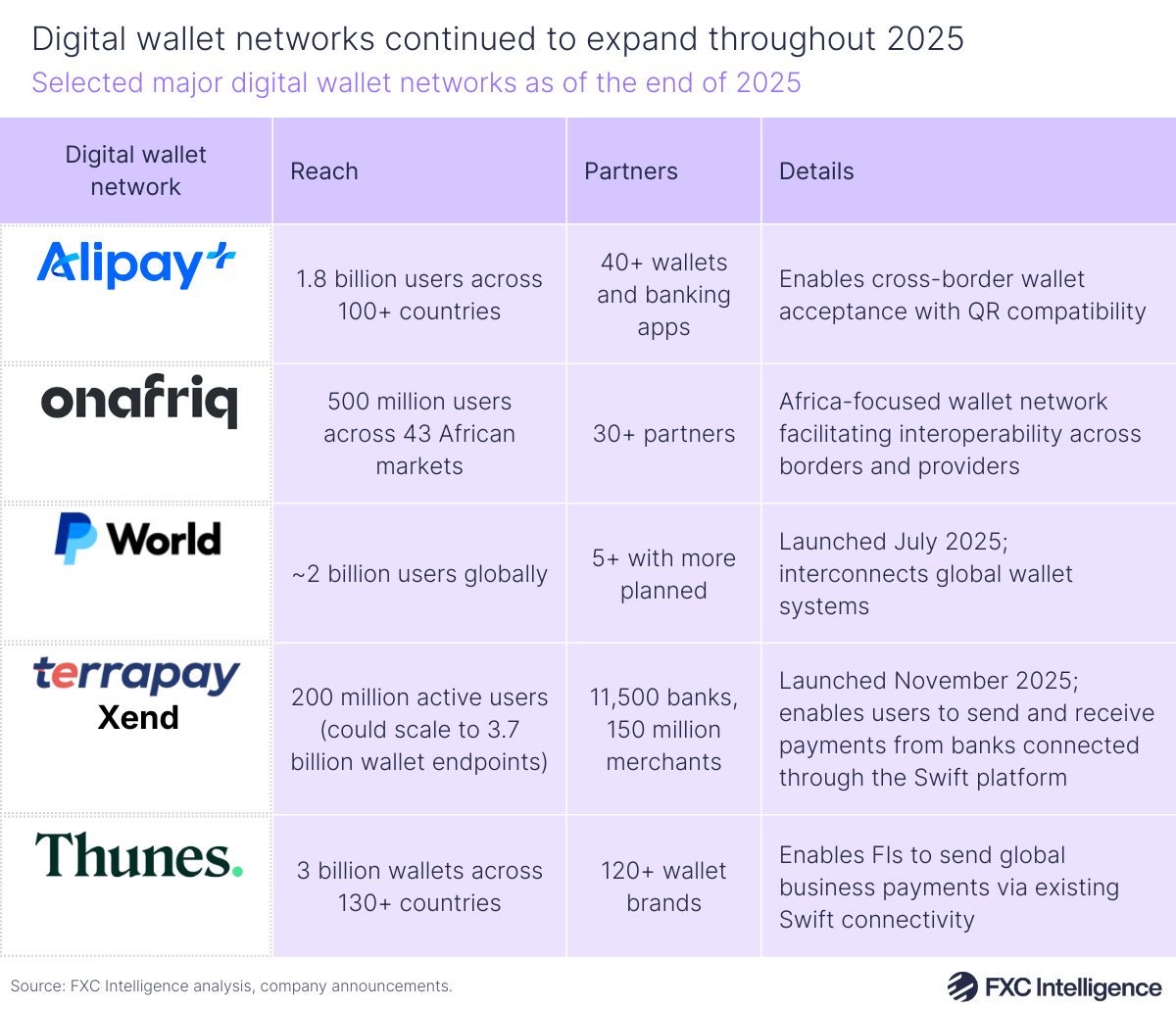

Digital wallet networks have traditionally focused on domestic payments, although this appears to be rapidly changing as efforts to interlink them become more commonplace. We take a look at how some of the biggest ‘networks of networks’ connecting digital wallets grew in 2025.

Alipay+, Ant International’s gateway that interconnects national digital wallets, expanded its ecosystem considerably during 2025, growing cross-border payment acceptance to more than 100 markets and expanding its partner ecosystem to 40, ultimately reaching around 1.8 billion users. In the first half of 2025, more than 6.5 million digital wallet users used Alipay+ cross-border payments for the first time, while transactions across online travel agents and in-store merchants increased by 30%.

In September, Japan’s cashless payment service PayPay started being accepted at over two million merchants in South Korea via Alipay+. In November, Ant International joined forces with DBS Bank in a move that saw the bank’s Singaporean mobile wallet PayLah! join Alipay+’s ecosystem, enabling over three million PayLah users to make QR code payments to more than 150 million merchants in over 100 markets.

PayPal also announced a new digital wallet platform that connects some of the world’s largest payment networks and digital wallets into one global system. The new offering, dubbed PayPal World, was announced in July and began rolling out in November, beginning with interoperability between PayPal and Venmo. Plans for further global connections to other major wallets, including India’s instant payment system UPI and Latin America’s online payment platform Mercado Pago, are set to progress throughout the beginning of 2026.

At the back end of 2025, money movement company TerraPay launched Xend, a new payments interoperability network and infrastructure layer that enables wallet users to receive funds from 11,500 banks via the Swift network, while opening up the ability to make payments at 150 million acceptance locations. The Xend network connects over 200 million wallet users at launch but eventually plans to scale to more than 3.7 billion digital wallets globally.

This trend also occurred in Africa, as South Africa-based Onafriq continued to connect a wide number of mobile wallet schemes across the continent. The company now offers an interoperability layer for African finance, supporting various use cases from peer-to-peer transfers and remittances to card issuance and agency banking. As of June, Onafriq’s network connected 961 million registered mobile wallets, 464 million registered bank accounts and more than 2,000 cross-border payment corridors.

As this trend continues to develop, particularly as initiatives such as PayPal World and TerraPay Xend expand their influence, 2026 looks set to become a pivotal year for digital wallets.