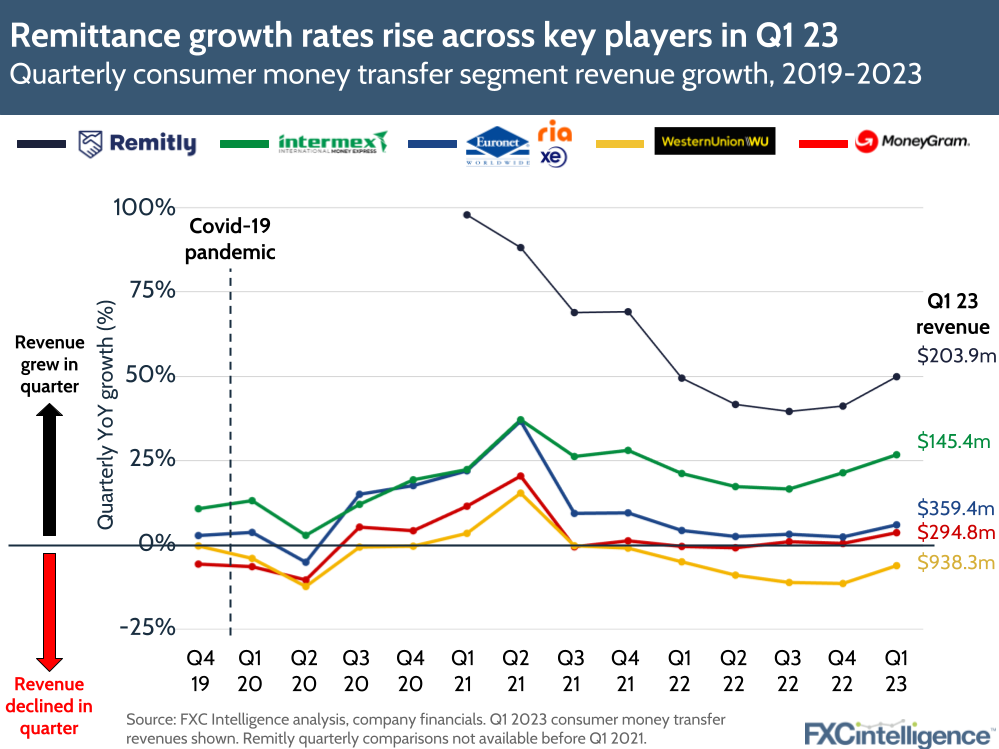

Market expansion and digital growth led to higher revenue rises for remittance companies in Q1 23. Intermex, MoneyGram, Remitly and Euronet (through Ria and Xe) saw faster growth, as well as a turnaround from the sequential decline in growth rates seen in Q1 22. And Western Union slowed its revenue decline compared to previous months.

Geographic expansion was a key theme for growth this quarter. Digital challenger Remitly, for example, has nearly doubled the number of corridors it serves to 4,500 and is pushing into more send markets, led by its acquisition of Israel-based Rewire. High customer acquisition caused revenues to grow 50% in Q1 to $203.9m, significantly faster than other incumbent players (though it is still much smaller).

Euronet also expanded its money transfer network with a 7% rise in retail locations to 528,000, helping to drive 6% growth in overall consumer transfer revenues to $359.4m – slightly higher than the 4.3% growth last year. Meanwhile, LatAm-focused Intermex’s Q1 saw revenues climb 26.8% to $145.4m – its fastest quarterly growth since Q4 21 – on the back of its acquisition of La Nacional’s US-based assets (the company has since acquired its European side too). Excluding La Nacional, Intermex’s revenue grew 11.5% YoY.

Also in Q1, money transfer players continued to see varying success with their digital strategies. On the one hand, MoneyGram’s digital revenues climbed 30% YoY, driving a 3.6% YoY increase in money transfer revenue to $294.8m. The company also achieved its target of having 50% of its transactions being digital for the first time, a full year ahead of its 2024 goal.

Western Union has also been pursuing a digital-first transformation, but this hasn’t yet driven enough growth for the company to outweigh the decline in the cash side of the business. Consumer money transfer revenues declined 6% to $938.3m and while branded digital transactions grew 7%, revenues from this segment reduced by 7% for the quarter.

For now, the uptick in growth rates amongst key remittance players shows that consumer money transfers have remained resilient going into 2023.