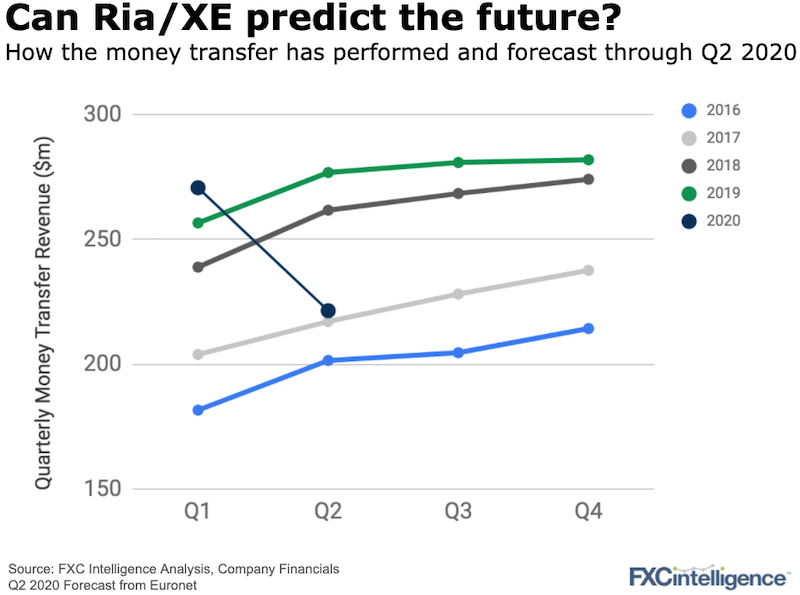

Ria’s parent company Euronet reported its Q1 2020 numbers yesterday. Outside of China, March 2020 was when the global lockdown took force. It will therefore be the Q2 numbers, rather than the Q1 numbers, where we’ll really see how the sector has been impacted.

Here are the headlines:

- Q1 revenue slightly up

We have to give credit to Euronet for continuing its impressive trend of consistent revenue growth in the money transfer segment. This has been driven by a switch to digital for Ria, US outbound holding up and XE benefiting from the currency volatility seen in March (which has heavily receded in April). - Q1 margins squeezed

Driven by anticipated cash-agent receivables defaults and an overhang of 2019 investments. - Q2 – expect big declines ahead

In Q1, Ria has seen bricks and mortar revenue declining 25%. According to Euronet’s CFO Rick Weller, we can expect “money transfer [revenue] to be in the 80% range of prior year” in Q2 as the Covid-19 impact will be much greater than in Q1.

We’ll be following the rest of the reporting season closely to see what big players expect for Q2 as well as what happened in a very mixed Q1.

[fxci_space class=”tailor-63345a3bd1ad0″][/fxci_space]