This past week I caught up with Keith Hatton, who has been CEO of Currencies Direct for the past 10 years. Currencies Direct is one of only a few major players in the sector that remain private equity-backed (for the rest see our Top 100 listing). Its PE owners are six years into their cycle and will have to do something with their asset soon.

Currencies Direct has a specific market positioning. First, it focuses on a mix of higher-end private customers (typically buying a six-figure second home abroad) as well as the SME, ecommerce and corporate space. It is one of the very few players to operate a multi-brand platform (all on one set of systems) with five different go-to-market brands. These brands receive a large portion of their business via a 3,500-large network of introducers from some of the biggest wealth managers down to small-property agents.

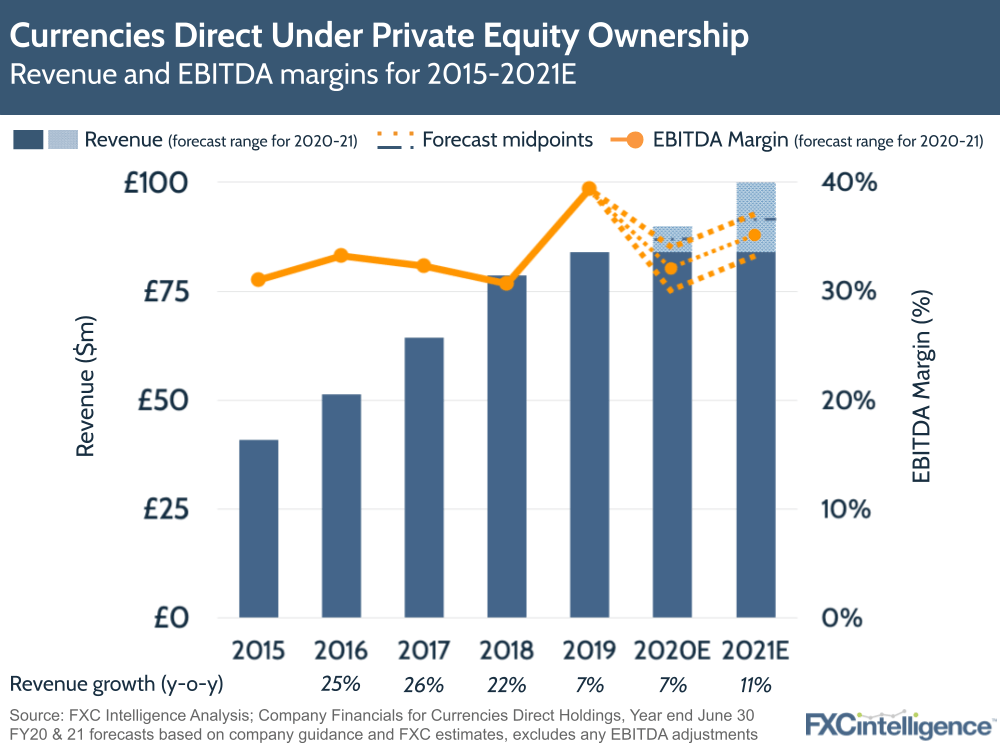

The early part of 2020 was especially hard for the business as the high-end consumer market froze up due to the pandemic. The good news though (and Currencies Direct reports a financial year from July to June) is the latest year looks much better with this segment bouncing back, as shown by the numbers above.

EBITDA margins are some of the highest in the sector and overall, the PE owners now have a business doing nearly three times as much EBITDA as when they bought it. This enabled the owners to take a decent recent dividend out the business – £165m to restructure the debt to a lower cost longer-term position. The PE owners probably don’t have all their initial investment back but are likely close (initial purchase price was around £210m).

The biggest downside of these sector-wide high margins means the right future home/buyer needs to be found. Several discussions were had over the past few years with OFX (a group with a similar customer mix) but these didn’t materialise. Moneycorp, another player with a substantial high-end private client book, is now focusing on B2B, while WorldFirst recently shut its private business, handing it off to XE (whose focus is digital-first).

A broader thought would be that Currencies Direct’s 100,000 customers, who mostly fit in the private wealth but below private banking level, could be very attractive to any organisation targeting this customer group. That could be bespoke travel, insurance or wealth management. We’ll be keeping a close eye on what happens next.

Who are the other Private Equity Backed players in the Top 100?