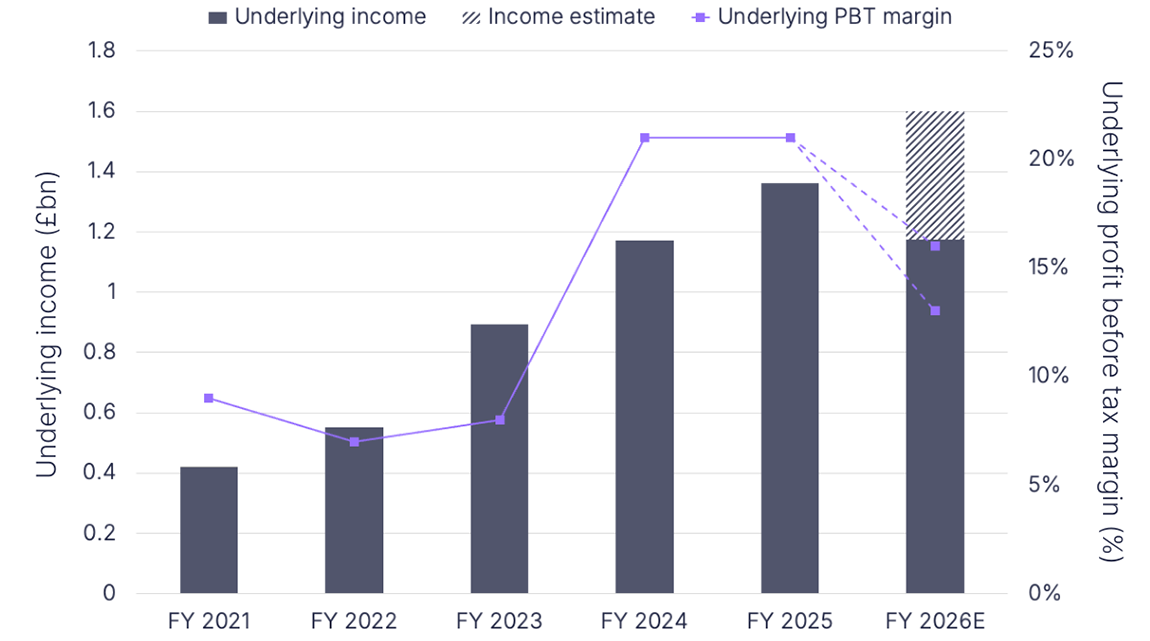

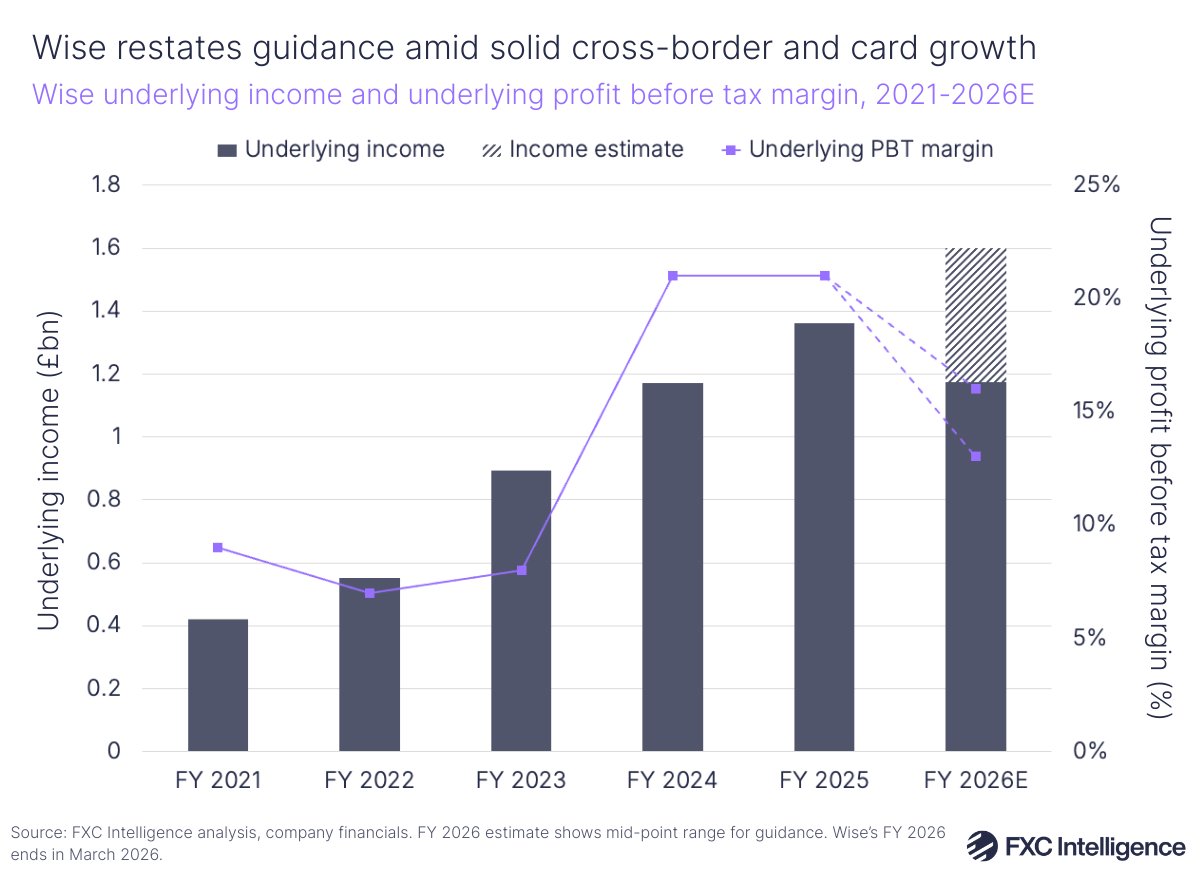

Wise reported solid growth in its trading update for Q3 2026 (spanning calendar Q4 25), during which the money transfer provider’s underlying income rose 21% YoY to £424.4m while total volume grew 25% to £47.4bn. For its full financial year, the company expects underlying income to be around the midpoint of a projected 15-20% YoY growth range (around £1.6bn), with a profit before tax margin (PBT) at the upper end of its medium-term target of 13-16%.

Wise’s underlying income comprises revenue, the first 1% of gross yield of interest income on customer balances and any interest expense on customer balances. It does not include interest income above the first 1% gross yield or benefits paid on customer balances. The company also refers to underlying operating profit, which is based on underlying income and excludes benefits paid related to customer balances. Wise reports these metrics so that it is focusing on income it is actually retaining from customers, and not basing its performance on income that it is looking to pass back to customers in the form of benefits.

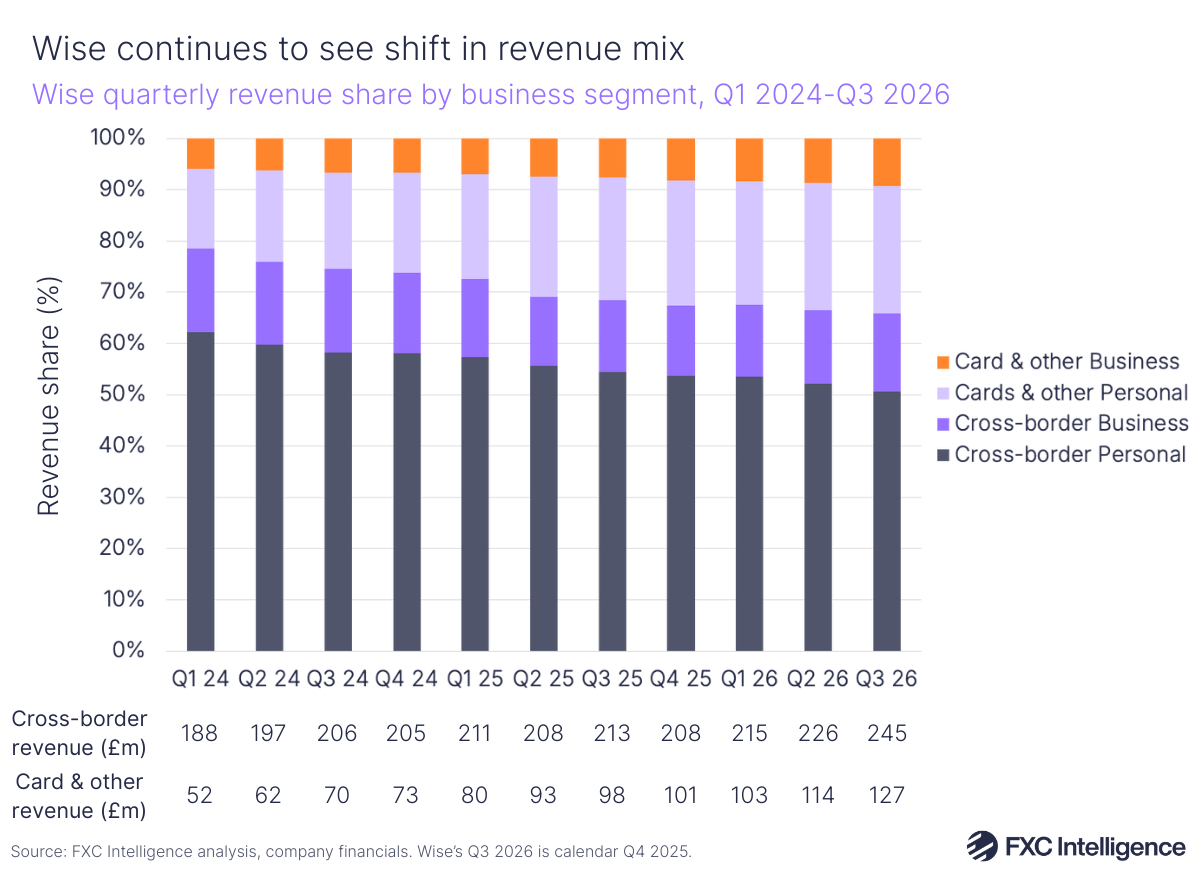

Cross-border revenue grew by 15% to £245.4m and still takes up the majority of income overall, though card and other revenues grew faster, with 30% YoY growth to account for £127.4m. Underlying interest income, meanwhile, grew by 33% to £51.6m.

Active customers rose 20% to hit 10.9 million in Q3 26. The vast majority of these customers (10.4 million) are in Wise’s Personal segment, though it has grown its number of Business customers by 25% to 542,000 and these customers tend to trade higher volumes through the platform on average. Overall, businesses contributed 30% (£14.2m) of Wise’s total volumes for the quarter despite being a fraction of the customer set, highlighting why Wise is increasingly targeting SMBs as well as larger financial institutions through its B2B2X product Wise Platform.

The company also continues to see benefits from its Wise Account product. Customer holdings grew 34% to £27.5bn, which in turn helped spur the 30% growth in its Card and other revenue segment. Wise also discussed the launch of its Wise travel card in India, which has seen over 75,000 customers join its waiting list in one month, as well as introducing Google Pay for its customers in the Philippines – both of which could serve its card segment.

As a result, Wise’s mix continues to shift over time. For example, Cross-border Personal revenue accounted for 51% of Wise’s core revenues (i.e. excluding interest income) in Q3 26, down from 54% in Q3 2025 and 58% in Q3 2024. By comparison, Cards and other Personal revenue accounted for around 25% of core revenues, up from 24% in Q3 25 and 19% in Q3 24.

With Wise continuing to add products and invest in long-term growth, its take rates are also shifting over time. The company’s cross-border take rate for Q3 26 was 0.52%, down from 0.56% a year ago, while its overall take rate calculates slightly higher at 0.79%, also slightly down from 0.82% a year ago.

As Wise moves forward, building out its infrastructure has been a key focus. The company has secured conditional licence approval in South Africa (its first in Africa) and is integrating with Japan’s Zengin system, bringing its number of direct integrations with domestic payment systems to eight. It also reported 74% of its payments were delivered instantly in Q3 26, up from 65% the previous year.

Finally, CEO Kristo Käärmann also noted that Wise expects to complete its dual listing in the US during the first half of this calendar year, which he expects to increase the company’s profile in the US as it expands its network.