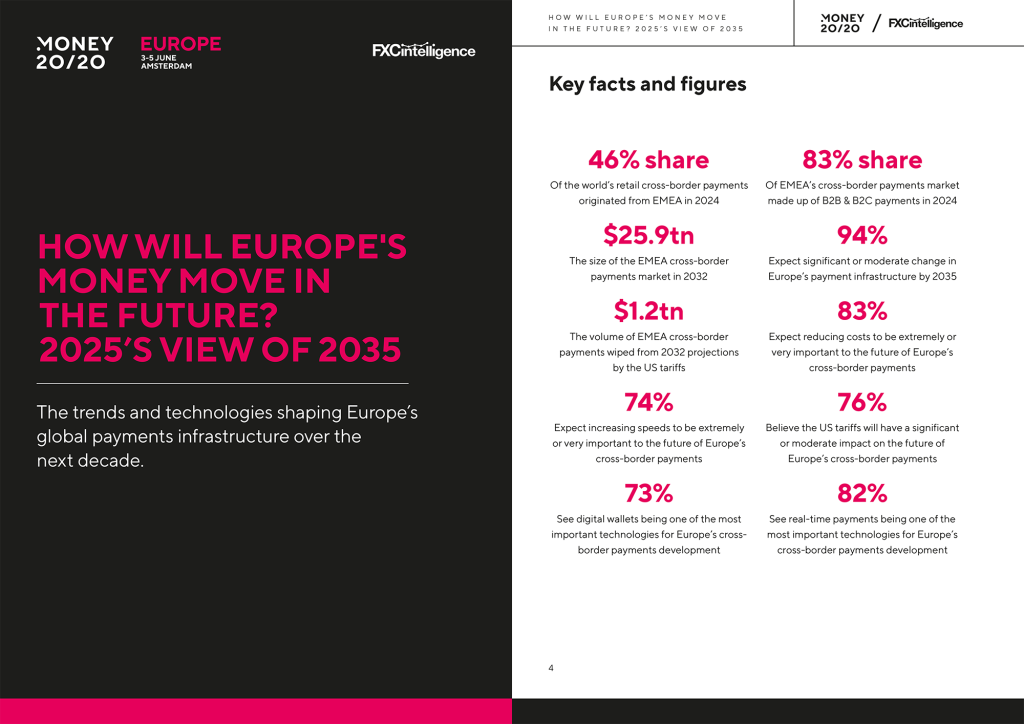

This week saw the publication of our second report produced with Money20/20: How Will Europe’s Money Move in the Future? 2025’s View of 2035. Drawing from expert interviews, a survey of over 50 fintech professionals across the continent and our own market sizing data and expertise, this is an overview of how Europe’s cross-border payments landscape will evolve – with some key findings for anyone operating in the region.

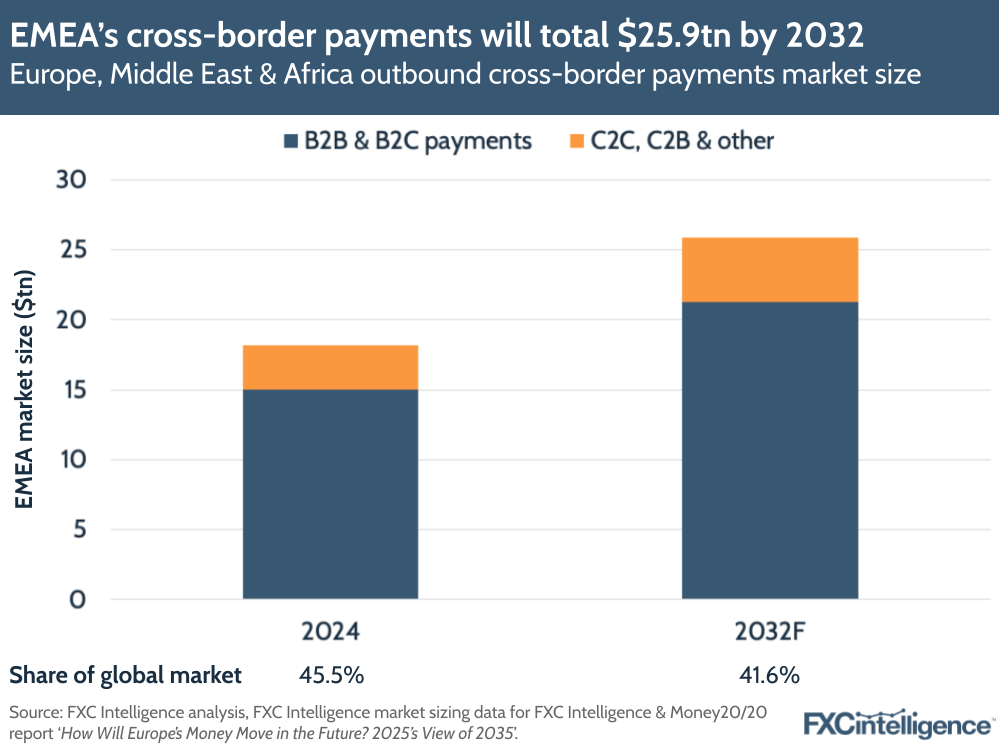

Our market sizing data shows that non-wholesale cross-border payments originating from Europe, the Middle East and Africa (EMEA) had $18.2tn in total flows in 2024, with 82.5% coming from B2B and B2C payments. This total is set to rise to $25.9tn by 2032, with B2B and B2C payments accounting for 82.2%. The region is set to grow slightly slower than Asia-Pacific but retain its lead as the largest bloc, although the Middle East and Africa will see faster growth than Europe.

The US trade tariffs are set to have an impact, with updated IMF forecasts prompting us to reduce our 2032 forecasts for both EMEA and the world. The global non-wholesale cross-border payments market for 2032 is now set to be $2.3tn smaller globally and $1.2tn smaller in EMEA in 2032.

Despite this, the opportunity in Europe remains significant, with marked growth and transformation expected over the next decade, driven by a unique blend of policy and corporate innovation. 94% of those surveyed expect significant or moderate change in Europe’s cross-border payments infrastructure by 2035.

The region is expected to see both reduced costs and increased speeds for cross-border payments both within and originating from Europe, with 83% and 74% respectively of those surveyed highlighting these areas as extremely or very important.

Ongoing collaboration between companies and policymakers is set to be key to this, however technology is also set to play a vital role. Real-time payments systems are expected to be particularly critical to Europe’s cross-border payments development, with 82% identifying this technology as a primary priority and 73% saying the same of digital wallets.

The full report, which includes additional analysis across technology, policy, companies and countries, can be downloaded via Money20/20’s website.

Read ‘How Will Europe’s Money Move In the Future? 2025’s view of 2035’