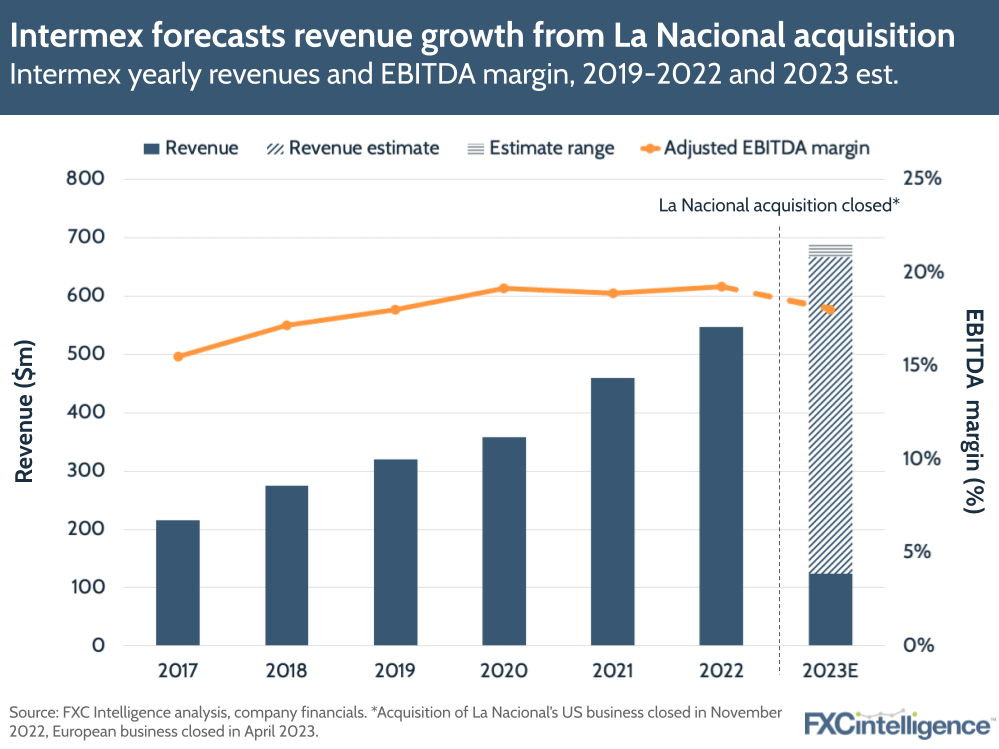

LatAm-focused remittances player Intermex is reaping the benefits of its recent acquisition of rival La Nacional, with revenues rising 26.8% to $145.4m – the highest quarterly growth for the company since Q4 2021 (excluding La Nacional’s contribution of $17.5m, revenues grew 11.5%). Having already acquired La Nacional’s US-based assets in November 2022, Intermex also acquired its European business at the start of April this year, expanding its total market from 28 countries to 60.

The company beat its expectation for the quarter on both revenue and profitability, with an adjusted EBITDA of 16.4% leading to an adjusted EBITDA margin of 16.6%. This margin, however, was down around 150 bps from Q1 2022. The company mentioned that net income growth (at just 0.9%) was offset by La Nacional, which usually sees slower revenue growth in Q1 2023, as well as higher interest and depreciation expenses.

La Nacional’s US assets – which include key locations for remittance customers sending money to LatAm – helped drive a 37.4% increase in unique, active customers to 3.6 million. In total, it generated 12.9 million money transfers, an increase of 28.6%, with total send volume rising by 22.4% to $5.3bn. During the quarter, Intermex had a 21.2% market share in the top five US to LatAm remittance markets, including Mexico, Guatemala, El Salvador, Honduras and the Dominican Republic.

Digital transactions grew 67.7%, which was solid but slower than last year’s growth of 107%. Having said this, digital’s share of total send and receives did grow 490 bps to 30.1%. As Intermex CEO Bob Lisy told FXC earlier this year, the company is mainly cash-focused in the US, but European markets could present a bigger opportunity for digital, so it will be interesting to see whether new markets change the company’s mix in the future.

Despite a strong start to the year, Intermex has kept its FY guidance the same, but did give its outlook for Q2: revenue of $168.6m to $174.1m, a 23-27% rise, and an adjusted EBITDA of $30.7m to $31.4m, an increase of 11-14%.

How much do companies charge for money transfers to Latin America?