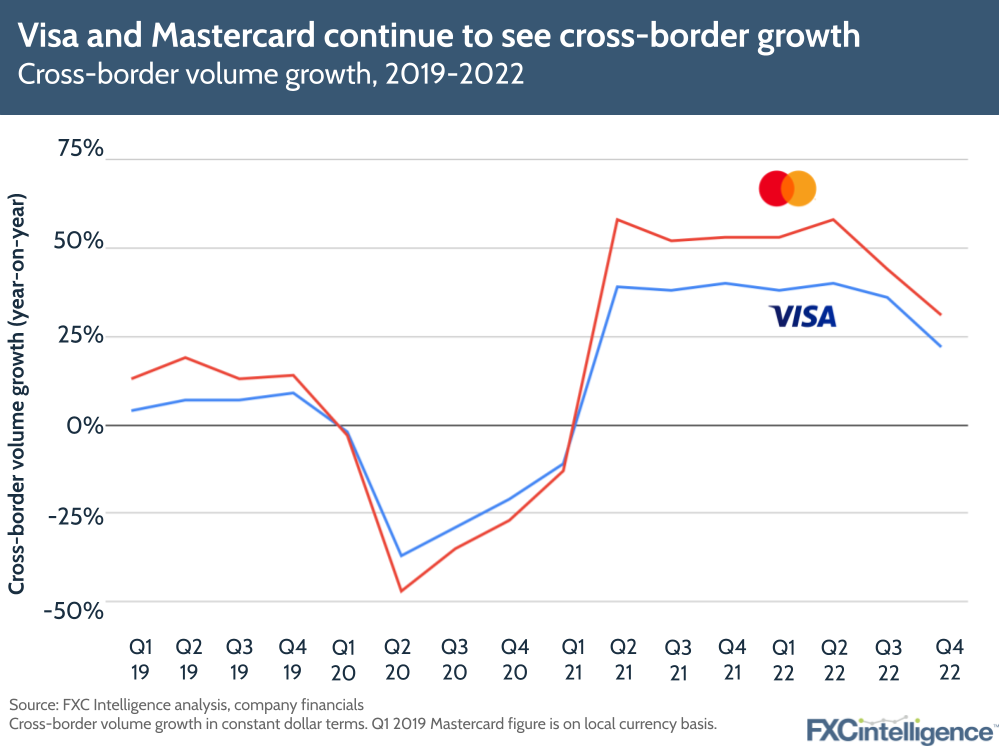

Visa and Mastercard have announced their latest earnings – Q4 2022 for Mastercard and Q1 2023 for Visa. Both companies have noted revenues rising as a result of travel markets opening up and continued consumer spending, despite suspended operations in Russia. Cross-border volume has continued to grow, but has slowed down for both companies compared to last year.

Visa Q1 2023 earnings highlights

- Net revenues increased by 12% YoY to £7.9bn in Q1, driven by a 22% YoY growth in cross-border volume (31% excluding intra-Europe), a 7% increase in payments volume and a 10% increase in processed transactions.

- Across 52.5 billion total processed transactions, international transaction revenues were a big driver, growing 29% to $2.8bn.

- Revenue growth was notably slower this year (12% compared to 24% in Q1 2022) as a result of a stronger dollar and discontinued operations in Russia. However, Visa said that revenues had still exceeded expectations as a result of higher FX volatility and cross-border growth.

- Travel-related cross-border volumes were 20% higher than in 2020, driven by the Asia-Pacific region, inbound improvements to the US and the World Cup. Visa expects mainland China revenues to recover this year after the country lifted Covid restrictions in January.

- Visa Direct saw 1.9 billion transactions during the quarter, up 39% YoY (excluding Russia). Non-US Visa Direct transactions as a percentage of total transactions grew nearly 20% from Q1 21 to Q1 23.

- Visa sees strong potential in the B2B space, with its estimated total addressable market of about $120bn across cards, cross-border, payables and receivables. Visa also mentioned that the rollout of real-time payment systems in countries such as India will help benefit the company’s value-added services in this arena too.

- The company has not changed its guidance, and is expecting full-year growth to be somewhere in the mid-teens on a constant-dollar basis. It said that Q2 revenues would likely see a revenue impact of almost five percentage points as a result of suspended operations in Russia.

Mastercard Q4 2022 earnings highlights

- Mastercard saw its net revenue increase 12% YoY, driven largely by cross-border volume growth of 31%. Across its fiscal year 2022 as a whole, the company’s adjusted net revenue increased by 18% while cross-border volume grew by 45% on a local currency basis.

- Cross-border volume fees increased by 40% – Mastercard said that these fees were nine percentage points higher than volume growth due to a more favourable mix, as higher-yielding ex-intra Europe cross-border volumes grew faster than intra-Europe cross-border volumes during the quarter.

- Inbound travel remained steady or increased in all regions compared to 2019. In the earnings call, executives said that cross-border volumes in Western markets will continue to recover at a ‘healthy but not accelerating pace’.

- As with Visa, lifted restrictions are expected to boost recovery in the Asia-Pacific region. China’s inbound cross-border travel volumes were roughly 1% of total volumes before the pandemic.

- Mastercard is expanding its remittances focus through Mastercard Send, partnering for example with money transfer provider Paysend.

- Higher levels of FX volatility supported growth in 2022 but going forward the company expects foreign exchange to be a tailwind of approximately 1% for the year as the euro strengthens against the US dollar.

- For full year 2023, the company expects net revenues to grow in low double digits, which considers an approximated 1.5% impact from Russian-related revenues in 2022.