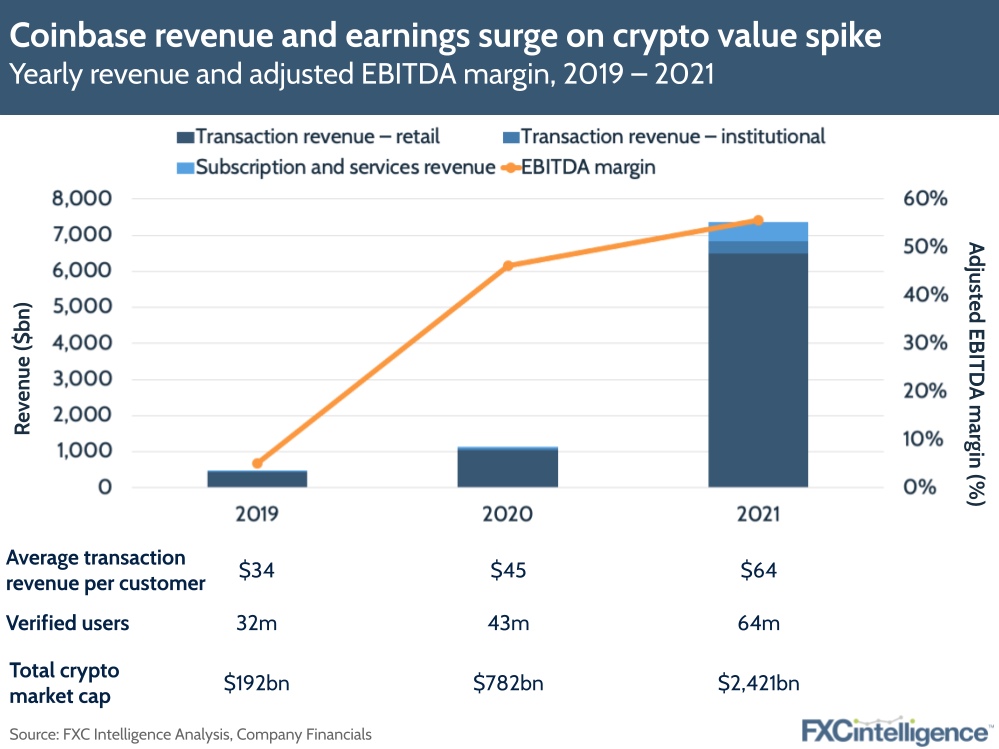

Coinbase has released its first full-year results since becoming the first crypto asset trading platform to become a publicly traded company, providing insight not only into its FY and Q4 2021 results, but also the performance of cryptocurrency as a sector. And 2021 has been an impressive year for both Coinbase and cryptocurrency as a whole with some amazing growth numbers.

With year-on-year net revenue climbing 545% to $7.3bn, and Q4 reaching $2.5bn, it’s been a very strong year for Coinbase, which grew trading volume market share by over 8.5x. The company has also seen a similarly strong jump in profits, with its EBITDA margin climbing for 46% in 2020 to 56% in 2021. However, it has warned that Q1 2022 is expected to be weaker due to a 20% drop in the global crypto market cap that has been exacerbated by tightening financial conditions and geopolitical instability.

Our key points from the call:

- Coinbase is beginning to diversify its revenue. While the company increased revenue from institutional investors in 2021 compared to 2020, the share remained roughly stable at 5% of transaction revenue. However, revenue from subscription and services climbed from 4% to 7% of overall revenue and reached 9% in Q4 21. This segment includes a wide range of peripheral offerings, with the largest being B2B platform Coinbase Cloud.

- The company has also launched a number of additional products over the year. In Q4 21 it rolled out Payroll in the US, enabling customers to receive part of their salary in crypto, and plans to expand this overseas in the future. It also launched Tax Center to help US customers with crypto tax filing and added support to receive tax refunds in USDC or crypto. It also added NFT and DeFi support to its Wallet service, and plans to expand its international offering of Wallet in 2022.

- CFO Alesia Haas also provided additional details about the company’s new crypto remittance pilot program. She said that while the company was partnering with Remitly for the Mexico pilot, its use of partners in other markets will depend on whether it has payment rails there or not. She indicated that in markets such as the UK Coinbase’s rails would allow it to enter on its own, although stressed that the company planned to use its learnings from the initial pilot to inform its plans for a global rollout.