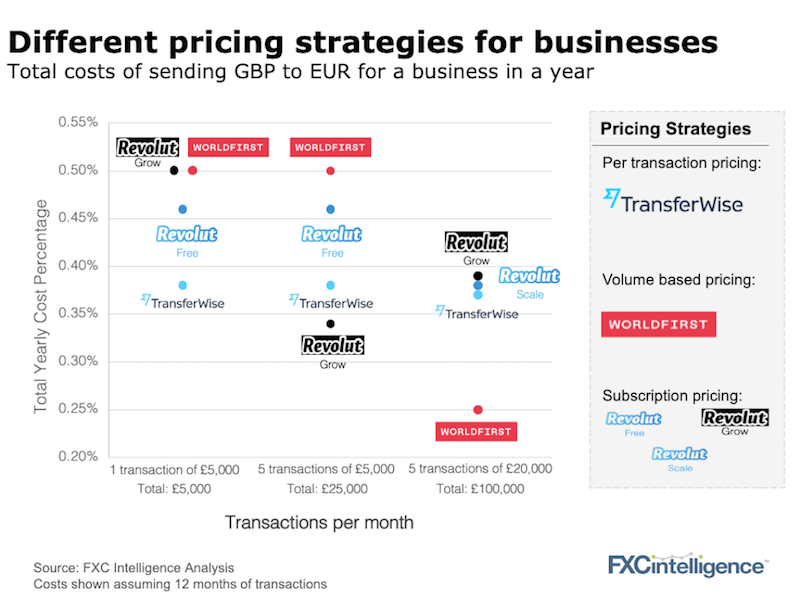

We’ll start with a deep dive into a core part of Revolut’s strategy, its freemium subscription based model and a topic we love – pricing. Unlike most payment competitors, who offer per transaction or volume based pricing, Revolut offers a free entry level (for consumers and businesses) and then tiered paid subscription levels from there.

We look at three different pricing strategies below; subscription-based (Revolut – free and paid tiers), transaction-based pricing (TransferWise) and volume-based pricing (WorldFirst).

Some takeaways:

- Each pricing strategy clearly targets a different profile of business.

- Revolut may offer “free business accounts” but cross-border transactions within those accounts are not free, above certain low-ish thresholds.

- The subscription and volume based models are set up to try to encourage stickiness and repeat business. Since the on-boarding of a business is more painful for a business than an individual, this can be a meaningful deterrent to switching providers.

- Whilst the example above focuses on businesses, a key growth segment for the providers above, the pricing strategy tenets hold true for individual customers as well.

Note that we excluded two pricing strategies found in the industry, especially for larger businesses – discretionary pricing (common amongst phone brokers) and matrix pricing (found in some banks and brokers). Both give more flexibility to the provider but are harder to communicate to the end customer.

Cold regulatory winds

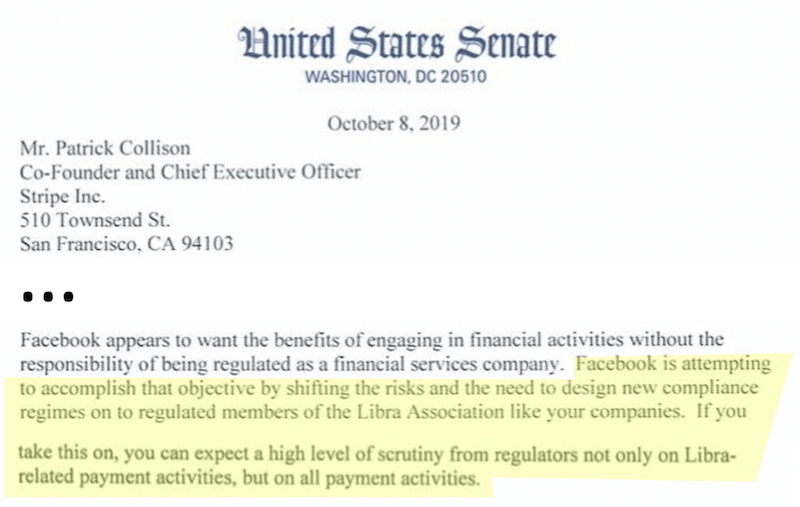

Anyone who thought that tech companies would have a light regulatory ride in financial services could not have been more wrong.

Let’s start with Facebook’s cryptocurrency Libra. The new Libra board met in Geneva on Monday but that was only after Visa, Mastercard, eBay, Stripe and Mercado Pago followed PayPal to the exit door (as we had predicted last week).

It’s easy to see why they left. Below is a key excerpt, highlighted in yellow, from the letter from the US Senate sent to the (former) Libra members:

Digital banking licences

Following this line, it should be clear to any of the digital banking players entering the US market (N26, Monzo, Revolut) that they can expect a tough time. In addition to state-by-state regulations, they’ll be up against lobbyists fighting to maintain market share for US incumbents.

And in Singapore, TransferWise launched a multi-currency debit card but is not going to pursue a banking licence, in contrast to local player Instarem (which is rebranding at Money20/20). The capital requirements and regulatory scrutiny will be playing a part in that decision.

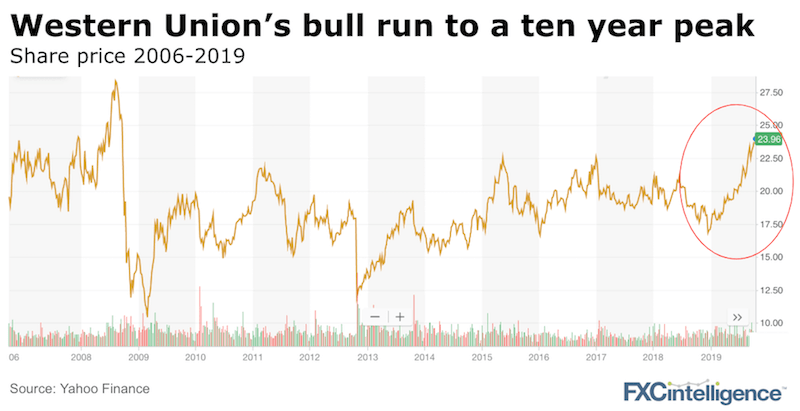

The resilience of Western Union

Some people at Western Union will claim they always believed they had a resilient business model but others are now believing it too, including, most importantly, the public market investors.

The investor world is now looking at Western Union as a value opportunity. The stock is performing better than at any point over the last 10 years and is on a considerable bull run, up c.40% in 2019. WU is moving to transform its model, as laid out by CEO Hikmet Ersek in a blog post earlier this week.

Helping all this is that Western Union’s market share by revenue continues to stand tall amongst its competitors (analysis here).

So for all the digital disruptors in the market, Western Union’s omni-channel strategy and the value of its network (best seen by the recent Amazon deal) is more than holding up.

Do you have all the pricing data you need? Have you thought through your next pricing strategy?

Get in touch for the best pricing data and deepest expertise in the industry.

[fxci_space class=”tailor-63330c0fe28ec”][/fxci_space]