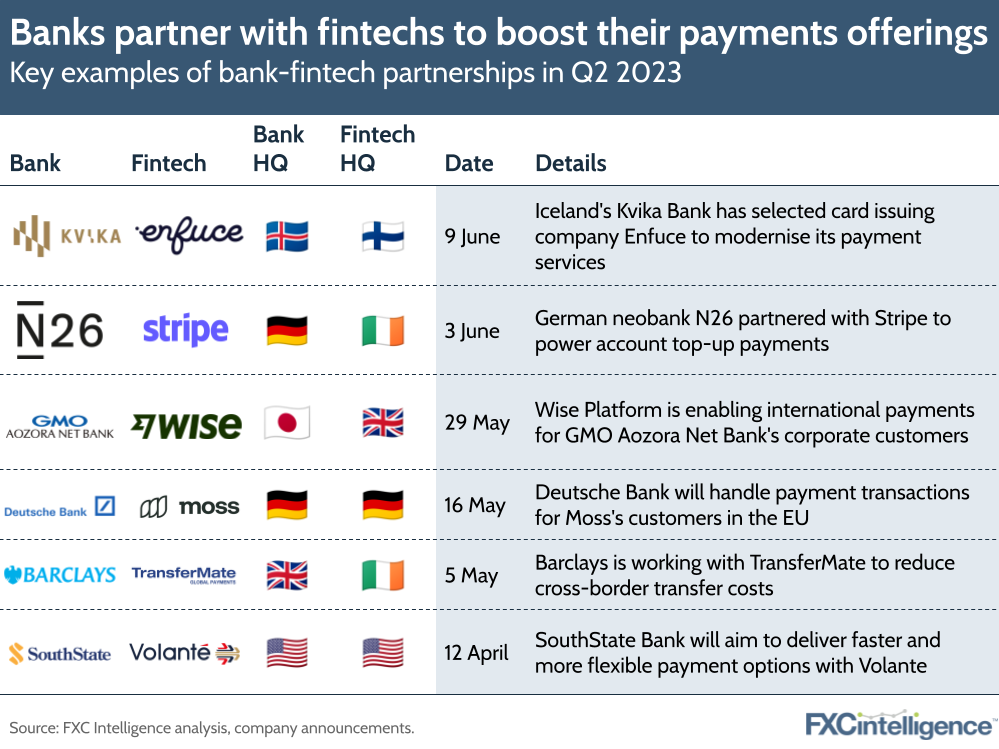

Banks continue to partner with fintechs this year, with the aim of expanding their payment offerings in an increasingly competitive space. As fintechs’ offerings mature, we see the biggest banks open up to partnering with them across payments product lines.

Some banks are using fintechs’ existing infrastructure to build entirely new payments arms. Last week, Icelandic bank Kvika teamed up with Enfuce, a Finnish card issuer, to help it launch a new Visa consumer credit card, as well as integrate Apple Pay and Google Pay into its services. Through the partnership, Kvika also wants to relaunch Aur, the mobile payments app that the bank originally acquired in 2021.

Other banks aim to improve their cross-border payments offering through partnerships with money transfer providers. Wise Platform (the remittance player’s division for banks and large corporates) has partnered with its first Japanese bank, GMO Aozora Net Bank, for which it will facilitate international transfers to 80,000 corporate customers. UK-based Barclays, meanwhile, is working with Transfermate to deliver an ‘international receivables package’, which it hopes will reduce cross-border transfer costs.

Banks are also preparing for a future where faster, real-time payments are the norm. US-based SouthState bank is working with cloud payments provider Volante Technologies to deliver “faster and more flexible payment options” to its customers through the US’s upcoming FedNow instant payments service (more on this in a future report).

As payment challengers continue to take market share, forming partnerships has become more important for banks to stay relevant, particularly when it comes to reducing the cost and complexity of cross-border transfers. It’s no surprise that many banks (such as Lloyds in the UK) have already set up innovation hubs for fintech entrepreneurs, financing their businesses in exchange for a share in new developments.

Which are the fastest growing parts of the cross-border payments market?