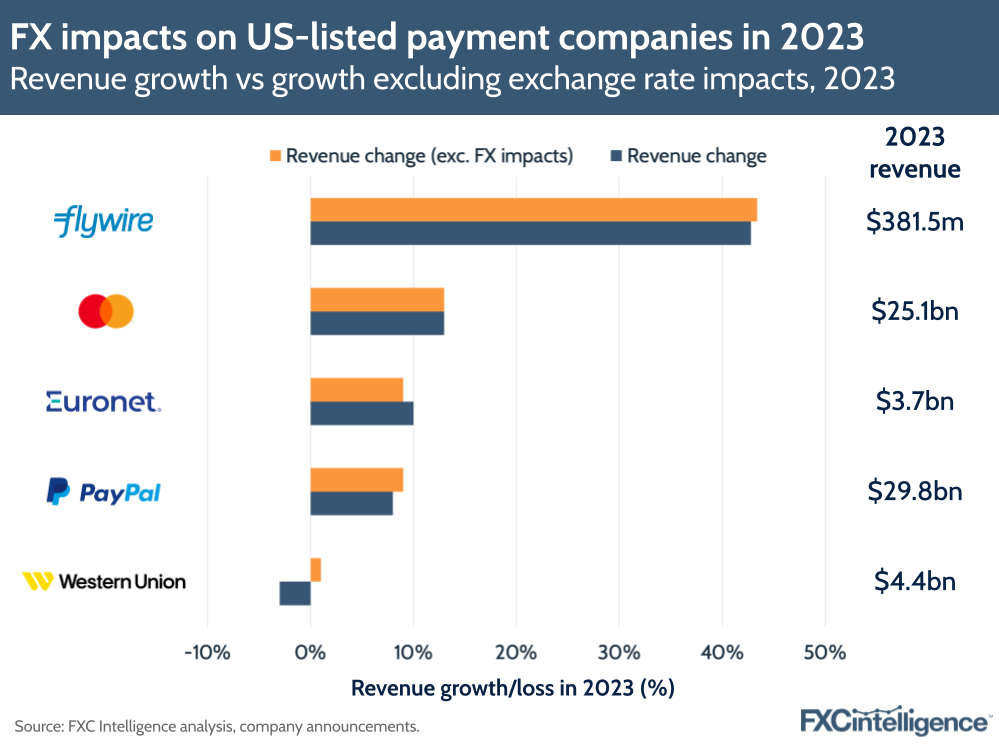

The relative strength of the US dollar can affect the income that global US-based payments companies generate in other countries. With the dollar remaining strong in 2023, we take a look at how foreign exchange rates have affected US-based companies last year.

Like other sectors, publicly owned payments companies often show the rate at which revenues increased compared to prior periods while excluding the impact of foreign exchange rate fluctuations, normally reported as the ‘constant currency’ or ‘currency-neutral’ growth rate. This is to show investors how foreign exchange rates affected the company’s growth over the year.

Western Union, for example, saw revenues decline 3% when considering FX impacts but grow 1% when they were excluded. Revenues grew 4% on a constant currency basis excluding the contribution of the company’s Business Solutions segment, now sold to Convera. Meanwhile, Euronet, which derives most of its income from other countries, saw 10% reported growth this year and 9% excluding FX impacts. The global electronic payment provider cited “improved FX rates against the US dollar” as one of the drivers for revenue growth. On the other hand, Mastercard saw revenues rise 13% on both a reported and constant currency basis, with the company noting it had seen lower revenues related to FX volatility versus the prior year.

Compared to 2022, companies in our sample haven’t seen as big a difference between their reported revenue change versus revenue change that excluded FX impacts. For example, education and B2B payments processor Flywire saw revenues (minus ancillary services) grow by 55% excluding the impact of FX in 2022, compared to 47% reported growth. However, in 2023, growth with and without FX impacts was roughly the same at around 43%. Similarly, Mastercard, Euronet and PayPal all saw a smaller disparity between revenue growth versus constant currency revenue growth, which suggests that exchange rate volatility did not have as large an effect on revenue growth rates this year.

Nevertheless, it also highlights that investors should remember the impact of currency exchange rate changes on a company over time, particularly during periods of macroeconomic upheaval. Much of the impacts observed can be attributed to the US dollar, which weakened in 2023 relative to July 2022, when the currency rose sharply and hit 1:1 parity with the euro. However, geopolitical tensions in the Middle East are strengthening the dollar again this year as it continues to be seen as a safe haven currency.

How can I find out more about inbound cross-border flows into the US?