Euronet’s money transfer segment enjoyed strong growth in 2025, despite experiencing challenging headwinds related to remittances and economic uncertainty. We explore the company’s latest results and look at how it plans to bolster future growth.

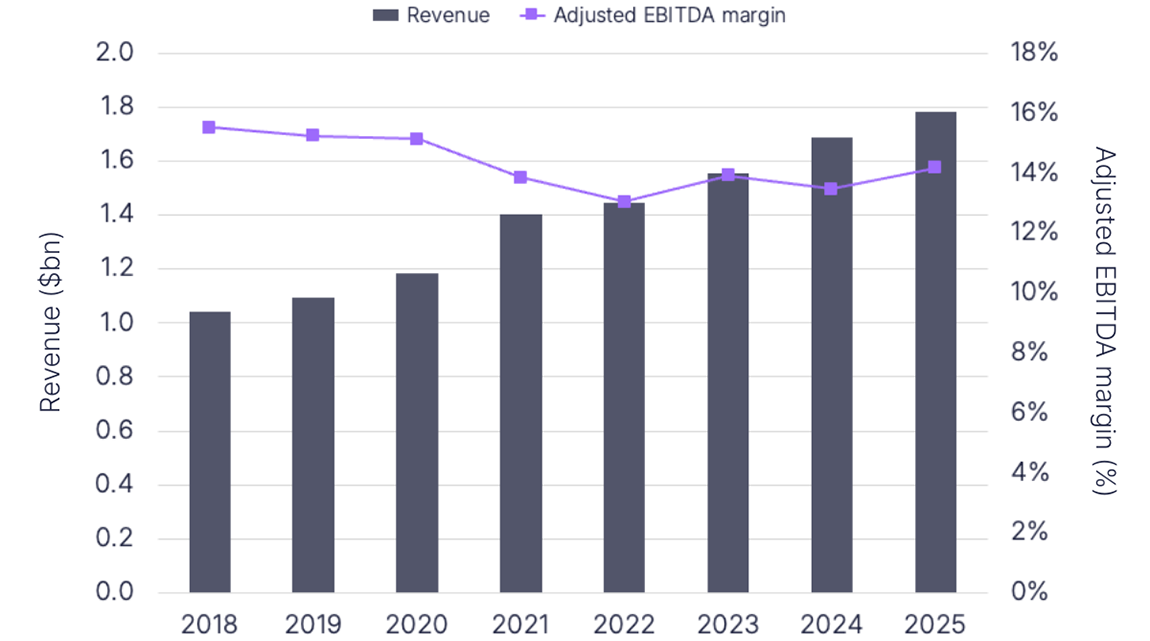

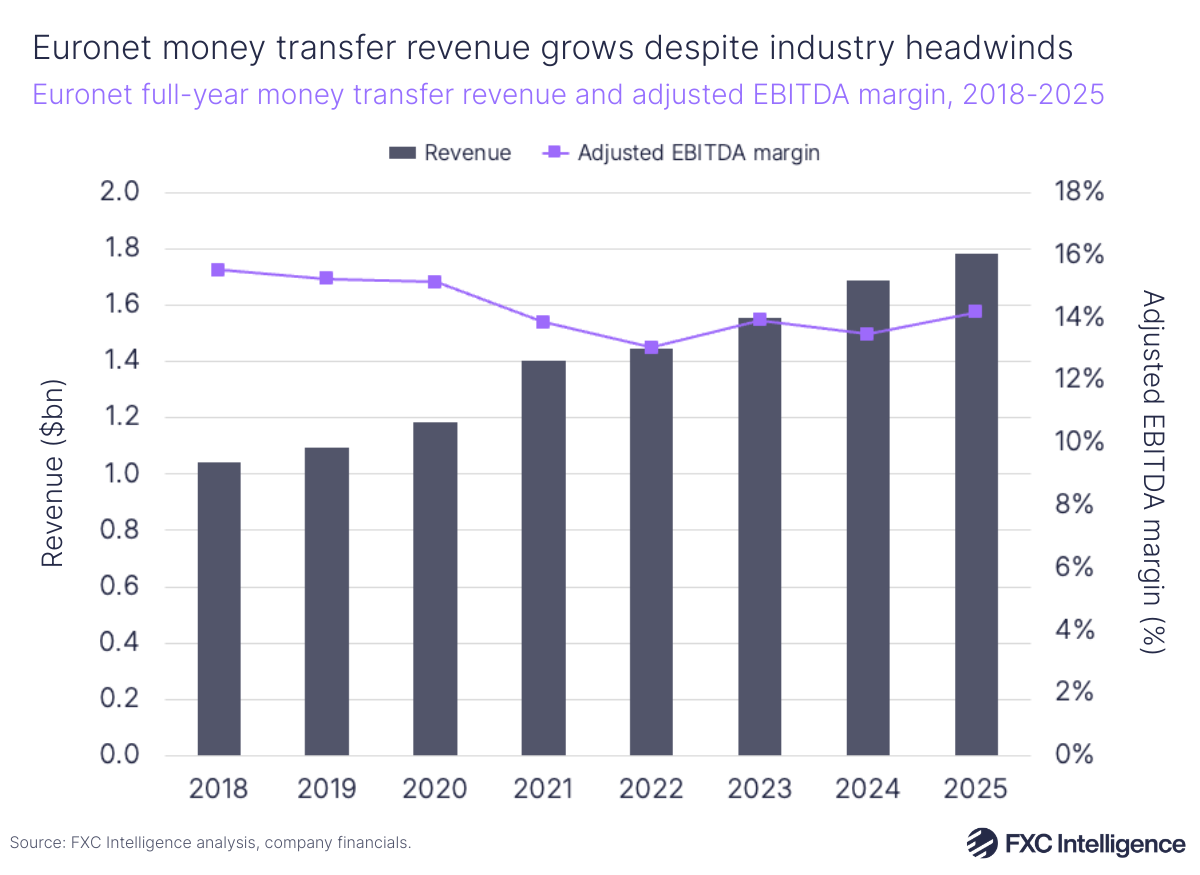

Euronet reported that its money transfer division (which comprises consumer remittance company Ria, real-time cross-border payments network Dandelion and foreign exchange service provider Xe) saw revenue increase 3% in Q4 2025 to $454.4m. This supported growth in Euronet’s money transfer segment full-year revenues, which rose 6% to $1.8bn.

Although operating expenses increased by 7% in 2025, Euronet’s company-wide adjusted EBITDA for the full year rose 10% to $744m, with its margin increasing by 51 basis points to 18%. While money transfers saw a 1% decrease in adjusted EBITDA to $64m in Q4, the segment’s full-year EBITDA increased 11% to $253m, with a margin of 14%.

This increase was driven by 5% YoY growth in international-originated money transfers and a 3% rise in US-originated money transfers for 2025. The company did however see US-originated transfers fall 2% YoY in Q4 specifically – attributing this decline to uncertainty surrounding US immigration reforms and increased economic stress on its sending customers.

During its latest earnings call, Euronet CFO Rick Weller noted that while the broader remittance market contracted in 2025, the company saw a slight increase in remittance volumes across the full year – in part thanks to previous efforts to diversify the payment corridors it serves. Despite the disruption in remittances, the company said it is continuing to expand its network, adding more digital touch points to new send and receive markets while adding new partners to the Dandelion network, including signing an agreement with Ant International’s UK-based fintech WorldFirst in Q4 to offer cross-border payment flows to its customers.

Throughout 2025, Euronet reported consistent growth in its number of network locations in each quarter, with the number reaching 639,000 at the end of the year. The company now also reaches 3.7 billion wallet accounts (600 million more than at the end of 2024).

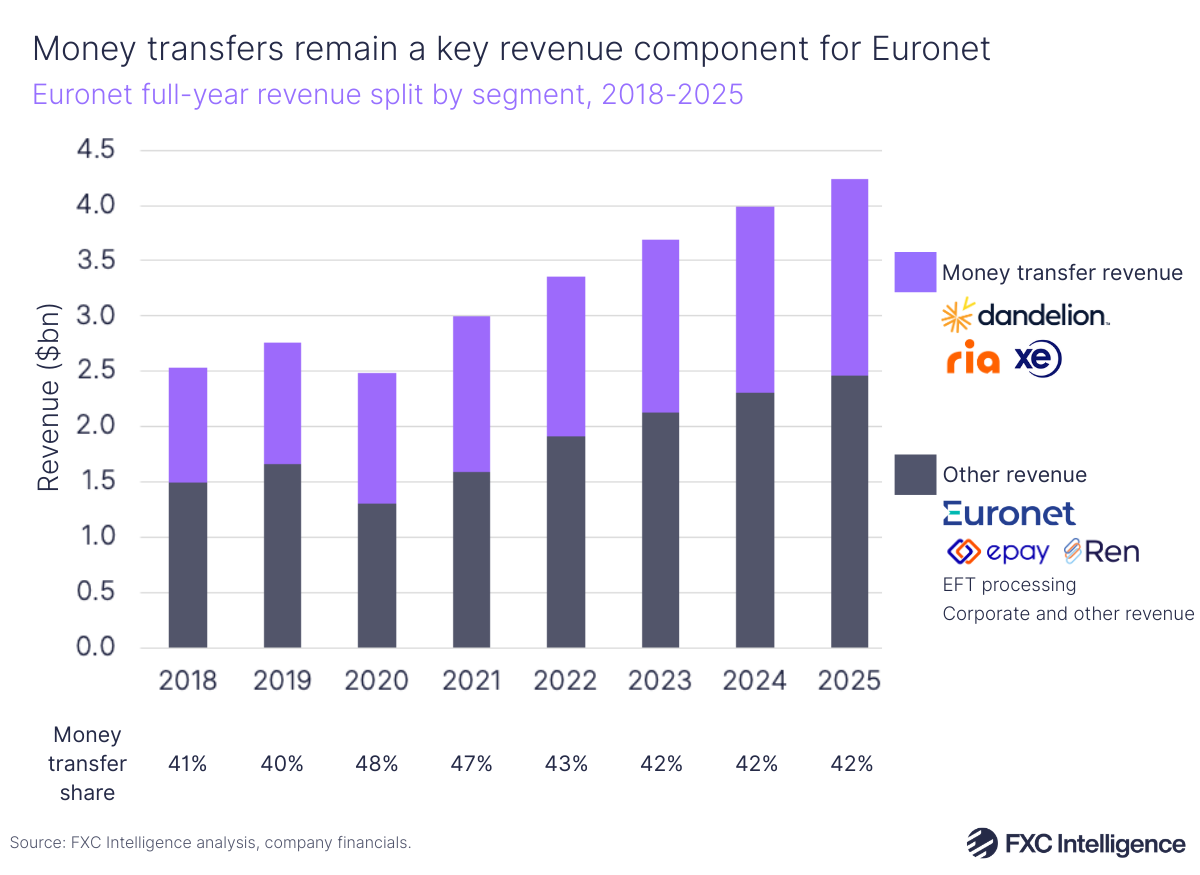

Money transfer revenue generated by Ria, Xe and Dandelion continued to make up the largest share of Euronet’s overall revenue, maintaining a 42% share in 2025. Euronet’s EFT processing division (the company’s ATM operations and PoS terminal solutions) saw its share grow slightly to 30%, while the share of the epay segment (payment processing and prepaid card solutions) decreased to 28%.

Looking to the future, Euronet outlined that it expects to drive 10-15% earnings per share growth in the coming year; guidance that aligns with the company’s performance in previous years, including in 2025. CEO Michael Brown explained that the company does not plan to adjust its long-term strategy in response to the uncertainty surrounding remittances, which it views as a short-term issue.