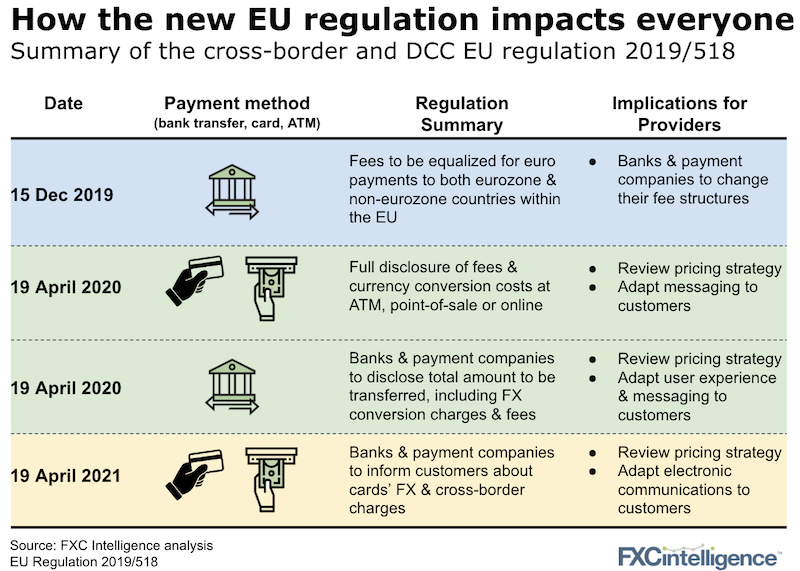

The EU wanted to lower the cost of Euro-denominated cross-border payments within the eurozone. In April 2019, it introduced new regulations to bring this about: the EC No. 2019/518 amending No. 924/2009. Good for customers, not so clear for finance, marketing and compliance departments in financial services companies.

The regulation introduces two main amendments:

- Price equality for Euro payments within the eurozone:

From the 15th of December 2019, EU member countries where the domestic currency is different from the Euro must not charge any fees for Euro payment in the EU above what would be charged when paying in local currency domestically. - Improved transparency:

From 19 April 2020, whenever making a card payment in a shop or online, or when withdrawing cash at an ATM in a European currency other than the euro, the conversion service provider must disclose:- The amount to be paid in the card currency after the DCC conversion.

- The amount to be paid in the domestic currency that is equivalent to the converted amount.

- The total fee expressed as a margin above the ECB rate between the Euro and the card’s currency.

The same is for transfers. Banks and payment companies will have to disclose the total amount to be transferred, including currency conversion costs and transaction fees.

- From 19 April 2021, banks and payment providers issuing cards will have to send electronic reminders to their customers regarding the FX and cross-border charges reported in the cards’ T&Cs. Banks will also have to disclose the cards’ T&Cs in a clear way on a publicly available website.

Some companies (those using our data) have reported an uptick in revenue since moving to a new pricing structure post December 2019 when the new regulation came into force. But overall, the EU predicts a saving of one billion euros to customers (aka a loss of up to one billion euros in revenue to the sector).

These regulations, rolling out year by year, will therefore impact everyone. Banks, payment companies, e-commerce companies, anyone offering DCC…the list goes on.

The implications

- The level of transparency of cross-border payments pricing is likely to increase significantly. However, since the regulation will be implemented and overseen at local level (by each EU member state), the level of transparency might differ across the EU.

- Since customers will be more aware of the fees and charges they are paying, banks and payment companies will need to review their pricing strategies, with obvious downward pressures.

- Our own research on consumer understanding of FX terminology (including a large study for the FCA) showed how little consumers understand the sector’s terminology. Thus, the impact of transparency may not be as straightforward as the EU hopes.

- Improved transparency and communication means not insignificant implementation costs for banks, payment companies and e-commerce companies. Card issuers will have to restructure their technology in a way to provide the information about FX and cross-border charges directly in shops, on either the POS or the counter, online and on all ATMs in the EU.

We have been tracking more than 600 of the biggest issuers across 60+ markets. Some have changed their pricing since the regulations, others haven’t. We’ve also carried out extensive research on consumer understanding of FX terminology.

[fxci_space class=”tailor-6334265bb881c”][/fxci_space]