High-profile sponsorships from Visa, Cash App, MoneyGram and Airwallex have brought increased attention to F1 for the cross-border payments industry. We look at the sport’s potential as a key marketing tool for the space.

As we rapidly approach the start of the 2024 Formula 1 season, the sport is undertaking its usual pre-season shake-up, including through the announcement of key new sponsorships across the organisation and the ten-team grid.

While there have been announcements from a broad range of players, payments companies have a key presence in this year’s F1 sponsorships. In January, news broke that Italian F1 team Scuderia AlphaTauri was to be renamed Visa Cash App RB, in recognition of its new joint title sponsors: Visa and Cash App. This was followed in February by the announcement that B2B payments player Airwallex had become an Official Partner of McLaren.

These players join numerous other payments-related companies, with one of the highest profile being MoneyGram, which begins its second season as title sponsor of MoneyGram Haas F1 Team this year.

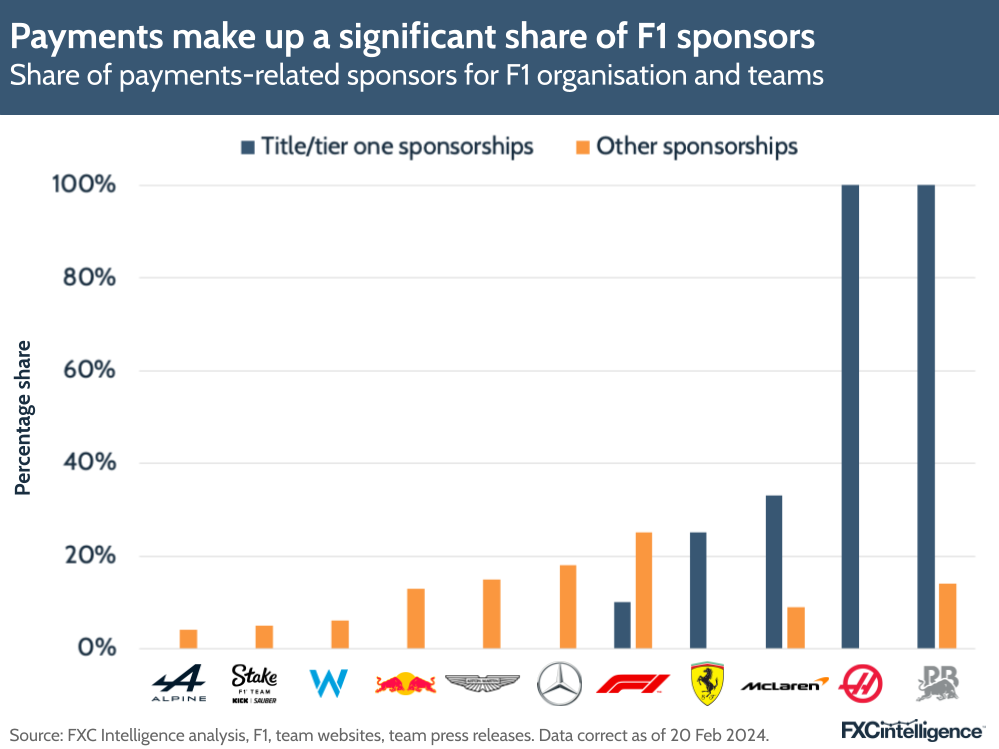

As it stands, 40% of the grid now has a payments-related player among its title or tier one sponsors, while every team – as well as the F1 organisation itself – has some form of sponsorship deal with a payments-related company. This suggests that the sport has become a key choice for payments marketers.

Meanwhile, F1 itself has been undergoing something of an evolution, with events in new markets and an increasingly broad fanbase, aided in part by the popularity of Netflix documentary series Drive to Survive.

With this in mind, what is it about F1 that represents an appealing opportunity for the payments industry and what type of companies are advertising through the sport? We take an exhaustive review of the current sponsorships across all 10 teams and the F1 organisation to find out.

Payments and the F1 sponsorship landscape

With a broad international presence and an increasingly diverse fanbase with high disposable income, F1 represents a strong opportunity for a broad intersection of industries, including those operating in the payments space.

How common are payments companies among F1 sponsorships?

Payments is not the most prominent industry among F1 sponsorships, however payments-related companies do have an outsized presence compared to their relative share of companies as a whole.

Among title and tier one sponsorships – the highest priced sponsorships with the most prominent positioning across vehicles and coverage for each team – payments are present across four of the 10 teams, plus the F1 organisation.

In the case of Haas and RB, these account for all the title/tier one sponsorships for these teams, while for Ferrari, McLaren and the F1 organisation, they account for one of a number of companies. Out of the 28 different title and tier one sponsors, 21% are payments-related companies.

Among the 280 tier two or lower sponsorships, which typically still feature on vehicles and in coverage but in less prominent positions, payments remain widespread, although slightly less prominently, with 9% of all such sponsorships from payments-related companies.

Which industries most frequently sponsor F1 teams?

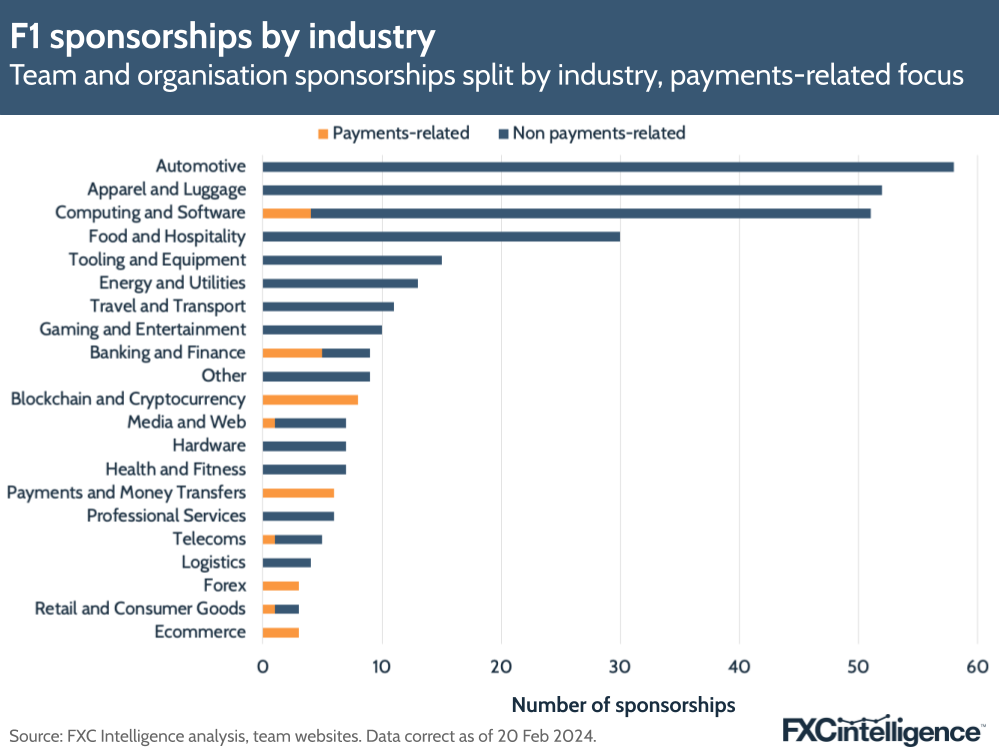

While a broad range of industries are represented among F1 sponsorships, there are some that are more commonplace than others.

Unsurprisingly, the most common are players catering to the automotive industry, with many serving as both suppliers and sponsors to F1 teams. A notable example here is tyre major Pirelli, which, as the sole tyre supplier for the sport, is the only company to have a sponsorship with every team on the grid, as well as the F1 organisation itself. In other cases, niche automotive companies will sponsor one team and also provide their goods or services for races.

Beyond this, apparel and luggage is the next most common industry. Here, companies trend towards luxury and high net-worth customers, with luxury watch manufacturers being particularly common. However, there are also a number of international sports brands, including Puma, which has the next most sponsorships after Pirelli, at four.

Computing and software is the next most common industry, with most players in this sector offering B2B services. This reflects the sport’s popularity among higher net-worth individuals, many of whom are in decision-making roles professionally.

For payments-related companies, while many fall into the ‘payments and money transfers’ category, there is a relatively broad presence across a variety of industries as many players offer payments as part of a wider group of products or services.

Which customer types are most commonly targeted by sponsors?

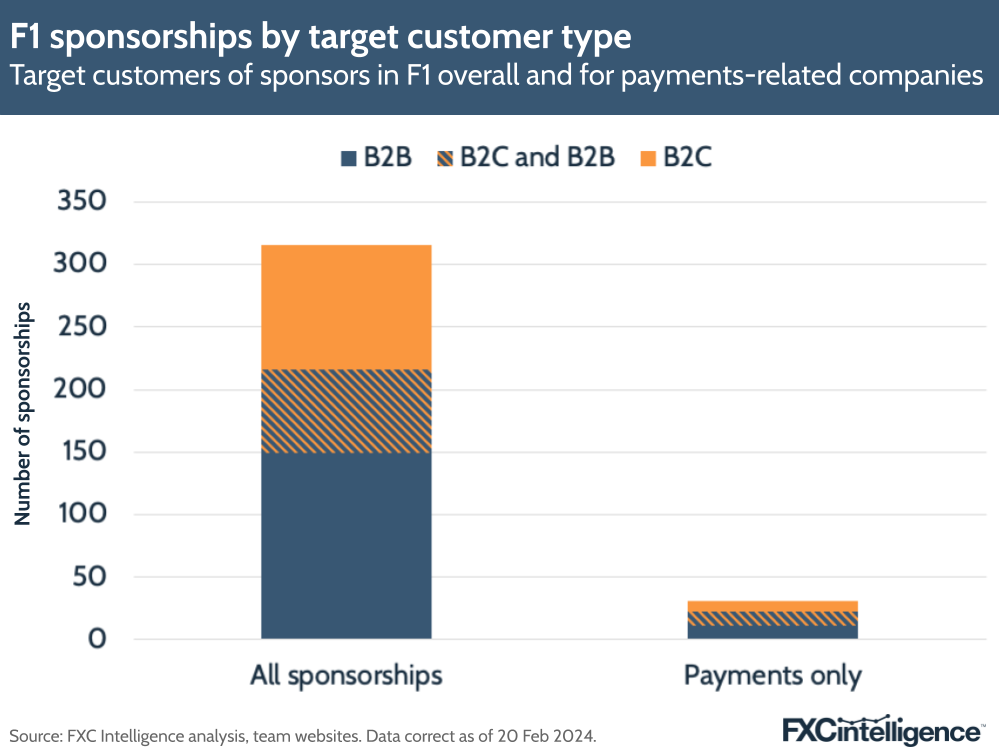

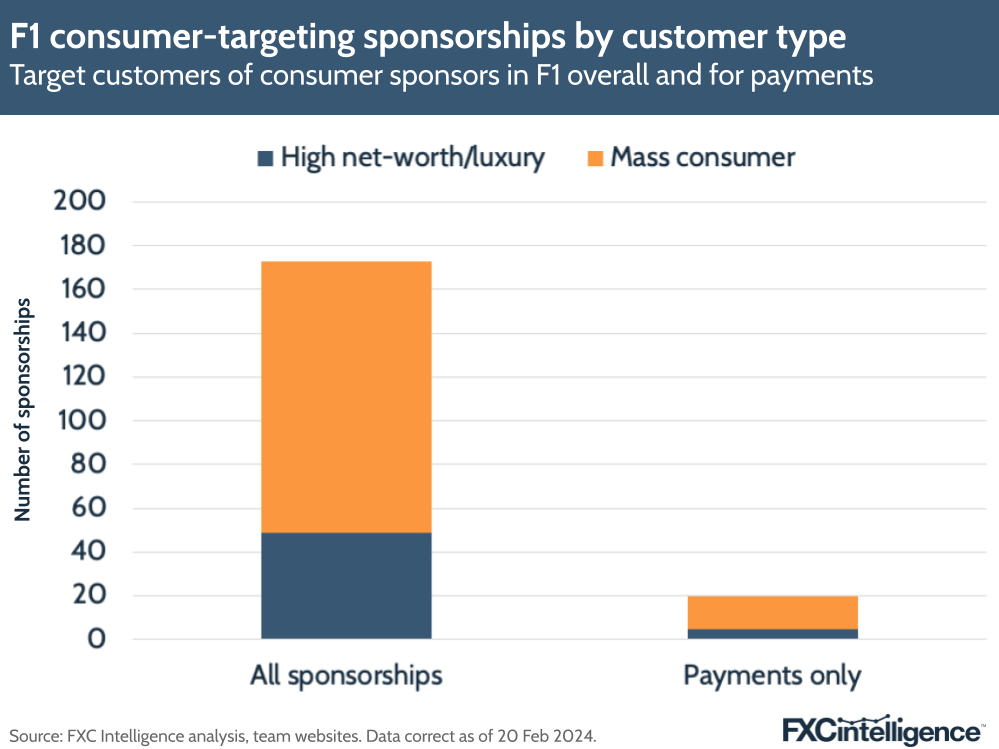

Companies sponsoring teams in F1 have a relatively wide range of customer types, although B2B customers are slightly more common than consumer customers. However, for payments in particular, the gap is far smaller between the two, with B2B-focused players being only slightly more common than those targeting B2C.

Among consumer-focused companies, while luxury and high net-worth-focused companies are overrepresented within F1, they remain a smaller segment than those targeting the mass consumer market. This is more pronounced among payments companies, which suggests that consumer-focused players tend to need a certain quantity of customers for an F1 sponsorship to make sense.

What types of payments companies sponsor Formula 1?

Among payments-related players, F1 is appealing to a broad range of company types, although there are some that are more common than others.

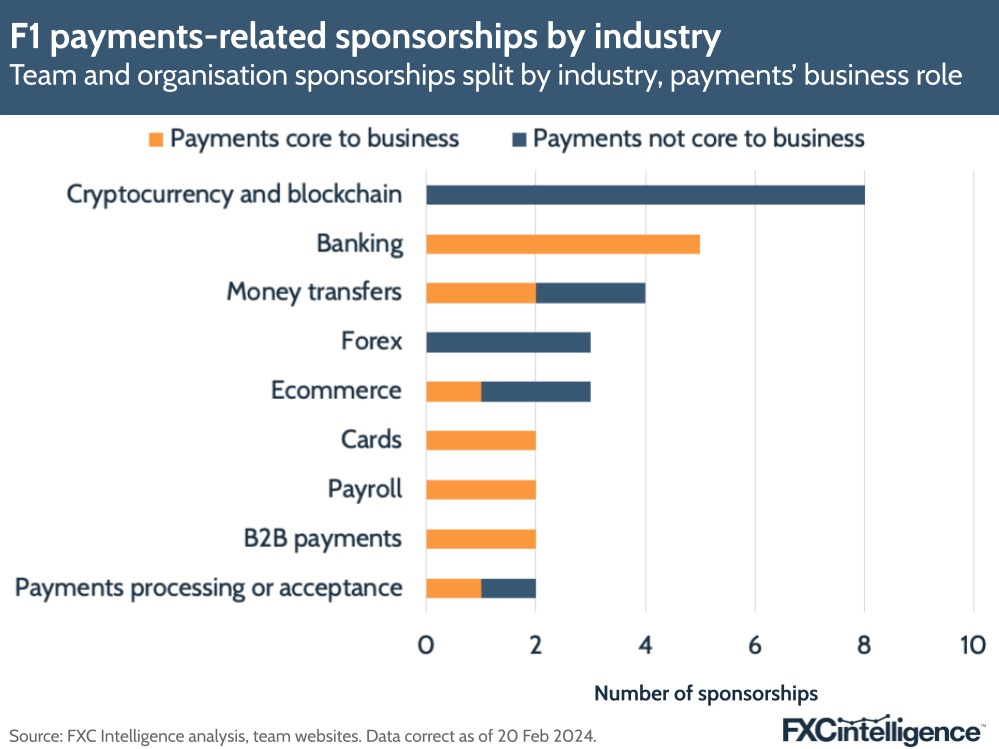

Among companies for whom payments is a part of their business but not the core focus, cryptocurrency and forex-related players are the most common, although the presence of the crypto industry in particular has slightly reduced in F1 from its peak a few years ago.

Banking is the most common industry of those for whom payments is core to the business, although there is also a presence from players across consumer money transfers, cards, payroll and B2B payments.

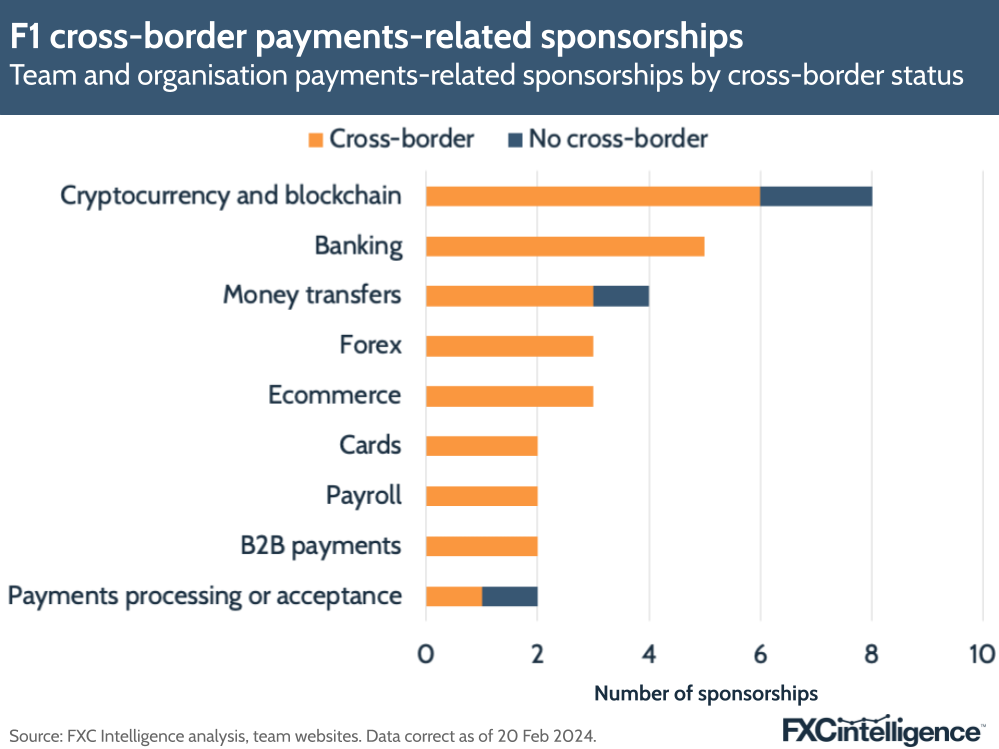

Notably, whether their payments service is a core part of their business or not, almost all of the payments-related sponsorships in F1 included cross-border payments services, reflecting the international nature of the globe-trotting sport.

F1’s evolution and appeal for sponsors

A consistent narrative within Formula One generally is that the sport is changing both in terms of who it is reaching and where it is reaching – and that is changing the types of sponsors it has synergies with.

“Formula 1 has undergone a remarkable transformation in terms of sponsorship opportunities over the years,” explains Stuart Searle, Account Director at CSM Sport & Entertainment, a global sport and entertainment agency.

“The sport has evolved into a global business powerhouse, attracting diverse sectors seeking exposure on the international stage.”

F1’s evolving appeal for sponsors

F1’s transformation, Searle explains, began in the 1980s, when the sport began to draw more corporate sponsors – a change from the smaller and typically local businesses (with the exception of a few major players) it had previously attracted. At this stage, the sport began to appeal more to B2B players who recognised “the potential to forge valuable business relationships within the F1 ecosystem”.

However, “an explosion of technological advancements” in the late 20th and early 21st century drew technology companies to the space as the sport began to become increasingly synonymous with innovation. This saw players not only able to achieve brand alignment, but also use the sport as a platform to showcase their own technologies, with collaborations between the two industries resulting in “innovations that often find applications beyond the racing track”.

As time has progressed, F1 has continued to expand its global reach, aided by its 2016 acquisition by Liberty Media, which set out to turn around a decline in viewership numbers. In the years that have followed, the appeal for mass consumer brands has also increased, with players across a wide range of consumer-facing industries seeking to “align themselves with the glamour and excitement associated with Formula 1”, according to Searle.

“This appetite from B2C brands has only been enhanced further in recent years given the popularity boom for F1 in the US.”

Here, the launch of Netflix’s documentary series Drive to Survive, which first aired in 2019 covering the events of the 2018 season, has been particularly key, helping to attract “American, female and young audiences to the sport, in some cases for the first time”.

Key demographics

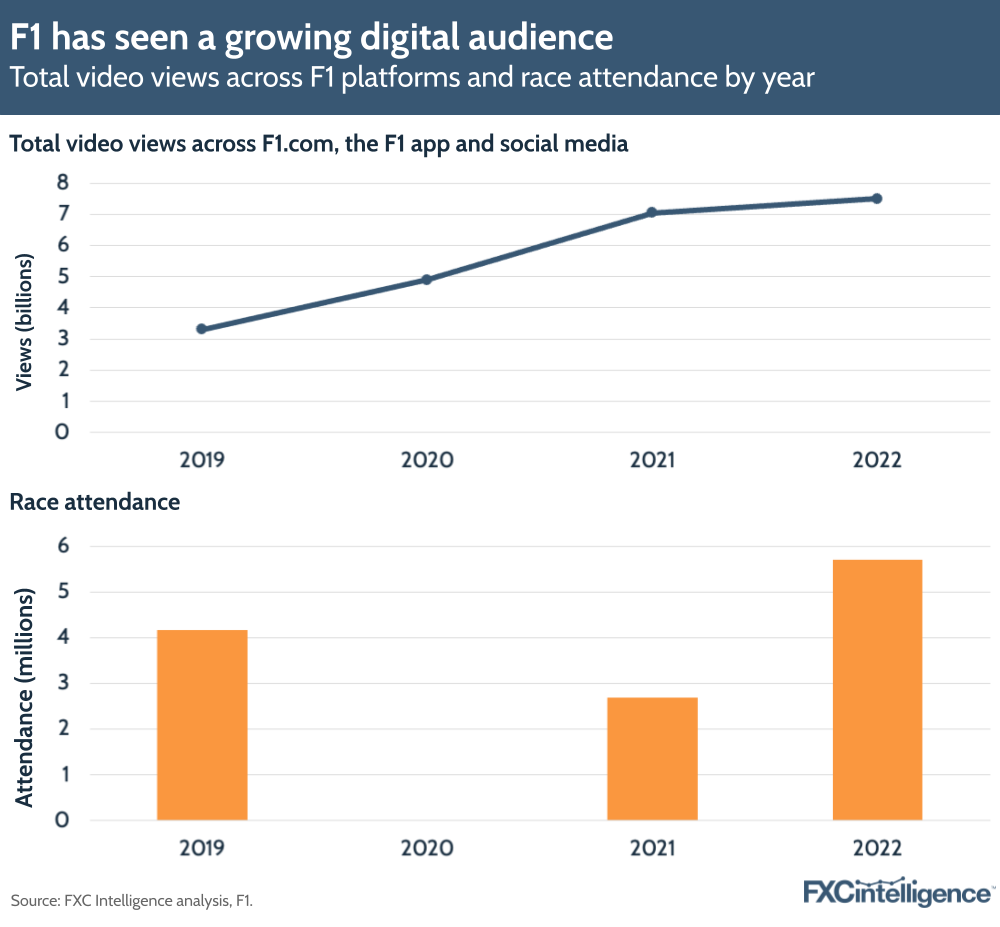

During the pandemic, F1 was forced to stop in-person attendance to races, and only fully recovered in 2022. However, alongside this, the sport has seen growing popularity across online multimedia platforms as younger audiences increasingly embrace F1.

A surge of remote viewership across the pandemic has not translated into a dramatic increase in TV viewership globally, but it has significantly boosted engagement via social media, the F1 app and the organisation’s website. As a result, video views across these platforms topped 7.5 billion for the first time in 2022, up from just 3.3 billion in 2019.

Global fan surveys, meanwhile, also show that demographics are changing. Fans aged 16-24 passed a third of all viewers for the first time in 2021, the last time the survey was taken, to reach 34%, up from 26% in 2017. Those aged 25-34 also reached 29% in 2021, up from 2017’s 27%. Meanwhile, fans aged 45 and up dropped from 25% in 2017 to 19% in 2021.

Over the same period, there has been a sharp uptick in the number of female fans, who accounted for just 10% of respondents in 2017 but reached 18% in 2021.

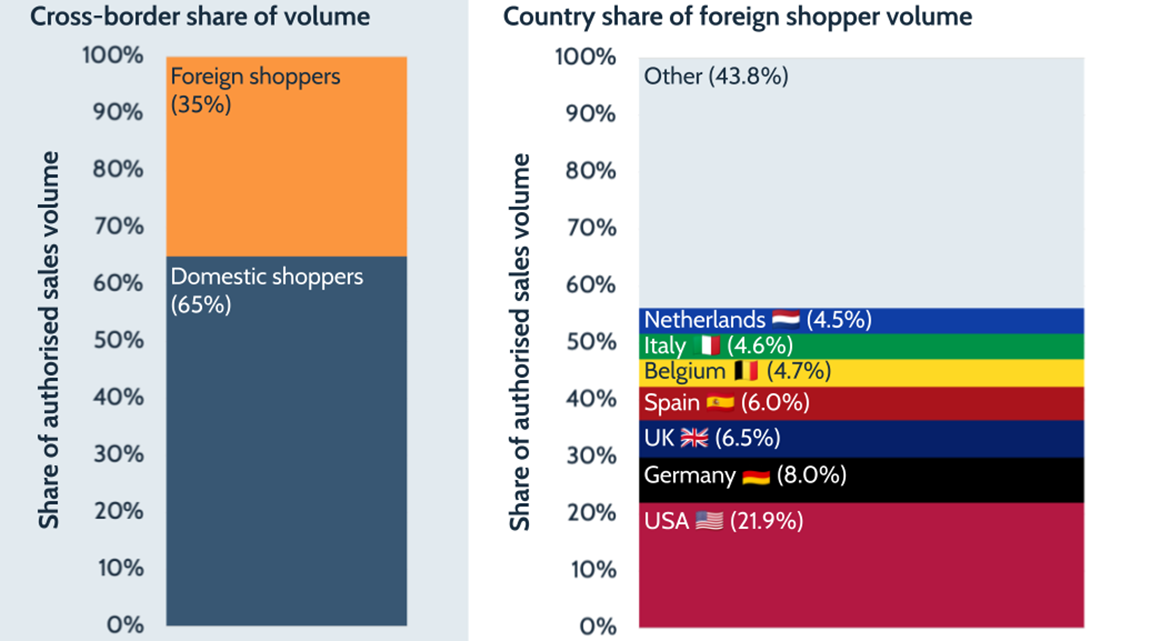

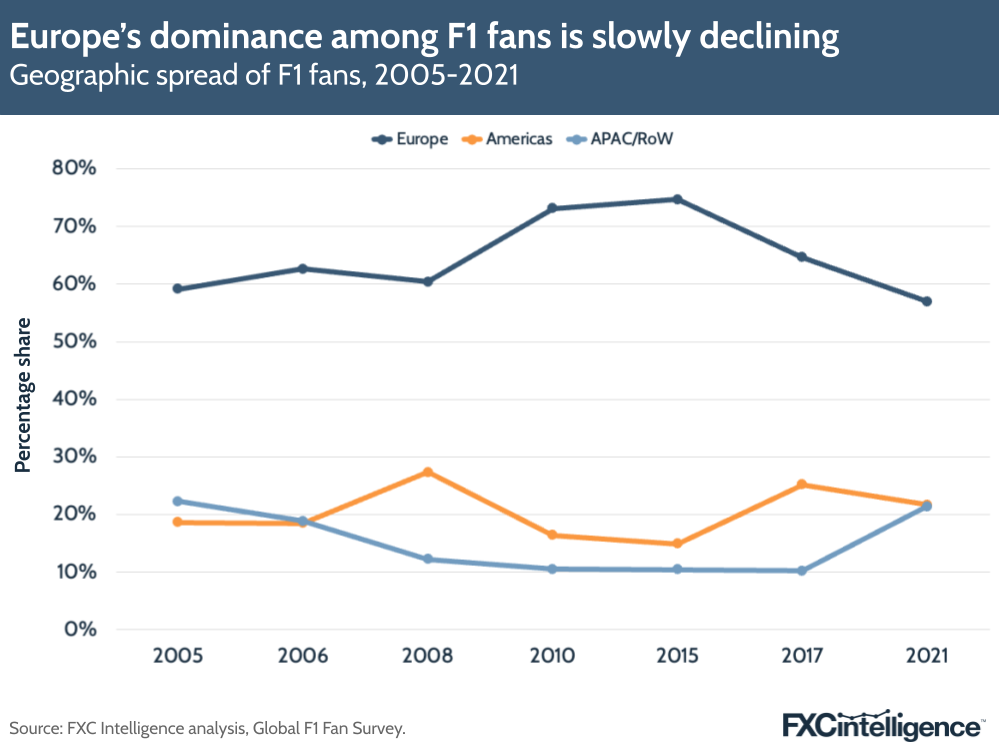

Geographical reach has also broadened, with Europe’s share dropping from 65% to 57% between 2017 and 2021 as the number of fans increase in other parts of the world.

The US in particular has seen increased interest in F1 in recent years, with the organisation making concerted efforts to grow the sport’s presence in the country, including through the addition of two new Grands Prix, in Miami and Las Vegas, to join the longer-running Austin circuit.

Brand benefits

While F1 provides potential benefits to companies in a wide variety of industries, according to Searle the sectors that consistently deliver the most substantial return on investment (ROI) “are those deeply entrenched in technology and mass consumer engagement”.

“Tech companies often experience significant ROI due to the synergies between Formula 1’s innovation-driven environment and their own technological expertise,” he explains.

“These partnerships not only enhance the teams’ performance on the track but also yield tangible technological advancements with broader applications, thereby amplifying the value for the sponsoring tech companies.”

However, for mass consumer players, the benefit is drawn from “Formula 1’s unparalleled global reach and immense fanbase”.

“The sport’s ability to transcend cultural boundaries and captivate audiences worldwide allows these brands to achieve unprecedented visibility and engagement,” says Searle.

Audience crossover

Critically for sponsors, Formula 1 represents the chance to showcase a brand both internationally and at a local level, through appearances and local coverage at races. This was a factor in MoneyGram’s selection of the sport, due to the high levels of synergy between race locations and its international footprint, while for Cash App the increased presence in the US was similarly beneficial.

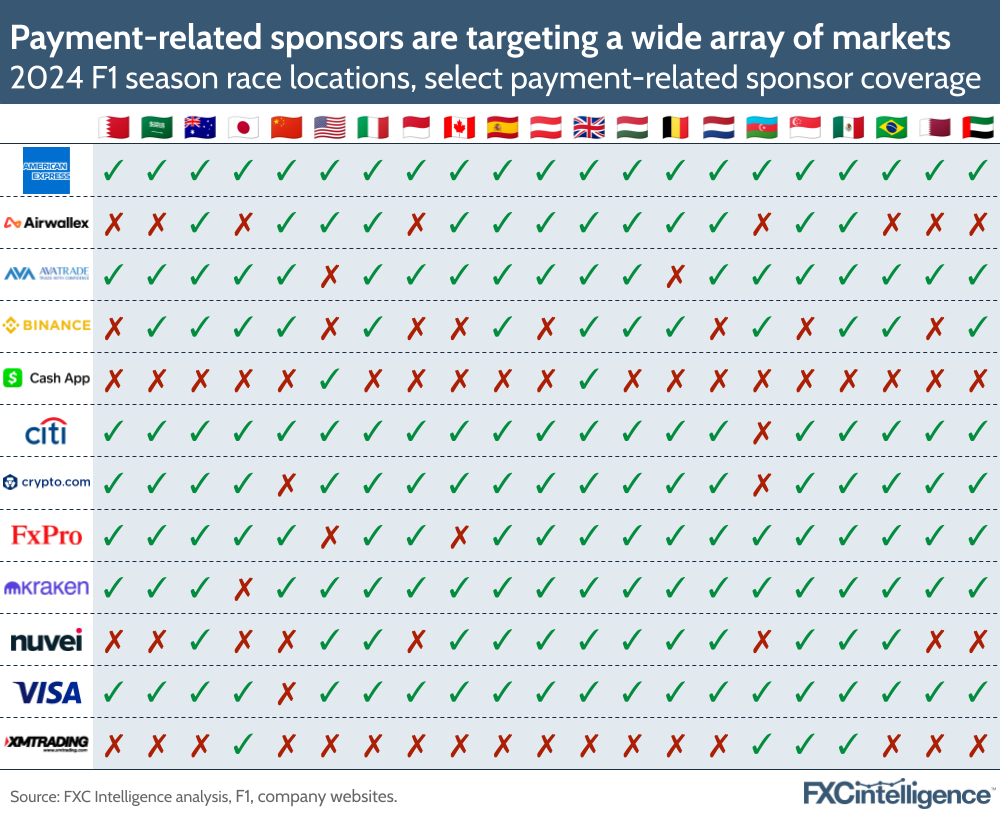

Looking at the countries that key payments-related brands who sponsor F1 teams operate in shows that there is a high level of overlap between market focuses and locations of the 21 races for most players. While not every company will look to maximise its investment at every race, the broad, multi-continent coverage does reflect the benefits for many brands.

Payments-related F1 sponsorships by team

While all teams have some form of payments-related sponsor, the number and significance of these sponsors varies notably between teams.

Sponsors of F1 overall

As an organisation, F1 overall has sponsorships across a wide range of industries, with three out of 20 sponsors (15%) operating in the payments space, all of which have a cross-border element.

Of F1’s 10 tier one partners, one (10%) is in a payments-related field: Crypto.com. In this case, this includes the title sponsorship of a specific grand prix, in the form of the Formula 1 Crypto.com Miami Grand Prix.

Beyond this, payroll-focused Workday and card player American Express are both regional partners for the F1 organisation.

Aston Martin Aramco Formula One Team

While its title sponsor, Aramco, is a player in the energy sector, Aston Martin has a broad range of sponsors from across multiple sectors. For non-title sponsorships, players in the apparel and luggage spaces are among the most common – perhaps a reflection of owner Lawrence Stroll’s investment history in the fashion space.

However, payments-related players do account for 15% of the team’s non-title sponsors, with two banks, Banco Master and Citi, among the four with payments focuses.

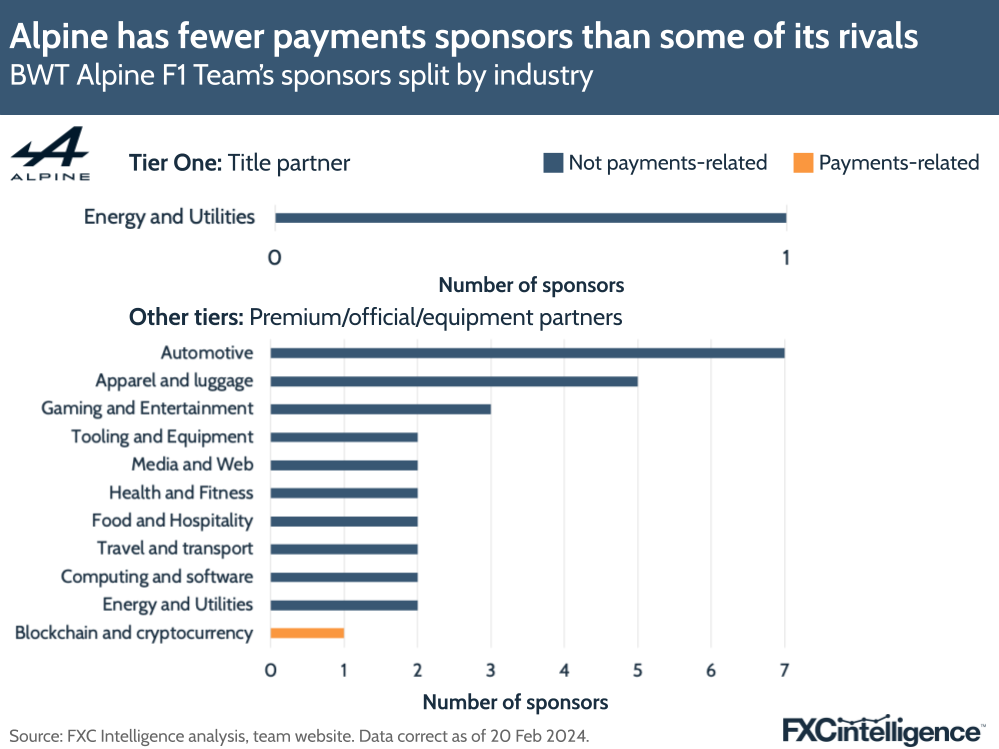

BWT Alpine F1 Team

Named for water treatment systems manufacturer BWT, which itself was the former title sponsor of Racing Point F1 (now Aston Martin), Renault-owned Alpine has one of the lowest shares of payments sponsors in the grid. With just one payments-related sponsor, cryptocurrency player Binance, payments-related companies make up just 3% of its non-title sponsors.

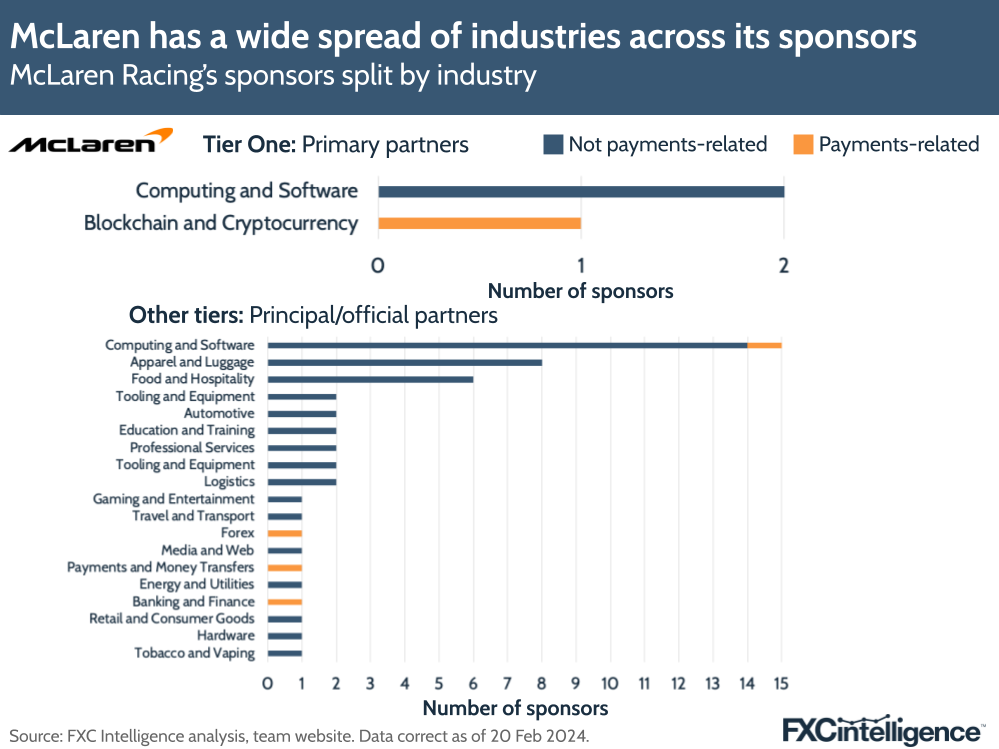

McLaren Racing

McLaren has the largest number of sponsorships on the grid, with three tier one sponsorships, known as primary partners, and 49 other sponsorships across the categories of principal partner, official partner and official supplier.

Within this, a third of its primary partner sponsorships are payments-related, while 10% of its other sponsorships are payments-related. Here, a significant addition this year comes in the form of B2B payments platform Airwallex, which earlier this month announced a multi-year deal as an Official Partner.

According to Jon Stona, Global Head of Marketing at Airwallex, the partnership was a reflection of the close alignment between the company’s ethos that “businesses need to be borderless from day one” and McLaren Racing, which exists to “drive innovation and excellence across the most global of sports”.

As is the case with many partnerships, this will not only see Airwallex build its global presence through the sport, but also involve McLaren using its payments technology.

“In our new partnership and relationship we will be both creating more visibility for our brand and business, but also modernising McLaren Racing’s global payment and financial operations,” explains Stona, adding that this will include “increasing speed of cross-border payments, decreasing FX costs and supporting the launch and ongoing operation of its digital partner merchandise platform”.

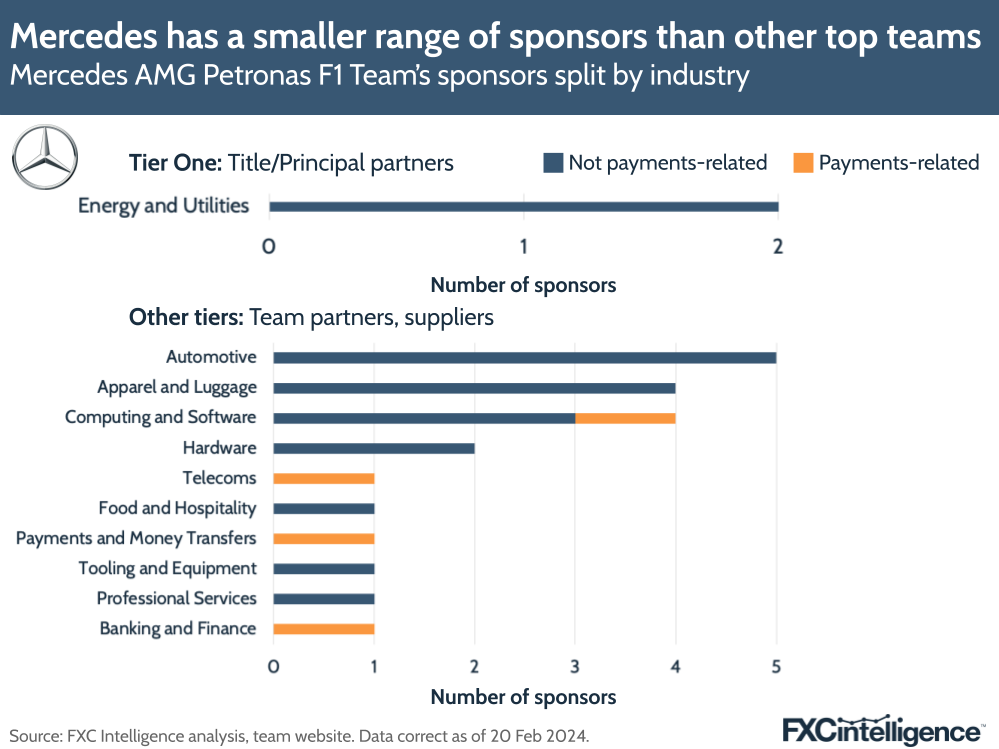

Mercedes AMG Petronas F1 Team

With two tier one sponsors and 22 other sponsors, Mercedes has the fewest sponsorships among the top three teams (alongside Red Bull and Ferrari) and appears to focus on smaller numbers of household-name brands across multiple industries.

While it has no payments-related players among its tier one sponsorships, four (18%) of its other sponsorships are payments-related.

Among these are B2B payments-focused Nuvei, which continues a partnership first announced in February 2023. At the time of the announcement, Nuvei Chair and CEO Philip Fayer said that the company “identifies strongly” with Mercedes’ approach, while Mercedes Team Principal Toto Wolff said that Nuvei’s “dedication to performance excellence through innovation aligns with our values”.

Other payments-related players include WhatsApp, which provides in-app P2P payments in some markets, as well as bank UBS.

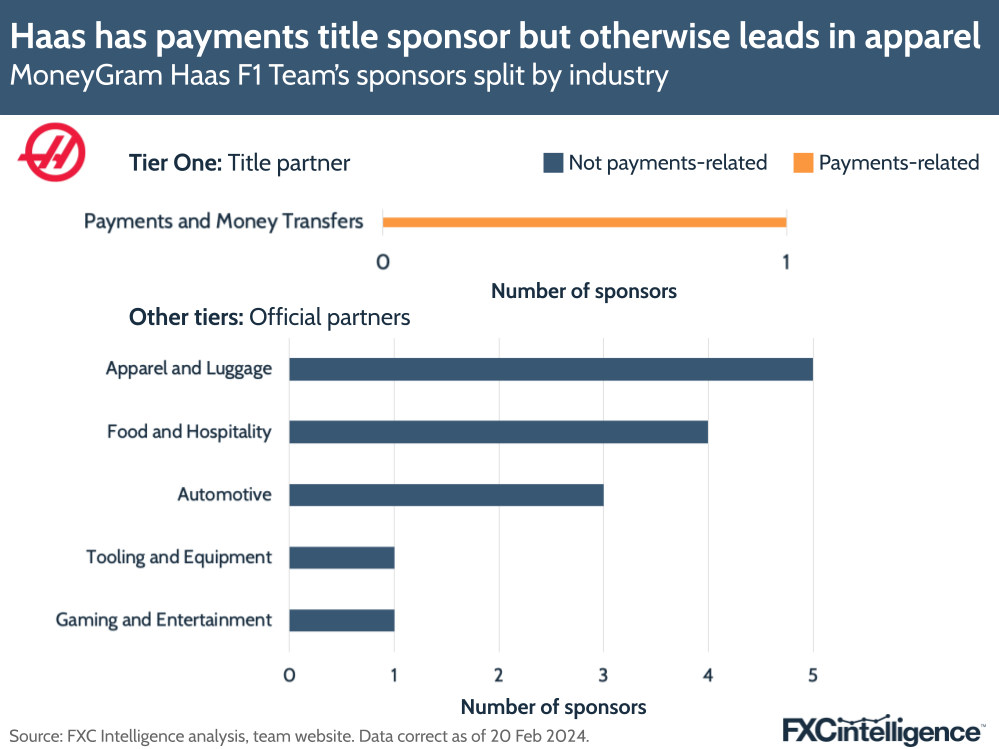

MoneyGram Haas F1 Team

Haas, the only American team on the grid, has the second fewest sponsors among the 10. While just one of its sponsors has a payments focus, this is its sole title sponsor: money transfers player MoneyGram.

First announced in 2023, the sponsorship came during MoneyGram’s shift to becoming a private company, and is part of the company’s ongoing move towards increased digitisation and an increased appeal to the expatriate money transfers market.

“By entering the world of F1 last year, we leaned into the global nature of our business as well as our focus on digital innovation,” says Greg Hall, Chief Marketing Officer at MoneyGram.

One year into the partnership, and with the benefits from coverage on Drive to Survive still yet to be realised, MoneyGram is already seeing a nine-point increase in global awareness of the MoneyGram brand, and saw a 55% YoY increase in earned media impressions in 2023.

“In our first year of title partnership with MoneyGram Haas F1 Team, we saw tremendous lift across the board in our marketing KPIs,” says Hall, adding that the company “set out to activate around the partnership” and ensure that it was “more than just a sticker on a car”.

“MoneyGram is for everyone, reaching consumers in just about every country around the world with innovative and accessible financial services that meet life’s daily needs, and we’ve aimed to bring a similar approach to the sport of F1 by providing access to custom content and promotions that bring our customers close to the action,” he explains.

“Our focus does not change in year two – we will continue to put our customers and race fans at the centre of everything we do, bringing them closer to the sport they love.”

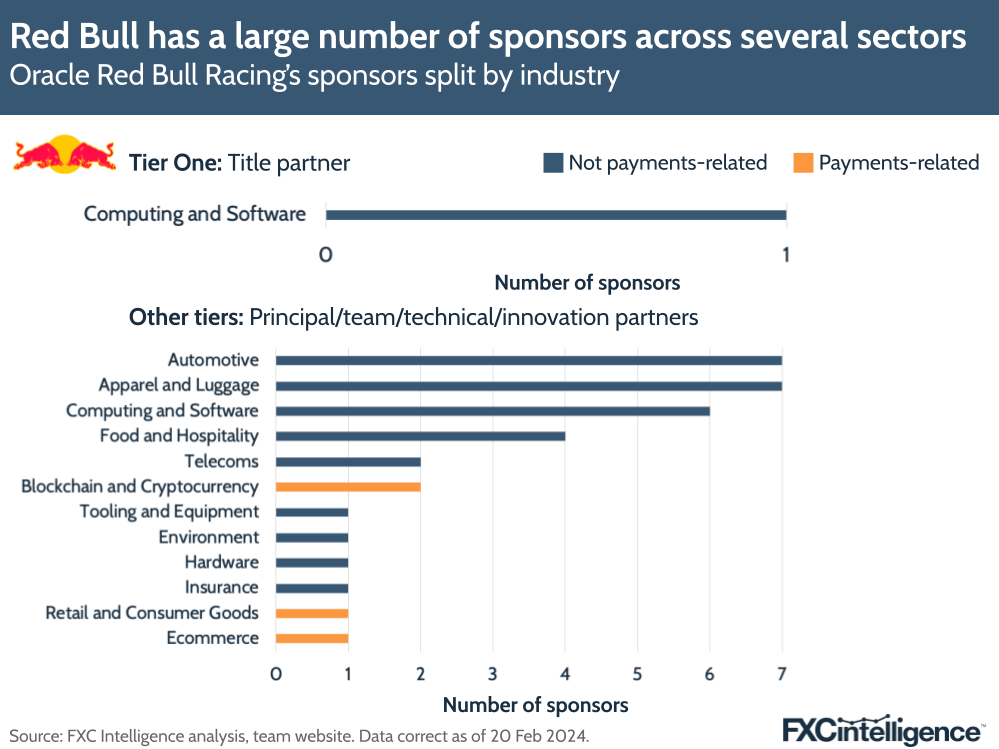

Oracle Red Bull Racing

With one title sponsor, software player Oracle, and 32 other sponsors, Red Bull has one of the largest numbers of sponsors on the grid. Notably, Red Bull tends to have specialised sponsors more than some other teams, with niche sponsorships including viewing partner (Hard Rock International), eyewear partner (Blenders Eyewear) and official blockchain partner (Sui).

Four of its non-title sponsors (13%) have a payments-related focus.

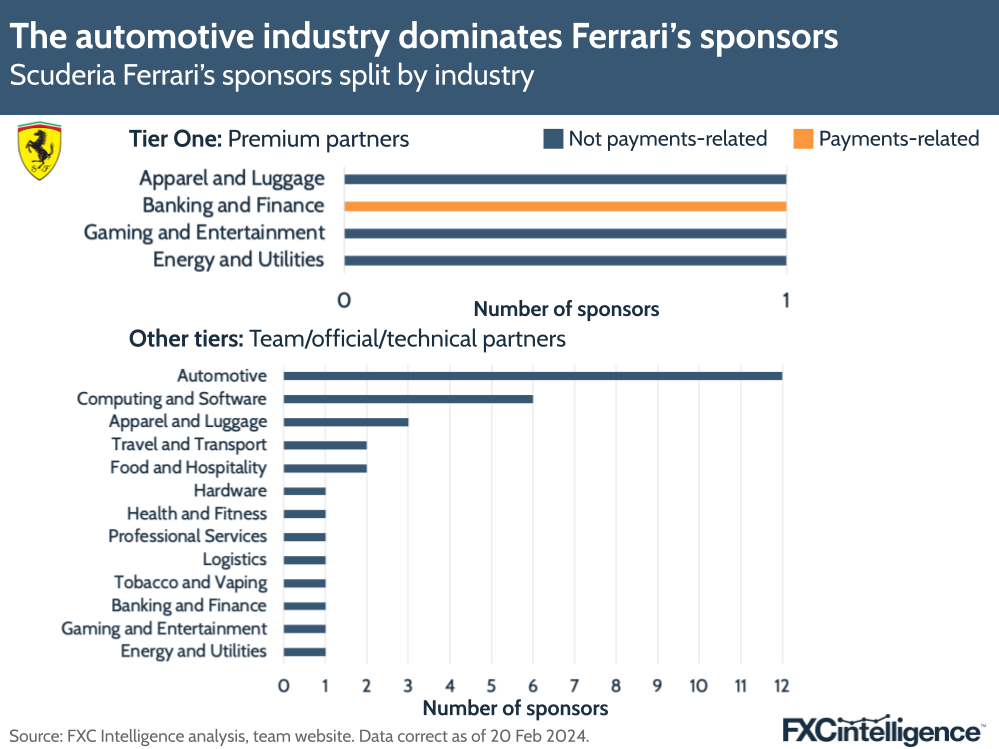

Scuderia Ferrari

Arguably the most prestigious team on the grid, Ferrari has 35 sponsors, which cover a list of B2B and luxury consumer brands. While this includes only one payments-related company, bank Santander, this is one of its four tier one sponsors, known as Premium Partners.

Stake F1 Team Kick Sauber

Previously Alfa Romeo, Sauber now has twin title sponsorships from gambling player Stake and streaming player Kick. This shared system, which was established in late 2023 following the end of the last season, is because local restrictions prevent gambling advertisements being shown in some jurisdictions. As a result, for some races Sauber will be shown with the Kick sponsorship alone.

Neither of these two tier one sponsors have a payments focus, and just two of the remaining 35 sponsorships (6%) are payments-related.

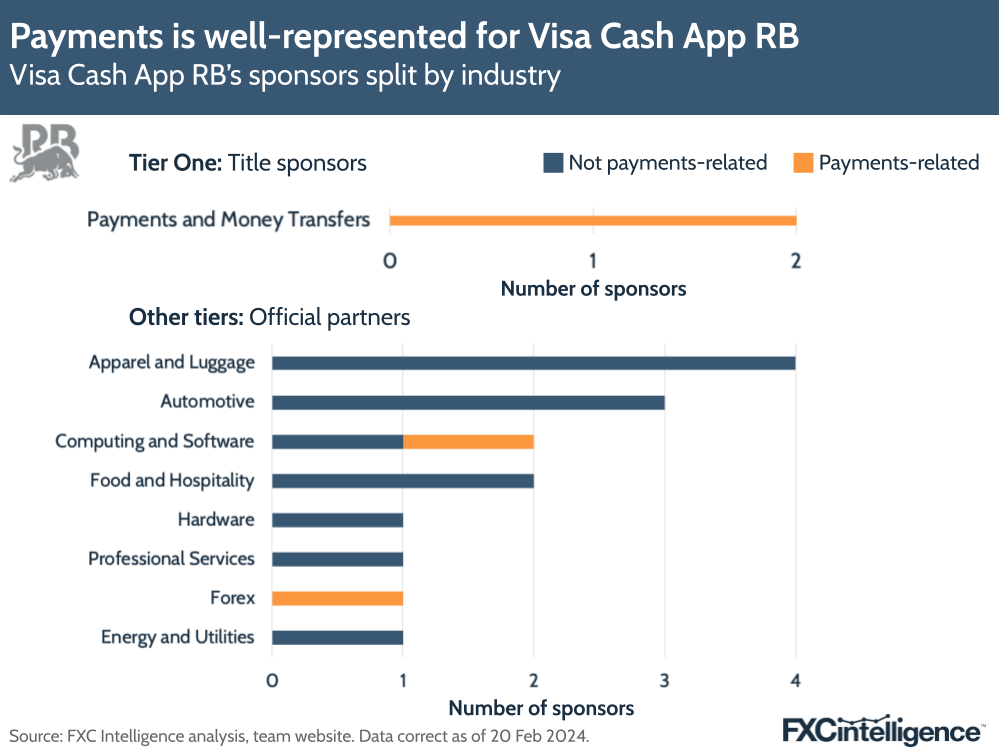

Visa Cash App RB

Until recently known as AlphaTauri, RB is the sister team of Red Bull and has entirely payments-related title sponsors due to a January-announced partnership with Visa and Cash App.Critically, the deal sees Visa being positioned as the first global partner of both Red Bull F1 teams, with its name appearing in the RB title as part of a broader multi-year deal. Here, Frank Cooper III, Visa’s Chief Marketing Officer, described the partnership as “groundbreaking” in a press release announcing the deal, adding that it is “a great opportunity for the Visa brand to engage one of the fastest-growing sports communities on the planet”. Visa has noted that it is the company’s first new global sports sponsorship in more than 15 years.

For Cash App, meanwhile, the sponsorship reflects the growing popularity of F1 in its core market, the US, with Catherine Ferdon, Cash App Head of Brand, saying that the sponsorship is enabling the company to “deepen [its] relationship with Formula One fans and furthers Cash App’s commitment to supporting and growing the culture of F1 fandom in the United States”.

The sponsorship also speaks to a growing alignment between both Visa and Cash App, with the latter highlighting the Cash App Visa prepaid debit card in a press release to announce the team name change.

Beyond this, two of the company’s 15 non-title sponsorships (13%) are payments-related.

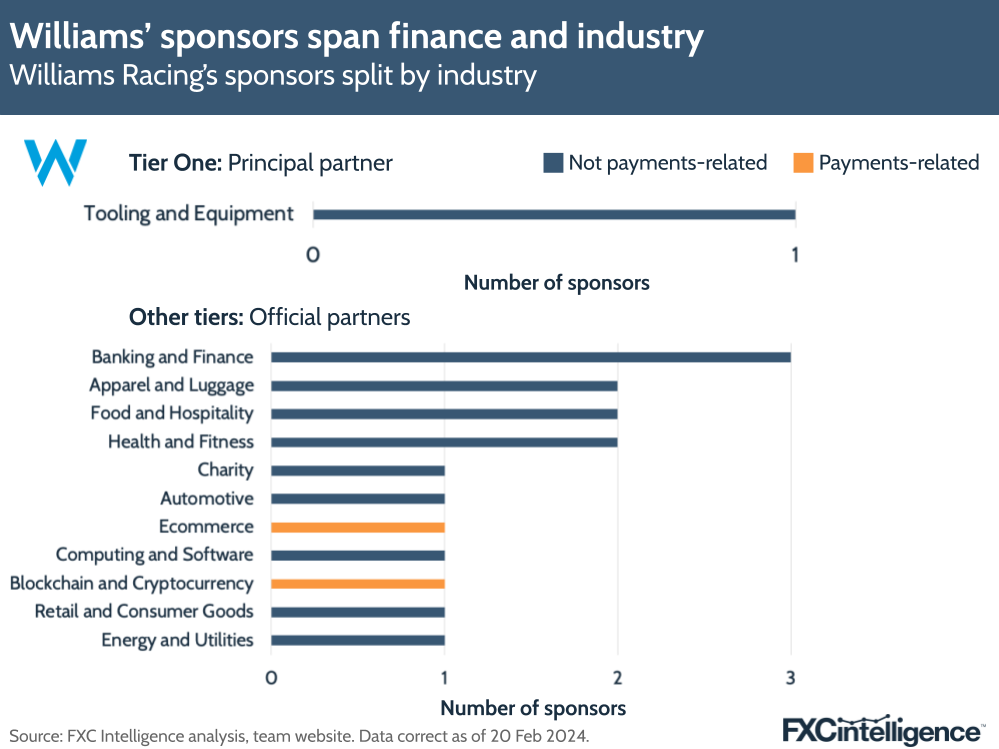

Williams Racing

Finally, legacy British team Williams has a relatively small number of sponsors, with one tier one sponsor and 16 other sponsors. While its title sponsor is not payments-related, two of its other sponsorships (13%) are, although neither is primarily focused on payments services.

Prospects in payments and beyond

With Drive to Survive’s coverage of the 2023 season due to air in less than two days and the Bahrain Grand Prix set to open the 2024 season shortly afterwards, the coverage of F1 over the next month or so is set to be significant globally.

For new additions to the grid’s pool of sponsors, this will be the first measure of their ROI, and will see payments players at the forefront of F1-related branding. For cross-border payments players in particular, the growing presence of F1 internationally, as well as in younger, more digital-focused markets, presents opportunities to speak to multiple audiences simultaneously.

“As consumer preference continues to shift online, many companies (payments included) are likely starting to see the marketing benefits that come along with a sponsorship in one of the world’s fastest and most technological sports,” says Hall.

For B2B-focused companies, meanwhile, there is a prestige and breadth of presence that speaks to and reaches decision makers at key companies. For players across the space, however, F1 is only growing in appeal and potential.

“We’re excited to see more organisations get involved, as we want the sport to continue to grow and flourish,” Hall adds. “We know sponsorship will continue to play a huge role in that.”