Over the past year, the potential applications of cryptocurrency for remittances have been a subject of increased focus. Facebook’s long-awaited remittances play Novi launched as a pilot in Guatemala, while major remittance pay-in country El Salvador made Bitcoin legal tender. However, other nations have not been so positive, with a number putting tight restrictions on cryptocurrencies, or even banning them outright.

As interest in cryptocurrency-based remittances continues to rise, the regulatory environment for digital assets remains ambiguous in many countries – and what stance countries ultimately take will be a major determiner in their eventual success.

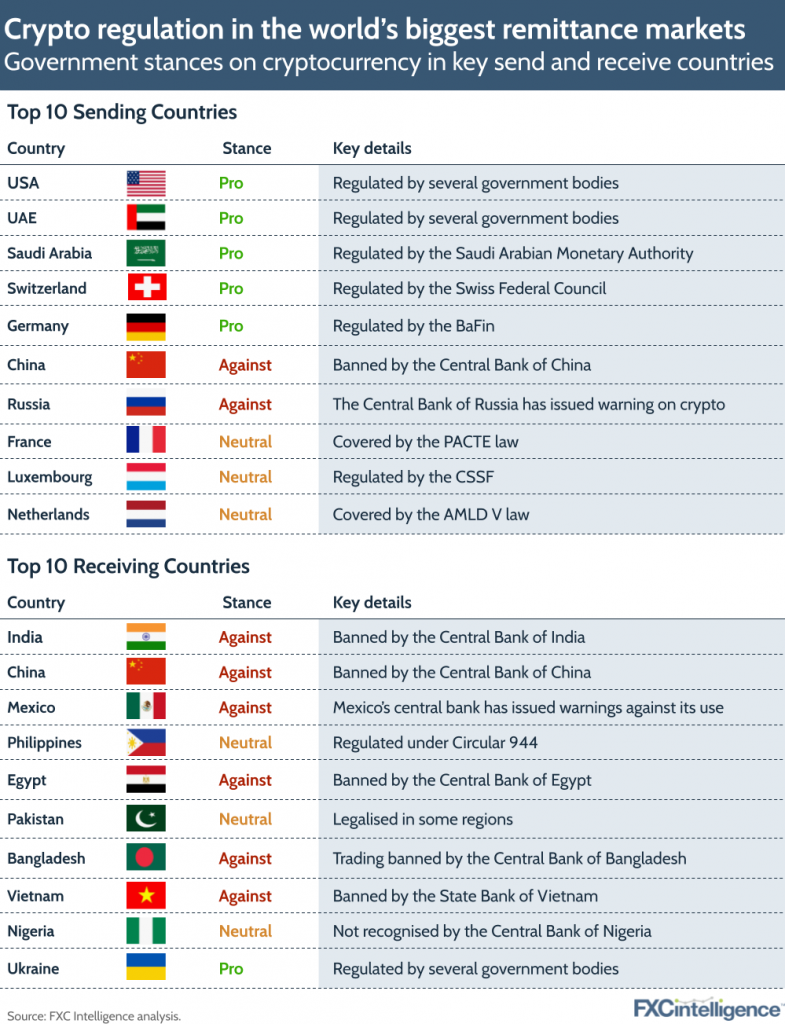

Crypto regulation in the top 10 sending countries for remittances

While half of the top ten sending markets have developed crypto-friendly regulations, another 30% have a more neutral stance.

In the US, the President’s working group on financial markets recently released proposed legislation on stablecoins, signalling an increased interest in cryptocurrency regulation. Meanwhile, in June France extended the application of its PACTE law to include all crypto firms operating in its territory.

Gulf countries have also been active in developing comprehensive cryptocurrencies rules, with the UAE and Saudi Central Bank pioneering the use of blockchain for cross-border money transfers, such as through a recent partnership with Ripple.

Most remittance receiving countries have taken steps to restrict cryptocurrencies

However, among the top receiving countries, the attitude to cryptocurrencies is more negative. The central banks of 60% of the top ten have released warnings about cryptocurrencies, with Turkey, Mexico, India and China issuing bans or restrictions in 2021, following in the footsteps of Bangladesh, Vietnam and Egypt.

In some cases the situation is complex and subject to change. India, for example, announced a bill to ban on cryptocurrencies as well as the creation of a framework for a digital currency issued by its central bank in November 2021. However, it is also considering a proposed bill that would enable cryptocurrency to be used as an asset but banning its use as a currency or other means of making payments.

Cryptocurrencies are often viewed as a threat to government-imposed capital controls and can have links to criminal activities, largely due to the absence of regulation and central oversight. The lack of transparency in cryptocurrencies’ ecosystem can also make it difficult for central banks to effectively monitor payment systems and track incoming funds.

Some countries are instead choosing to accelerate the development of their own central bank digital currencies (CBDCs), such as the eNaira and digital renminbi, but these alone will not replace the incumbent digital currencies.

How countries regulate digital currencies is a strong indicator of the potential of cryptocurrency in the remittance space. The framework for a regulatory system in most countries remains uncertain, even as multiple agencies continue to address questions related to crypto. In the long term, more stringent regulation could add further legitimacy to cryptocurrencies, and ultimately to their use in remittances.