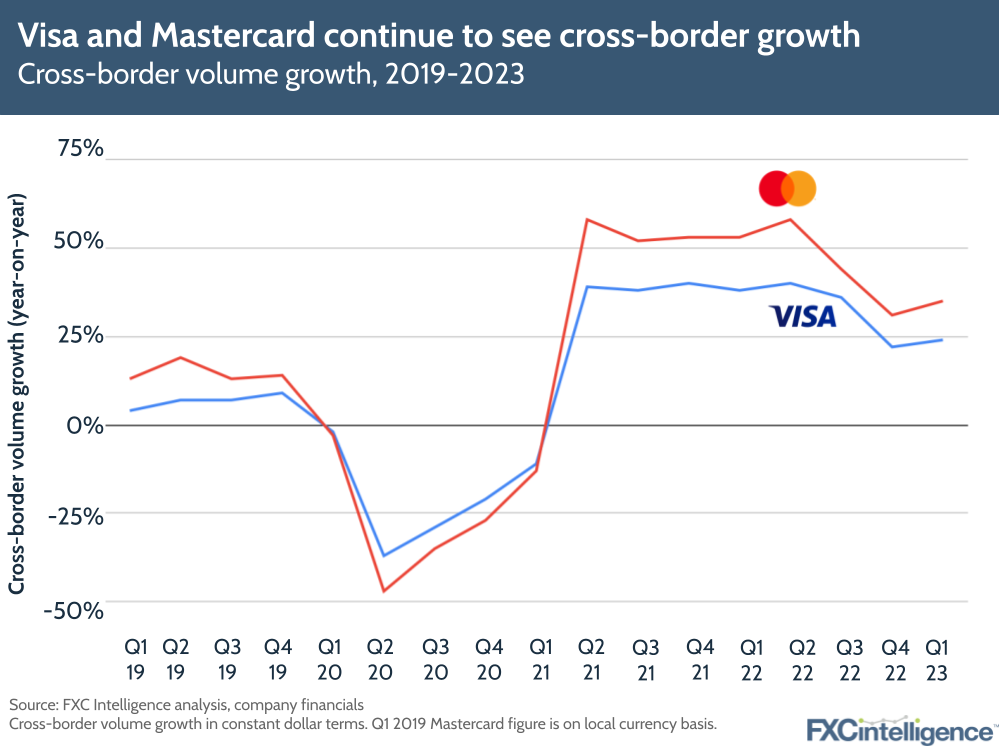

Last week, Visa and Mastercard released their latest earnings – Q2 2023 for Visa and Q1 2023 for Mastercard. We’ve highlighted the most important takeaways from a cross-border payments perspective below.

Visa Q2 2023 earnings highlights

- Visa’s revenues grew 11% to $8bn (13% on a constant-dollar basis). While growth was higher than some were expecting due to recent economic conditions, it is also the lowest the company has seen since Q3 2021.

- Cross-border volume grew 24% (32% excluding transactions within Europe). This was notably lower than the 38% growth last year, though that was before last year’s economic slowdown. However, Visa believes the ongoing return to travel in Asia (particularly China) will add volume moving into the second half of the year. Overall, Visa saw a 10% rise in payments volume, with total processed transactions rising 12% to 50.1 billion.

- Nearly 30 banks, across more than 20 countries, have signed up to Visa’s B2B Connect solution, with payments routed to 90 countries globally. Visa’s CEO Ryan McInerney – promoted to the role in February 2023 – said that the company is working country by country to build out its B2B payments network.

- International payments volumes grew 27% in LatAm, 29% across CEMEA (excluding Russia), 17% in APAC (excluding China) and 13% in Europe (31% excluding the UK).

- Visa Direct transactions were up 32% (excluding Russia), with cross-border growing even faster (at 50%) as Visa Direct’s use cases and network continue to expand.

- The company also discussed Visa+, its solution that allows payments to be sent between different P2P apps. The solution is focused on domestic US payments, but could go cross-border eventually.

- When asked about the potential impact of FedNow – the US’s instant payments system set to launch in July – McInerny said that it will take time to build adoption in the US. He added that Visa Direct has not seen a tangible impact in the UK, which has had its Faster Payments system for years.

Mastercard Q1 2023 earnings highlights

- Mastercard’s net revenues grew 11% (14% on a constant currency basis), backed by resilient customer spending and continued cross-border travel recovery, though growth was slower than Q1 22. Headwinds are expected from higher interest rates and the current banking environment, but consumer health is still seen as strong.

- Net revenues across Mastercard’s payments network increased 7% on a currency-neutral basis, with payment rebates and incentives growing 25%. Meanwhile, revenues from value-added services, including solutions in areas such as cybersecurity, rose 21%.

- Cross-border volumes grew 35% (40% excluding Russia) which, like Visa, was bolstered by Asian markets opening up to travel. Compared to 2019, cross-border travel overall has gone up by 148%, backing a 168% rise in cross-border volumes as more people spend abroad.

- Mastercard is now accepted at 100 million acceptance locations worldwide. The company’s executives also said they were continuing to target growth in countries with lower/rising digitisation, as well as India and China.

- Mastercard Cross-Border Services continues to expand, with partners such as Checkout.com and MFS Africa, as well as adding cash use cases.

- The company made several new deals with banks during the quarter, including the National Bank of Egypt, N26 in Germany and Wells Fargo in the US, and supported the launch of Argentinian prepaid card provider Ualá.

- On FedNow, Mastercard said competition is a good thing, but is still waiting to see the features the system offers and how it is adopted by businesses. However, it did say that it continues to seek out B2B partnerships, such as its recent partnership with J.P. Morgan on a Pay-By-Bank open banking solution.