Payoneer saw a strong FY 2024 on the back of a surge of B2B volumes. We speak to CEO John Caplan about how the company is aiming to grow its share of this multi-trillion dollar market, as well as the impact of its recent acquisition in China.

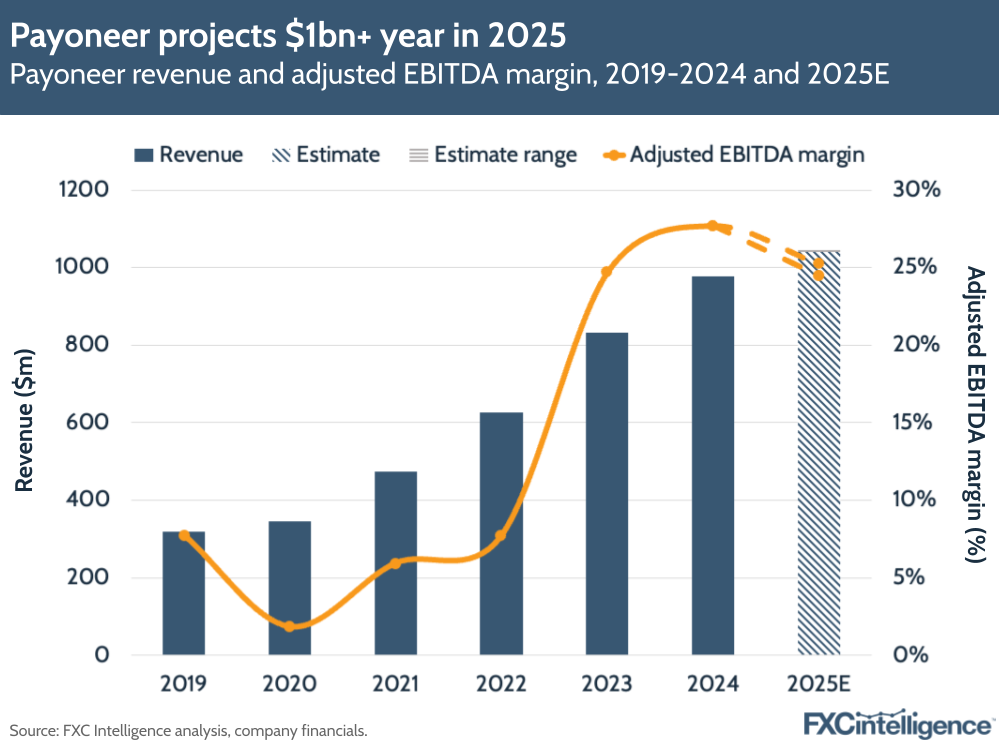

Payoneer’s revenue grew 18% to $977.7m in 2024, on the back of a 21% rise in annual volumes to $80bn. The SMB-focused payments processor continued to see strong growth in B2B volumes, which increased 42% YoY in 2024, surpassing the company’s 25% target. Adjusted EBITDA reached $271m for the year, driving a 28% margin.

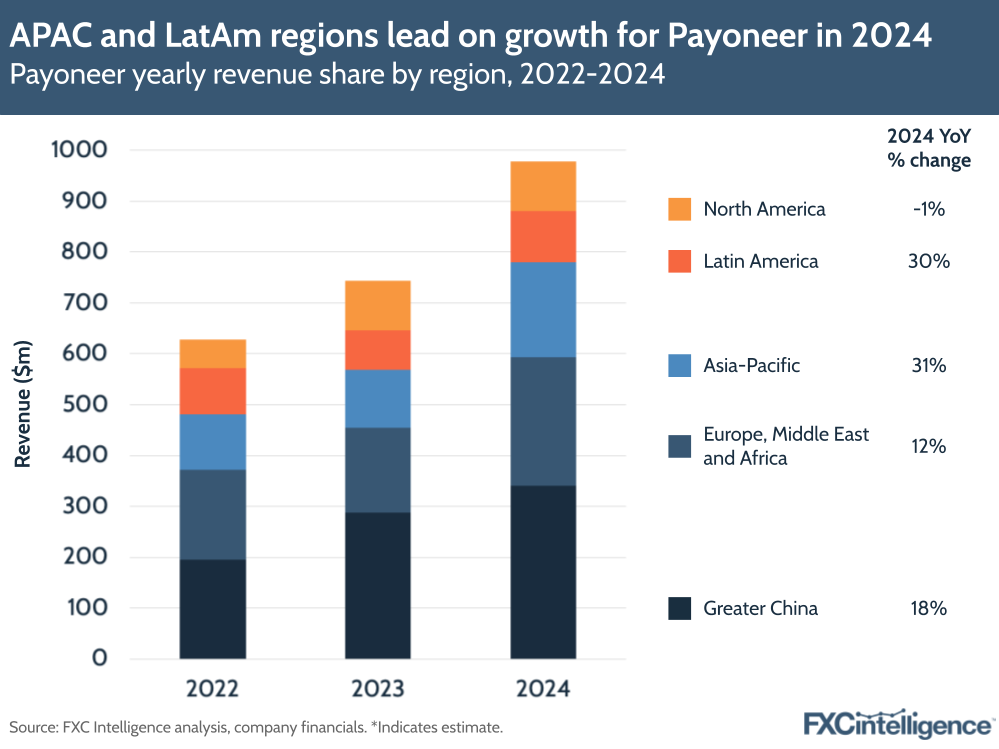

The company saw strong growth in Latin America and APAC, though its highest share of revenues were reported in Greater China. Payoneer also announced that it had received regulatory approval for its previously announced acquisition of a licensed China-based payments service provider, which will make it one of few Western companies to hold such a license following the closing of the acquisition in H1 2025.

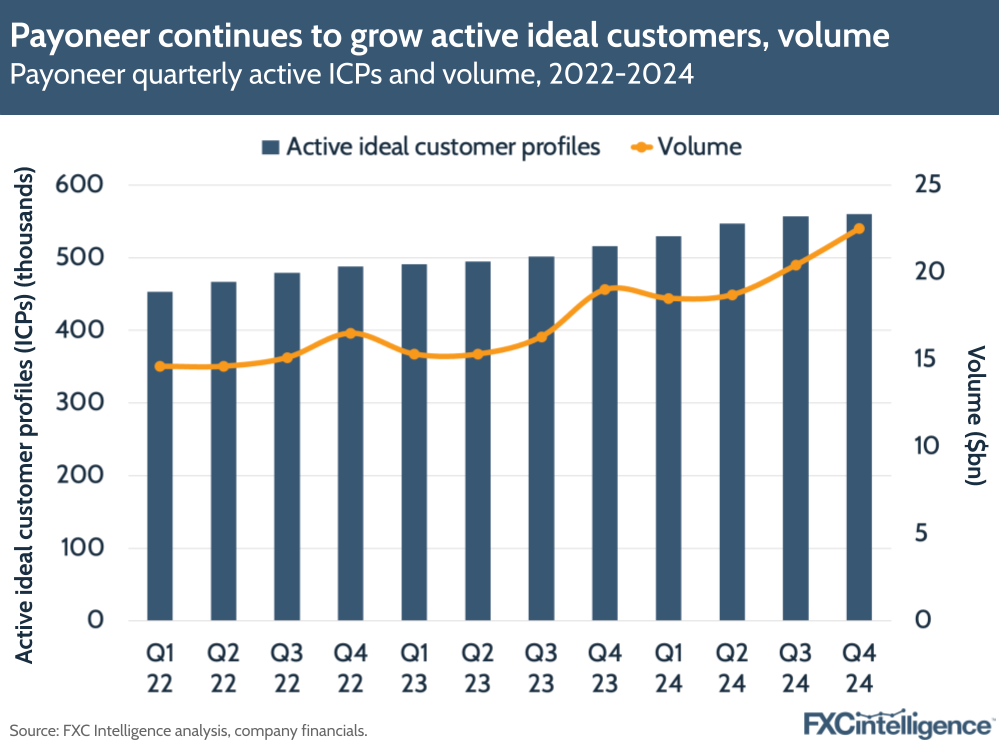

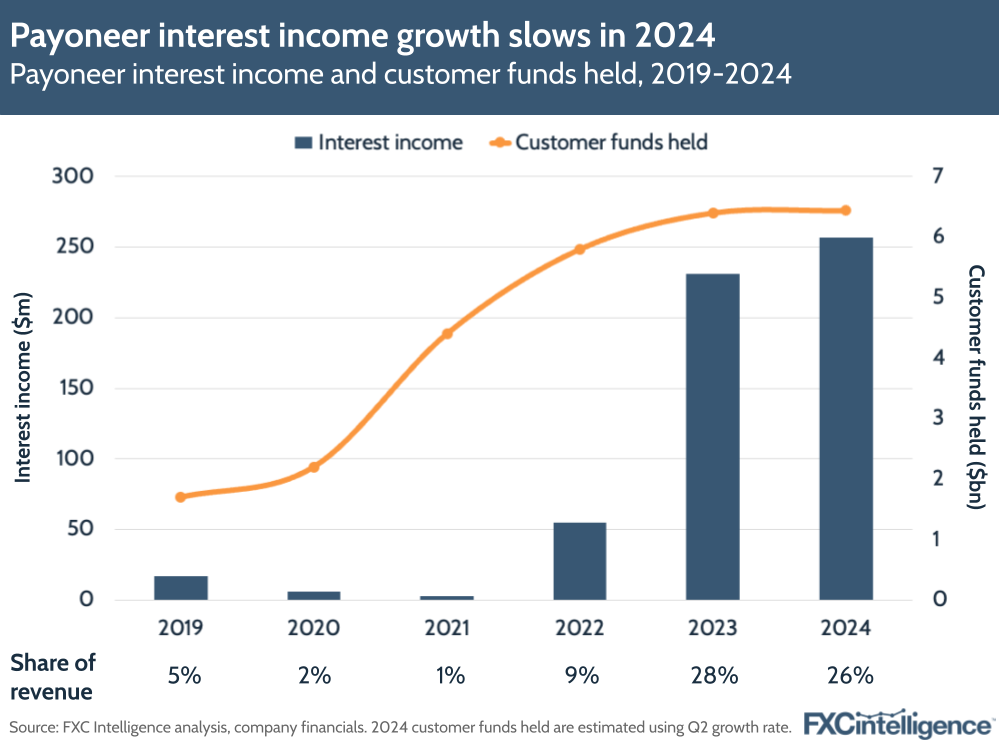

A continued focus for Payoneer is on boosting its number of Ideal Customer Profiles (ICPs) – customers handling over $500 in monthly volume that were active over a trailing 12-month period. ICPs rose by 8% to 560,000 in Q4 2024, with the company noting that ARPU excluding interest income grew 21% YoY in the quarter. Interest income still took up a notable portion (26%) of Payoneer’s overall revenue in FY 2024, though growth in this metric has slowed significantly compared to the previous year (11%, down from 320% in 2023), and the company’s revenue excluding interest income rose 20% to $721m.

Going forward, Payoneer is projecting revenues to be between $1.04bn and $1.05bn, including $215m of interest income and $825m-835m of core revenue. At the midpoint of the company’s guidance implies 15% growth in core revenue excluding interest income. This includes an expected 25% growth in B2B volumes, as the company continues to target a multi-trillion dollar SMB payments opportunity (which we’ve projected to rise to $21.2tn out of a wider $50tn TAM for B2B cross-border payments by 2032).

We spoke to CEO John Caplan about how Payoneer continued to outpace the B2B payments market in 2024, as well as how it aims to grow share in 2025.

Payoneer FY 2024 key revenue drivers

Daniel Webber:

John, Payoneer is becoming a big business in the space, getting very close to $1bn, and you’re outpacing the market. What were some of the key revenue drivers for Payoneer in 2024?

John Caplan:

2024 was a record year for us: $80bn of volume, 20% core revenue growth and $14m of positive adjusted EBITDA in the core business, excluding interest income. To put that in context, in 2023 we delivered $585m in core normalised revenue and a -$25m loss of adjusted EBITDA, excluding interest income. So if you think about the transformation of the P&L from $585m of core revenue to $721m, from losing $25m to making $14m in the core business, 2024 is an extraordinary year for Payoneer.

Driving that performance is our formula for growth: ICPs times ARPU minus cost to serve. We acquired more customers, we grew our ICP count 8%, we drove our ARPU [up] 21% and we’ve been extremely disciplined about our costs. And that results in the healthier, stronger, fast-growing profitable business that we have today.

In 2025, we’re going to do more of what we’ve been doing, which is acquiring more ICPs, especially focused on the high-dollar ICPs. We’ve had really strong success, net revenue and logo retention with customers who were receiving $3m or more into their Payoneer account for the trailing 12 months. So, we’re seeing larger customers leverage the Payoneer platform for all of their cross-border activity.

So the first thing is driving ICPs and larger ICPs. The next is driving revenue per customer, continuing with cross-selling more products. We’ve been very successful providing products that our customers want to attach to their Payoneer account, such as our cards. We see 70% of our card usage with our largest ICPs ($10k plus). That business has seen 30%+ growth in volume for six straight quarters. So we are seeing strength at the upmarket, in our attach rates, in our pricing and in our acquisition of customers, and we are exceptionally disciplined on our costs.

When you look at the results for 2024, that year really is a springboard for the next decade of growth for us. We’re continuing to do what we’re doing to be the provider of choice for entrepreneurs around the world that have entities in multiple geographies, that have customers and have vendors globally. Payoneer is the purpose-built solution for those businesses and our results speak for themselves.

Payoneer projects $1bn+ year in 2025

In Q4 2024, Payoneer’ saw revenue grow 17% YoY to $262m, on the back of B2B volume growth (up 37% YoY to $3bn) spurred by strong customer acquisition, as well as strength from SMB marketplaces and merchant services. The company also noted its cards as a driver, with a record $1.5bn spent on Payoneer cards in Q4 2024, up 36% over the course of the year. For the full year, this meant the company’s revenue grew 18% to $977.7m, which was above its guidance from Q3 2024.

Adjusted EBITDA rose 21% to $63m, driving FY 2024 EBITDA up 32% to $271m – a margin of 28%. Overall, Payoneer drove a 30% rise in net income for the full year, though it noted a -33% drop in this metric for Q4, with the company continuing to see rising transaction costs, sales and marketing fees and other expenses.

Payoneer is now projecting that its core business revenue (excluding interest income) will grow 15% YoY, with total revenue expected to rise 6-7% to $1.04bn-1.05bn. This more conservative growth projection is backed by the company expecting B2B volumes to grow 25%, down from 42% in 2024 but in line with long-term targets.

How investors see the cross-border payments market

Daniel Webber:

Investors have been giving the cross-border payments market a slightly harder time recently. What do you think is being misunderstood about this market?

John Caplan:

I’m an advocate for our customers. As an entrepreneur, I hear challenges from other global entrepreneurs. A business process outsourcer in the Philippines will say to me, “John, I’ve got 500 contractors around the globe and I need to give them credit cards to manage their expenses. I need to pay them and track their payments. I need to be able to make sure that they have certainty in what they do. I have customers in Germany and in Japan and in the US that I need to invoice effectively. And then I have subcontractors in Colombia and Argentina”.

The guts or the sort of central nervous system of how businesses work isn’t really well understood by investors. There’s an understanding gap between that entrepreneur who sees Payoneer as an essential solution to her ability to be successful, and an investor who thinks, “Oh, I have a Citibank account or a Morgan Stanley account and everything just works, and I call my private wealth guy”.

Between your private wealth manager for an investor and the true grit that it takes to be an entrepreneur around the world, those gritty entrepreneurs turn to us because we solve something nobody else really solves well for them.

As to the larger macro concept about how the fintech landscape has sort of taken a beating – as you’ve seen over the last 30-60 days – investors need to evaluate companies based on their growth rates and their profitability. When you look at our growth rates, our growth and profitability is accelerating, our TAM is big and we’re best-positioned to capture it.

All of the metrics that point to the health of our business are getting stronger. And so while we’ve seen the market react in this recent period, I take a long-term view of the value creation in front of us and the customer we’re serving, and I get genuine comfort. I’ll be in China the week after next meeting with our customers. I’m going to be in Dubai in a couple weeks. We have a team that was just in Argentina doing a big review with that cohort of customers.

Our customers are telling us we’re more valuable to them every day, and the products we’re building are more useful. Investors will see that in our financial performance and reward us with that. We’ve outperformed the sector [in terms of the underlying performance of the business] and we’re going to keep outperforming the sector.

Daniel Webber:

I think that some of the job is to help people that have not spent the time understanding the dynamics of the rest of the world to understand the complexities and needs of a business that is supporting that.

John Caplan:

You know this because you have access to the best data. The amount of money flowing around the world – people don’t really understand the volume, the size of that. And what I see is the pain the business owner had. I talk to those customers and they tell me over and over, “You do something my local bank doesn’t do”. They don’t have the regulatory ability and the technical proficiency to do it, and the customers don’t trust them to do it.

We have the regulatory framework, we have the technology excellence and we’re trusted, as demonstrated by $7bn of customer funds in our platform. I had an investor say to me that the market doesn’t see it yet, but you’re uniquely valuable in this space and you’re getting lumped in with all these other companies that may be features or products but not yet companies. Payoneer is a global company with a unique value proposition, taking market share and growing really quickly and profitably. We just guided to over $1bn in revenue.

Geographies, scale, industries, product attach rates, profitability. On every metric, this company is unique. It gets lumped in with everybody else, but actually we’re not AvidXchange, we’re not Bill and we’re not Flywire. There are wonderful people at all of these companies, but they aren’t delivering the growth or profitability that Payoneer is delivering.

Our job is to keep it simple and realise that entrepreneurs around the world need us and the numbers speak for themselves.

Payoneer seeks out high-value customers

Core to growth is Payoneer’s rising customer base. In particular, Payoneer continues to prioritise high-value SMBs, which they claim drive higher ARPU, retention and cross-sell potential. The company has captured this in its active Ideal Customer Profile (ICP) metric, which counts customers that have a Payoneer account containing over $500 per month in volume on average and that were active over the trailing twelve-month period.

The number of ICPs grew 8% YoY to 560,000 in Q4 2024, with volume and revenue from $10,000+ ICPs increasing by over 20%. This growth helped drive an 18% rise in volumes to $22.5bn in Q4 2024, driving an increase of 21% to $80.1bn in volume for the full year.

According to Payoneer, high-value SMBs that are using the company’s “full financial stack” contributed the most to volume growth and revenue retention, and the company continues to target the largest ICPs through its acquisition strategy. The number of actual $10,000+ clients Payoneer had in Q4 2024 was flat compared to the previous year, while ICPs with $500-10,000 going through Payoneer’s accounts rose 10%, showing there’s still work to be done to attract these clients.

Payoneer’s revenue growth strategy in 2025

Daniel Webber:

What’s in your 2025 strategy that will help the company take the next step forward?

A reasonable point you might raise is, “John, you had 5% [revenue excluding interest income] growth in 2023, you delivered 20% growth in 2024 and you’ve now guided to 15% growth for 2025”.

I’ll tell you why I’m optimistic about where our business is. At the Payoneer Investor Day in 2023, I imagine people thought, “These guys have a lot of ambition, but let’s see what they deliver”. New CEO, new management team, new strategy. And we hit the cover off the ball. Everything we did was doubly [better] than we told the market we would do.

So, we guided to 15% growth after 20% growth. It looks like a deceleration, from the numbers, but if you look at the absolute dollars and the momentum of where we are, we had a great 2024. We’re going to have a very strong 2025 on this multi-year march to build a really big and profitable company.

The first [thing that goes into our 2025 strategy] is focus. We have an incredible amount of focus on our customer. We learned a lot about our customers last year. We’re smarter than we’ve ever been. We’re clearer than we’ve ever been on the opportunity and we’re getting smarter every day. And that turns into better solutions for those customers I was just talking about.

It’s the flywheel: the better your service and the bigger your network is, the more customers come and the more products are added. In September 2023, it was ambition. Today, it’s the early stages of achievement, and that’s a very important difference.

Interest income growth slows for Payoneer in 2024

A key aspect of Payoneer’s earnings this year has been interest income, which we’ve noted has had a growing impact on cross-border payments companies as customers grow the amount of interest-bearing funds in their financial accounts.

In 2024, Payoneer generated $257m in interest income, a rise of 11% YoY that saw it account for 26% of 2024 revenue, but growth slowed significantly compared to 2023 (320% growth). This is reflected in slowing growth for customer funds held on Payoneer’s platform, with this rising 1% to $6.4bn in 2024, versus 10% growth the previous year. Excluding interest income, revenue growth accelerated to 20% – up from 5% in 2023.

During its earnings call, Payoneer mentioned a number of measures it has introduced to “reduce its sensitivity to interest rate fluctuations”, including investing $1.8bn of funds in US treasury securities and term-based deposits as of 31 December 2024.

Inside Payoneer’s China acquisition

Daniel Webber:

You’ve secured regulatory approval for a licensed China-based payment provider, something not many players have. What do you hope that will allow you to do that you can’t necessarily do at the moment?

John Caplan:

I’d like to separate this into two frames. The first is that the licences themselves are part of the moat and the asset value of Payoneer. Being one of two Western firms with this licence is an exceptionally powerful asset for us to have, because we’re trusted by regulators around the world, and in complex, evolving trade relations, being trusted by regulators globally makes us a stronger, more valuable company. So that’s number one and very important for us long-term.

In terms of what it allows us to do, there are a number of future products we can introduce and a number of future flows we can support. Students from China travel all over the world, even if fewer of them are going to Canada than they used to.

But you could imagine the power of Payoneer’s brand and the breadth of our relationships. You could see we’re in the funds flowing into China business today. Long term, we have the opportunity to be in the funds leaving China business as well. That would be one arena that one might imagine we’d have the potential to exploit.

Payoneer’s regional performance and China strategy

During the earnings call, Payoneer announced it had secured regulatory approval to acquire a licensed China-based payment provider, with closing expected in H1 2025 – a move it expects to help the company grow outbound payments from the country as it continues to grow market share there.

This is reflected by Payoneer’s new regional revenue structure, which it has changed in its latest results to merge Middle East and North Africa with its Europe segment (now called EMEA), while also merging South Asia revenues into its existing APAC segment. Under this new structure, Payoneer’s Greater China segment grew 18% and continued to take the largest share of FY 2024 revenues at 35% – consistent with the previous year – driven by Chinese exporters.

However, the company saw its fastest growth in its APAC segment, which grew 31% on the back of growing B2B transactions, merchant services and payroll payments. LatAm saw the second-fastest annual growth, driven by marketplaces and local currency solutions. Meanwhile, the new EMEA segment grew 12% to take the second largest share of revenues – at 26% – on the back of B2B growth.

Payoneer’s B2B volume growth

Daniel Webber:

What other parts of the business are you focusing on at the moment?

John Caplan:

When we think about 2023, our B2B business was small and had gone through some challenges and ended Q4 of 2023 with 13% growth. In Q4 of 2023, we guided to 2024 25% growth, and we delivered effectively 40% growth in our B2B.

B2B is nearly 25% of the volume at Payoneer. We’re the world’s best at marketplace payouts. $300bn market, we grew that business really nicely and we’re best in the world at it. But the TAM is capped. In the B2B space, the TAM is uncapped.

And we have unlocked in our business a growth driver that is relevant to more of the world, more businesses on the planet, and we’ve proven to ourselves, most importantly, we have permission to go win and continue to disrupt those flows globally.

We just guided to 25% growth in our B2B franchise. It’s 13% to 40% to 25%. Consistent profitable growth is what I focus on. The reality is consistent growth like this is what I’m managing the firm to deliver. And we will deliver a really solid 2025 in B2B and 25% growth. The B2B side of our business will build a much bigger company than the marketplace business could have ever built.

Daniel Webber:

Based on FXC Intelligence figures, the B2B cross-border payments market saw a CAGR of 5.7% between 2016 and 2024, and is set to grow at a 5.9% CAGR up to 2032. Payoneer’s volumes are growing at 25%, meaning that you are taking a significant share of this market.

John Caplan:

We are. In some countries around the world, we’re at single-digit market share of their B2B volumes. If you think about the size of global trade, Payoneer is starting to crawl into market share numbers that are getting interesting. This was innovation born at Payoneer, zero to one.

Last year, we proved to ourselves the potential, and now we’re going to institutionalise a growth algorithm to capture materials here in that market.

Payoneer sees strong growth from merchant services, B2B payments

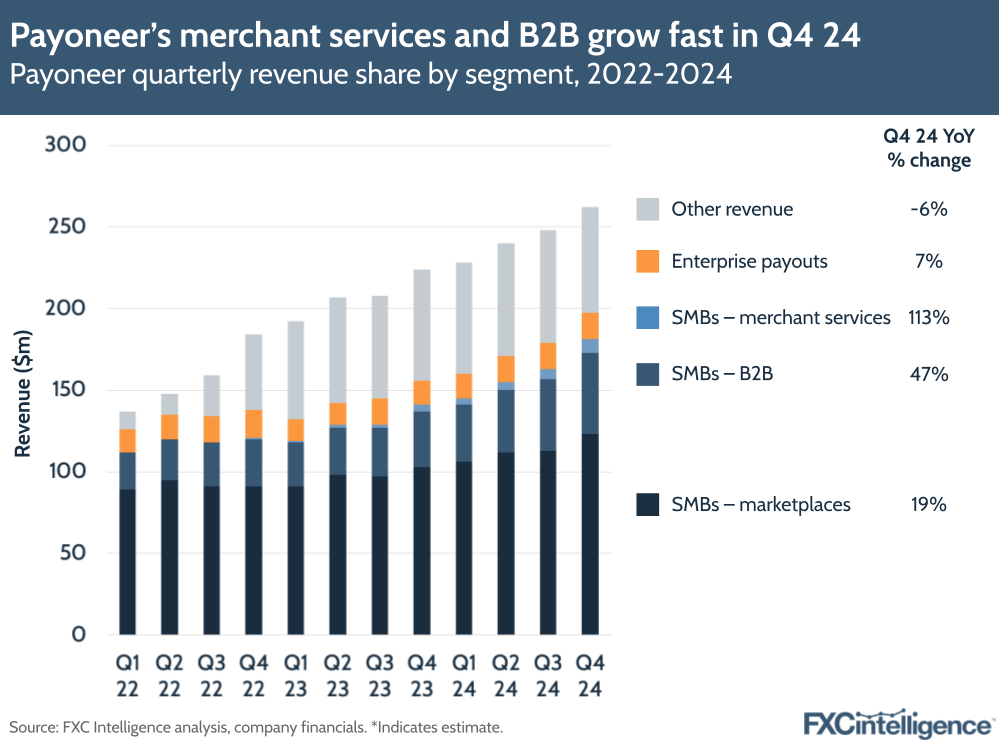

Payoneer continues to see its main beneficiaries as SMBs, which it subdivides across marketplaces, B2B payments and merchant services. Overall, SMBs accounted for 74% of Payoneer’s volumes in Q4 2024 and 69% of revenues, with revenue growth of 29%. This growth was particularly driven by the merchant services segment, which grew 113%, as well as B2B payments, which grew 47%.

Marketplaces, meanwhile, grew 19% but still was still the largest segment by revenue share (accounting for around 47%). Enterprise payouts saw slower growth of 7% and accounted for 6% of revenues overall.

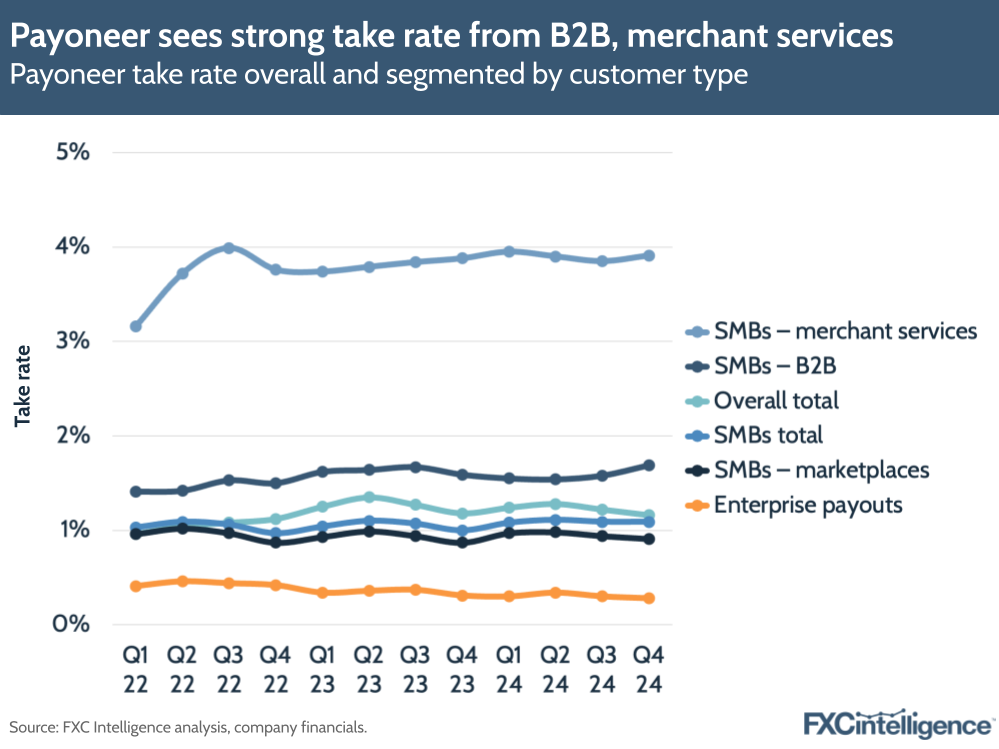

Aside from growing significantly faster than marketplaces, both merchant services and B2B payments also both have a higher take rate, with Payoneer highlighting in its materials that its take rate on B2B is roughly 1.5x that of marketplace business. The company said that overall it expects revenue to grow faster than volume based on take rate dynamics it is seeing within the business, building on the expansion in the SMB take rate as it continues to cross-sell higher-value products to its customers.

How Payoneer aims to grow its share of the B2B cross-border payments

Daniel Webber

Our figures project the B2B total addressable market growing 58% from $31.6tn in 2024 to $50tn in 2032. Given how big this market is, how do you think about where to prioritise within that to make sure that you’re going after the right parts of it?

John Caplan:

Perfect question. The first thing our growth team has done is prioritise specific geographies through our lens of brand power where we’re strong. The second is [prioritising] where we have leading, influential customer penetration, where we have customers who are advocates of Payoneer. We see those customer advocates who are saying, “I use Payoneer to invoice people” or “I use Payoneer to manage my contractor and other payments”.

We’re focusing on Tier 1 countries where we have strong penetration and also where the competitive landscape is pretty weak. There are some geographies where PayPal is a wonderful business, and I’m rooting for Alex and Michelle and the team there, because it’s better for the entire ecosystem for the legacy leaders to become innovators again. PayPal’s success is good for the industry. But there’s parts of the globe where we regularly don’t see them and we are taking share, and we’re going to keep doing that.

Daniel Webber:

Anything else to add?

John Caplan:

It’s all systems go at Payoneer. The team, the results, the opportunity. We are heads down and focused on out-delivering and serving our customers.

Daniel Webber:

John, thank you.

John Caplan:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.