Digital money transfers saw strong growth for Euronet in Q3 2024, where the company reported transaction growth four times faster than the market. We dig into the details in this breakdown of the company’s revenue drivers and strategy going forward.

Since its acquisition of Ria in 2007, Euronet has evolved to become one of the world’s biggest remittances networks. As cash usage in remittances declines and mobile adoption rises, the global payments provider has been pushing hard on its latest evolution: digital growth.

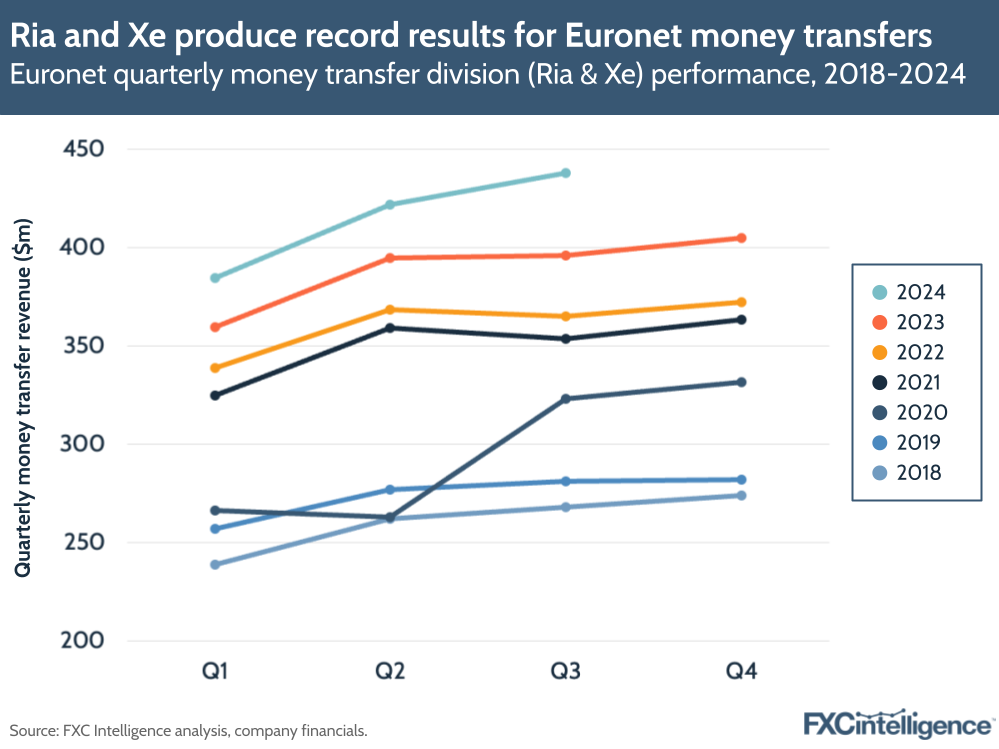

Last week, the company released its results for Q3 2024, in which it marked record revenues of $1.1bn for the quarter (up 9.5% on Q3 2023), along with adjusted EBITDA of $225.7m, giving a margin of 20.53%. Around 40% of the company’s revenues were from its money transfer segment, which grew 11% to $438m, with a key driver being growth in digital transactions.

Through global network expansion, Euronet has built a brick and mortar empire for remittances, but several of its new products and partnerships in recent years have skewed towards digital transfers – notably a recent tie-up with WeChat, which enabled the company to expand its reach to over one billion mobile wallets. Other incumbent money transfer players, such as Western Union, are following suit as digital players such as Remitly, Revolut and Wise continue to vie for market share.

Though it hasn’t given a projected revenue figure, Euronet expects that in 2025 it will again produce adjusted earnings per share growth in the 10-15% range. Below, we explore Euronet’s latest results, with a particular focus on the company’s money transfers, digital strategy, expansion opportunities and why the company is seeing success in this area.

Euronet revenue drivers Q3 2024

Euronet splits its revenues across multiple segments, with the biggest in terms of revenues being its money transfer segment. This includes Ria and Xe as well as Dandelion, the company’s B2B2X cross-border payments platform powered by Euronet’s global network.

In Q3, the 11% growth in money transfer revenues to $438m was driven by numerous factors, with the company seeing US outbound and international originated transactions growing 12% and 14% respectively, with digital transaction growth at 30%.

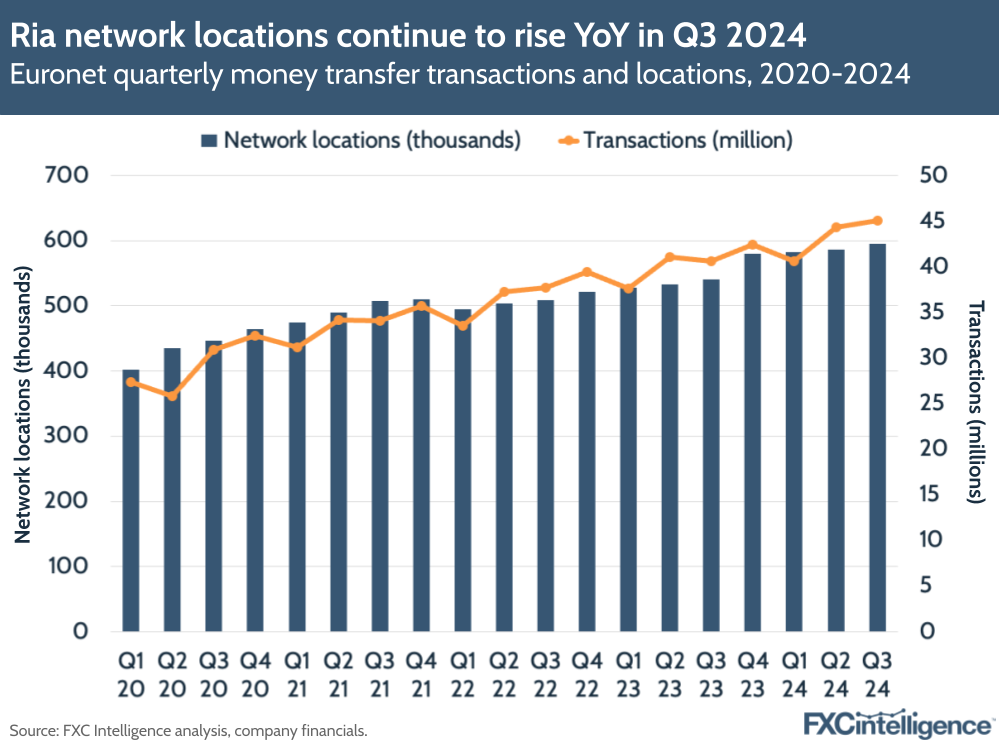

Overall, the number of transactions grew by 11% to 45.1 million, with Euronet CEO Michael Brown saying that Euronet was growing four times faster than the wider money transfers market. He also noted the impact of partnerships, including a deal with US-based money transfer provider PLS Financial Services, which are expanding the company’s global reach.

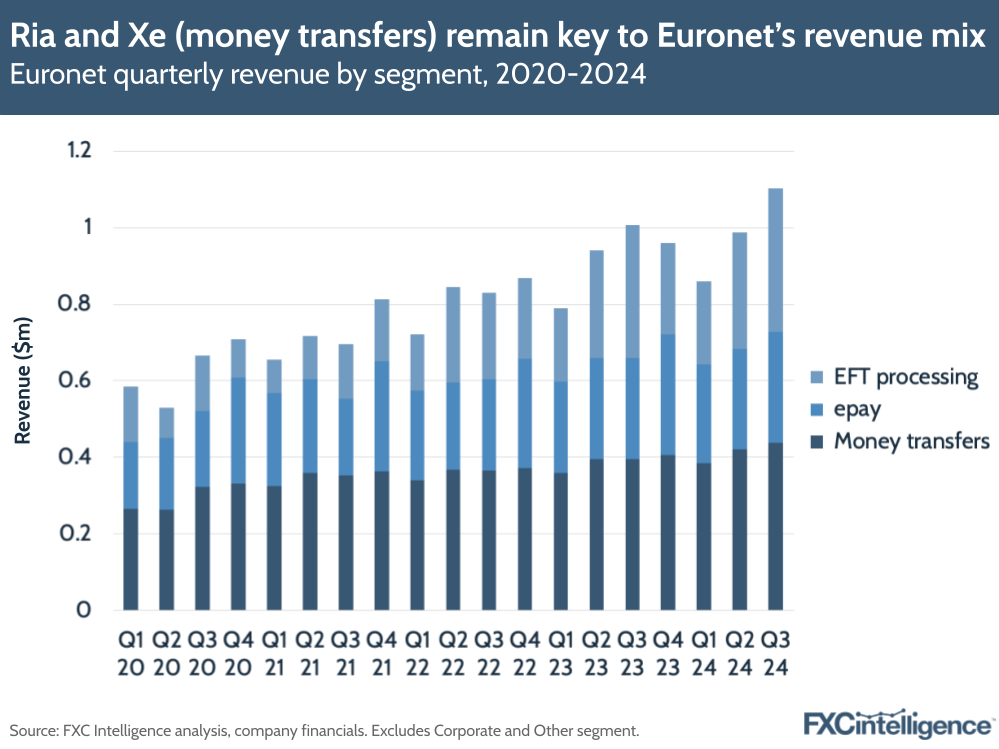

The growth of Euronet’s money transfer segment has outperformed Euronet’s two other major segments – epay, which offers branded and alternative payment methods to retail businesses, and EFT processing, which contains earnings from the company’s ATM, PoS and processing products – as it did in Q3 of last year.

This is significant, as Euronet’s EFT processing unit has outgrown the money transfers segment for almost every quarter, with the notable exception of Q1 2020 to Q1 2021 when the Covid-19 pandemic had a significant impact. Money transfers continued to take the highest revenue share overall in Q3 2024 at 40%, followed by EFT processing at 34% and epay at 26% (not accounting for a nominal impact from the company’s corporate and other segment).

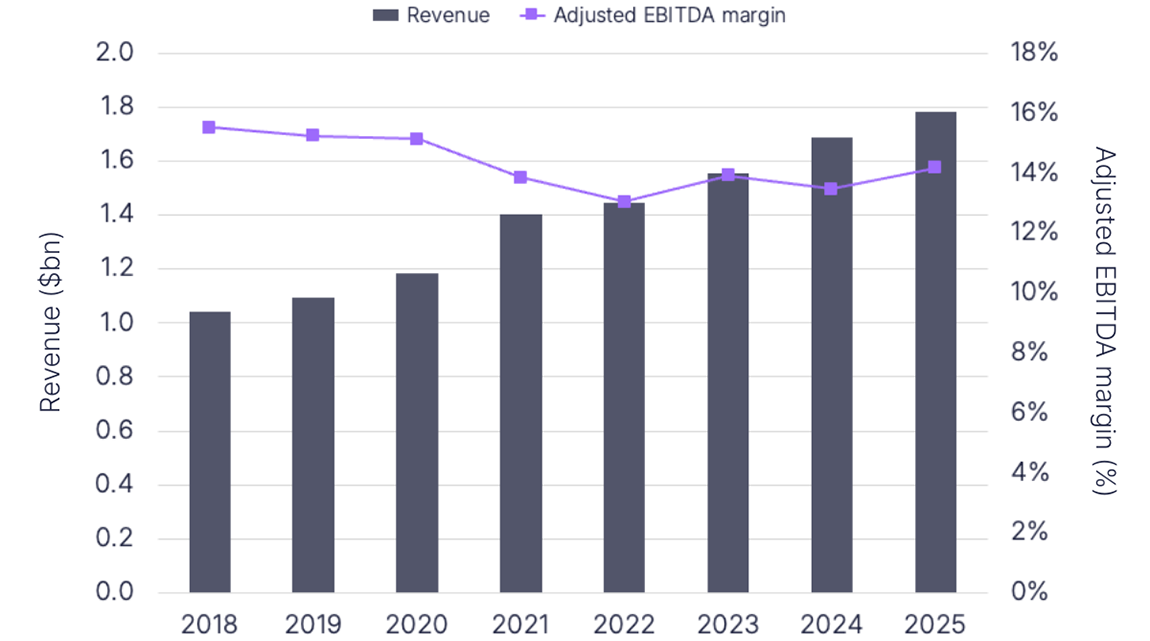

The story is different in terms of profitability, with the money transfers segment growing EBITDA 6% to $64.1m, giving a margin of 15% – higher than epay at 11%, but lower than EFT Processing at 38%.

Behind Euronet’s digital strategy

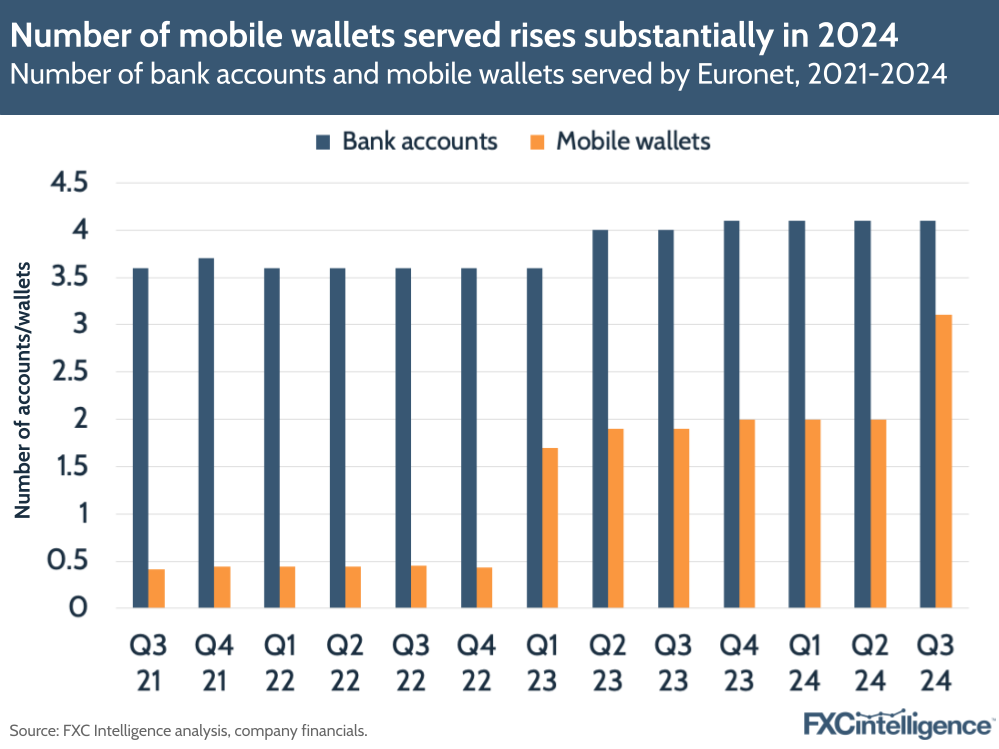

Euronet’s digital channel has become more important to the company, with its own executives pointing to the fact that emerging markets are modernising and financial inclusion is growing, with more people opening bank accounts and mobile wallets.

This has been reflected in the company’s continued expansion to serve higher numbers of these items worldwide. As of the end of Q3 2024, the company said it is now serving 3.1 billion mobile wallet users, up from 416 million in Q3 2021, though a big driver for this has been its aforementioned deal with WeChat. The number of bank accounts served by the company’s network has also grown since this period, though at a slower rate – from 3.6 billion to 4.1 billion.

For the second quarter in a row, Euronet has mentioned the impact of digital customer marketing spending on the business, with an additional $2m in spending affecting its operating income growth (7%, compared to over 10% otherwise). Customer acquisition is working however, with Euronet seeing 58% growth in year-to-date customers in Q3.

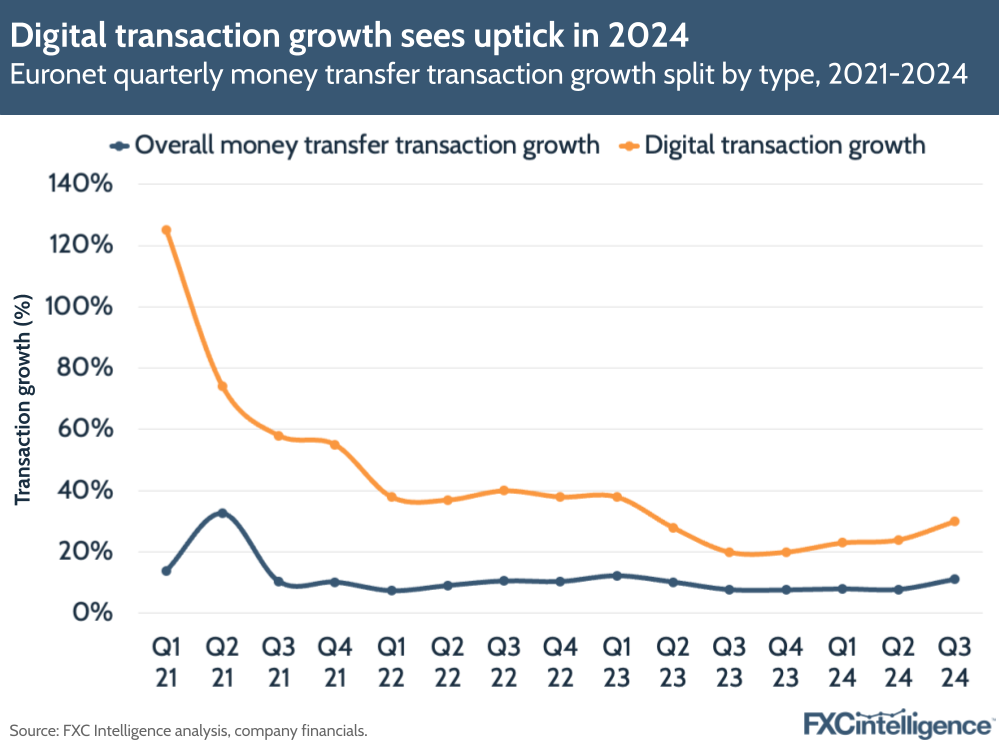

The impact of this has been growth in digital transactions, with the company’s digital products now representing 19% of the company’s total transactions in Q3 2024. Though this figure is still increasing, Euronet’s digital transaction growth has significantly outperformed Euronet’s overall transaction growth in recent years and the company noted that its digital payout capabilities grew 35% YoY and represented 54% of its total volumes.

Digital transaction growth slowed after the pandemic, with the company arguing at the time that the company had begun hitting a ceiling on the numbers of new digital customers it could adopt. However, transaction growth has increased sequentially in quarters since the start of the year, up from 23% in Q1 2024 to 30% in Q3 2024.

New customers are helping drive this growth, but keeping them is also important. When asked about the profile of digital customers during the earnings call, Brown said that it was different from the general profile for family remittances as it involves bank accounts and digital payment methods. However, customers transacting digitally appear to be “sticky”, with some customers who began five or six years ago still making transactions with the company.

While the company has seen an additional impact from digital marketing costs, Brown explained that the digital transactions the company acquires are more profitable than retail transactions. While Euronet has to pay its agents around 45% of the customer fee for the latter, he said that there was no such cost for digital transactions. For Brown, the key to maintaining growth has been being the best independent channel distribution for bricks and mortar while also having a great digital product.

Partnerships and expansion

Euronet has evolved as a company through partnerships and acquisitions, and Q3 2024 was no exception. In addition to the aforementioned WeChat and PLS deals, Euronet also partnered with Azizi Bank in Afghanistan and Italcambio in Venezuela to expand its network.

Aside from adding new wallet and bank accounts to its networks, new partnerships have helped Euronet grow the number of locations it serves by 10% to 595,000, having also signed 16 correspondent agreements across 12 countries.

Expansion into new areas aligns with geographic growth across other areas in the business – in particular, adding newly acquired business Infinitum in Singapore and 800 ATMs in Malaysia.

Euronet’s B2B2X play

One interesting direction that Euronet continues to pursue is as a payments infrastructure partner through its Dandelion solution, having added Chinese B2B payments player XTransfer as a client, as well as Wallex, a payment service provider for SMEs in Singapore and Indonesia.

While Euronet’s numbers on Dandelion’s performance are sporadic, the company has landed significant clients (it is already embedded with HSBC), with more in the pipeline. As an effort to lease the company’s vast money transfer network, the company’s continued mention of Dandelion reflects a wider B2B2X trend in the industry, seen with Visa Direct and Mastercard’s Cross-Border Payments services.

From a digital perspective, Euronet will continue to find competition with other C2C players in the space, while the potential of the B2B payments space is well known (our own prediction puts the market at $50tn by 2032). As it continues to report strong digital results, it will be interesting to watch whether diversifying further with Dandelion could become a more sizeable part of the company’s regular earnings discussion.