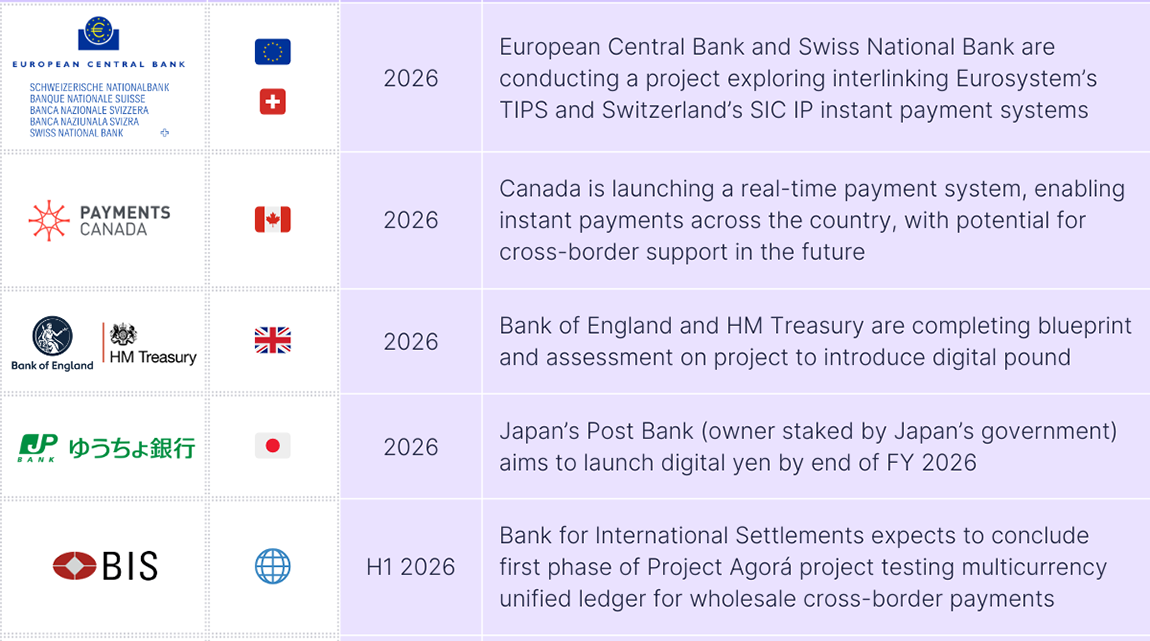

Payments infrastructure projects are expected to make progress in 2026 as governments, central banks and global financial institutions continue to adapt in response to regulation and new systems. We’ve taken a look at some of the key cross-border related payments infrastructure projects and milestones taking place this year.

A major theme this year is central banks continuing to explore the introduction of digital currencies, now with new impetus as regulations spur the development of stablecoins by banks and the payments industry. The Bank of England expects to complete its assessment on the introduction of a digital pound in 2026.

In Europe more widely, the EU’s European Central Bank concluded its prep phase for a digital euro in October 2025 and hopes that incoming legislation in 2026 will enable a pilot exercise to begin in 2027, facilitating the potential launch of the currency in 2029. These moves are significant, as they could lead to the development of new standards and rules around how money moves across corridors in the region, having a direct impact on how infrastructure is set up to shape those payments.

Real-time payments are also seeing traction, with the European Central Bank and Swiss National Bank conducting research this year to explore how the Eurosystem can link TARGET Instant Payment Settlement (TIPS) with the Swiss Interbank Clearing Instant Payments (SIC IP) system, continuing a trend for interoperability among systems we’ve seen largely occurring in Southeast Asian countries. Canada, meanwhile, is expecting to launch its own real-time payment system; while initially focused on speeding up domestic payments across financial institutions in Canada, this could have significant implications for cross-border, with the Bank of Canada acknowledging the “potential to link with payment systems across borders.”

Meanwhile, other organisations are trying to enhance large-value transactions between financial institutions across borders. For example, the Bank for International Settlements expects the first phase of Project Agorá – its initiative exploring the potential of a multicurrency unified ledger for cross-border payments – to conclude in H1 2026. The project is building a prototype to test whether tokenisation could replace a legacy correspondent banking system and learnings from this could help shape the approaches of central banks towards this technology in the future.

Overwhelmingly, central banks and governments appear to be increasingly focusing on digital methods for moving money across borders, a direct response to how many key companies in the industry are tapping into global payments demand. As much of this demand has focused on emerging markets, this year could also see more region-specific initiatives – particularly in Africa and Asia – seeing significant developments.