PayPal has announced its Q1 2025 results, seeing a 1% increase in net revenues to $7.8bn, or 2% on a currency neutral basis, as the company moves towards a single commerce platform model.

This approach, which the company outlined in detail during its Investor Day in February, is seeing PayPal shift all its products to a single connected platform. Through this it plans to use its P2P payments and related products as a key pipeline to its other services, including its increasingly personalised commerce, including an in-development “dynamic smart wallet” and its cryptocurrency services.

As part of the process, it has also unified PayPal P2P and Xoom, meaning that while customers will be able to use the brand independently, they can also send remittances using Xoom’s rails from within the PayPal ecosystem.

While PayPal did not address this particular part of the process further in its latest results, CEO Alex Chriss did say that the company had begun “to execute on the strategy”, and that there was already “so much to be proud of” in terms of impacts. He highlighted in particular an 8% increase in transaction margin dollars that has given the company its fifth consecutive quarter of profitable growth, attributed to growth across areas including its omnichannel commerce, online PayPal checkout and Venmo.

Total payment volume (TPV) also grew 3% YoY to $417.2bn, or 4% on an FX-neutral basis, while active accounts grew 2% YoY to 436 million, although transactions dropped -7% to six billion, with transactions per active account dropping by -1% to 59.4. Much of this decline was a result of the company’s payment services provider (PSP) division, however, with transactions growing 6% and transactions per active account by 4% without PSP.

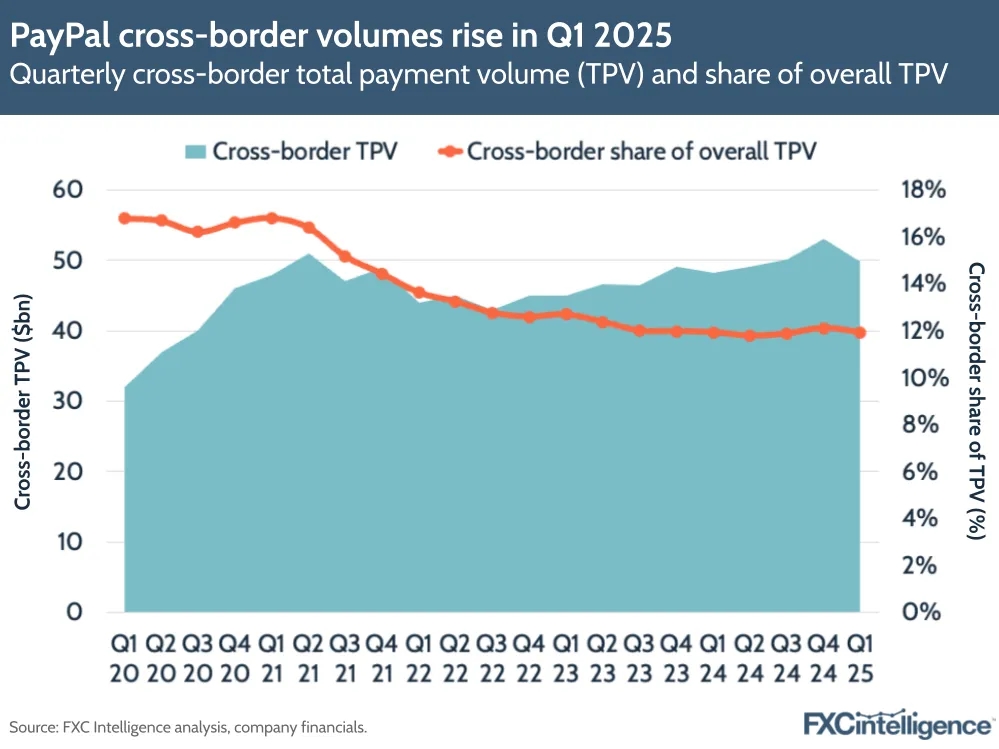

Meanwhile, cross-border TPV, which PayPal says “occurs primarily between two PayPal accounts in different countries and includes transactions initiated through Xoom product”, saw 3% YoY growth to $49.8bn, retaining its 12% share of total TPV.

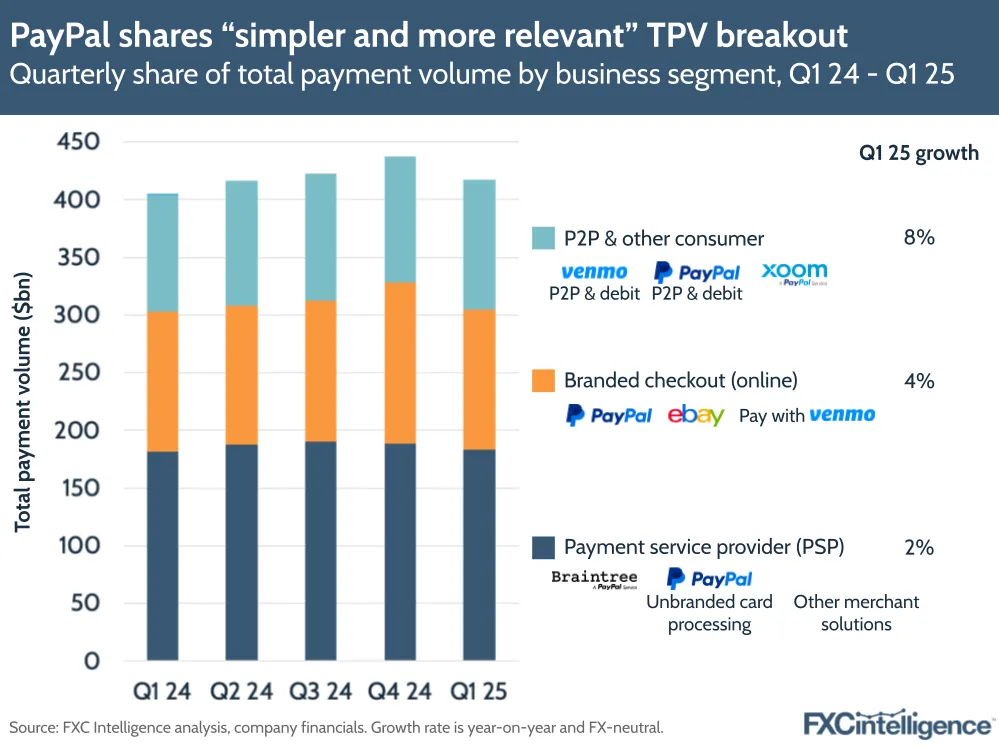

The company provided little update on its non-Venmo P2P payments, which includes both those sent between PayPal accounts and those sent over Xoom, other than pointing to “growth” in the division. The company has also shifted to what CFO Jamie Miller described as a “simpler and more relevant TPV breakout”, which he said “reflects how we think about our product portfolio today, the go-forward strategy and our customer needs”.

This means that PayPal no longer shares a direct metric for P2P excluding Venmo, instead grouping it into P2P & other consumer with Venmo debit and PayPal debit when used outside PayPal branded checkout. Combined, this group accounted for 27% of PayPal’s TPV, or $113bn, although comparing the new breakouts with earlier versions suggests that P2P excluding Venmo is likely to be around 8% of TPV, or $33bn.

PayPal also addressed the current macroeconomic environment, with Miller stressing that the company being “globally diversified” put it in a position of strength, and adding that less than 2% of its branded checkout TPV was from Chinese merchants selling into the US, the area of its business most exposed to the tariffs. However, it also opted not to increase its full-year guidance despite a “strong start”, citing the macro environment, and in its SEC filing stressed that “any factors that reduce cross-border trade or make such trade more difficult could harm our business”.

How does Xoom’s remittance pricing compare to its competitors?