Last week, Visa reported its earnings for Q1 2024 (spanning calendar Q4 2023), while this week Mastercard reported its earnings for Q4 and full year 2023 results.

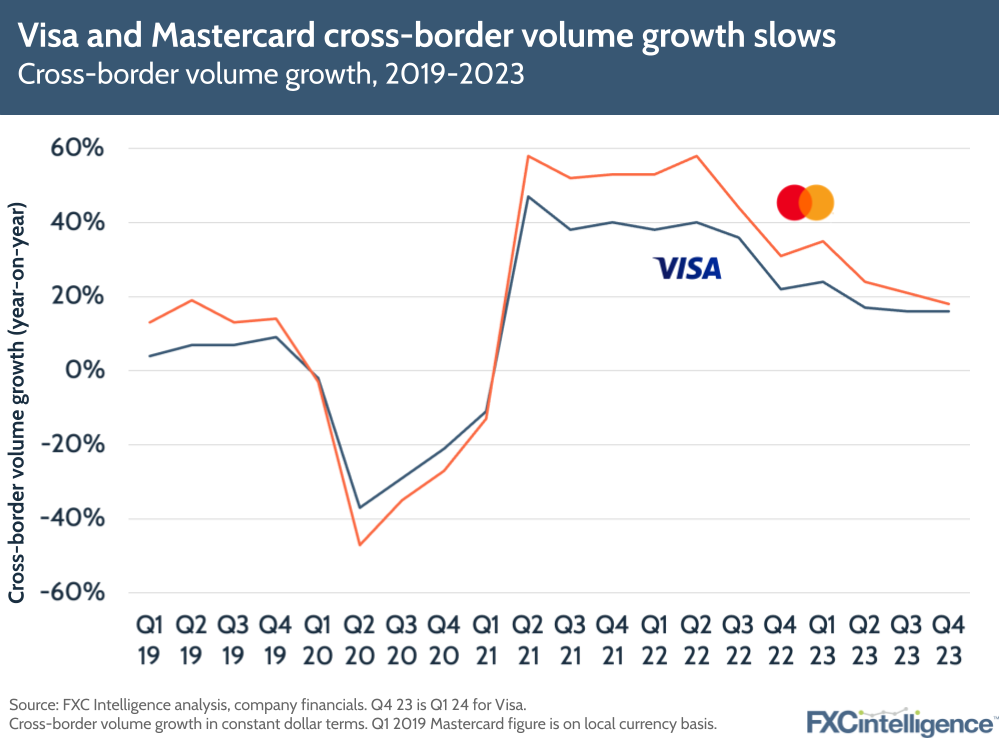

Both companies continue to see rising cross-border volumes, albeit at a slower pace than the same period in previous years, though Mastercard noted that cross-border travel continued to be impacted by tougher comparisons to the post-Covid recovery of the sector last year.

Some of the main cross-border related highlights from the earnings for both companies are included below:

Visa Q1 2024 highlights

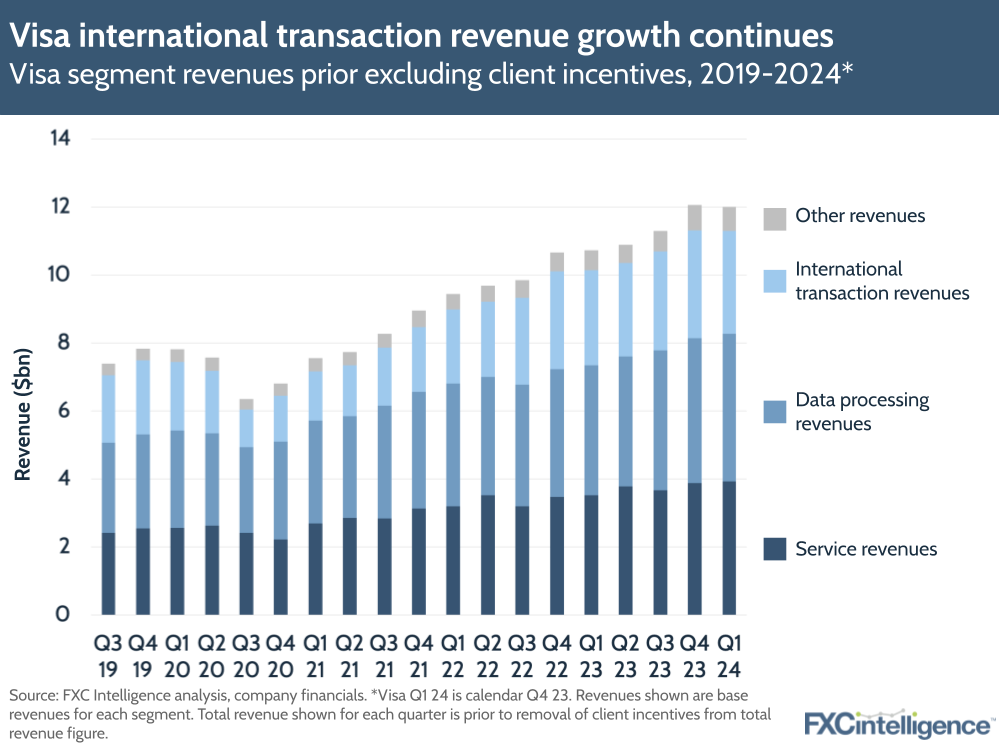

- Net revenues rose by 9% to $8.6bn, driven by cross-border volumes (excluding intra-Europe) rising 16% YoY in constant dollar terms. US payments volume grew 5% YoY, while international payments volume grew 11%.

- Cross-border volumes were aided by a 142% rise in cross-border travel compared to 2019 levels. In total, the company now enables global payments across 8.5 billion endpoints in nearly 200 countries and territories.

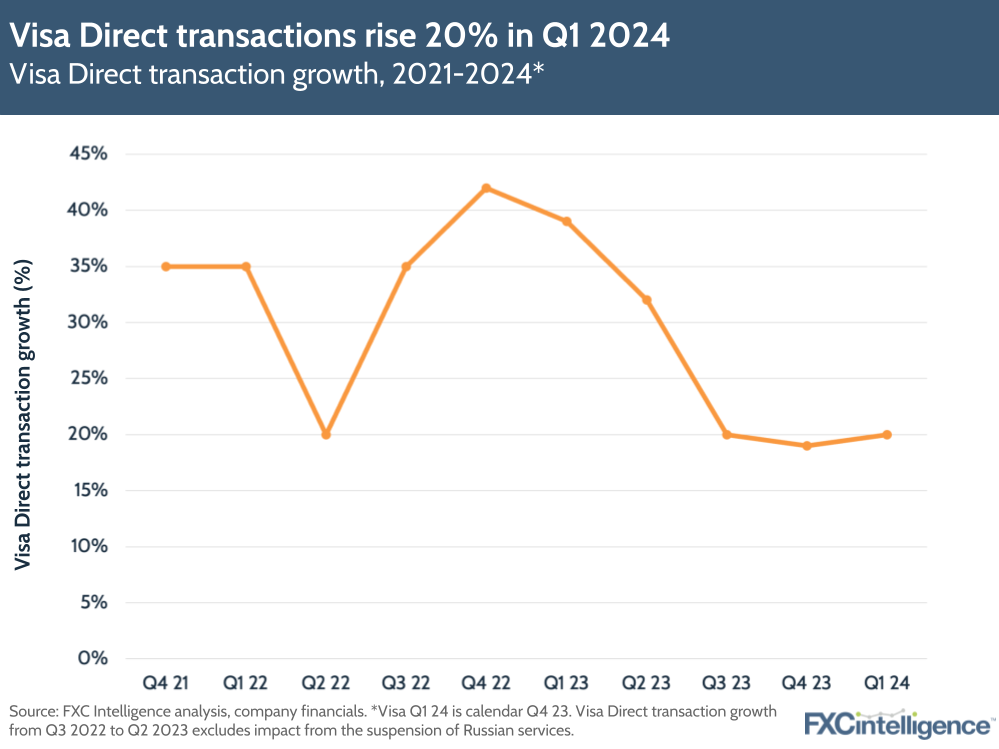

- Visa Direct transactions grew by around 20% to 2.2 billion, with P2P cross-border transactions growing by 65% YoY. International transaction revenues rose by 8% YoY to $3bn, compared to a 29% growth in Visa’s Q1 2023.

- Visa has formed a number of new partnerships, including with Western Union, Remitly, CIBC, Simplii and HSBC’s Zing, to help these companies expand their remittances capabilities.

Mastercard Q4 2023 and FY 2023 highlights

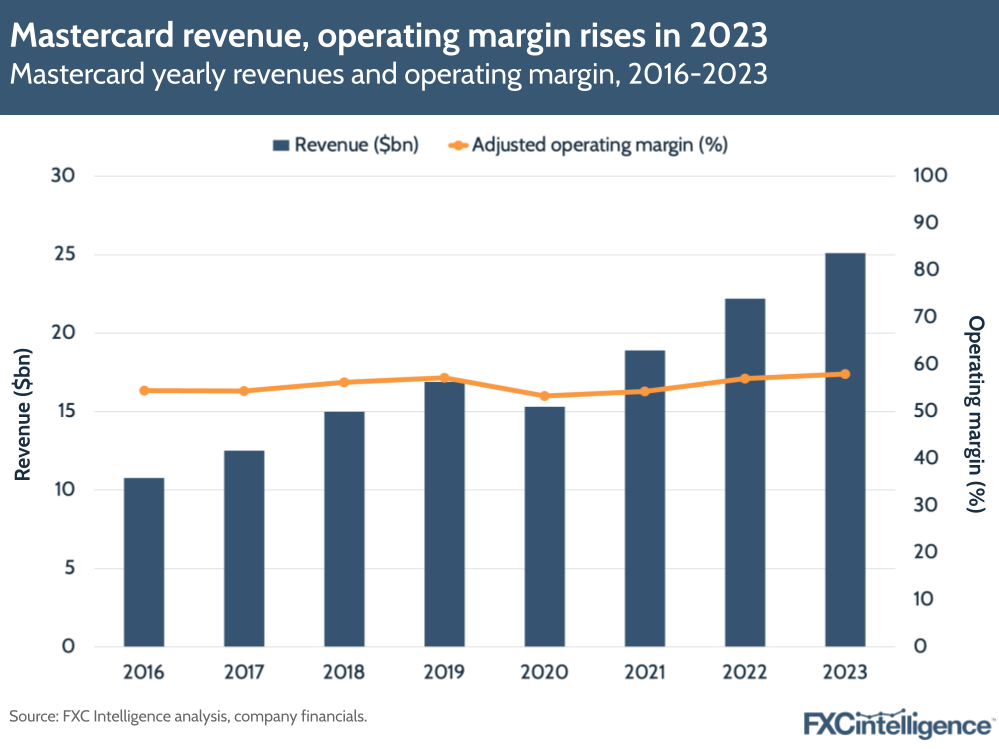

- In Q4, net revenues rose by 13% to $6.5bn, which the company attributed to a 9% rise in payment network revenues, 18% cross-border volume growth and 12% growth in switched transactions.

- Mastercard also saw 19% net revenue growth in value-added services and solutions, driven by its cybersecurity products. Adjusted operating margin improved to 56.2% in Q4.

- In Q4, cross-border assessments – the charges based on activity related to cards bearing the Mastercard brand where the merchant country and the country of issuance are different – rose by 23% to $2.2bn .

- Spanning Mastercard’s full year, net revenues rose by 13% to $25.1bn, driven by a 10% rise in payment network net revenues, 24% growth in cross-border volumes and 14% growth in switched transactions.

- Mastercard continues to advance its Cross-Border Services platform, with a number of new and expanded partnerships, including with UBS, Alipay, Arab Bank and Dubai Islamic Bank.

Visa Direct expands, international transaction revenue grows

Visa Direct – the company’s global payments platform – has continued to make progress during the quarter. Transactions across the platform grew by around 20% to $2.2bn, with P2P cross-border transactions growing by 65% YoY.

Visa formed a new partnership with remittances giant Western Union spanning a number of services, including Visa Direct, across 40 countries and five regions. It also expanded an agreement with Remitly to enable remittances to over 100 countries and announced a partnership with CIBC and Simplii to facilitate remittances to digital wallets in countries such as the Philippines, China and Bangladesh.

The company has also launched a new partnership to apply capabilities from Visa’s Tink and Currencycloud to HSBC’s Zing – a new money transfer app, initially focused on the UK but set to expand into new markets. Also this quarter, Visa closed its acquisition of Pismo, a cloud-native issuer and banking platform that operates in Latin America, Asia Pacific and Europe.

Visa’s international transaction revenues still make up a sizeable portion of the company’s overall revenues, but its growth in this area continues to slow down. International transaction revenues rose by 8% YoY to $3bn, compared to a 29% growth in Visa’s Q1 2023. When adding together revenues from different sectors across the company (and before subtracting client incentives), international transaction revenues accounted for around 25% of Visa’s revenues in its Q1 2024 results.

Mastercard revenues driven by cross-border growth

Over its full year, Mastercard’s net revenues grew by 13%, which was largely driven by its overall cross-border volume growth of 24%. Despite operating expenses rising by 11%, the company has continued to grow its adjusted operating margin from 57% in 2022 to 58% in 2023.

The company is benefitting from the results of healthy consumer spending, which it put down to strong labour market and wage growth; however, the company said it is still measuring macroeconomic events in the environment such as inflation.

Like Visa, Mastercard has enabled a number of high-profile partnerships recently. This includes enabling instant cross-border payments for UBS, and connecting with Chinese cross-border payments network Alipay to enable international travellers to make cashless payments when visiting China. It also partnered with remittances challenger Remitly and Dubai Islamic Bank to integrate Mastercard’s Cross-Border Services into its network.

Mastercard also mentioned its work on generative AI – an increasingly hot topic for companies in the payments space, but one which is still in its early stages. In particular, Mastercard noted creating a tool for small business owners to help them navigate business challenges.

On its expectations for its Q1 results, Mastercard noted that it expected to see reduced growth in Q1 2024 as a result of tougher comparisons to Q1 2023, when the company saw higher revenues related to FX volatility compared to other quarters.

How much do cross-border card transactions cost around the world?