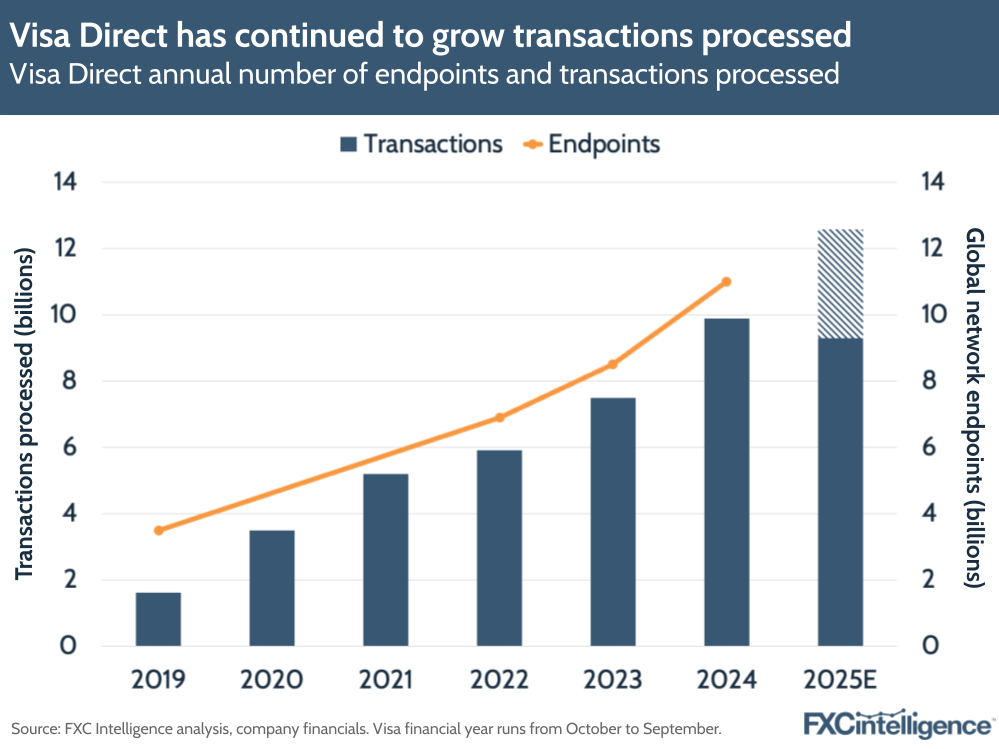

Visa’s B2B2X solution Visa Direct is a critical part of money movement in the cross-border payments space. Providing card and non-card rails that underpin P2P, B2B, B2C and government-to-consumer (G2C) payments and beyond, the brand processed 3.3 billion transactions in Q3 2025 alone, and is on course to pass 12 billion in FY 2025.

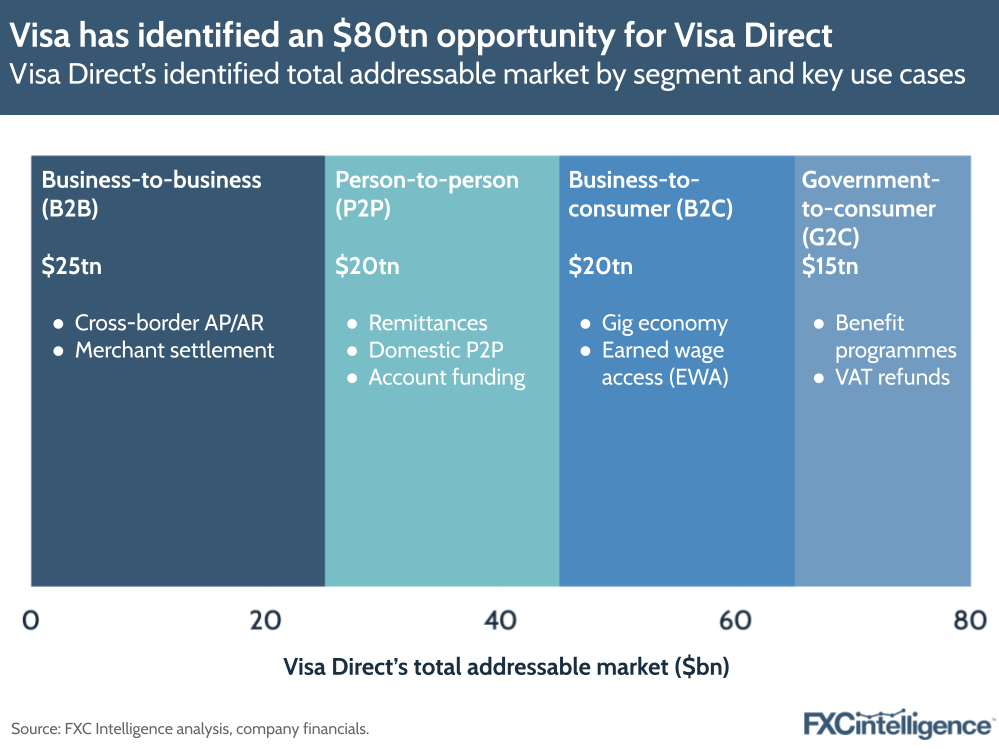

Now, with the brand actively pursuing an $80tn opportunity in domestic and cross-border flows, it has appointed a new Global Head: its former Chief Revenue Officer Vira Platonova.

Now in her seventh continuous year working for Visa, and tenth overall, Platonova has held the position of Chief Revenue Officer and Global Head of Sales and Solutioning Teams since February 2024. Prior to this, she held the position of Senior Vice President and Group Country Manager, CISSEE, in which she oversaw operations across 17 Central and Eastern European, Caucasian and Central Asian markets from Visa’s regional headquarters in Kyiv, Ukraine, including the acceleration of payments digitisation that occurred in response to Russia’s invasion.

Ahead of the official announcement to the market, FXC Intelligence CEO Daniel Webber caught up with Platonova to discuss her appointment, and how she sees Visa Direct’s brand and product positioning evolving amid wider market changes.

Vira Platonova’s appointment as Global Head of Visa Direct

Daniel Webber:

A pleasure to be with you and to be the first external person to congratulate you on your new role. What excites you most about the opportunity to lead Visa Direct?

Vira Platonova:

Global Head goes far beyond running sales and the solutioning, and it includes development and enhancement of our product, of our network, current and non-current, and operations part.

The first moment I heard from Chris [Newkirk, President, Commercial & Money Movement Solutions, Visa] about the opportunity, I was positively shocked for sure, and I realised that I have a unique chance to lead this 360° world of Visa’s Money Movement business. Not only from a business and client perspective, but to be this integral point where product, network, operation, treasury, innovation and client meets.

The whole strategy of Money Movement will depend on me, which sounds extremely appealing and scary. But I have an amazing team.

I’m 20 months into my current role as Chief Revenue Officer, and through these 20 months, I have managed to build an amazing sales and solutioning team across the globe, in each region, in most of the countries.

I’m 100% confident that our offering to clients is already really strong and at the same time, the product team and network and operation team, which also become a part of my responsibility, are also very strong. The people who are leading those functions are outstanding and I need to learn from them a lot.

The Visa Direct brand group

Daniel Webber:

A lot of people are familiar with Visa Direct’s sub-brands, such as Currencycloud and B2B Connect. How do you see those fitting in?

Vira Platonova:

When I speak about Visa Direct, I speak about the Visa Direct umbrella, which includes B2B Connect, Currencycloud, Earthport, which we call VPL – Visa Payments Limited – now, and our card rails.

Currencycloud and VPL are the non-card rails for us. For the last 20 months, we’ve made sure that we optimise those resources and the capacity of both platforms. We are making decisions about how we send money on behalf of our clients, taking into account the best components of each of the platforms.

We don’t want our customers and clients to think, “Now I’m using B2B Connect, now I’m using Currencycloud or VPL”. They’re using Visa Direct, and we guarantee that we provide the best solution for each particular case that is required by the client.

The future of the cross-border payments landscape

Daniel Webber:

How do you expect the cross-border payment space to evolve over the next few years, and where do you see Visa Direct’s place in that?

Vira Platonova:

The cross-border money movement space is extremely competitive, and that was a discovery for me when I joined this business, because I was previously in the core Visa business where there are not so many players.

That’s really good, because innovations are happening daily in this world and we have to not only respond, but be ahead and be someone to follow and to showcase.

This space is driven by the demand from the consumer side, and they all want instant payments, a fair price and trusted rails. These are three points of competition. Years earlier we underestimated [the potential of] our current money movement rails a little bit, despite us developing them and them growing very fast.

But now understanding how that card is a unique 16-digit token that can be recognised anywhere in the world and that you can move money to this 16-digit token anywhere in the world from anywhere in the world, that gives us a huge unique opportunity and competitive advantage. And we are going to accelerate this capability much, much more.

I believe in the next two, three years we will see an acceleration of the competition, we will see significant improvements in the UX, the quality of service, the quality of rails and the services that are provided for each corridor. For example, delivery confirmation, different reports, transparency on FX and transparency on the cost of the transaction for consumers, on any types of rails.

In the end we will reach the quality, speed and intuitiveness of such transactions that we have in many domestic markets.

Competitive positioning beyond cards

Daniel Webber:

Beyond the cards piece, how do you see Visa Direct’s competitive positioning versus the market?

Vira Platonova:

For cards, we are in a very strong, highly competitive position. In the non-card space, the opportunities in these markets are unlimited.

Despite there being so many players, we are still fighting with cash. When we look, for example, at the US to Mexico corridor, we understand that at least half of all volumes, incoming and outcoming, are still cash rails. So, yes, competition is tough. And as I said, it’s those three things through which we compete right now: speed, price and trustfulness. The confidence that the money will reach the end point for the customer is very important.

The reason why there are so many players in this market is that we have hardly scratched the surface yet in money movement for non-cards and cards. But our role here is to be an ecosystem, to be the rails – not to compete with them.

That’s how we position ourselves: we will never compete with our clients for the end consumer, we are providing the rails and their job is to make sure that they utilise this competitive advantage in the best way.

Stablecoins’ role in Visa Direct’s strategy

Daniel Webber:

Where do you see stablecoins fitting into the wider strategy?

Vira Platonova:

Stablecoins are definitely becoming a big thing. We’ve developed our strategy, our view for the next couple of years, on how we want to include stablecoin into our money movement proposition, and they will definitely be a powerful extension of Visa’s money movement network.

We will have a number of updates and announcements in the coming months on how we want to grow stablecoins as a part of our money movement. That’s probably all I can say for now.

Visa Direct’s evolution

Daniel Webber:

How have you seen Visa Direct evolve over the 20 months you’ve been with it so far, in terms of the products, the positioning and the clients?

Vira Platonova:

We’ve been building a strong foundation for our non-card world, because, as you know, Visa’s core business is its card purchase business and money movement between cards.

But now we are definitely at the forefront of this direct strategy overall for current money movement and non-card. If we split our strategy into these two big parts, and that’s how we look at it right now, I can say that our current money movement ecosystem has become even stronger.

Now we have 90%+ of the whole globe enabled to move money between cards, and this is a unique capacity and capability, because it is instant, transparent and, most importantly, trusted by consumers and our B2B clients.

But the non-card space was new for us two to three years ago. That’s not the case anymore.

We have already proved to ourselves and to our clients that we are one of the most reliable partners and networks in the non-card space. We have one of the largest account-to-account and wallet-to-wallet networks across the globe. And overall we reach almost 11 billion endpoints.

In the last 12 to 20 months, we’ve got traction with a number of the largest remitters and overall global clients around the world. We became trusted partners of them; we brought a number of innovations to the market; we developed our view and strategy on stablecoin.

And you will see more coming. We now feel very confident when we talk to our clients about our capabilities in the non-card and card space.

Daniel Webber:

What innovations have excited you most in the market during that time?

Vira Platonova:

One of the brightest and most noticeable innovations in the last couple of quarters was the launch of Tap to P2P [Visa’s contactless in-person P2P payments solution], which we started in the US through our partnership with Samsung.

We launched a number of white-label projects, moving money between mobile numbers using our alias directory via card rails. And we see us launching effective, competitive, non-card rails for a number of our largest clients.

Daniel Webber:

Is there anything else that you would like to mention before we finish?

Vira Platonova:

The key success of any big strategic project is changing people’s daily lives.

Payments is definitely something that we do daily and which is critical for us. Who are those people who are driving those technologies to clients and to the market?

It’s not just words: I really feel and believe that we have the best team ever to bring these Direct rails to market and be the best.

So in the next 12 months, we’ll show this.

Daniel Webber:

Fantastic, more to come. Vira, thank you.

Vira Platonova:

Thank you.