More and more financial institutions are joining China’s Cross-border Interbank Payment System (CIPS) – the country’s official infrastructure for clearing and settling cross-border payments made in yuan. However, the rise of the system is sometimes overstated. We’ve taken a closer look at the system’s growth over time below.

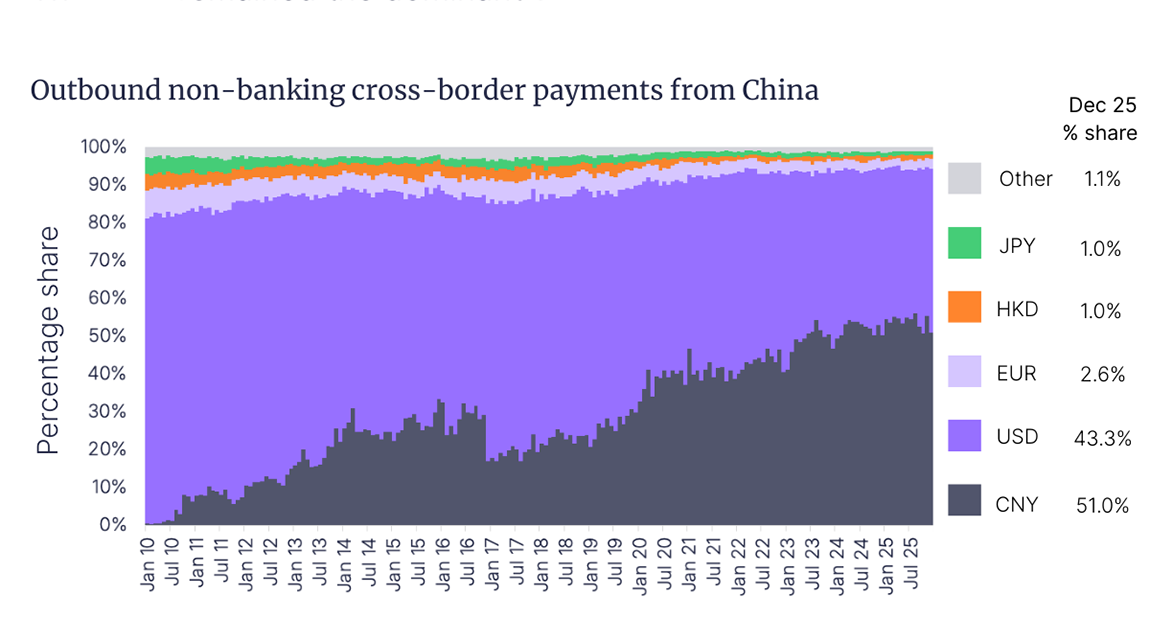

Launched in 2015 by the People’s Bank of China, CIPS was designed as part of China’s wider push to help internationalise the yuan, which is increasingly being preferred to the dollar for both outbound and inbound payments to China. The system allows financial institutions to directly settle payments with each other through a secure network in real-time.

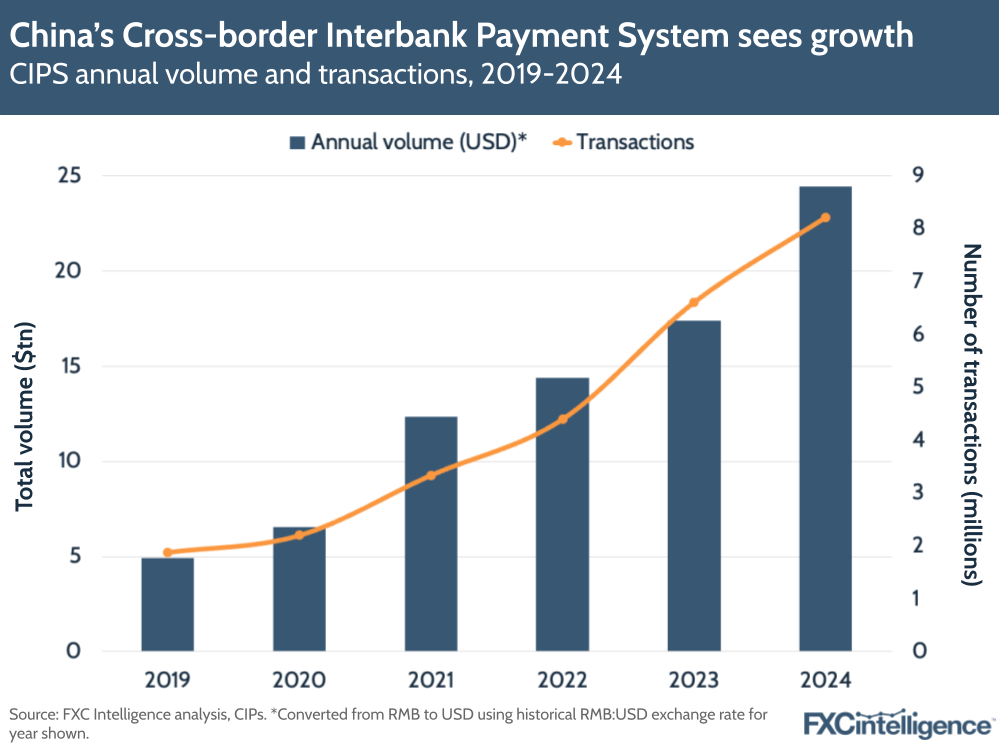

In 2024, total annual volume passing through CIPS rose 43% to ¥175.49tn ($24.45tn), driven by a 24% increase to 8.2 million transactions. Both volume and the number of transactions have more than tripled since 2020.

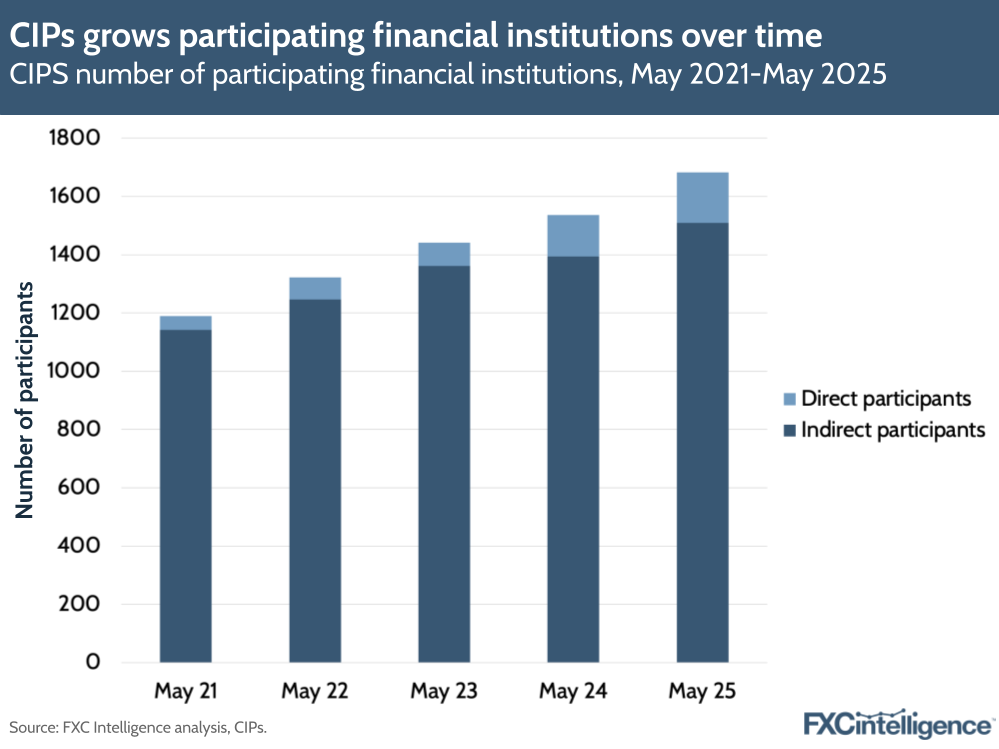

In May 2025, CIPS reported the number of participants had risen by 10% YoY to 1,683, with the vast majority of these being indirect participants (i.e. connected via a direct participant). Asia accounts for 73% of the share of indirect participants, with 17% being European institutions. However, significantly fewer indirect participants are based in Africa (4%), North America (2%), South America (2%) and Oceania (1%).

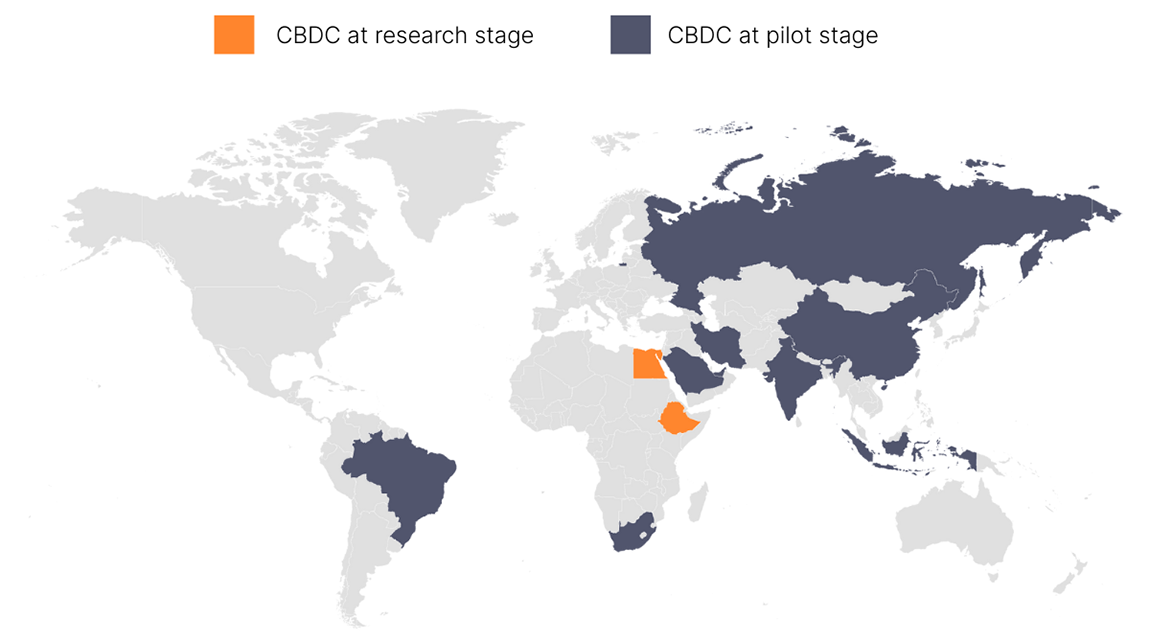

In June, it was reported that CIPS had forged its first direct partnerships with six foreign banks in the Middle East and Africa. This fits into a wider narrative for countries seeking alternatives to dollar-based infrastructure or concerned about sanctions. Since Russia’s removal from the Swift network in 2022, countries in Asia, the Middle East, Africa and the BRICS bloc have increasingly explored yuan-based settlement.

Having said this, comparing CIPS to Swift isn’t really apt. Swift is a global messaging network, while CIPS focuses on clearing and settling yuan payments. With over 11,500 institutions in more than 235 countries and territories, Swift remains far more extensive and provides messages for transactions in virtually every major currency. CIPS therefore still relies on Swift to send messages between banks for a large proportion of transactions, especially those not directly connected to CIPS. Back in March, Swift even signed a memorandum of understanding that will see it work alongside CIPs to improve its capabilities, showing it sees it more as a partner than a rival.

Events that devalue the dollar (e.g. the recent US trade war) tend to lead to more reporting around China’s push to make the yuan a global payments currency. However, Swift’s RMB tracker for June 2025 shows that the yuan only accounted for 3% of the share of currencies being used for global Swift payments, versus 48% for the US dollar and 24% for the euro.

Overall, CIPS is seeing increasing traction as China continues to challenge Western-based financial systems. However, the system still lacks scale globally, and whether it can substantially have an impact on China’s quest to internationalise the yuan remains to be seen.

How can I track global policy moves in the cross-border payments space?