Our latest report, Benchmarking cross-border ecommerce checkout experiences, explores how cross-border checkout experiences vary across major retailers, and the impacts for consumers.

With the steady growth of ecommerce and online shopping in the past few years, it is becoming increasingly important for companies to offer easy and efficient checkout options on their websites.

This includes a smooth and transparent experience for the many customers who purchase online goods and services internationally, and as such often use payment methods in currencies other than the seller’s own.

Ecommerce companies must decide how they want to cater to their international customers, and one of the main ways to achieve this is by offering currency flexibility.

The aim of this report is to introduce the different types of checkout methods, and show how each of the checkout experiences is implemented in practice, by exploring the step-by-step process of buying products from a number of sellers.

Furthermore, we aim to provide some insight into how frequently each of these methods is used among the world’s largest ecommerce providers.

Checkout experience and payment choice is a key feature when it comes to appealing to customers online and increasing their satisfaction. To implement a successful checkout experience sellers must keep in mind that:

- Customers want options when it comes to the currency they pay in

- Customers prefer to pay in their home currency over the merchant’s currency

- Merchants in different sectors may have different preferred checkout experiences

- Fees play an important role when selecting which checkout experience to implement.

Contents:

- Checkout experience classifications

- Market overview

- How the market breaks down

- Predetermined currency

- Multi-currency choice

- Last-step conversion

- Conclusion

Checkout experience classifications

When it comes to the currency conversion procedure and purchase options for shipping abroad from various ecommerce merchants, we have identified three different types of checkout experiences.

Those options are:

- Predetermined currency: The merchant offers no currency choice. The purchase will be either made in the marketplace currency or the merchant will determine the currency which will be used based on where the order is made from.

- Multi-Currency Choice: The customer has the option early in the shopping process to select which currency the prices will be processed in and they will be charged in.

- Last-Step Conversion: The merchant allows the customer the choice between paying in the marketplace currency and the customer’s card currency. The merchant sets the exchange rate.

Selecting which checkout experience to implement can have a large impact on the willingness of customers to buy from any given website.

Not only does it influence how customers navigate the website while shopping, it also impacts the way that transactions are processed by the merchant, banks and card networks.

This means that different fees will be applied depending on the checkout experience, and the resulting costs for the customer can vary significantly.

Predetermined currency

With predetermined currency, the merchant offers the customer no currency choice. The seller offers only one payment option to the customer, which is either the merchant’s marketplace currency, or a currency that the merchant has assigned to the customer based on geographical settings.

While a merchant may process payments in multiple currencies, the customer cannot influence which currency they pay in at all.

Multi-currency choice

With multi-currency choice, the customer has the option early on in the shopping experience to determine which currency they would like to pay in.

In our Economics of Cross-Border Payments report, we explained the processing backend that services such an experience. Generally the multi-currency choice experience corresponds to either Multi-Currency Pricing (MCP) or Multi-Currency Conversion (MCC) methods.

With MCP, companies will set prices separately in multiple different currencies. Under the MCP model, merchants determine an entire range of new prices. These depend on the current exchange rate, but can also reflect other factors, such as shipping costs or import taxes.

With MCC, merchants typically only use exchange rates to convert prices across markets.

Under the MCC model, prices are automatically converted from the base currency to the other currencies that are offered by the seller using the current exchange rates.

Under these models, the customer has a choice between multiple currencies beyond just the card currency and the marketplace currency.

Last-step conversion

With last-step conversion, the customer is typically given a choice at the checkout as to whether they want to pay in the foreign currency or in their home card currency.

If the customer chooses to pay with their card currency, the merchant sets a new price in the customer’s card currency that is based on an exchange rate set by the merchant (the mid-market exchange rate plus a margin that represents the merchant’s compensation for providing the conversion service).

This is usually facilitated by means of a Dynamic Currency Conversion (DCC) process. This includes a fee that the merchant has to pay to the payment processor who enabled the DCC transaction.

The pricing is not known beforehand, but rather only upon entering the card details, as that is when the seller learns what the card currency is. The customer therefore only has a choice between using their card currency and the marketplace currency.

Market overview

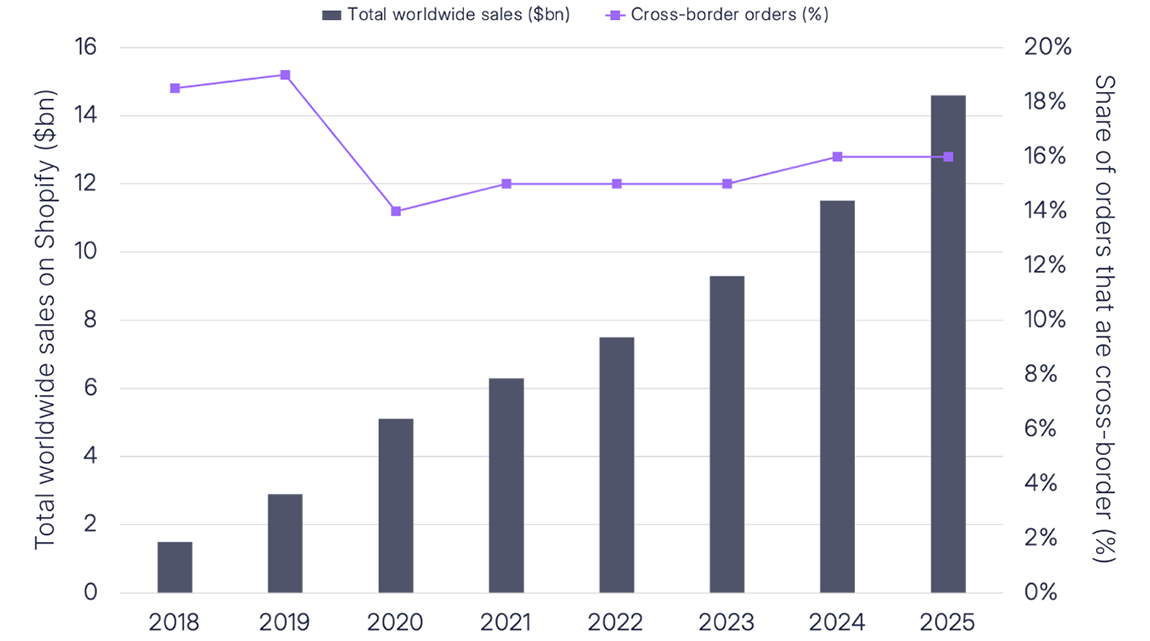

We have collected and compiled checkout experience data for the largest 100 cross-border ecommerce players across seven market sectors and multiple geographies.

This list is who we consider to be the largest players in the world that fulfil cross-border customers with goods and/or services. The top 100 players were identified based on the estimated fraction of their revenue linked to cross-border sales.

How the market breaks down

We have carefully assessed all of the above top players’ checkout experiences with regards to currency payment options.

Two-thirds of the list still does not provide customers with the option to choose what currency they would like to pay in. Of the one third that do offer currency selection, the vast majority favour multi-currency choice over DCC.

This may be due to the fact that DCC is more difficult to implement as it requires in-depth knowledge of each target market. From the extensive research conducted at FXC Intelligence with our cross-border transaction data, we have concluded that fees and fee structures heavily vary across regions and even on a country-to-country basis.

Therefore, in order to successfully implement a DCC conversion, merchants must know the charges that customers are likely to face in each market, as otherwise the DCC option might be too expensive, leading to dissatisfied customers that may avoid buying from the same merchant in the future.

Multi-currency choice also helps sellers who have websites that cover multiple regions, as they can easily sell the same items across different websites.

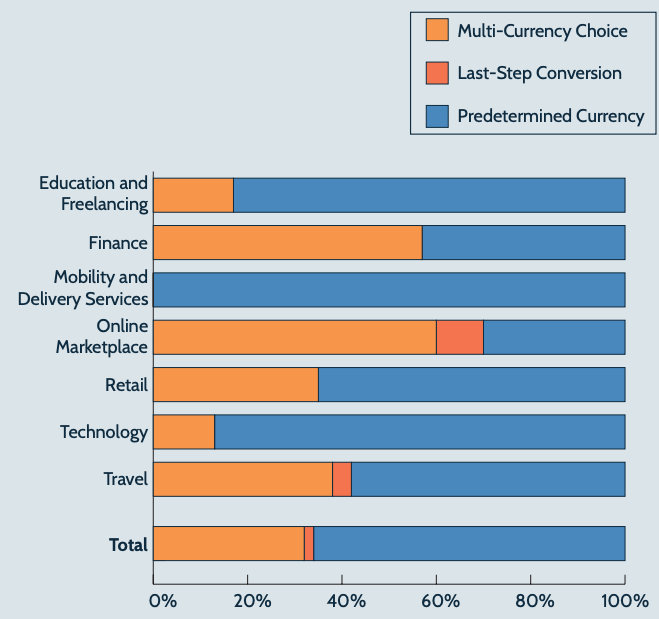

When looking at the checkout experience by sector, it is clear that currency flexibility is much more common in some sectors than in others.

Online marketplaces and the financial sector are the only sectors where the majority of investigated companies offer some form of currency choice to their customers.

There is also significant progress in the retail and travel sectors, where around 40% of players have implemented currency selection options. Currency selection is the lowest in the technology, mobility and education and freelancing sectors, with less than 20% in each.

Figure 1

Breakdown by market sector

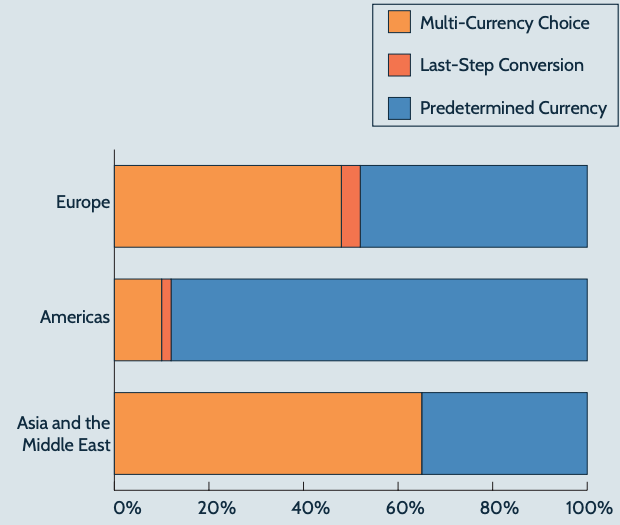

Checkout experiences with respect to payment currency also vary across regions.

Asia and the Middle East have the highest rates of sellers offering customer choice, with 65% of companies offering multi-currency choice to their international customers.

Europe has the second highest rate of currency choice options, with just over 50%, while the Americas have a much lower rate at just over 10%.

Most companies in the Americas still opt to determine the currency based on region or to sell only in the marketplace currency.

Figure 2

Breakdown by region

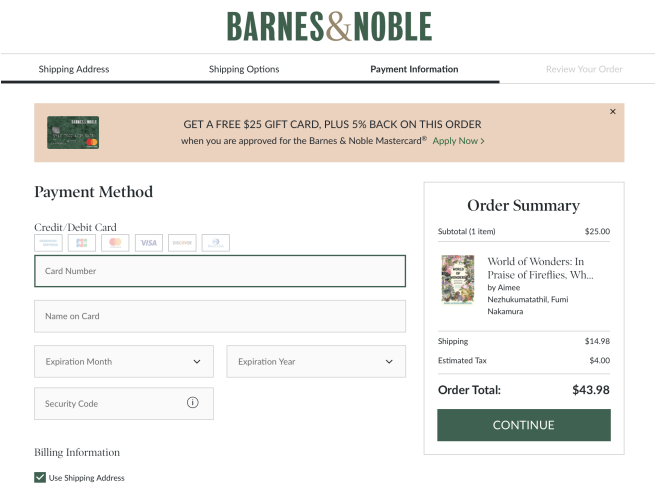

Predetermined currency

Most online sellers still do not offer any currency selection options to their customers. However, while many simply charge all customers in the merchant’s home currency, some may change the currency depending on a number of criteria, such as the location from which they are accessing the website, the entered shipping address or – in cases of airlines – the departure location of the first flight.

Merchant’s currency only

A large number of international sellers only offer payment in the merchant’s home currency. They do not distinguish between local customers and international customers, and only provide the ability to pay in the marketplace currency.

Figure 3

Barnes & Noble

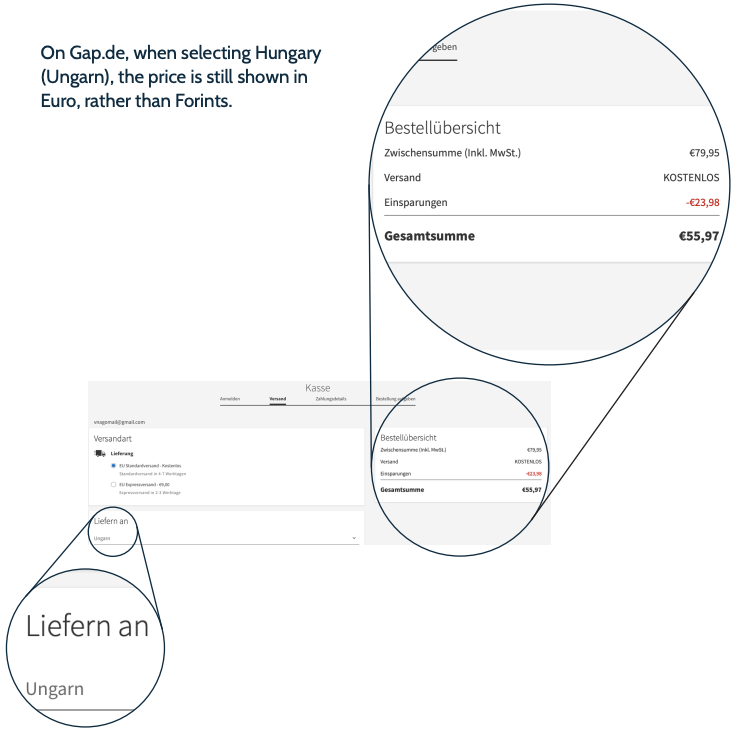

GAP.com does not ship internationally, however some of its European websites do offer international shipping. After selecting a product on Gap.de, it is possible to select a number of different countries other than Germany, such as Hungary in the example opposite. The price will, however, remain in Euros and cannot be changed.

Figure 4

GAP

User experience

Customer experience

The customer experience when checking out is very simple as there is no choice for the consumer. They simply follow the steps and are given a price in the merchant’s currency.

Usability of choice

The customer has no ability to influence the checkout experience.

Ease of understanding fees

Fees are very easy to understand as only the customer’s bank fees are applied. The merchant does not apply any fees or charge any conversion margins.

Fee transparency

The customer can familiarise themselves with the fees by contacting their bank or looking at their card terms and conditions.

The main benefit of only accepting payment in the merchant’s currency is that there are additional costs associated with accepting payments in other currencies, with merchants required to pay processors to provide this service. Furthermore, converting currencies back to the merchant currency also incurs a cost.

Merchants that only offer payments in the merchant’s currency, however, are likely to be losing out on a large number of global customers.

Shopify reports that 92.2% of customers prefer to shop in their own currency and one third of customers will even abandon a purchase if they are offered to pay only in USD.

Customers prefer to have options and even if navigating the website may be easier with less options, the comfort of the home currency more than makes up for such additional complexities.

In this case, the fees for the currency conversion are imposed by the bank and the merchant has no opportunity to provide a conversion service.

Since the customer has no option to choose currencies, the checkout process is simple and linear. However, customers may try to find some customisation options and be disappointed when they can’t, potentially looking for another seller at this point.

The customer is aware that they will be paying in a foreign currency and will incur the conversion fee imposed by their bank. In this case it is the customer’s responsibility to inform themselves of the fees imposed by the bank for FX purchases.

Pre-determined with currency flexibility

Some sellers that don’t offer any currency choice at the moment have still taken steps to adapt their selling practices to help to international customers. The shopping currency is adjusted based on the shipping or IP address.

Others, such as some airlines, may use factors such as location of departure to determine the displayed currency. Customers will not have a choice when it comes to currency, but are more likely to be paying in their home currency than if the merchant only offered payment in the marketplace currency.

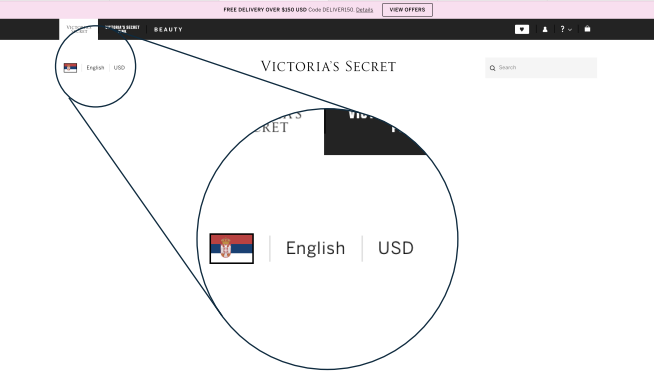

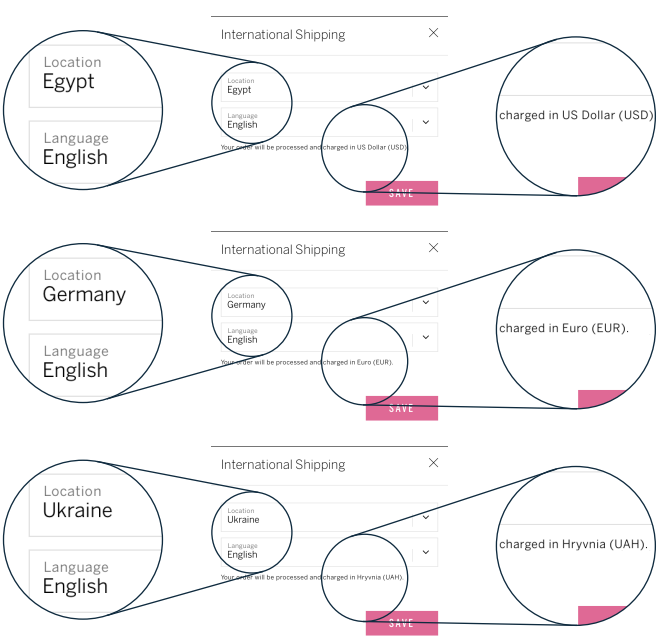

Victoria’s Secret delivers to many countries globally. When selecting the desired shipping location and language, Victoria’s Secret will automatically change the currency depending on the shipping destination. The assigned currency is not necessarily the currency in the location country. Victoria’s Secret processes a number of currencies and assigns currencies to countries based on best fit.

Figure 5

Victoria’s Secret

When going on the VS website, in the top corner one can find the customisation

options for international shipping.

While many countries will have their own currency automatically selected, in some cases USD will be used if the local currency is not supported.

In the examples below, Ukraine and Germany have their local currencies supported (EUR and UAH), while orders shipped to Egypt and Serbia (above) are processed in USD.

Figure 6

Victoria’s Secret

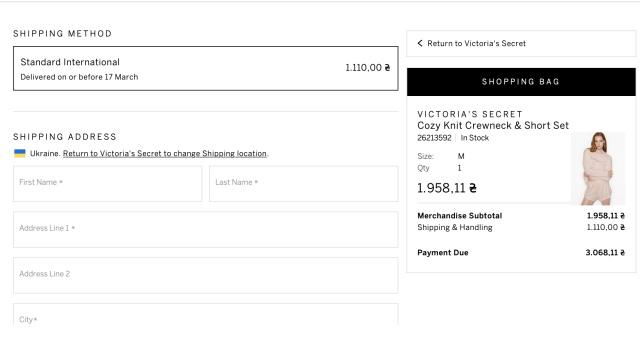

From here on out, every part of the shopping and checkout experience is processed in the selected currency, including shipping options and delivery.

Since the shipping address is tied to the checkout currency, there are no options for customers to influence the currency they pay in.

Changing the location and language settings is fairly easy and can be done with several clicks on each page on the website. The main drawback, however, is the lack of currency selection options and the incomplete coverage of international currencies.

This means that most customers in countries whose currencies are not supported will have to pay in USD, likely leading to further fees. Furthermore, the prices on websites where the currency is not USD are much higher than for USD countries, with a price increase between 23%-29% above interbank mid-market rates. This price increase is dependent on currency, as selecting a country with USD other than the US will not change the prices.

Figure 7

Victoria’s Secret

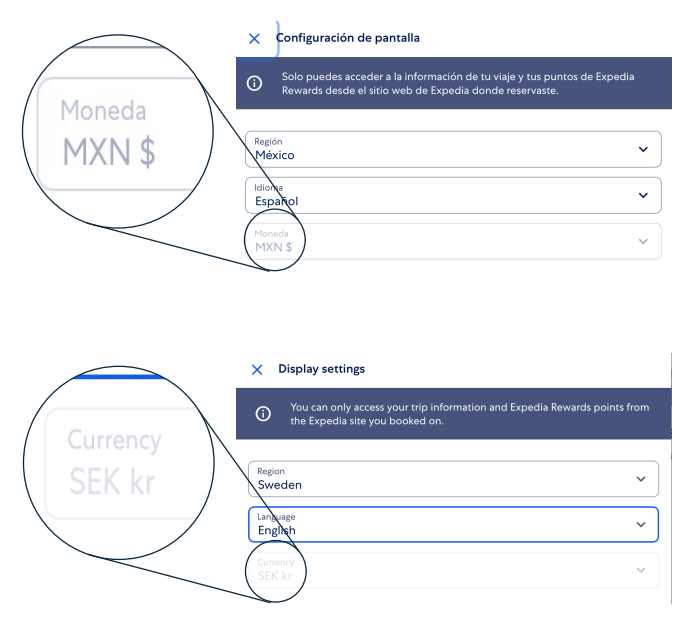

Expedia implements a similar system to Victoria’s Secret. It has a large number of regional options and while it offers a region and language selection, the currency is determined and fixed depending on the choice of region.

For all of the available regions, the company offers payment in the local currency. Upon selecting the region, all prices are displayed in the assigned currency.

Prices between different regions are converted at current interbank rates, meaning that there is no price increase when buying in foreign currencies.

Figure 8

Expedia

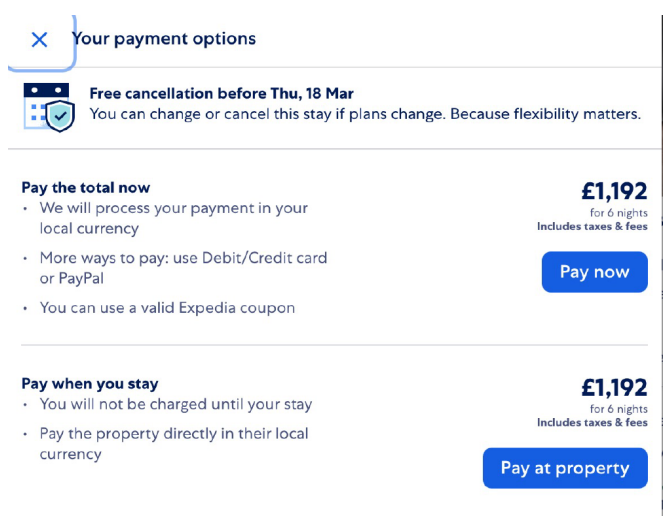

Expedia offers payment directly at the property (or accommodation), which is taken in the local currency, or payment on the website in the selected website currency.

Entering a card from a different country than the selected one will not change the currency at checkout.

Figure 9

Expedia

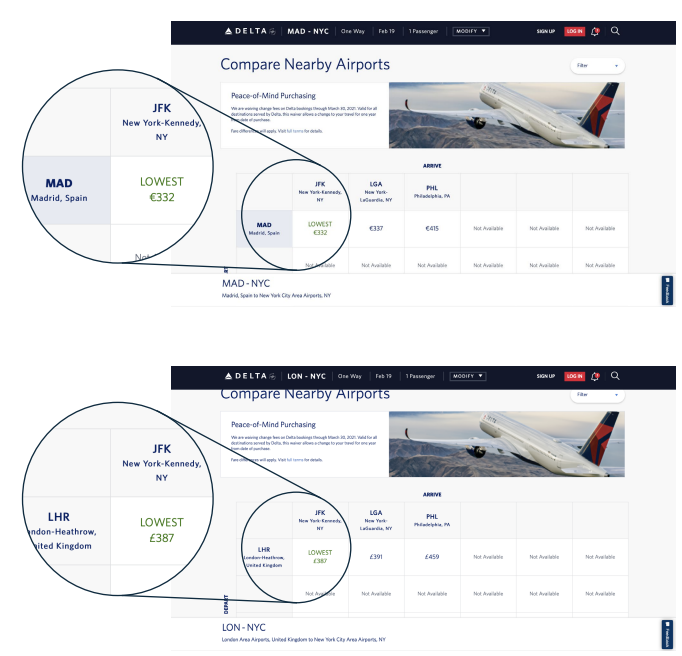

In some cases, currencies do not depend on the region that the website was accessed from or on the shipping address, but rather other factors.

In the case of Delta Airlines, the currency depends on the choice of airports. As can be seen in the examples opposite, the currencies depend on the airport of first departure.

When departing from Madrid to New York, the price is displayed in EUR, while when flying from New York to Madrid the prices are displayed in USD.

Flights from the UK to the US are shown in GBP, while national flights in the US are processed in USD.

Figure 10

Delta Airlines

Figure 11

Delta Airlines

User experience

Customer experience

While the merchant does not offer choice in terms of currency selection, the customer may have to select the correct location settings. This is done quickly and since the merchant needs this information to display the correct prices, the customer is likely to be clearly asked.

Usability of choice

The choice is limited and easy to use. It will enable the customer to quickly see prices in the currency that the seller deems to be the best fit for them, based on location and the merchant’s supported currencies.

Ease of understanding fees

The fees are usually difficult to understand. The merchant is unlikely to display how the conversion from the original price in the merchant’s currency is performed. Furthermore, the bank may charge no fees when the payment is made in the home currency or may treat it as an international transaction and charge fees anyway.

From our transaction-based data at FXC Intelligence, we have concluded that banks can be vague when it comes to these cross-border fees and even may charge somewhat different fees than what is stated in the T&Cs.

Fee transparency

There is little fee transparency. In order to compare prices in the merchant’s and buyer’s currencies, the customer will have to navigate multiple websites and use external sources to determine the markup over the mid-market rates. If the seller makes the location selection automatically, customers may even be entirely unable to compare prices across different websites.

Companies that change the currency based on the location of the customer have identified the importance of capturing international customers and introduced systems to help improve their experience. Usually setting up the correct region is very simple and is often performed automatically, meaning that customers do not lose time looking for the required settings.

The main issue, however, is that this method does not function well for customers with any form of foreign currency cards, and also requires the seller to quickly support as many currencies as possible, as the system is only as good as the range of covered currencies.

For unsupported currencies, the experience is more or less the same as for sellers that offer sales in the marketplace currency only.

If the customer makes a purchase in their home currency with this method, banks will usually forego the currency conversion (FX) fees. The seller thus has the opportunity to incorporate the fees when setting the pricing in the foreign currency.

Banks in some countries use the location of the transaction as an identifier of whether cross-border fees are applied, instead of whether a currency conversion took place. This means that some customers may be charged both the service fee by the seller and a cross-border fee by their bank.

The customer may have to do some work to get the desired checkout option, such as selecting their region. In other cases, however, this may be done automatically. Generally these options aren’t difficult to find, as selecting the correct region is detrimental to the operation of the website and delivery to the customer.

Fees in this type of checkout can be difficult to understand. Companies may greatly increase the prices across currencies, but in some cases they may also be simply converted at interbank rates.

Customers therefore must compare prices across different websites to see if and how much of a price difference there is. The seller is unlikely to provide a fee breakdown. Furthermore, they may have to do additional research to understand how their bank processes payments in their own currency abroad.

Multi-currency choice

Some merchants provide the customer with the option to select the currency that the prices will be processed in early on in the shopping experience. In some cases, the choice is between a few currencies, while other merchants may offer a wide range of currency options.

The merchant can achieve this by either having a conversion rate at which they convert between currencies or simply set prices for each currency and/or region independently. Usually the default prices will be determined by the region from which the customer accesses the website, but can be changed at later stages of the checkout process.

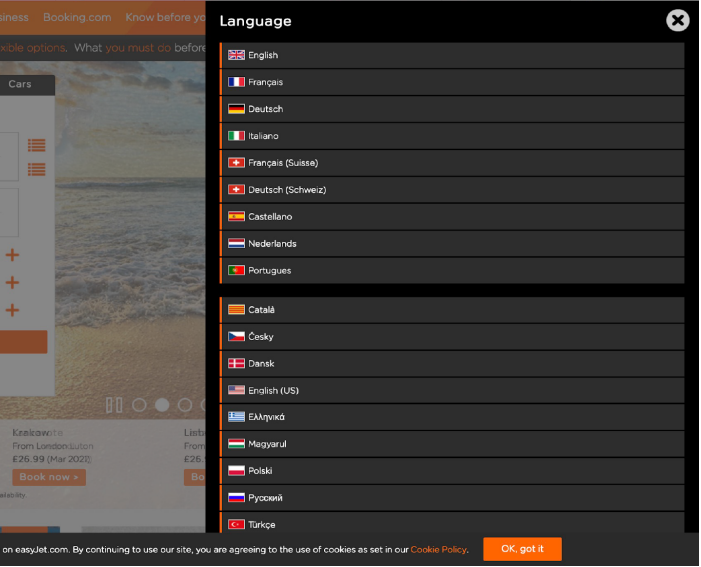

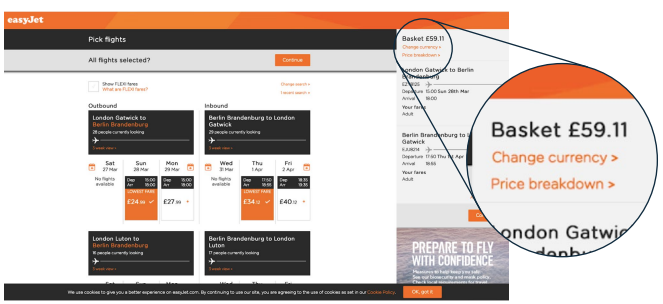

Easyjet offers a choice for the language and region when the customer first opens the website.

Figure 12

Easyjet

After selecting the flight dates, the customer will have the option to change the currency. Selecting that option opens a selection of currencies.

Easyjet supports only the currencies displayed in the selection. The language setting does not influence the currency selection later on.

Changing the currency will immediately show all prices in the selected currency. All selections aside from flight tickets are deleted and have to be selected again. The checkout will then proceed in the selected currency with no further changes available at later stages of checkout.

Figure 13

Easyjet

From the perspective of a user, the ability to change the currency is a welcome addition.

It offers both flexibility in the sense that it makes it possible to pay with different currency cards or in preferred currencies. Both the currency and language settings can be changed with only two clicks. However, the option to change the currency setting may be difficult to spot, especially for people who are not aware that such an option is available.

It is presented only during the flight customisation process, where users tend to focus on other parts of the page, such as flight selection or luggage settings. This may lead to customers missing out on the option and paying in a currency that may not be ideal for them.

Easyjet increases the price when converting from GBP to other currencies by around 4.6-5.0% above the mid-market exchange rate.

Figure 14

Easyjet

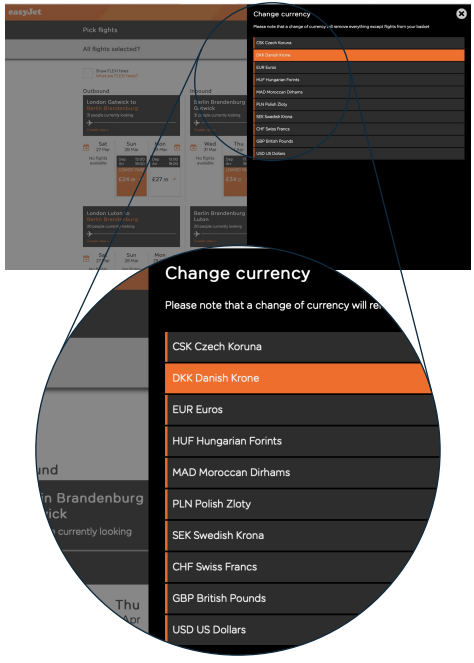

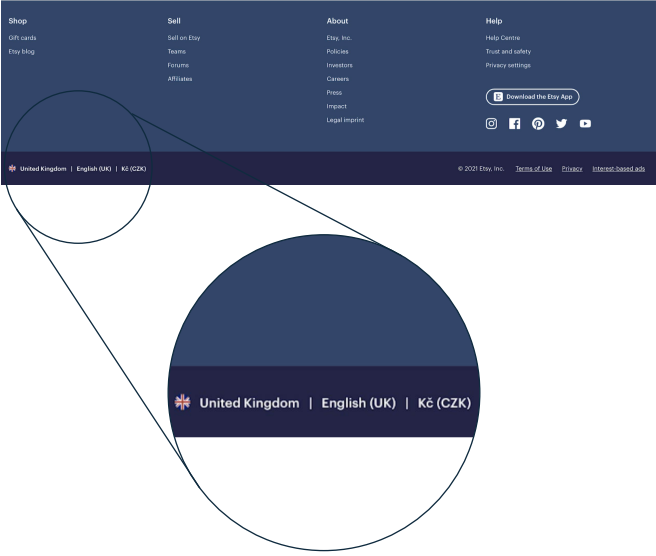

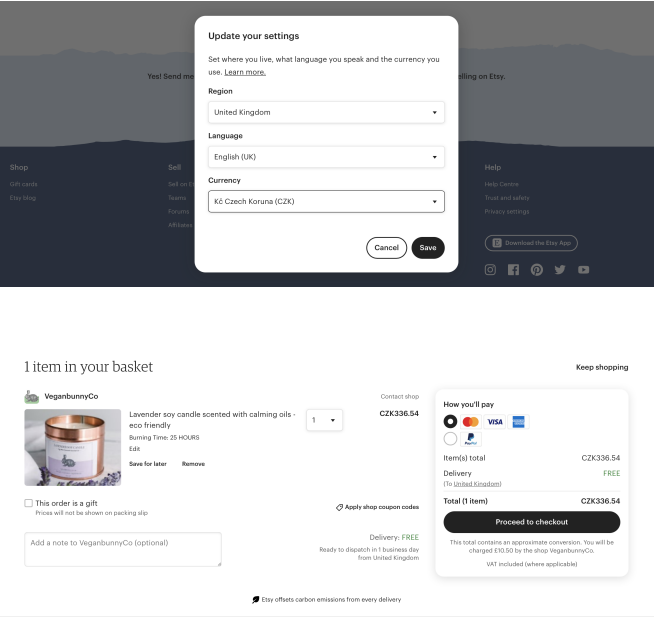

When visiting the Etsy website, customers can scroll to the bottom to select region, language and currency settings.

Figure 15

Etsy

While the region setting covers most of the world, the language and currency settings are more limited, although both still offer a number of options.

Although Etsy claims that the region selection does not limit what you can see on the website, it does primarily show the items that can be delivered to the selected location.

Selecting a currency in the drop down will change all the prices on the website, and the checkout will be conducted in the selected currency.

Changing the prices to both EUR and GBP from USD increases the price by around 4% compared to mid-market exchange rates.

Figure 16

Etsy

User experience

Customer experience

The customer has the most complicated choice in this type of checkout experience. They have to select the currency, and possibly location as well, on their own. Furthermore, the currency selection interface will likely have to be found first, and in some cases changing the currency too late may lead to having to start the purchase from scratch.

Usability of choice

While the choice is extensive, there are likely to be many options that the customer does not need, as they are most interested in either the marketplace or their own currency. If the currency choice interface is difficult to find, the utility of it may be limited.

Ease of understanding fees

The customer will need to compare the fees across different currencies to identify the best option. This is usually performed easily, but may require navigating versions of the website with different currencies.

Fee transparency

The seller is unlikely to provide an insight into why the prices and fees may be different for different currencies. The bank will charge FX fees when paying in a foreign currency and may charge cross-border fees when paying in the home currency.

Multi-Currency choice is a powerful tool because it allows the user to determine, to a large extent, how they want to be charged. This is well suited to all customers, including those with foreign currency cards.

Furthermore, customers can potentially select to pay in foreign currencies where they have lower fees or no fees at all. For this method to be effective, a smooth shopping experience is necessary as well as a wide coverage of currencies.

Customers have a choice as to whether they want their bank to determine the conversion fees or the merchant. This enables the merchant to incorporate the exchange fees in the prices they set across the different currencies.

Last-step conversion

Some merchants allow the customer to make a choice of payment currency at or near the very last step of the checkout. Last-step conversion, or DCC (Dynamic Currency Conversion) is a payment method where the merchant allows the choice between paying in the marketplace currency and the customer’s card currency.

The merchant will determine the exchange rate between marketplace and card currency. Since banks frequently add currency conversion fees for purchases made in foreign currencies, last-step conversions are marketed as the “full fee”.

However, in some cases banks may charge additional fees even for this option. While some merchants may convert at rates that are close to the mid-market rate, frequently they will charge premiums for the service, resulting in higher charges when using last-step conversion rather than simply paying in the marketplace currency.

Upon entering the Ryanair website, the customer has the option to select a country.

Figure 17

Ryanair

Depending on the country selection and the flight destination, the home currency of the website may or may not change.

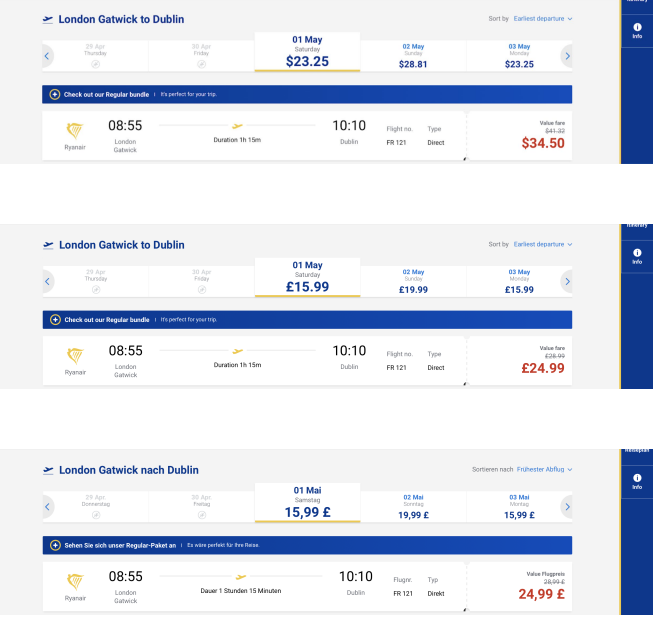

Below we can see the London to Dublin flight for the US, UK and Germany selection respectively.

Figure 18

Ryanair

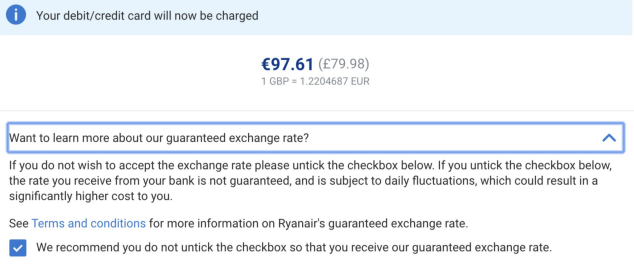

Ryanair provides a DCC service where it converts the price into the currency of the customer.

Below, in a different example, we can see that after the customer has entered their card at checkout Ryanair has determined that the card is a EUR card, while the selected currency is GBP. Ryanair immediately converts the price to the card currency and the customer has to opt out to be charged in the marketplace currency.

Ryanair suggests against opting out. The rate is marketed as a “guaranteed exchange rate”, due to the fact that when paying in the marketplace currency the conversion rate is only later determined by the card network (such as Mastercard or Visa).

Figure 19

Ryanair

While Visa and Mastercard rates are much closer to the mid-market rate than the rate that Ryanair offers, banks will frequently add conversion fees when the conversion is conducted by the card network, meaning that depending on the market and bank, it may be cheaper or more expensive to select Ryanair’s exchange rate.

The currency selection for Ryanair is shown to each user after Ryanair identifies their card to be in a currency other than the marketplace currency.

The option is given to customers who it’s most relevant for, rather than each customer having to search for the option independently.

Selecting the currency is fairly straightforward as well, as simply ticking or unticking a checkbox is enough to make the selection and there is a clear explanation of what each option does, along with some information on how the conversion is done in each case.

Ryanair automatically ticks their guaranteed exchange rate as well as suggests to customers not to untick the box. In this specific case the mid-market exchange rate at the time of this purchase was around 1 GBP = 1.1475 EUR, meaning that for this conversion Ryanair is charging an exchange margin around 6.5%.

While the benefit of Ryanair’s conversion is that many customers will not face any additional charges, some customers may be able to save money if their bank does the conversion cheaper than Ryanair.

Hybrid checkout

Some sellers who have implemented DCC only for a small number of global currencies operate a form of hybrid checkout experience.

Upon payment, they offer the ability to select a number of currencies that they support.

For some of the supported currencies they may even automatically select them when card details are entered.

For customers whose currencies are not supported, they can select one of the offered currencies instead. We have called this a “hybrid checkout” because while there is a clear DCC option for the supported currencies, it is not available for all of the unsupported currencies.

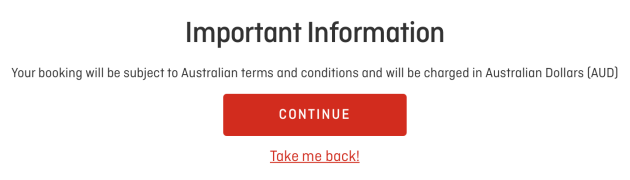

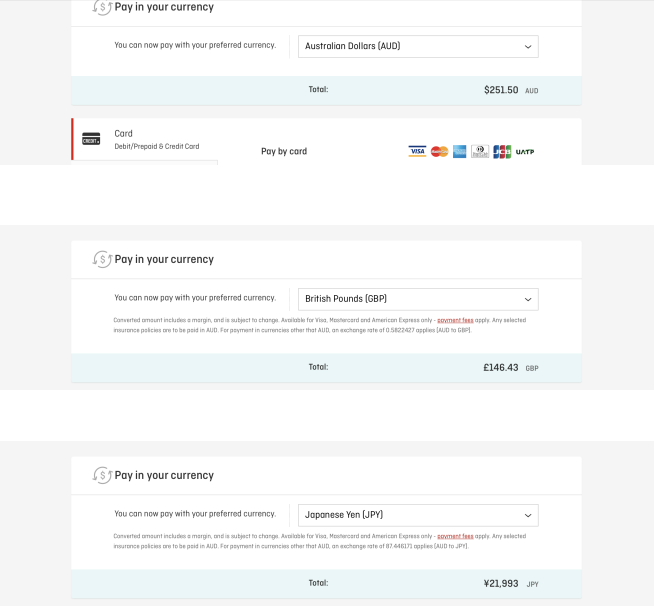

At the start of the Qantas checkout, there is no option to select any currency.

However, once the flight details are selected, the website displays a message stating which currency the payment will be processed in. In our experience, this would depend on the departing location of the first flight in the itinerary.

Figure 20

Qantas

The checkout process is then conducted in this currency until the card details are entered. At this stage, the customer has the option to select one of the other offered currencies. The card currency does not have an influence on the choice.

In the below cases, the GBP and JPY prices are around 5% higher than the AUD equivalent, meaning that for these conversions Qantas is charging an exchange margin of about 5% above the interbank rate.

Figure 21

Qantas

User experience

Customer experience

The customer can proceed with their purchase without having to select any currency options. They will however have some choice when checking out.

Usability of choice

The choice is made quickly and between two or more relevant options. It significantly impacts customer satisfaction and also the resulting fees.

Ease of understanding fees

Understanding the seller’s fees is usually simple. The customer can quickly compare prices across the different currencies as they are both stated clearly upon checkout.

Fee transparency

The fees are usually clearly stated and displayed, at least in terms of the price that will be charged to the customer’s bank. Margins charged by the seller may be displayed in some regions, as rules have been passed that define how sellers must state their fees. Bank fees may remain unclear until the purchase is made.

Last-step conversion is a powerful tool because it allows customers a significant currency choice while also keeping the user experience as simple as possible.

Since most customers are interested in buying in their own currency, offering each customer the ability to pay in the currency of their card will leave customers with their desired option.

Customers do not have to look for currency choice options and can be sure which currency their transaction will be processed in.

Displaying all the payment options upon checkout also gives the customer a clear ability to compare the options without having to navigate multiple websites and currency selection options.

Lastly, sellers are able to capitalise on bank fees and when converting to the customer’s currency can increase the exchange rates to earn a margin. In order to avoid overcharging the customer, or having the customer incur both a higher conversion margin and cross-border fees, sellers need to know what fees are usually charged for each foreign currency.

Conclusion

Ecommerce players have an opportunity to capture an international customer base by ensuring that the checkout experience is as simple and convenient for customers as possible. The aspects that need the most focus are:

Simplicity of the website

The website should be easy to navigate with quick and simple customisation options. Complex websites may turn the customer away, as well as issues arising at the end of the checkout process.

Currency customisation

Having the choice of paying in multiple currencies, especially in the customer’s card currency, is favourable for customers and increases customer retention.

Fee transparency and understanding

Customers want to have an understanding of the fees that they are being charged and will especially be dissatisfied with the seller if they perceive the final fees as too high or significantly more than it seemed upon purchase. This is especially true if the fees end up being much higher than what the customer usually pays for online services abroad.

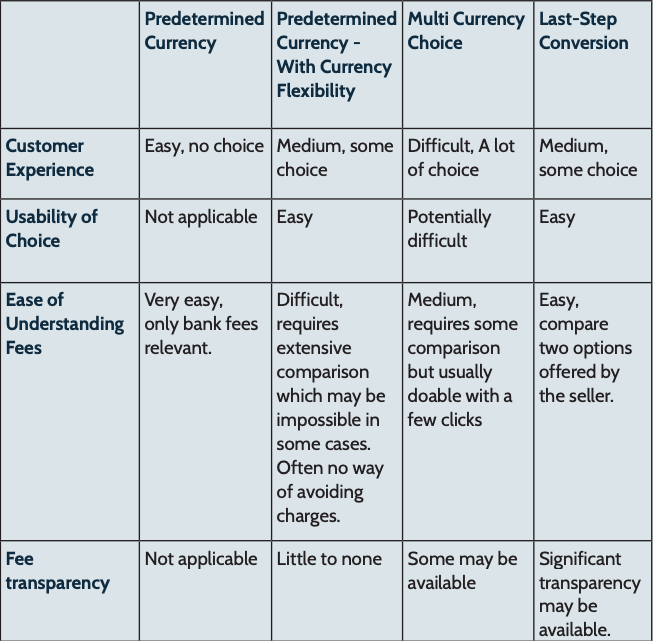

Each of the discussed checkout experiences have benefits and drawbacks in terms of the above factors as displayed in the table below.

The ideal checkout experience for each seller will depend on which of the factors are most important to their specific customers and the volume of international purchases that they face.