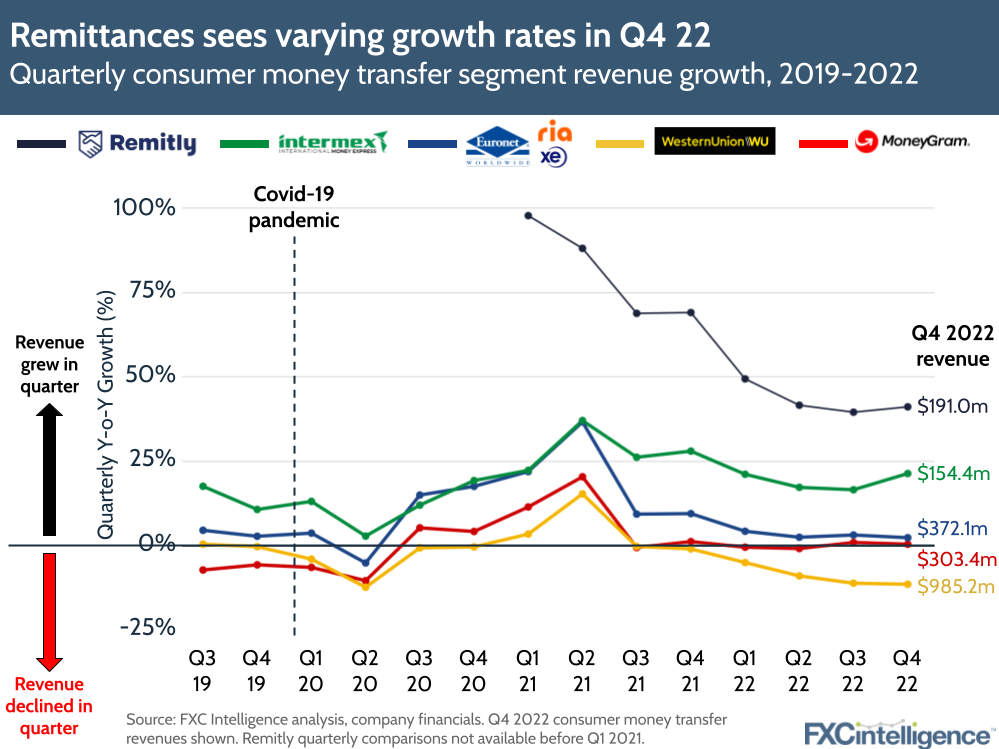

In a mixed quarter for key remittance companies, digital player Remitly and retail-focused Intermex recorded a solid rise in revenues. MoneyGram and Euronet (which owns Ria and Xe) continued to see slower growth but digital outperformed. Meanwhile, Western Union’s consumer revenues declined although it still has the largest share in the market by far.

Western Union’s consumer decline contributed to an overall 15% revenue drop for the company. Suspended operations in Russia and Belarus, as well as activity reductions across most regions, drove an 8% decline across its digital transfer revenues. On the other hand, growth in the LACA region contributed to a 2% increase in transactions overall.

MoneyGram’s total money transfer revenue rose 0.4% to $303.4m, with revenues negatively impacted by the strong US dollar (on a constant currency basis, revenue was up 5% compared to last year). However, the company is making good progress in its transition to being a digital-first company, increasing its overall digital revenue by 33% (the 12th consecutive quarter of digital growth) and digital transactions getting closer to 50%.

Euronet saw a 2% increase in its money transfer segment, which contributed to the company’s overall 7% increase in revenues. As part of this, the company saw 13% growth in both US outbound and international-originated money transactions (the latter includes sends from Europe, the Middle East and Asia). Direct-to-consumer digital transactions grew 38%.

Intermex’s quarterly revenues rose by a strong 21.4% as a result of its omnichannel strategy: adding agents in targeted locations on the retail side, and investing more in its app and website to grow customers online. Digital transaction growth was 84%, and it is continuing to grow share in the LATAM region through its acquisition of remittance company La Nacional.

Remitly’s growth has continued to outpace other, much bigger players, with revenue rising 41% in Q4 2022 on the back of high customer acquisition and retention, as well as expansion in 2022. With the company recently expanding into the Middle East and New Zealand, it is hoping to convert these revenue rises to profitable growth in 2023.