Dynamic currency conversion (DCC) – the function by which merchants or ATMs abroad allow users to convert a transaction’s price to a customer’s home currency at the point of sale – is an area that touches various consumer aspects of cross-border, including travel and tourism, hospitality, retail and ecommerce. Below, we look at what’s driving growing interest in the product.

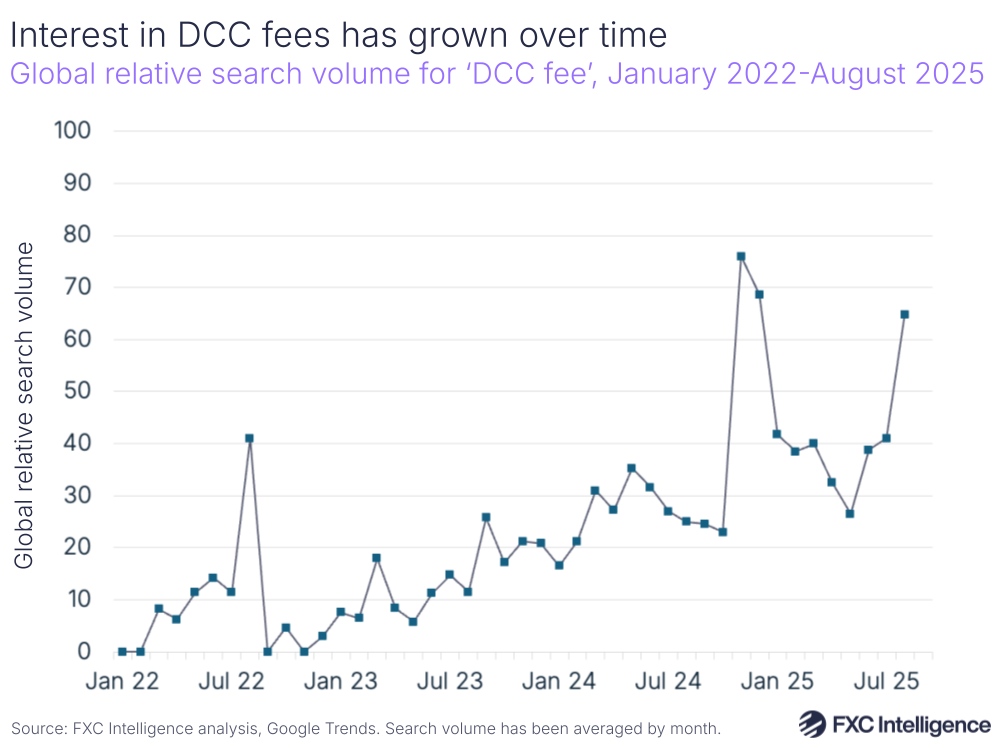

Google Trends data highlights that searches for the term ‘DCC fee’ have risen significantly in the last three years, with the average monthly relative search volume for the figure hitting 64.8 out of 100 (where 100 was the peak popularity for a term) in August 2025, versus 25 in August 2024. Several factors could be influencing this rise over the three-year period, including a post-pandemic return to travel leading more consumers to encounter DCC prompts at ATMs, hotels and shops abroad.

Some countries have shown an interest in increasingly regulating transparency around DCC fees and fees on international card transaction payments in general. For example, under the European Union’s PSD2 Directive introduced in 2019, where payment cards are issued in the European Economic Area (EEA) and the merchant is EEA based, a markup percentage must be displayed over the European Central Bank exchange rate showing how much the consumer will pay for the conversion.

Various payment providers have launched products in the DCC space this year. In May, Elavon launched a new payment gateway service enabling payment acceptance for SMEs, with DCC enabled across more than 80 currencies. CellPoint Digital has launched a new orchestration platform for airlines and the travel industry, enabling dynamic currency conversion as one of several features for travel merchants entering new markets. Separately, in July Shift4 completed its acquisition of payments platform Global Blue, which provides DCC as one of its core products.

Despite some regulators looking to enhance transparency of DCC for consumers, a key challenge for many payments providers in the industry is understanding how different providers are pricing for currency exchange. FXC Intelligence data is able to help with this by identifying the real cost of cross-border card transactions across more than 100 countries and over 10,000 individual payments cards.

Learn more about FXC Intelligence’s card and ecommerce datasets