Japan’s cross-border payments market is shifting in response to ongoing trends around digitalisation, a return to travel and demand for cross-border ecommerce. Below, we explore some of the major developments in this market, which is increasingly moving away from cash and towards digital interoperability, in some cases with help from external players.

Japan has seen changes to regulations that are simultaneously opening up and formalising its cross-border payments system for non-bank cross-border payments companies. For example, in 2022 the country’s real-time payment system Zengin opened up to allow non-banks to join the network, with Wise becoming the first such company approved to join the system in October 2024.

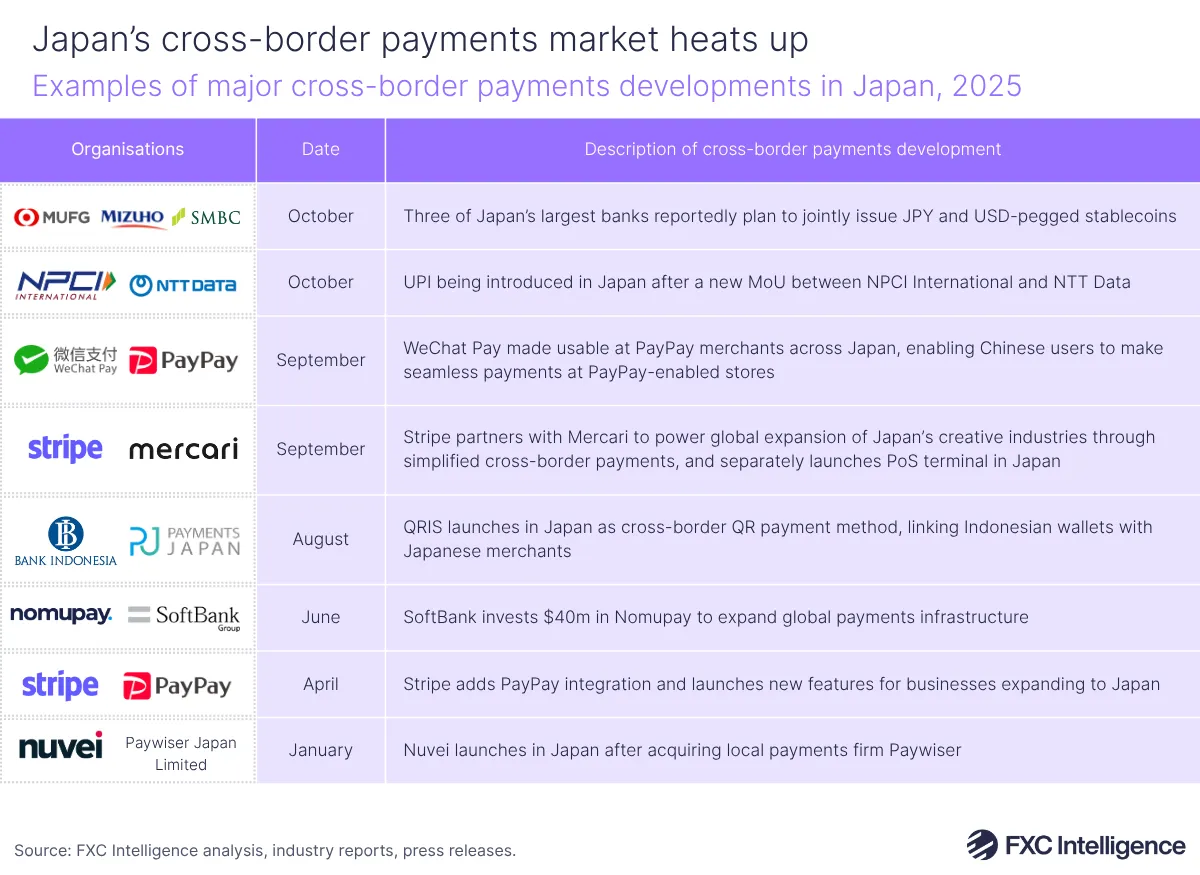

At the start of this year, Nuvei acquired Japanese payments firm Paywiser, giving it a licence that provides it with direct acquiring capabilities in Japan. Meanwhile, Stripe has launched new features for businesses in the country, as well as signing a major partnership to enable payment processing for Japanese marketplace Mercari.

Nuvei and Stripe’s interest is fitting as ecommerce remains a particularly important driver for cross-border payments in Japan. The yen’s depreciation against the USD has boosted demand for foreign goods from the country, with exports hitting a record ¥107tn ($707bn) in 2024 – reportedly the highest level since records began in 1979.

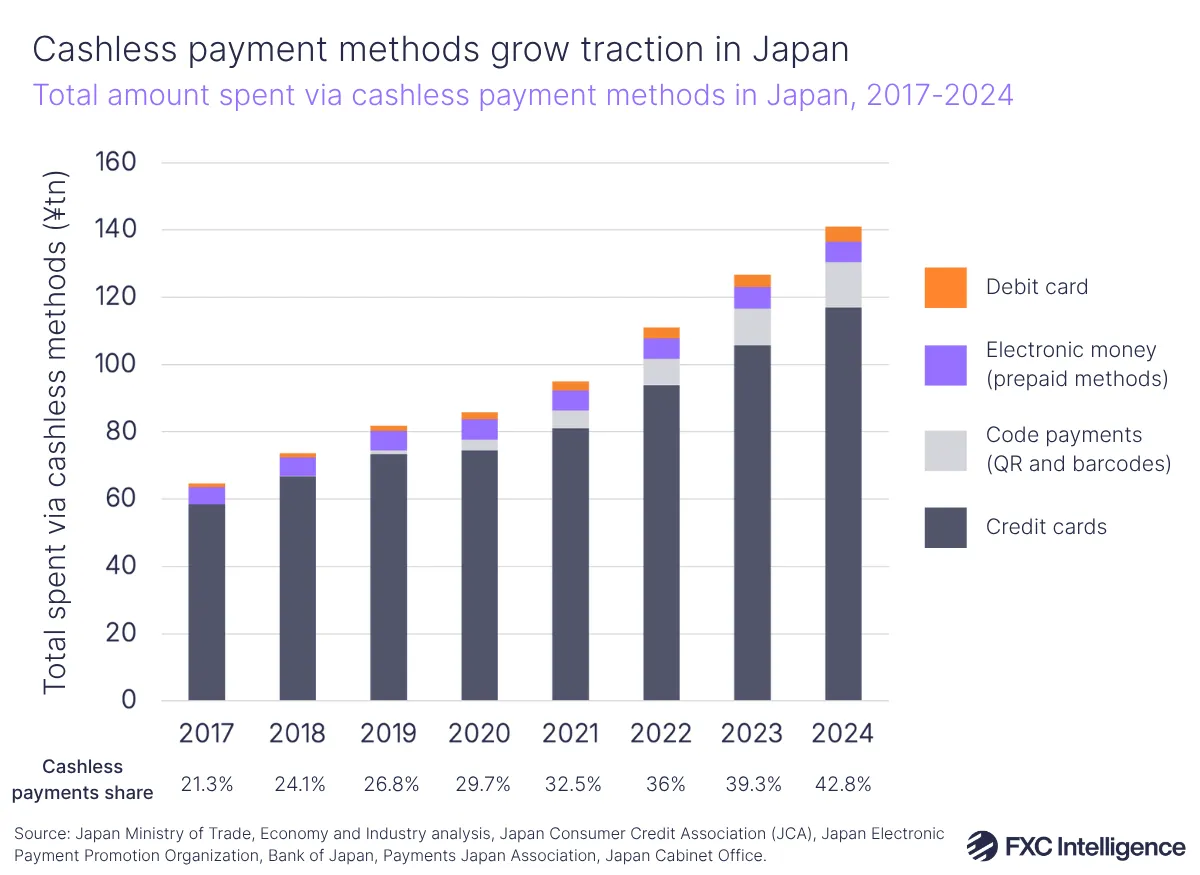

Another factor has been Japan’s push towards digital payments through its Cashless Vision: a government-led initiative launched in 2018 to increase cashless transactions. The ratio of cashless payments made within the country was 42.8% in 2024, a significant bump from 13.2% in 2010. Credit cards continue to dominate the transition, accounting for 83% of money spent using cashless transactions in 2024, though the country is seeing fast growth across the amounts spent through QR codes.

Within this digital payments shift, digital wallets and mobile apps such as PayPay and Rakuten Pay have grown adoption significantly within Japan’s local market. The former of these surpassed 70 million users in July 2025, making it a dominant payment system in a country of 124 million people. As the systems mature they are increasingly linking with overseas platforms such as mobile payment behemoth WeChat, which integrated with PayPay to enable users of 26 cashless payment services from across 14 countries and regions to make payments at PayPay merchants when visiting the country.

Earlier this month, reports emerged that Indian tourists could soon make payments at Japanese merchants using QR codes powered by India’s UPI payment system, following a partnership between IT solutions provider NTT DATA and the National Payments Corporation of India (NPCI). Similarly, Indonesia’s QRIS system went live in Japan in August, enabling Indonesian tourists to pay directly via their domestic mobile wallets.

These moves align with a significant return to travel in Japan. The total number of visitor arrivals to the country grew 47% YoY to 36.9 million in 2024, which was 16% higher than a pre-Covid-19 peak in 2019. Though South Korea accounted for 24% of arrivals in 2024, China is likely to once again account for the highest number of visitors in 2025, having seen its number of arrivals grow 188% YoY in 2024. China accounts for 23% of arrivals so far in 2025 (up to mid-October), making it the leader for visitor arrivals this year, followed by South Korea (22%), Taiwan (16%), the US (8%) and Hong Kong (6%).

Meanwhile, banks are increasingly exploring stablecoins after regulatory updates introduced in 2022 legally recognised stablecoins as payment instruments under certain conditions. This month, Nikkei reported that the country’s three largest banks – MUFG, SMBC and Mizuho – are allegedly seeking to jointly launch stablecoins pegged to the yen and the US dollar. This comes just over a year after the same banks launched Project Pax, an initiative to create a blockchain-powered cross-border payments network.

Taken together, the developments here indicate Japan remains a key market for developments in money movement backed by both private and public initiatives, and one to watch going forward.