Faster payments currently available mainly for domestic money transfers are one way to a customer’s heart. A second is reducing the pain of processing payments and onboarding customers. We look at both today, as well as comparative payment speeds of providers.

Remitly had a massive Series E raise (more on that next week) and finally, we dig into a big decision out of the Netherlands that may scupper your open banking and consumer marketing dreams.

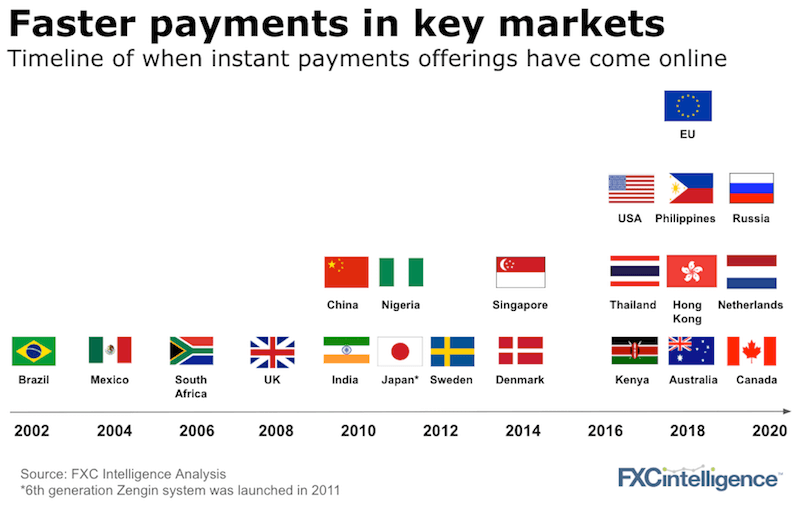

Faster Payments schemes, typically connecting to a central payment system have been 20 years in the making. And in the last 10 years, the pace has really picked up. Connecting to them is like plugging into the backbone of the internet – it supercharges the speed of your payments. Is it worth all the work?

The majority of participants so far have been banks. Banks have massive domestic payments needs as well as the sheer quantum of payments to make. But increasingly payments companies wanting to control more of their own rails and offer speed as a competitive advantage are joining. In the UK, TransferWise and Ebury (working with Form3, a specialist in the area) have led the way. In Latin America, EBANX has started.

There are different paths to faster payments. Blockchain is pushing speed as a use case. Direct connections to central banks is another. Expect the focus on speed to continue.

Comparative FX transfer speeds

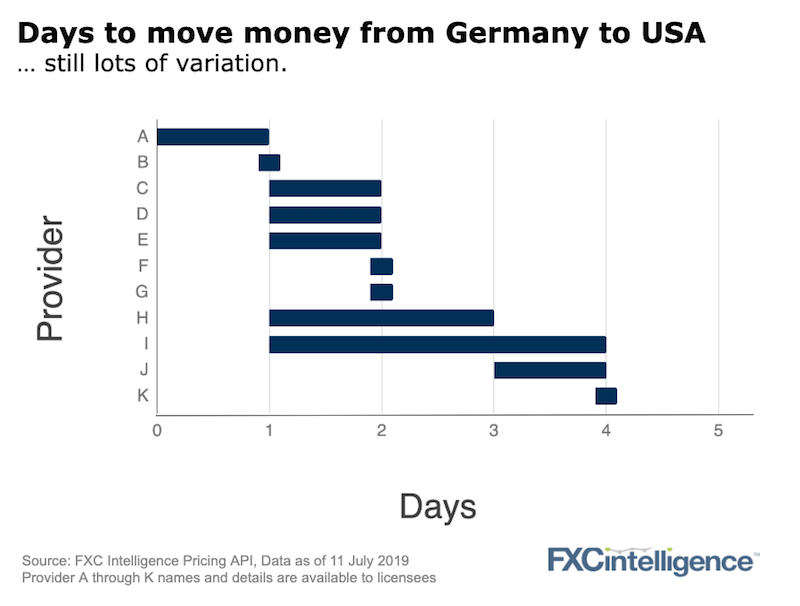

International transfers are still not yet a homogeneous and commoditised market – we frequently discuss the variation we see in pricing for moving money between countries. But providers’ transfer speeds also vary considerably even along quite major country and currency corridors.

Shockingly, the speed can still vary considerably by any given provider. For instance, for the Germany-US, route one provider indicates that a customer’s money will reach its destination within one to four days. Faster payments for international transfers is still a ways off.

Focus on the process of making payments

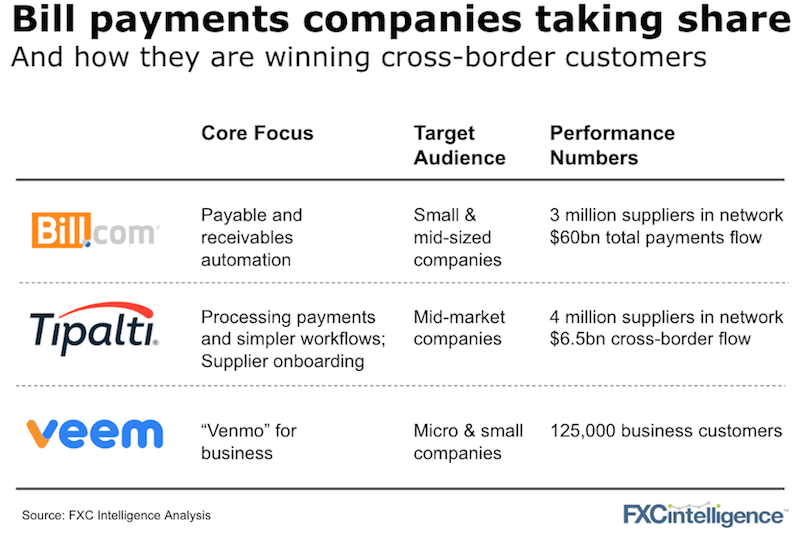

When it comes to winning corporate FX business, one of the bigger pain points many companies face is processing accounts payable and accounts receivables, especially when there is a cross-border element to it.

Businesses such as Bill.com, Tipalti and Veem are all winning international payments clients by solving non-price related pain points in the payments cycle.

The response by the incumbents in the sector is to either build or partner to offer the same capability. Cambridge Global Payments announced the launch this week of their own bill payments automation offering but for now these are mostly add-ons and not the core offering.

All three of the companies in our chart are growing faster than the SME cross-border sector overall. They are also building their own closed networks of payers and payees aiming to develop unique network effects in the space. Since they all based in San Francisco, it must be either the weather or the water out there.

The risks of building a business using personal data

If you are building a value proposition based on utilising the personal payments data of your customers, you may want to pause for a minute. This past week, the Dutch Data Protection Authority advised the Dutch Banking Authority that: “Banks are not allowed to simply send their customers personalised offers based on their payment details.”

As Holland is of course under EU Law, it would not be surprising to see other European markets follow with similar guidance. The implications should not be underestimated:

- For many neobanks and open banking aggregator apps, significant value and a differentiated consumer experience comes from analysing customer spend patterns, messaging them about it and ultimately selling new services.

- For big new industry plays such as Facebook’s Libra, and Facebook, a company with more personal preference information than perhaps any other, the idea that your financial data could be combined together and then targeted advertising sent to you, now really does seem very Big Brother but also very real.

Data protection laws such as GDPR have generally been good for the customer to the point that it is now part of all marketing processes and we hear little about it save for a few major fines. But increased data privacy is a directional trend that is far from finished, so don’t bet the house on monetising consumer data.

Our FX Pricing API licensees can see the names, speed of transfer and pricing details of all providers across over 1000 currency corridors. Are you building the right products to win? Are you able to track the speed and pricing of your competitors?

[fxci_space class=”tailor-6332ffc5154f7″][/fxci_space]