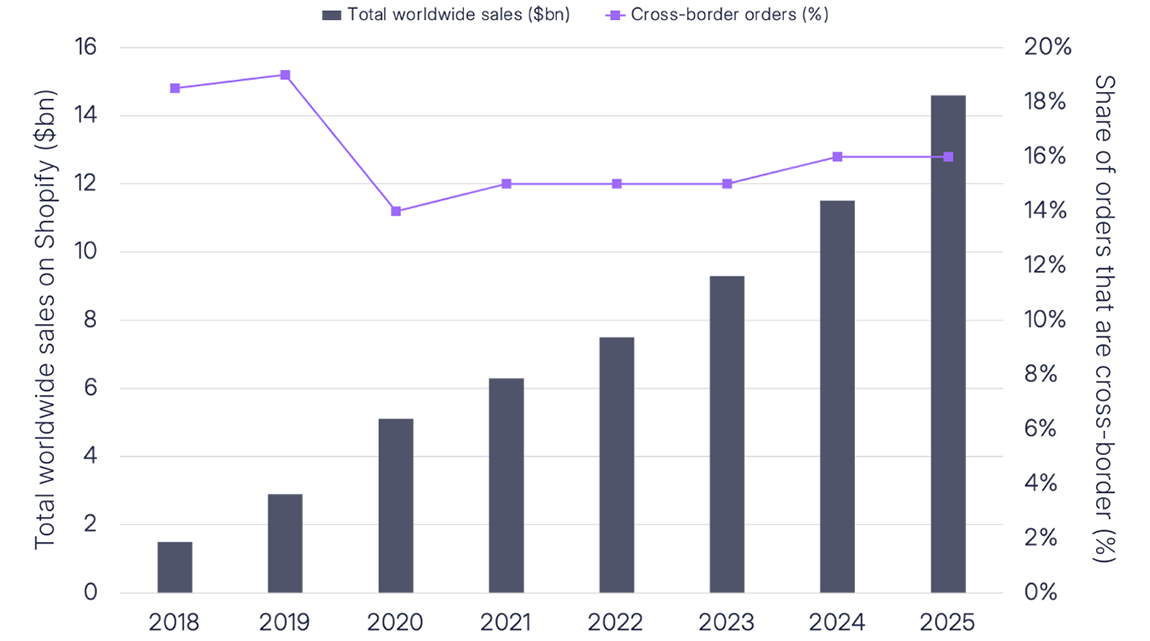

This Friday, merchants around the world will be hoping to make record sales as shoppers rush to find the best deals during Black Friday. Once an offline event mostly held in the US, it has since become a largely online affair, adopted by numerous countries and increasingly attracting growing numbers of cross-border purchases. Merchants in many countries will be hoping to pick up domestic and international sales, but how might the fees they face influence their revenue?

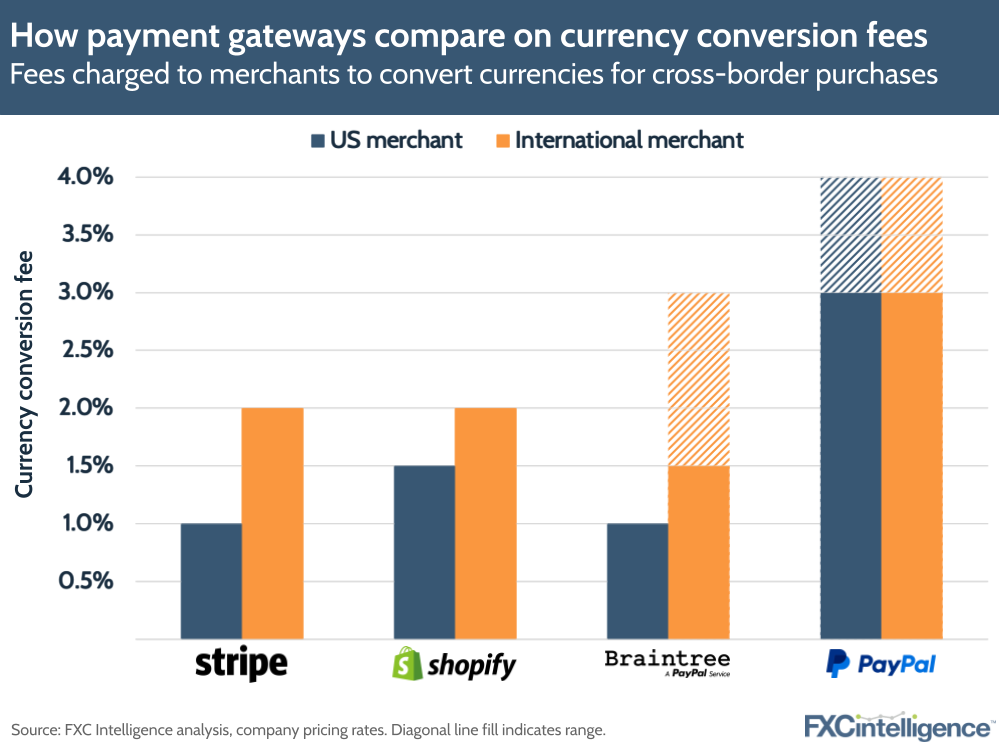

How currency conversion fees for merchants compare

Currency conversion fees are by no means the only fees facing merchants, with transactions typically coming with a percentage-based charge that varies depending on the payment type and the provider. However, for international transactions, not only are credit card fees payable by merchants typically higher than their domestic equivalents, but in many cases merchants also need to pay a currency conversion fee.

This is charged either at the point of sale or when a merchant converts their account balance into their local currency, depending on the structure of the provider, but in some cases the fee is borne by the customer instead. If the store prices its goods exclusively in the merchant’s local currency, then any currency conversion fees will be paid by the customer. However, if the merchant opts to offer products in their customers’ local currencies, then this conversion fee will be borne by the merchant. In most cases, payment gateways will give the merchant the choice on this, while some players such as Square will only support currency conversion on the customer’s side.

While some payment gateways, such as Worldpay or Adyen, do not publish standard currency conversion fees, there is a significant range among those that do. US merchants consistently see lower fees than their international counterparts, although in the case of Braintree the international range is dependent on whether the merchant’s currency is considered standard or exotic.

In some cases, additional fees can also apply. For example, Stripe charges an additional fee for cross-border transfers, which ranges between 0.25% and 1% depending on the corridor, and also charges for local payouts at a rate typically around the local equivalent of $0.25 plus 0.25%.

How much does the cost of making cross-border transactions vary globally?