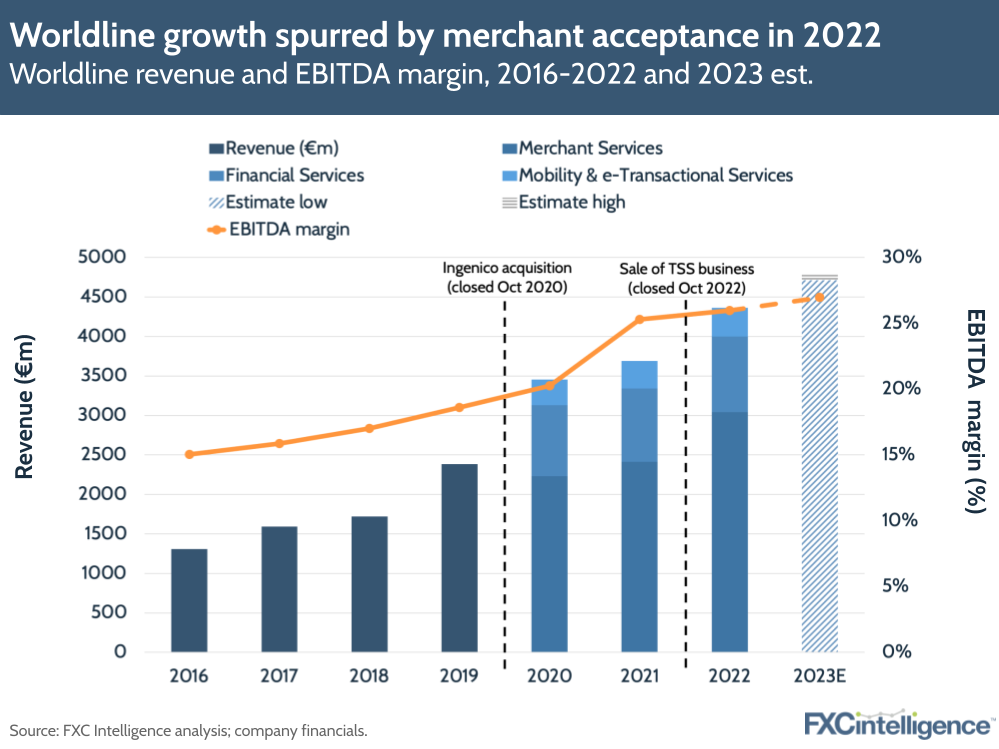

French payment processor Worldline has beaten its revenue expectations for the year, having reported 10.7% revenue growth to €4.36bn in 2022. The company’s Merchant Services segment and acquisitions drove business in Q4, which saw revenues rise 8.3% to €1.186bn.

Worldline’s EBITDA increased by 15.7% to €1.1bn in 2022 and represented 26% of the company’s revenue – a 110 bps improvement on last year.

Other key highlights from Q4 and 2022 are below:

- Merchant Services remains the company’s key growth driver. The segment’s revenues rose 10.3% in Q4 to reach €835m, and grew 14% to €3.04bn over the year. Since 2020, Worldline has onboarded more than 200,000 new merchants to its platforms, bringing the total number it was serving by December 2022 to 1.25 million.

- Two years after acquiring French payments rival Ingenico, Worldline has now completed the sale of its Terminals, Solutions and Services segment (which comprises Ingenico) to private equity firm Apollo Funds. Executives maintained that the sale will simplify Worldline’s structure, while the proceeds (totalling €1.1bn) will contribute to development and cutting debt.

- Mobility and e-Transactional Services grew 7% to €92m in Q4 and 7.3% to €365m in FY 22, while Financial Services saw 2.9% growth to €260m over the quarter and 2.5% growth to €958m over the whole year. The latter segment is expected to see an impact from Worldline’s extended partnership with Dutch bank ING, for which it provides card issuing services.

- Throughout the year, Worldline has been acquiring other payments acceptance companies to further market expansion, including 80% of Axepta Italy; a controlling stake of ANZ in Australia; and Eurobank’s merchant acquiring activities in Greece.

- Looking to 2023, the company gave similar revenue guidance as it did last year: an 8-10% increase. It also expects EBITDA margin to rise by over 100 bps in 2023.