Business account owners benefit from specific exchange rates and transfer fees when it comes to making international payments. While opening such an account can be a challenging and lengthy process in some markets, it is nonetheless a vital element in a company’s growth trajectory. Understanding the value of that account in different territories can also help to guide operations and provide indicators on a sector’s competitiveness.

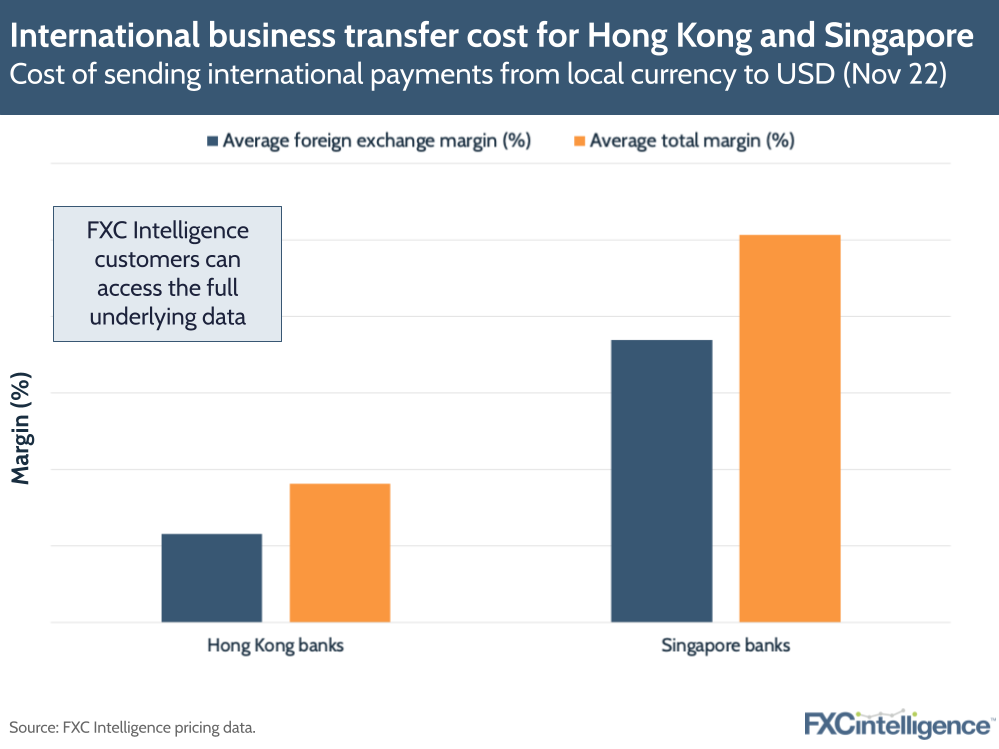

Looking at our data on Hong Kong and Singapore, the cost of sending international payments from the local currency to US dollars is relatively low for business owners.

Hong Kong and Singapore are both financial hubs in the region and count a wide array of local and international banks in their finance sectors.

When looking more closely at the data though, Hong Kong is much cheaper than Singapore, with a total margin that is almost three times lower.

This can be attributed to its highly competitive banking environment, leading banks to keep their FX spread low to retain current customers and win new ones. To remain Asia’s leading financial hub, Hong Kong banks need to keep transactional costs on the lower end.

How can FXC Intelligence help banks compete in the B2B segment?