Mexico is emerging as a hotbed for cryptocurrency and blockchain innovations, especially within the remittances space.

In 2021, Mexico overtook China to become the second-largest recipient country of remittances in the world, ranking only behind India. Around 1.6 million Mexican households (around 4.5% of total households, according to the 2020 census) rely on payments from family members in the US as their most important source of income; the US-Mexico remittance corridor is the largest in the world, with remittances totalling $59bn in 2022, according to FXC market sizing data.

It comes as no surprise, therefore, that over the last year alone dozens of crypto giants have been vying to carve out a slice of this ripe-for-disruption market, to varying degrees of success. Here we take a look at what’s going on in this multi-million-dollar remittance corridor, as well as some of its idiosyncrasies and challenges.

Capturing remittance growth

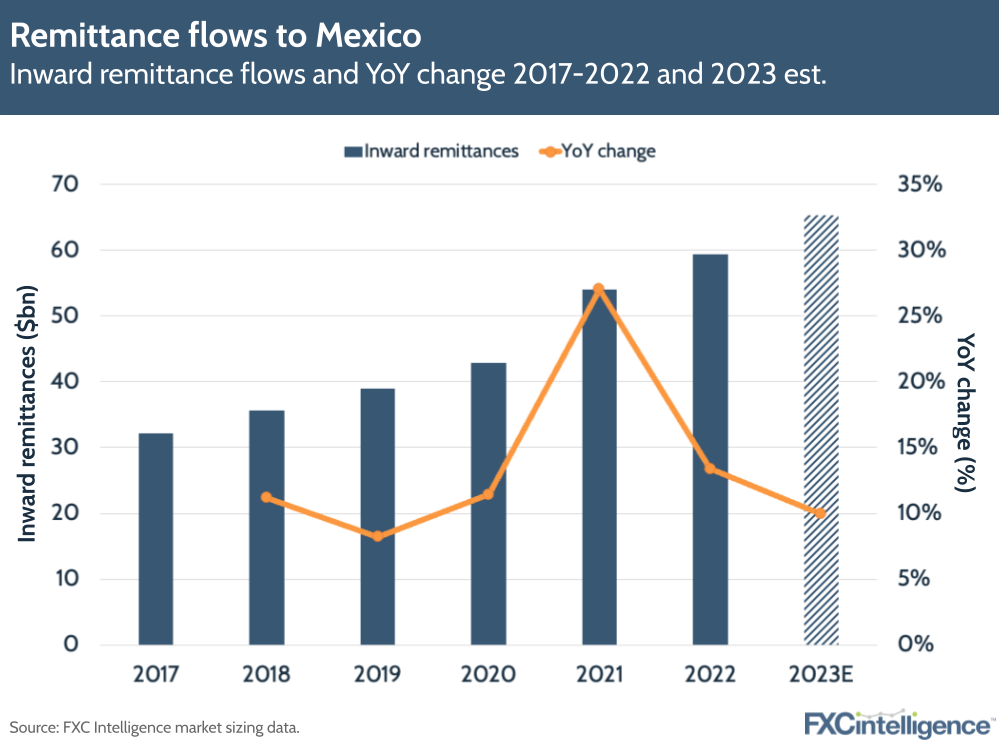

Since the Covid-19 pandemic, growth in remittance flows from Mexico’s northerly neighbours has been strong. A significant recovery in the US’s labour market following the pandemic, particularly among foreign-born workers, saw remittance flows to Mexico surge in 2021, with a 26% jump on 2020 numbers, according to FXC market sizing figures. The data shows continued growth into 2022, with a 13% increase and an estimated further 10% growth across 2023. According to the 2020 US Census, there are approximately 62 million Latinx people residing in the US today, with Mexicans comprising 62% of this population.

Among the countries registering double-digit growth in inward remittance flows, Mexico came in fourth place with 25% growth, behind Guatemala (35%), Ecuador (31%) and Honduras (29%). However, recorded flows to Mexico also include funds received by transit migrants from other countries in the region, including Honduras, El Salvador, Guatemala, Haiti, Venezuela and Cuba.

The pandemic also became a big driver for consumers seeking alternative methods to send remittances, and trying out new digital solutions as many traditional service providers closed their doors to the public. Remittances have been a lifeline for the Mexican economy since the pandemic, helping rural communities in particular, as GDP plummeted 8.2% in 2020, with a slow recovery afterward. Money transfers have also helped bolster Mexico’s peso, which was among the top performing major currencies in 2022.

Covid-19 also catalysed Latin America’s digital payments revolution, which has been consolidating and driving interest in cryptocurrencies. This is due at least in part to local populations’ enthusiasm and willingness to adopt new technologies; a survey of 35,000 Latin American consumers undertaken by Mastercard last year revealed that two-thirds of interviewees expressed desires for greater flexibility to use crypto and traditional payment methods interchangeably in their daily operations.

Moreover, due to the country’s young population (the median age is 29) and a favourable regulatory landscape, Mexico is prime territory for fintechs and neobanks to thrive. There are currently around 20 neobank solutions offered in Mexico, and the market is forecast to see strong growth in coming years. Likewise, increasing interest in bitcoin in Mexico also led to the installation of the country’s first bitcoin ATM in its Senate building in April last year, with the support of several legislators and crypto enthusiasts.

However, around 80% of remittances sent from the US to the Latin America and Caribbean region are still sent via cash, with only around 20% being digital. Cryptocurrency companies are looking to take a share of and grow this 20%.

There are two main advantages that crypto remittance platforms are able to provide to customers: cost and speed. In 2021, the global average cost of sending remittances was 6.3% of the overall payment, according to the World Bank Remittances Price index, which is powered by FXC Intelligence data.

By eliminating intermediaries and bringing down the risk of exchange rate volatility, crypto has the potential to cut these costs, and our own crypto pricing data shows that such payments are often cheaper than traditional remittance equivalents. Sending by crypto is also more efficient; direct account deposits can take up to five days, while crypto transfers go directly to the recipient in a matter of minutes. Traditional remittance incumbents such as Western Union can take an average of two to three days to deliver some forms of payments, based on the type of transfer, whereas crypto transfers are practically instant, although the off-ramp to fiat can add more time, depending on the service.

For crypto companies looking to tap into this region, it would seem that starting off in Mexico would be a wise choice, given the market’s size, consumers’ embrace of digital currencies and its strong growth in digital payments.

Interested in our market sizing data? Get in touch with our team

A look at some of the main players

Companies far and wide have been quick to seize the opportunity to start offering their services in this lucrative corridor. The most common strategy has been for crypto and remittance platforms to harness local providers’ expertise and parallel technologies by entering into partnerships. By working in tandem, they can ensure both swift integration into what may be an unfamiliar market, and carve out what could potentially be a smart niche in the industry.

Bitso

The growing power of digital currencies in Latin America is evidenced by Bitso’s success to date. In 2020, Bitso reported it had processed roughly $1.2bn in crypto remittances, which CEO Daniel Vogel claimed to be equivalent to 2.5-3% of the annual remittances volume between the US and Mexico. In the first half of 2022 alone, the company said it had handled $1bn in crypto remittances between the US and Mexico, 400% growth on the same period in 2021, according to the company.

As mentioned, crypto platforms can offer a cheaper rate for sending payments than traditional methods, and Bitso’s pricing starts at $1 per $1,000 sent. This is lower than many other international transfer providers, which in some cases can charge as much as 11% per transaction.

Bitso has also engaged in a number of recent partnerships. In 2022, it joined forces with remittance provider Félix Pago, a chat-based payments provider, to enable WhatsApp-integrated crypto payments from the US to Mexico. Through this, users are able to send funds internationally in a manner similar to sending a text message, with real-time settlement.

Félix Pago operates as a backend crypto provider, allowing users to seamlessly send US dollars that are then received as Mexican pesos, thus eliminating the need for users to navigate complex crypto infrastructure in order to send payments.

Another partnership Bitso entered into last year was with African-Canadian remittance platform Africhange, through which it facilitates cross-border transactions with crypto from Canada to Mexico. Whilst the US-Mexico corridor may be the world’s largest, the Canada-Mexico corridor is also significant, and growing fast. Mexicans are increasingly migrating to Canada; according to the 2021 census, just over 155,000 Mexicans officially resided in the country, while Data Mexico reported that in Q1 2022 alone, Mexico received $146m in remittances from Canada.

Africhange currency has over 15,000 users in Canada, and aims to support Mexicans residing in Canada with safer, faster and cheaper solutions to send money to their home country. Africhange, which launched services in December 2020, is helping leverage blockchain technology to serve users in Canada.

Similarly, in December, Bitso joined forces with fintech company Tribal to launch a cross-border B2B payment option, which enables small and midsize enterprises to convert Mexican pesos to the Stellar USDC cryptocurrency.

Coinbase

Coinbase, a global crypto exchange, is another player giving traditional cross-border retail payment providers a run for their money. In early 2022, Coinbase announced plans to offer a cash-out service in Mexico, allowing recipients to convert crypto sent to them by other users into Mexican pesos at more than 37,000 retail outlets across the country, including department stores, supermarkets and all 20,000 branches of Oxxo, Mexico’s largest chain of convenience stores.

This would allow customers to save on fees, and users would be given the option to save or invest their crypto into a Coinbase account. Recipients can also convert their balance into over 100 different cryptocurrencies.

Belfrics

In August last year, Belfrics Mexico, a digital currency exchange entity operated by the Malaysia-based Belfrics Group, announced plans to open crypto transfer operations in Mexico. Originally formed in 2019, development plans for Belfrics Mexico were put on hold due to the pandemic, but with business returning to normal, the company is deploying its blockchain-based wallet and remittance solution to capitalise on increasing remittance flows.

MoneyGram

Last November, mainstream remittance company MoneyGram announced the launch of a new service enabling consumers to buy, sell and hold cryptocurrency via the MoneyGram mobile app. Currently this feature allows MoneyGram customers in nearly all US states to trade and store Bitcoin (BTC), Ethereum (ETH) and Litecoin (LTC) through its mobile app, and the company is expected to expand its future selection of crypto coins as it explores opportunities to move into other markets, as global regulations allow. MoneyGram’s crypto offerings are made possible via its partnership with crypto exchange CoinMe in 2021.

How can FXC Intelligence’s crypto pricing and market size data help my business?

Inflation and stablecoins

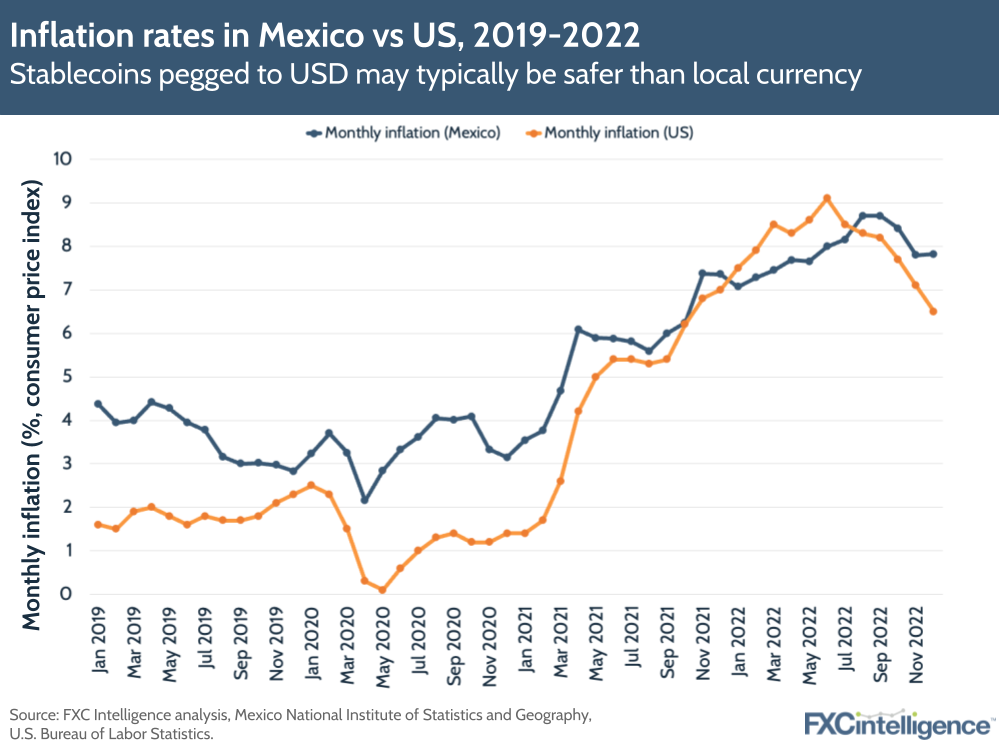

Crypto is also starting to be used by Latin Americans as an option to shield their bank deposits against inflation, which unfortunately plagues many nations in the region. According to an estimate from the International Monetary Fund, the main five Latin American nations – Brazil, Chile, Colombia, Mexico and Peru – had inflation of around 12%, a 25-year high, in August 2022.

However, what these countries share is a growing use of crypto for remittances and a need to store value that is largely able to survive digital assets’ volatility due to rampaging inflation. This way, high commissions on remittances sent back from family members overseas can also be avoided.

With widespread adoption of crypto, it follows that stablecoins are also finding solid ground in Mexico. Stablecoins can help recipients hedge against any devaluation of their local currency, and the fact they are pegged to a fiat currency means that a great deal of the price volatility is eliminated. This is in contrast to cryptocurrencies such as bitcoin, whose value is determined entirely by the number of people buying and selling it. Because of their lower volatility, stablecoins are considered better suited to everyday use, and users can simultaneously benefit from high transfer speeds and lower crypto fees, making them ideal for remittances.

A Mastercard study conducted in June 2022, ‘New Payments Index 2022’, suggested that more than a third of Latin American consumers are already using stablecoins to make everyday purchases, and in contrast to the views widely held by those in developed economies, in Latin America stablecoins are seen as a relatively safe, inflation-proof solution to local currencies.

Remittance-specific crypto products mainly using stablecoins have only recently been introduced to the Mexican market. In November last year, Bitso partnered with US-based stablecoin operator Circle to jointly launch an international wire transfer product that allows small businesses and freelancers to change their dollars to stablecoins, which can be sent to Mexico and collected in pesos.

Likewise, in May of 2022 blockchain-enabled platform operator Tether added the MXNT token to its roster of stablecoins, which is pegged to Mexico’s peso. MXNT is Tether’s first venture into Latin America.

Discover how our FX pricing data can inform your remittance strategy

Challenges

Despite the potential, there are hurdles to the adoption of cryptocurrency for remittances, including the fact that relative lack of knowledge of these tools has slowed adoption. The technical nature of crypto platforms, along with limited local currency withdrawal options, present some unique challenges that are likely to stifle uptake among customers.

Furthermore, research conducted by the Universidad Iberoamericana de Puebla showed that many Mexicans living in the US harbour concerns over using cryptocurrencies to send money back to their native country, not least due to their sheer volatility. Given recent difficulties in the global crypto markets, it’s no surprise that customers may be hesitant about sending money to their families and loved ones in a form that’s value could change radically at any given moment.

However, there have been industry efforts to reassure consumers. Last November, Bitso laid out a transparency roadmap, as pressure from users mounted following the high-profile collapse of crypto exchange FTX. While Bitso’s growth could suffer in the near-term as it implements these new transparency methods, an executive from the company said that non-investment services, such as remittances to Mexico, could help offset the blow. It remains to be seen whether such moves suffice in sustaining, let alone increasing, crypto confidence for remittances.

Mexican citizens still overwhelmingly prefer using cash to make payments. Research from FIS suggests that 41% of point of sale transactions in Mexico were still conducted by cash in 2021, and while this represents a decline from the highs of past years (76% in 2018 and 71% in 2019), it is still almost 20% higher than the next most common method (debit card at 24%). Some have predicted that by 2025 Mexico will be one of the only major countries in the world where cash will continue to represent the most common PoS payment method, although FIS does project cash’s share of PoS sales to decrease to 29% by 2025.

Additionally, many Mexicans do not have access to a bank, meaning financial literacy rates are low and there is only a limited viable user base for crypto remittances to exploit. The World Bank estimates that just over 60% of Mexican adults are unable to access banking tools such as credit, leaving millions of people subject to sky-high exchange rates and fees for transfers.

Despite rising crypto remittance figures, there are still major hurdles for widespread crypto adoption in the country. Going forward, it will be interesting to see how the tech-savvy and crypto evangelists navigate the challenges facing adoption and take advantage of the momentum provided by the growing remittances industry.

Conclusion

Although crypto adoption has been uneven, it has been swift and Mexico is a unique case study for crypto remittances. The signs seem optimistic for crypto remittance providers to reap the rewards of disrupting such a market given the US’s strong post-pandemic recovery; a large and growing Latinx population north of the border; and an energetic and promising digital finance industry in Mexico.

When compounded with the nuance created by inflation boosting stablecoin uptake, these factors make for a particularly favourable landscape for crypto remittances to take root as a more mainstream transfer method. Nevertheless, there remain substantial challenges, not least Mexico’s large financially illiterate population; lack of confidence in using crypto; and concerns over its volatility and safety. It will be interesting to observe how crypto remittance providers can address such challenges, and the extent to which they can make headway in this huge and innovative market.