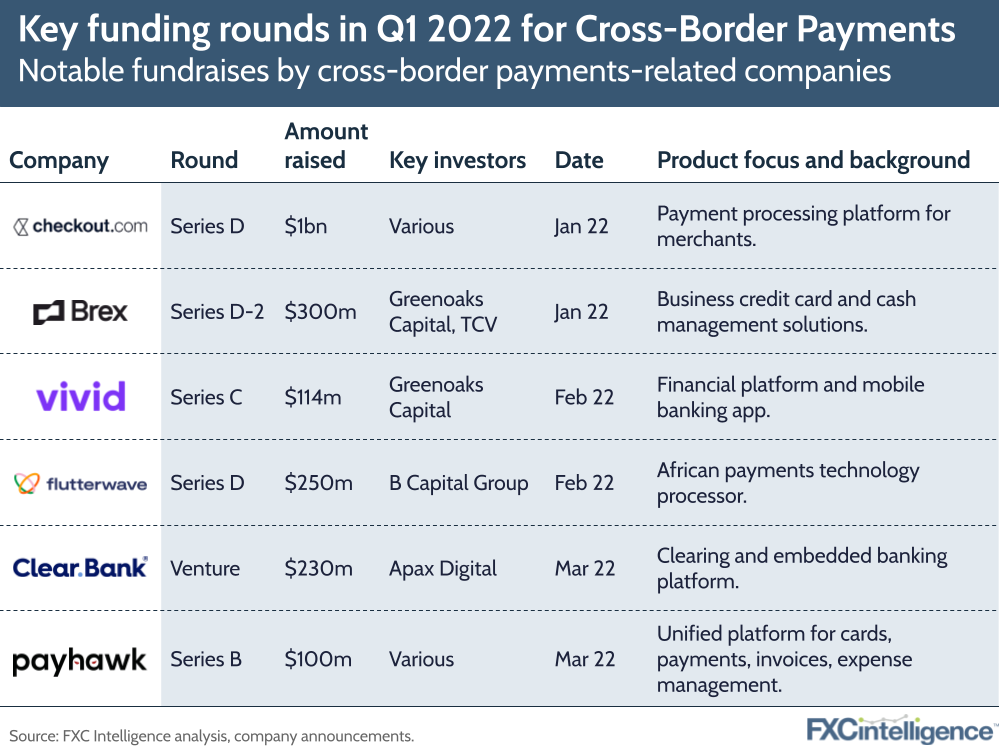

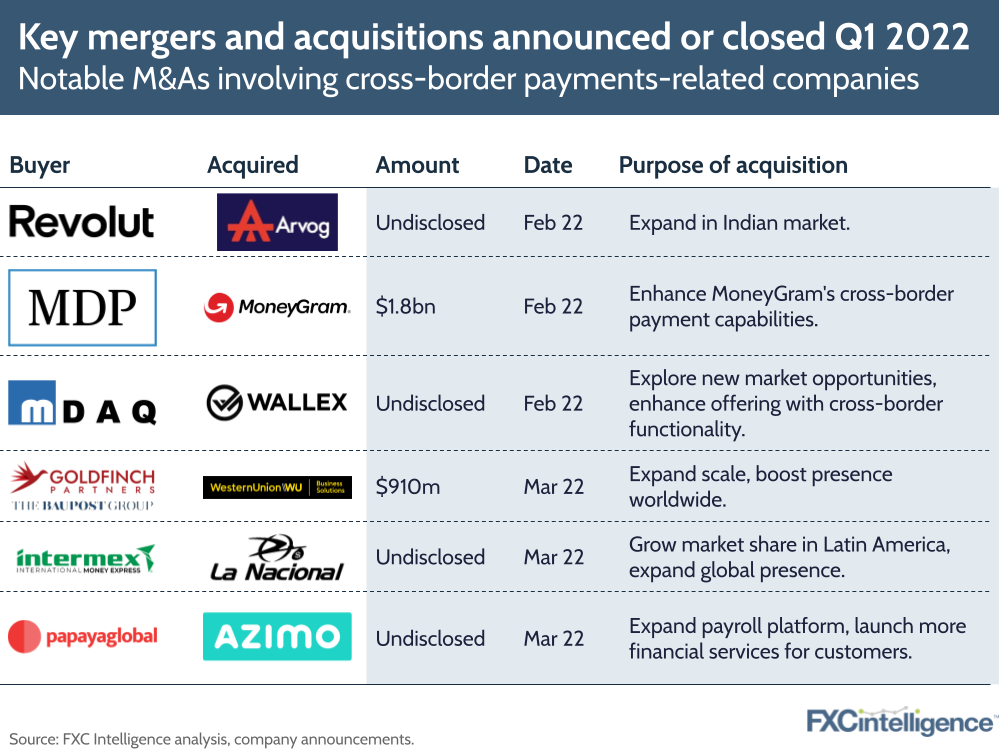

Q1 2022 is now behind us, but while it has been quiet in terms of IPOs due to the market decline, the cross-border payment space has seen a significant number of funding rounds, as well as some landmark M&As.

Checkout.com and Flutterwave have had particularly successful funding rounds in Q1. The former closed its $1bn Series D funding round with a new valuation of $40bn, making it Europe’s second most valuable startup behind Klarna. Meanwhile, the latter tripled its valuation to more than $3bn over a 12-month period to become Africa’s most valuable startup.

In acquisitions news, Madison Dearborn Partners acquired MoneyGram for $1.8bn – the biggest deal the remittances industry has ever seen. Meanwhile, Western Union Business Solutions was renamed Convera after seeing its acquisition by Goldfinch Partners and Baupost Group completed in the quarter, and payroll company Papaya Global acquired Azimo in a bid to provide improved payroll payments globally.

Q2 has already started with some notable raises from players such as Circle and Remote and on the M&A front, Bolt acquiring Wyre. This early momentum suggests a busy Q2 ahead.

Who are the Top 100 Cross-Border Payments companies for 2022?