Q2 has drawn to a close, and there’s been considerable investment activity in the industry over the past few months, both in terms of funding rounds and in public market debuts.

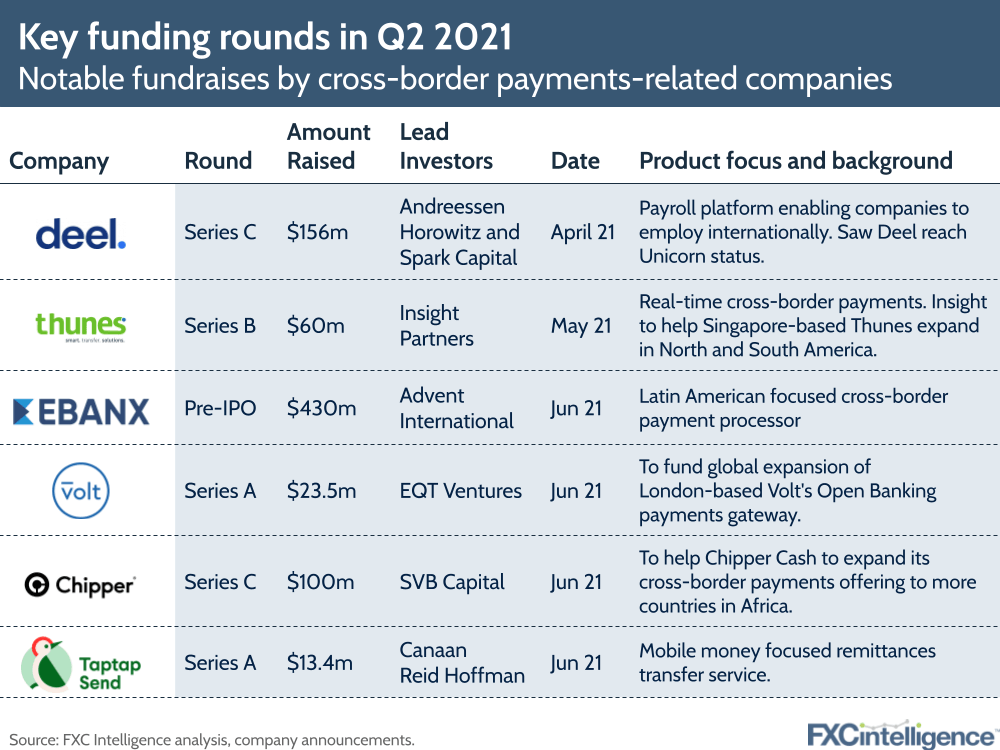

In funding rounds, some of the most interesting activity this quarter has been away from the traditional bases of North America and Europe, with Singapore-based Thunes seeing investment to help it expand in the Americas. Chipper Cash, meanwhile, has also drawn major investment to continue to expand its cross-border payments offering across Africa – a region currently experiencing rapid innovation in fintech.

Brazil-based EBANX was another standout, raising a monster $430m round ahead of its planned IPO. Much like dLocal, investor appetite for market leaders in Latin America remains very strong.

Other investments are giving us a sense of the changing needs of businesses, with one of the biggest raises made by Deel, which crossed the $1bn valuation mark to become one of the most valuable payroll companies in the world. Key to Deel’s offering is the ability to hire employees anywhere in the world – with both compliance and payroll issues handled – which comes with a considerable slice of cross-border payments handling in the process. Expect more interest in B2B-focused companies that address the increased interest in remote working to draw investment in the future.

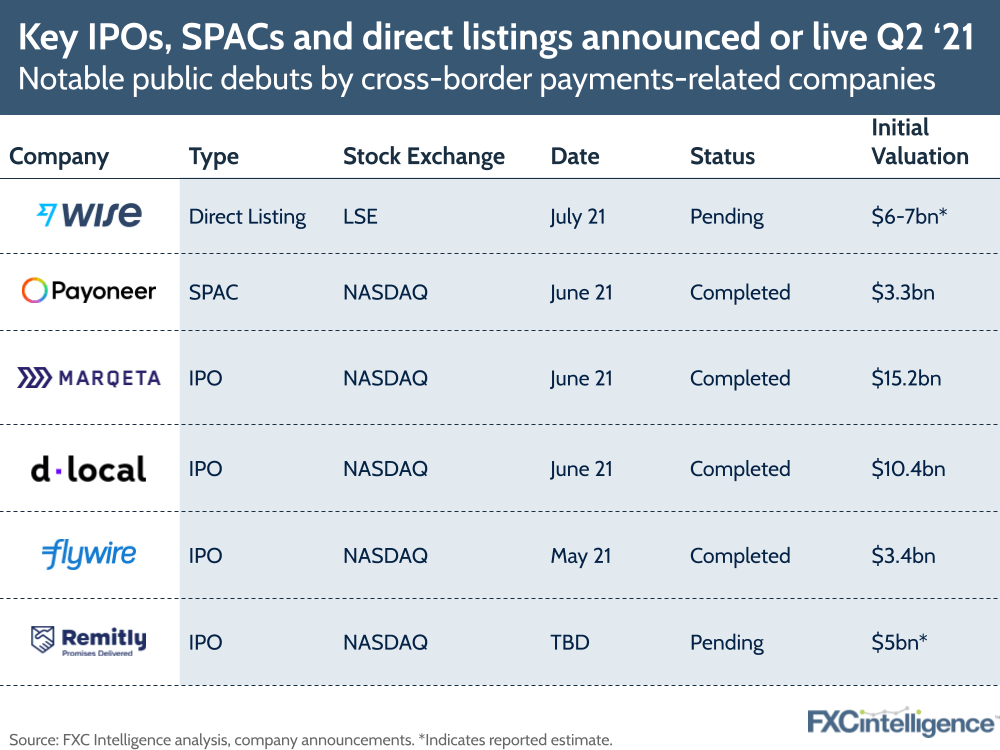

Meanwhile, it’s also been an interesting quarter for entries into the public markets, with a number of long-awaited debuts finally occurring.

Payoneer finally completed its SPAC at the very end of the quarter, beginning trading under its own ticker on 28 June, while Wise announced its direct listing just a few weeks earlier. Remitly has also submitted its draft registration statement to the US SEC, making its own IPO likely to occur soon.

Of the companies that completed their IPO this quarter, most have seen further increases in market cap since their debuts. The standout, however, is dLocal, which has surged to a market cap of over $15bn (from a $6bn start). Investor confidence in payments clearly remains strong, both in B2B and on the consumer side. dLocal’s rise and EBANX’s raise both hint at the premium of cracking the B2B side of emerging markets above all else.