Wise has released its Q2 for FY23 results (Q3 2022 in calendar time, which is how we’ll refer to it from now on). The UK-based money transfer player saw revenues rise 59% YoY to £211.5m, leading it to update its guidance for FY23. However, growing volatility has led the company to increase its prices across some corridors.

Wise’s price rises raised eyebrows but our recent report on Wise’s business model shows this was just the company’s cost-plus model responding to more expensive currency costs in a volatile market.

Here are some of the main highlights from Wise’s results:

- Total cross-border volumes rose 50% YoY to £27bn, driven by an overall rise in customers to 5.5 million, compared to 3.9 million in calendar Q3 2021. Volumes across Wise’s business segment grew 55% to £6.9bn, while volumes for its personal segment grew 49% to £20.1bn. Take rate also rose 4bps, to 0.78%, compared to last year.

- The company raised prices across some corridors due to high volatility, while prices have decreased for sending money to China and Chile. Wise reports that its average customer price increased to 0.64%, an increase from 0.62% compared to calendar Q3 2021. However, Wise calculates this figure across ‘a fixed basket’ of currencies and representative corridors. If you want to see comprehensive data on Wise’s pricing and the wider market, our dataset can help with that.

- Wise completed more than half of its transfers instantly for the second consecutive quarter, while approximately 90% of all transfers were completed within 24 hours. It hopes to increase these numbers even further by speeding up financial crime checks.

- Volume per customer increased by 18% for business and 5.4% for the consumer segment. This shows the growing value of business to Wise’s operation, but the consumer segment still accounts for the bulk of Wise’s revenues (78%), volume (74%) and customers (95%).

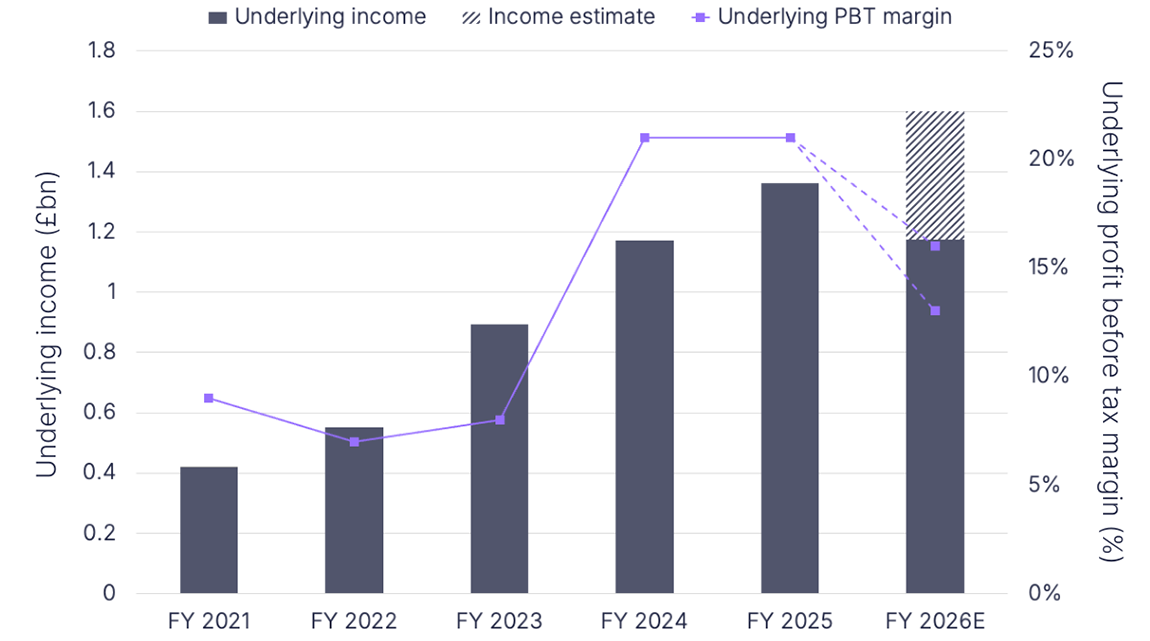

- Wise has updated its full year guidance for FY23. It now expects total income growth of 55-60% in FY23 and an adjusted EBITDA margin over the medium term at or above 20% of total income.