Fresh off the back of Remitly’s launch of Passbook – its new banking product, we talk with them to understand what drove this product extension and we compare it to other debit card led strategies.

Just need a card or become a bank?

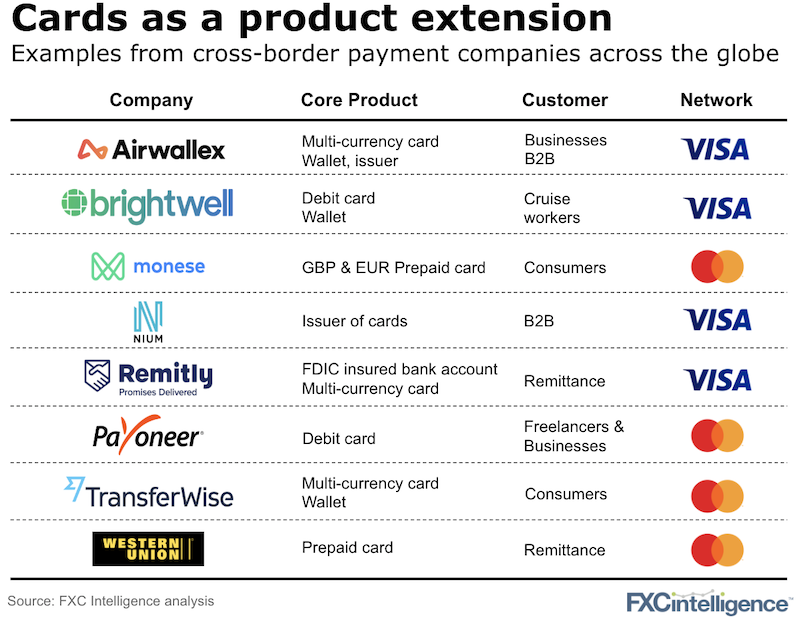

Debit and pre-paid cards are the natural extension for many cross-border payment companies’ product suite. For customers, they allow a simple way to store value and spend money. For the payment company, they remove the need to have to become regulated as a bank.

Remitly has taken a big step forward from the debit card baseline to provide an actual bank account. We spoke with Remitly this week to dig into this strategy. (For background, read our interview with Remitly CEO interview Matt Oppenheimer.)

Why offer a bank account, not just a card?

That’s the key question. Other players in the sector have generally chosen the path of a debit or pre-paid card (with some fancy features) and considered it as sufficient. Whilst the new digital banks are on the other side of this, many do not even offer cross-border payments or target Remitly’s customers.

Remitly’s is solving the problems of the immigrant

With the exception of Western Union, the companies above are not targeting lower-income immigrants. Immigrants, especially in the US, struggle to open bank accounts and are poorly banked if banked at all. Critically, virtually all US banks require a Social Security number to open an account, which many immigrants don’t have. Remitly’s new account doesn’t require this. How is this possible?

In-house KYC capability

Opening a bank account for immigrants would frighten most financial companies. Remitly (as some other remittance companies) has built its own in-house KYC capabilities for this customer segment. They’ve built the user experience and have the data required. Although banking KYC is nuanced and slightly different, Remitly’s capabilities put them pretty close to what is needed.

What’s next?

Remitly is working in partnership with a federally chartered bank who holds the funds. This allows for a much fuller suite of products to be offered down the line.

Solving other pain points for immigrant communities (read future products) – whether it is lending to those with limited or no credit history, or granting insurance to people who find it difficult to obtain it, you get the idea.

And a final thought…why haven’t WU, MoneyGram and Ria already done this?

Maybe they haven’t asked their customers all the right questions. Maybe they don’t want to be a consumer bank (WU has a bank) or maybe they are just too focused on defending their core remittance product.

[fxci_space class=”tailor-633429aea558f”][/fxci_space]