The latest figures published by Banco de México (Banxico), Mexico’s central bank, highlight that remittances sent to the country have tracked significantly downwards in Q2 2025. We take a closer look at the data below.

Banxico defines remittances as being sent by a person who is a non-resident of Mexico to a person who is a resident of Mexico. Specifically, it consists of transfers, in cash or in kind, from non-resident households to resident households, generated primarily by the migration of individuals to foreign economies.

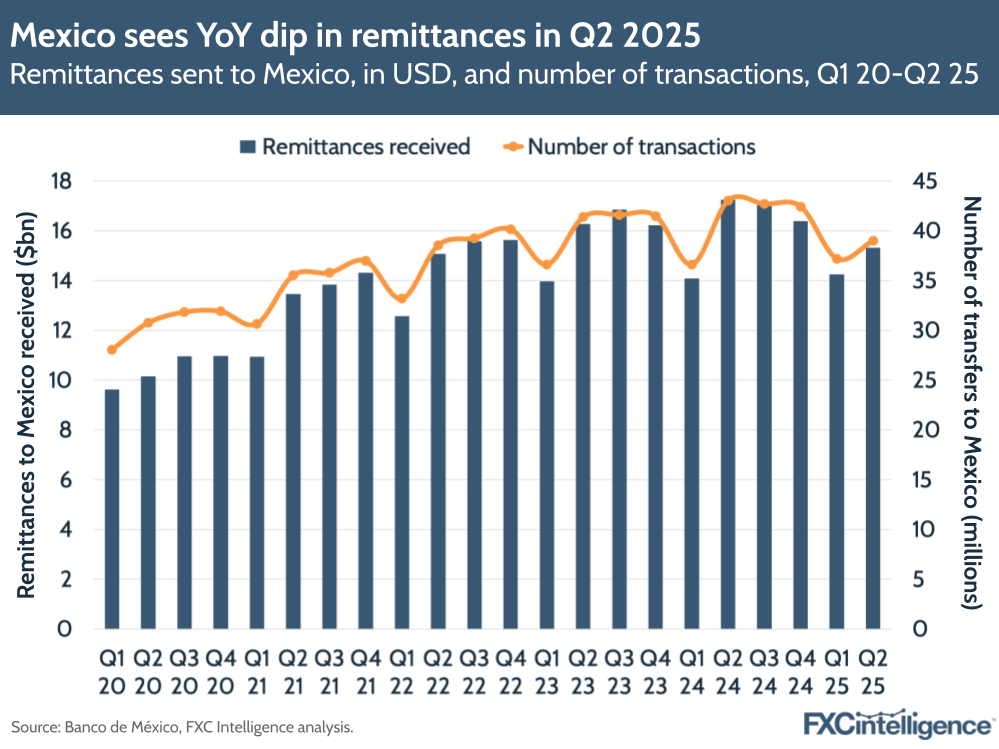

Overall, inbound remittances from abroad to Mexico decreased by 16.2% YoY to $5.2bn in June 2025 – the steepest monthly decline the country has seen in this metric since 2012, according to data from Banxico – while outbound transfers from Mexico rose 2%. Calculated on a quarterly basis, remittances to Mexico fell by 11% to $15.3bn in Q2 2025, though the rate of growth in remittances received has also been more generally slowing since 2022 after a significant uplift during the Covid-19 pandemic.

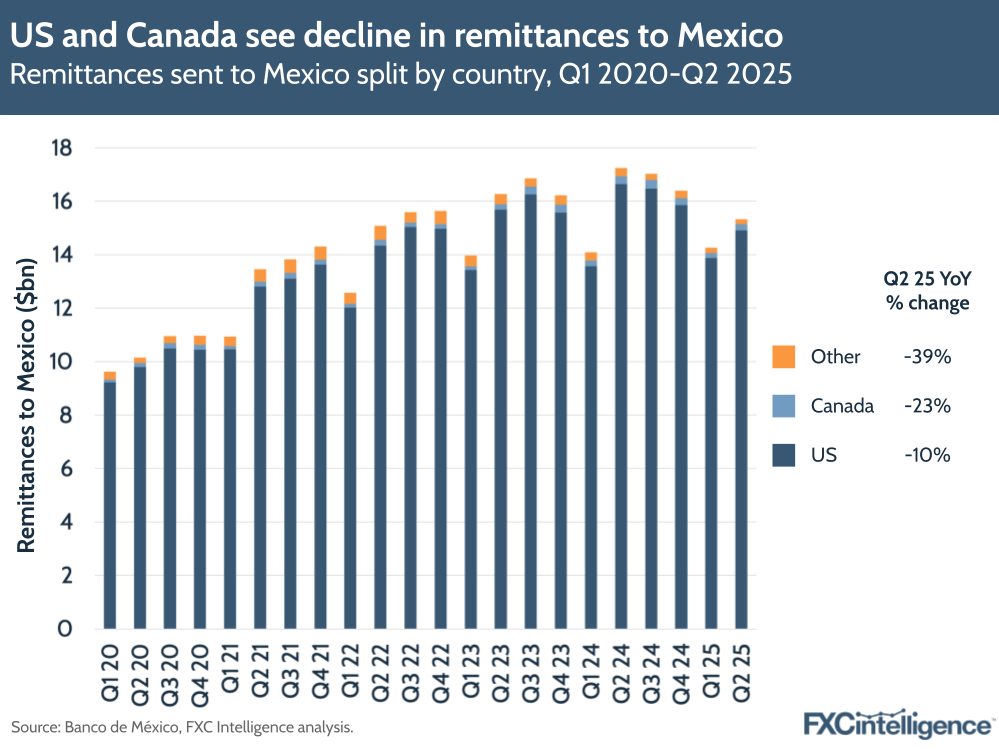

The US consistently drives the lion’s share of remittances to Mexico – around 97% in the latest quarter – though it saw a 10% dip in remittances overall to the country in Q2. Canada, the second-biggest remitter to Mexico with a 2% share, saw its figure fall by 23% while across all other countries combined remittances fell by 39%. However, with such a large share coming from the US, it is the clearest driver of change both up and down.

The number of transfers to Mexico also declined by 9% to 39 million during the quarter, with 99% of these being electronic transfers. Based on our calculations, the average transaction total has fallen by 2% to $393, the fourth consecutive quarter this metric has fallen in a row, having previously risen every quarter from Q1 2020 to Q2 2024.

Some analysts have argued that the data could be aligned with growing fears among migrants of going to work in the US amid the country’s growing agenda on deportation. Others have suggested that it could be due to a weakening labour market for foreign workers, with some employers becoming more reluctant to employ migrant labour, which in turn is impacting the amount of money that migrants are able to send back home.

Regardless of the reasons, the figures point to a more structural shift across the world’s largest remittances corridor. Last week, we looked in more detail at money transfer provider Intermex, which is focused on retail transfers with Mexico as one of its core markets and is now being acquired by Western Union amid declining transactions and volume.

For money transfer providers serving Mexico, diversification across customer segments and geographies could be key, as well as continuing to closely monitor the downturn to see how it continues, given the US’s launch of a new 1% tax on cash-based transfers starting in 2026.

How do money transfer providers compare on pricing to Mexico?