For cross-border ecommerce sellers, particularly those in China, the boom days of the pandemic have long gone. While many were seeing strong sales purely through Amazon during the early phases of Covid-19, the combined impacts of lockdowns in Shanghai, supply chain pressure, energy prices and reduced spending have created a far tougher landscape for sellers today.

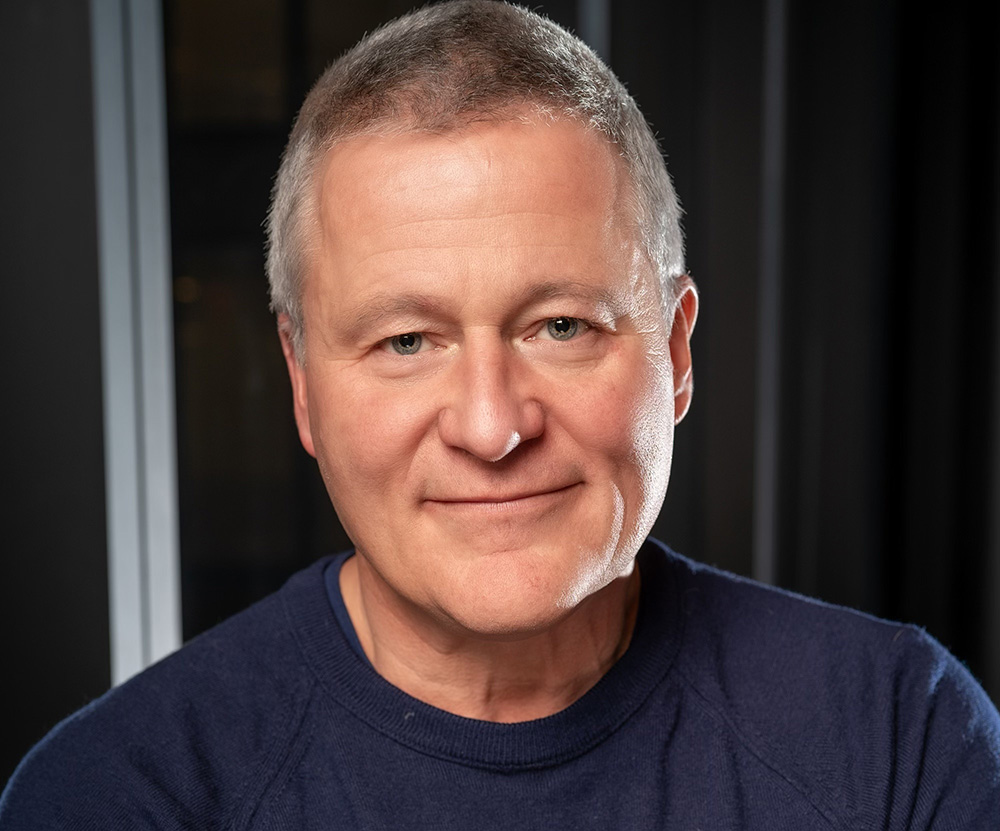

“The outlook for this year is quite turbulent, certainly with challenges both on the demand and supply side,” explains David Messenger, Executive Chairman of LianLian Global, which provides cross-border payments solutions for sellers.

“It is a time of pragmatic caution. It’s not the explosive growth we had at the early stages of Covid.”

In this changed landscape, sellers are diversifying how and where they operate. Having already begun to diversify away from being solely reliant on Amazon over the past year or so, sellers are increasingly exploring two avenues: B2B commerce, providing bulk orders to the US and Europe, and direct to consumer (D2C), where they are increasingly directly selling to consumers in the same regions.

“For Chinese cross-border sellers, having relied on Amazon to a very significant degree, there is increasing focus on diversification,” says Messenger.

From Amazon to D2C: Overcoming crowded marketplaces

For many sellers, while Amazon was once a vital gateway for cross-border ecommerce, it has become an increasingly difficult space in which to compete.

“There are so many Chinese sellers on Amazon, it is very competitive, and you look at the margins that sellers can generate, they’ve been under pressure,” explains Messenger, adding that increased scrutiny around reviews and other business practices has also posed a challenge for some sellers.

For many, the solution has previously been to diversify the range of channels that they are selling across. However, this is a phenomenon that is not exclusive to Amazon, with other traditional channels such as eBay also seeing similar pressure.

“Some of their core existing channels have become more challenging, more competitive, so they’re looking for new [approaches],” he says.

For many, the solution is increasingly D2C, with, says Messenger, many sellers looking at “the value of building their own brand”.

“They say, ‘If I can figure out how to go D2C, I can build brand loyalty. I can extract greater value. I’ve got to do more. I can’t rely on the marketplace to drive for traffic,’” he says.

“If they can solve those marketing and customer acquisition challenges, then there’s a higher margin opportunity and the strategic value in having the customer relationship.”

This trend has been particularly pronounced for large sellers, who faced action from Amazon over business practices and so had to “rethink” their use of the marketplace. By contrast, Messenger sees midsize sellers retaining “some strength on the marketplace side”, while small sellers have been hit particularly severely by ongoing issues around supply chains and logistics. However, he sees this “evolving by quarter”, suggesting that the shift to D2C may spread more to smaller segments.

Supporting cross-border sellers as they shift to D2C

The current shift to D2C has inevitably come with changing cross-border needs for sellers. While previously some elements such as checkout were handled entirely via the marketplaces, D2C requires sellers to arrange their own checkout process.

LianLian Global has responded to this shift by expanding its offering, including through the provision of an acquiring solution for the checkout process. This enables support for local and international card payments, as well as a variety of other local payment options, while other services include the conversion of funds to local currency.

“We are expanding our acquiring solution for Chinese and Hong Kong sellers, including those sellers who have got some scale and they’ve set up entities in US and Europe because D2C is already a core part of their business,” explains Messenger.

“So we’re broadening our payments product set for those sellers and are starting to integrate some value-added services that really are relevant to that core challenge.”

This includes marketing, which is more complex away from Amazon, but is vital to maintaining a successful D2C business.

“You need more sophisticated marketing tools, so those are the new value added services we’re going to be rolling out this year.”

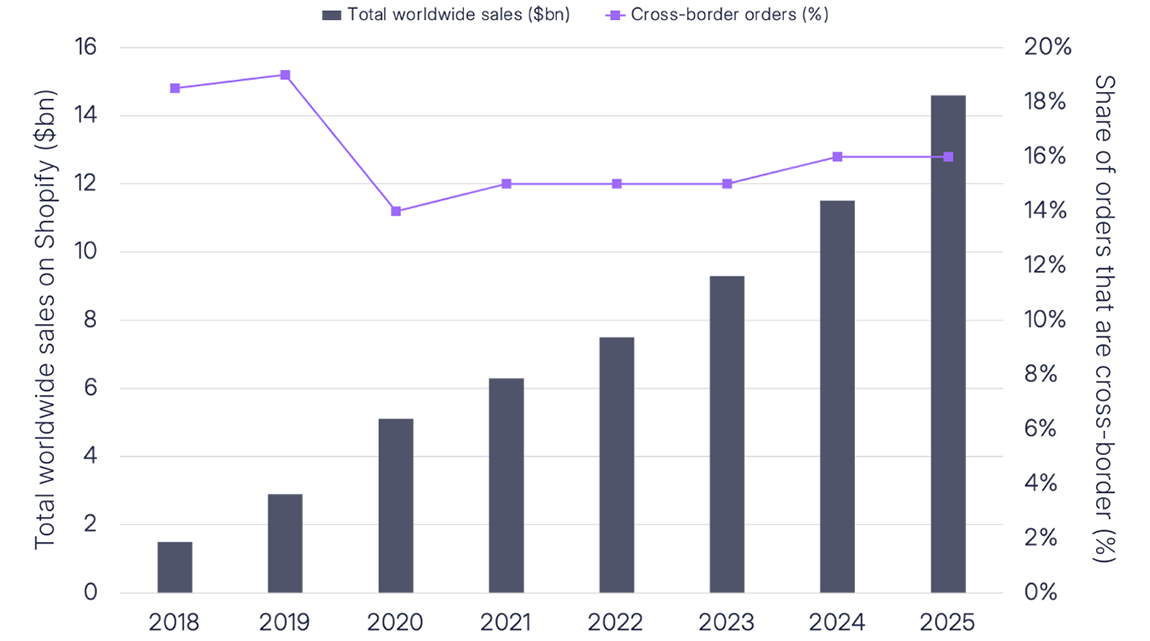

LianLian Global has also added an integration with leading SME ecommerce platform Shopify, where it provides the “broader set of payment services” to sellers.

Diversifying beyond D2C

While D2C is a key area of focus for LianLian Global, there are still considerable opportunities in the marketplace space, where it serves sellers with its cross-border wallet solution.

“D2C is a big trend, but we do think there are still opportunities in marketplace channels that have been under-utilized by sellers because of friction and not understanding the complexities of different marketplaces,” says Messenger.

“Through our marketplace partnerships we’ve built the infrastructure to streamline all of that.”

This has seen the company focus on opening up access to marketplaces that he describes as “traditionally have been more challenging, particularly for Chinese sellers, to actually take advantage of”.

He highlights major regional players in Europe such as Poland’s Allegro and France’s Cdiscount as key examples. These can be accessed via the company’s Global Selling product, which enables one-click store opening on such niche marketplaces.

“Literally in one day you can have your store operational on those sites,” he says.

“Previously it might take you four to six weeks to even get a store opened. And all of the challenges, the language issues around operating in a new market, we’ve taken the friction out of that.”

B2B and beyond

While the shift to away from Amazon and particularly towards D2C has been key for Chinese sellers, LianLian Global is also increasingly targeting key seller markets beyond the country, and already has a strong presence in Southeast Asia.

“We’re absolutely targeting to be taking market share from the established players outside China, like Payoneer and others, with the wallet solution,” says Messenger.

However, the company is also increasingly serving the B2B market, as many sellers have shifted to become suppliers in response to the changing market conditions. And here, its increasing infrastructure beyond China has been particularly vital.

The company’s multicurrency e-wallet service is currently supported by three hubs, the UK, Singapore and the US, where it now has licences in all 50 states. Europe is also set to be next. This enables it to support Chinese sellers at all levels, but also intersects with its B2B platform as it enables the company to “provide unique capabilities for managing B2B payments into China”.

“This is a much more flexible payments tool for a cross border business in terms of receiving funds from around the world from whatever sales channel they have, whether that’s marketplace B2B, maintaining multi-currency balances, managing FX, handling supplier payments, disbursements and obviously domestic withdrawals. So we’re very excited by that.”