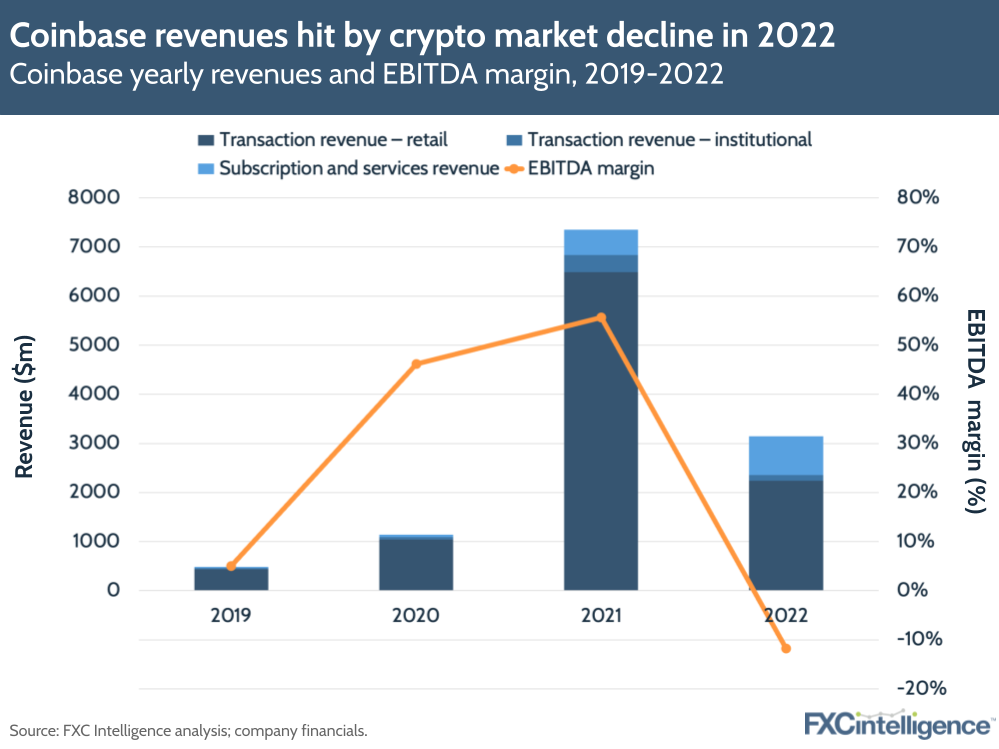

Despite a 5% quarterly increase in net revenues, to $605m in Q4, Coinbase has had a difficult 2022 overall, with FY revenues declining by 57% to $3.1bn. Compare this to 2021, when the crypto exchange saw a 545% revenue rise, and the impact of the crypto market decline becomes even more stark.

However, Coinbase believes its headcount reduction and continued focus on subscription and services will help turn the tide in 2023. While the company’s share price (as of 22 Feb) is still down over 60% YoY, it has risen more than 80% since the start of January, indicating a return of investor interest as bitcoin and ethereum prices rise.

Here are some of the other key points from Coinbase’s Q4 and FY 2022 earnings call:

- EBITDA in 2022 was -$371m, a 109% decline compared to 2021, while EBITDA margin was -12%, down from 56%. EBITDA in Q4 was -$124m, lower than previous quarters, with the company saying this was the result of a foreign exchange loss.

- Trading volumes declined 50% in 2022, while transaction revenues fell 66%. Coinbase said these drops were due to a 64% decline in crypto market capitalisation over the course of 2022, a year that saw the depegging of LUNA last May and the collapse of FTX in November. Note that trading volume in 2022 ($830bn) in 2022 was still much higher than it was in 2020 ($193bn).

- Subscription and services revenue grew 34% to $283m in Q4, driven by the company’s USDC services. Total revenue for this segment rose 53% in 2022, to $793m, as the company continues its shift to focus on subscriptions and services over its more volatile trading segment.

- After “hiring too many people, too quickly in 2022”, the company believes its latest headcount reduction (around 20% of its employees) and ongoing cost management efforts will result in a 30%-plus reduction across various expenses in Q1 23.

- Bitcoin and ethereum increased their share of overall trading volumes, but other crypto assets had a smaller share of 45% (down from 55%). The number of crypto assets on the platform fell from 278 in 2021 to 80 in 2022, while monthly transacting users dropped to 8.3 million in Q4, down from 8.5 million in Q3.

- Coinbase Co-Founder and CEO Brian Armstrong believes incoming crypto regulation could be beneficial for the company. For example, he said that new legislation to ensure stablecoins are backed to maintain their 1:1 peg would be a “great win”.

- There was no specific guidance on FY 23, only that the company wanted to improve adjusted EBITDA in absolute dollar terms compared to 2022. For Q1, the company sees subscription and services revenue rising to $300-325m.

How does crypto pricing compare to fiat cross-border transfers?