Whether through a request for proposal (RFP) or another procurement approach, buying cross-border payment services can be a challenging process. Alongside our own team’s expertise, we speak to industry experts to discover common issues and best practices.

More than ever, the cross-border payments industry is dominated by partnerships and collaboration. Many companies are looking to step up their presence in the cross-border space, or even engage with it for the first time, while others are instead broadening their reach to new and unfamiliar markets. In all of these cases, buying cross-border services can be a critical and effective solution.

However, whether via a request for proposal (RFP) or another procurement strategy, the buying process can be highly challenging and riddled with potential pitfalls. This is a particular risk for companies new to buying cross-border payment services or those looking to expand into new areas, but even those who are well-versed in the industry can face challenges.

In this report, we explore the process of procuring cross-border payment services via RFPs and other methods to determine common mistakes, best practices and potentially beneficial strategies. In doing so, we speak to experts from across the cross-border payments industry, and so provide vital, actionable insights into the process.

The benefits of buying cross-border payment services

A whole range of companies now need to buy cross-border payments services. These can be banks, both global and regional, looking to expand their offering or coverage. They can be payment companies serving anything from remittances to complex business payments. And increasingly it can a full range of non-financial organisations, from ecommerce, to marketplaces, to accounting, looking to embed a cross-border payments offerings in their products. .

“If you look at the global payment market, it’s very competitive right now,” says Raymond Qu, CEO of Geoswift. “So if every company wants to build everything by themselves, it’s very tough.”

Companies looking to build on their own face significant obstacles to overcome, including widespread regulatory challenges, which vary significantly by market, as well as building connections with local banks or other payments infrastructure. As a result, even experienced cross-border players will typically opt to partner with other companies when entering a new market or space.

“There’s a lot more collaboration across the board, from fintechs to techs. Sometimes we partner up with other fintechs as well,” explains Jason Kumpf, Global Head of Strategic Partnerships, Rapyd.

For established players, this kind of approach enables them to work with local service providers who “have very strong connections there”, according to Qu, allowing for a “win-win” partnership.

“We bring value to the table, they bring value to the table, then we work together to create a much better solution for the customers,” he says.

“That’s the most important thing, because the customers don’t care how you make it happen, they only care about the experience; if you give them better services, a better price, through the partnership, they will be happy.”

For companies with less experience in the space, however, buying cross-border payment services enables access into the space via a relatively low-risk route, enabling add-on services to be included in a wider product without the overheads of scaling up a full in-house solution.

Meanwhile, providers of cross-border payment services also benefit from this strategy in a number of ways, according to Nium. This includes pursuing new business opportunities and increasing the diversification of the business in new sectors, as well as expanding the company’s presence and visibility in newer markets. It also enables companies to get deeper market insights, including into the activities of their competitors.

It can even see multiple companies working together to serve a client’s need, with the industry in general increasingly embracing a collaborative approach.

“The broader theme in the market right now, which has turned a corner on a past theme of different networks trying to compete with each other for the future of payments, is that now there’s actual ways we can collaborate using the technology that’s already plugged in,” explains Ryan Zagone, Head of Bank Partnerships at Wise.

However, in the aftermath of what Kumpf describes as a “reset in fintech payments”, where the wider economic downturn has prompted a “repricing across the board”, providers are being more cautious in how they approach such partnerships.

“It’s not just price per transaction, there’s risk, there’s onboarding, KYC, all those regulations are getting more detailed and time and resource-consuming,” he says.

“It’s understanding what’s a fair value: ‘What do you think this is worth to you? We’re going to offer you global wallets across the world for all of your clients, you’re going to build a whole ecosystem, what do you think that’s worth?’”

Which companies are buying cross-border payment services?

The types of organisations buying cross-border payment services varies significantly, with any player operating in the space either as a primary or supplemental business activity potentially having a need. However, there are some trends that are making certain types of players more likely to buy services at present.

For one, the rapid development of the market is creating a need among companies looking to modernise or advance their offerings.

“The market matures and comes up with new developments and new technology innovations,” says Stephen Peters, Head of Enterprise Payment Solutions, FIS.

“We have to respond to that with new solutions, our customers also need to respond to new innovations with the implementation or support of those new advancements.”

More broadly, embedded payments and wider embedded fintech is bringing large numbers of players who traditionally operate in other areas into the space. Here, cross-border payments is increasingly being offered as an add-on to other products and so is drawing in companies who have not previously had to negotiate with the variety of challenges the industry poses.

“The RFP process overall has got a lot better in the last couple of years, but it also comes coupled with a lot more players in the fintech space, which becomes challenging,” says Justo Benetti, SVP Head of Americas, dLocal.

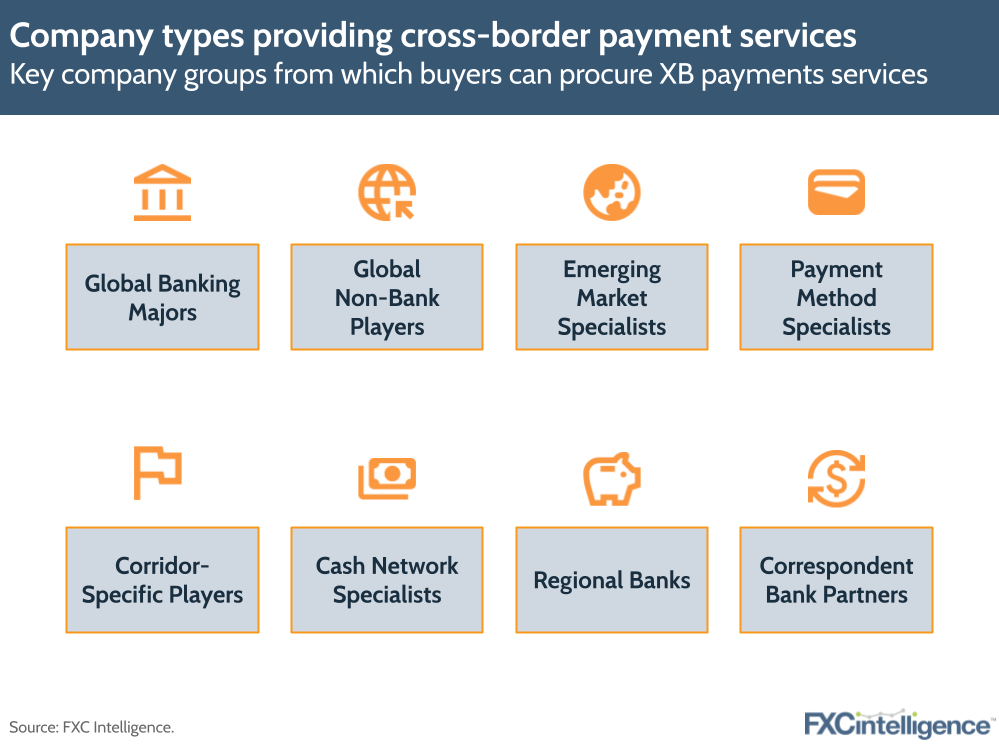

Identifying the right sellers

However, while there is significant demand for cross-border payment services, not every seller will be a good fit for every company. Instead, organisations need to identify groups that align well with their needs, which when it comes to new markets, involves significant local experience, according to Benetti.

“It’s very important to find the right person, to get the right partner and to launch the right product,” he says.

There is no perfect strategy to doing this, with networking at conferences such as Money20/20, as well as industry forums and other events, considered to be an effective strategy to build suitable connections by multiple people interviewed for this report.

However, it is also beneficial to leverage existing connections where possible.

“Reach out to those people you have within your network that are going through a similar process because at the end of the day, they’re all trying to achieve the same,” says Benetti.

“It’s about getting in touch with your peers, seeing what has worked for them – and also with your partners – and then coming up with the best strategy.”

How can I connect with potential sellers of cross-border payment services?

The value of dialogue to buying cross-border payment services

How companies go about buying cross-border payment services can vary significantly, however in all cases – no matter how formalised the final proposal needs to be – it is essential to build a strong dialogue between the organisations involved.

“That initial communication is the most important thing to have, then you know you’re reading the right book together,” explains Rapyd’s Kumpf.

dLocal’s Benetti agrees, adding that alongside formalised RFP processes, the company has “a deep-dive discovery with the customer to understand what the pain points are”.

This back and forth is key because truly understanding a customer’s needs can be highly complex, particularly as customers will not always have a clear picture themselves.

“Our approach involves being pretty thoughtful and product-driven with what we are looking to enable with the partner,” explains Wise’s Zagone.

“‘What are you trying to do and what can we enable? How are your customers using us today?’ It’s really rooted in that. We are using the volume and the customers from our direct consumer and direct business product to inform, help advise the bank, oftentimes teaching them about the use cases they can unlock and how their customers act today.”

Zagone says his role is “much more in teaching” than in sales, a sentiment echoed by several people interviewed for this report.

“We usually try to take a very educational approach. Usually, there’s probably a 20-30% realignment from everyone,” says Kumpf, adding that this strategy includes working out what is immediately required, and what can be added at a later date.

“There’s some solutions that can be very comprehensive but will require a lot of resources from their side. There are other solutions that may handle 80% of what they need, and maybe it handles all of their requirements, but only 50% of their nice to haves. But they can roll that out in a month with less. That helps in the beginning, so any group can prioritise better.”

This education-led approach can be particularly beneficial when it comes to regulatory compliance, according to FIS’s Peters.

“When you get new compliance initiatives like ISO 20022, that often requires a lot of education,” he says, “because banks who may be new to that standard will want to know what it means and what it’s going to do for them to get their return on their investment.”

A solution mindset, not a technology mindset

One common mistake companies can make is to enter discussions not with a sense of what problems they want to solve, but instead with a specific set of technologies or technical solutions in mind.

Rapyd’s Kumpf, for example, says that while it is “good to work with other groups that have a clearly defined set of expectations and requirements”, where must-haves and nice-to-haves are clearly delineated, there can be situations where a company is overly prescriptive without fully understanding the market.

“Sometimes groups will come and think they already know the solution that they need, and they’re not directly in fintech, maybe they’re not in payments, and so they’ve just heard they need virtual accounts for this,” he says. “Then when we get into it we’re like, ‘Well, why do you think you need virtual accounts? You actually need an e-wallet for that.’”

Similarly, dLocal’s Benetti says that some companies will focus on technical requirements designed to enhance their current payment stack without considering that there may be other strategies to address their needs.

“They laid out, ‘Okay, these are our technical requirements.’ But when you get into the weeds, it could be, ‘We have massive reconciliation problems in markets like Nigeria or Egypt.’ Or, ‘We cannot expatriate funds in markets like Argentina or Brazil’,” he explains.

“The problems become a lot more specific when you get a chance to talk to the customer.”

Ultimately companies need to be mindful not only of what they are solving, but also how it will fit into the wider operations.

“Always have a clear objective and a clear set of outcomes in mind of what you want to do with the solution, how you’re going to operate it, how it’s going to be implemented in your operational teams and so forth,” says FIS’s Peters.

Involving all stakeholders

Critical to this dialogue-led approach is ensuring that all stakeholders are involved, however in practice this can be challenging, such as when a specific department is running an RFP.

“You can get biases come through where, for example, a technology side of a bank might run an RFP, but perhaps the business side isn’t on board with all of the aspects of the RFP outcome because they haven’t really been involved in a process sufficiently,” says Peters.

“That isn’t unusual. I wouldn’t say it’s common, but it’s not unusual.”

He adds that the ideal circumstance is to “have some visibility into a single point of authority in the customer who’s going to bring all those threads together, and be able to make decisions as part of the change that the new system will bring”. Such change, he says, is “inevitable”, and so it is key for there to be someone who can support and own this across the company.

“If the buyer isn’t really prepared to do that, then you can run into problems,” he adds.

Be ready for implementation

While it may seem obvious, it is also important to ensure a company is ready to integrate any cross-border payment services – something that can be challenging in some circumstances.

Wise’s Zagone, for example, says that banks can find API integration challenging.

“It’s forcing the bank to learn a new language,” he explains. “Few of them use APIs internally: they’re all built on that Swift infrastructure. Forcing them to learn your language is the biggest resistance point in an integration, in a partnership.”

More broadly, Peters says that companies have not always gone through the “strategic process” of determining how they will implement a solution in a formal process such as an RFP where they understand their objectives and technical outcomes.

“Some companies almost seem to be making it up as they go along. And invariably, those RFPs are not successful and banks or customers struggle to make decisions because they weren’t clear what the outcomes were before they started the process.”

The potential of pilots

As a partnership builds up, companies may look to do some form of pilot, something that Geoswift’s Qu says is “so important” to the process, providing a “sandbox” for the buyer to experiment and ensure that the solution works for them.

“If we want to build a partnership with potential people, we’ll start to look into the API document to see the quality of the technology itself. Then we’ll start some testing,” he says, adding that in many cases this will also enable the company to assess third-party suppliers and other connected organisations in the process.

“Most are the banks, so you need to make sure all the banks like that flow as well.”

However, it is also important to ensure any such pilots are handled and paid for appropriately, and not to expect too much at the proposal stage without remuneration.

“Quite often we are asked to do a proof of concept, which is some sort of technical demonstration, and we may have to do some customisation as part of that,” explains FIS’s Peters.

“When customers expect us to do a lot of work for free, and sometimes they ask for a lot of things, then we may not be able to respond in time, or as completely as we would like, due to other constraints based on timing and so forth.”

The RFP process: Best practices and common mistakes

While the RFP process is by no means the only approach to procuring cross-border payment services, it is a common strategy in many parts of the industry. It often follows on from a request for information (RFI) in order to narrow down the number of players involved.

“An RFI is a fairly broad, top-of-the-funnel process with maybe 10 or 20 respondents,” says FIS’s Peters. “A buyer will typically narrow that down to five for an RFP, because it’s not productive to run an RFP with a huge number of respondents.”

Whether a full RFI and RFP is used or not, there can be significant benefits to ensuring that any such process is run effectively.

“Well-run RFPs have all the hallmarks of clear strategic outcomes, they have a target operating model in mind and they’re very structured and organised. That comes through strongly in the RFP,” says Peters, adding that by contrast a failed RFP can see a company “not being able to make a decision”.

“They end up in this analysis paralysis, limbo land, for months, years even. And it’s a tremendous cost to the vendors and the customer as well.”

Such problems are highly undesirable for all involved, however they are more common than one might expect.

“You’d be surprised how many times companies go through an RFP process, select a partner, and then realise that it wasn’t the right pick,” says dLocal’s Benetti.

With this in mind, here are best practices and common mistakes when it comes to running the RFP process:

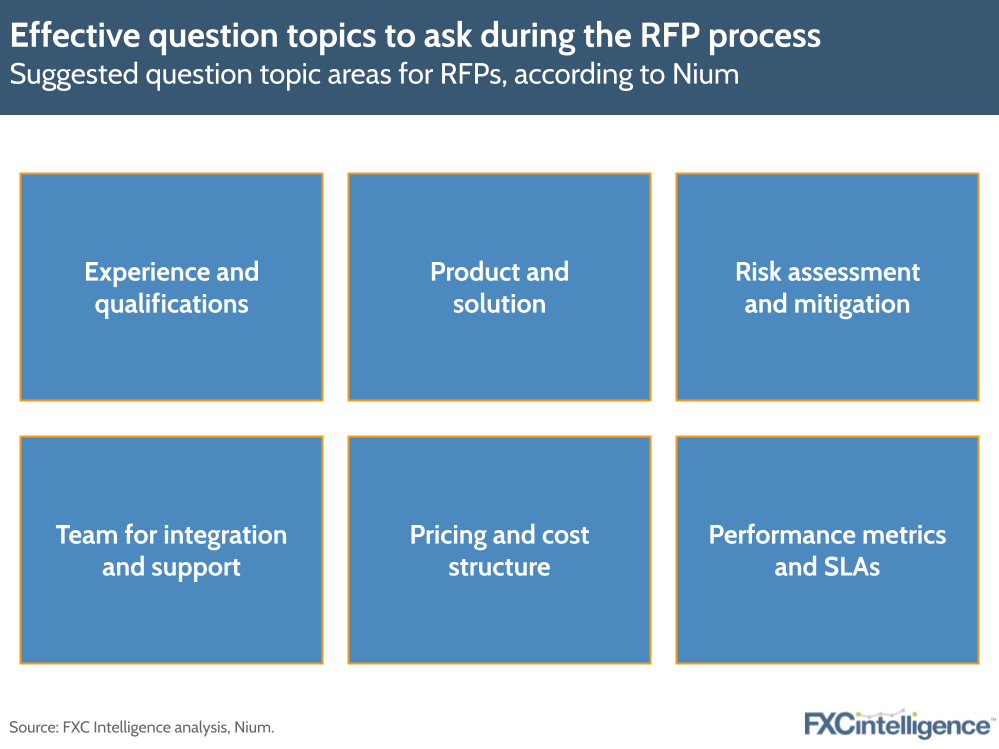

The value of good questions

How well-written an RFP is can, according to many organisations we spoke to for this report, be absolutely critical to its success. In particular, the wrong word or term, or even vague definitions, can cause confusion and ultimately result in less effective responses.

“The objective of floating an RFP is to select the right vendor for the scope of work among multiple vendors in the market and getting the right responses, and quotations from vendors is critical for a fair and detailed evaluation,” says Krishna Kumar Singh, Vice President – Bids and Program Management, Nium. “To achieve this, it is important that all vendors understand the ask in detail and that there is no ambiguity in the RFP.”

Taking the time as a buyer to write good questions – and in turn for the seller to write good answers – can be key to aiding effective communication, even if organisations have already had extensive discussions prior to completing the document.

“Companies that invest a lot of time in making sure they’re communicating what they’re looking for efficiently really see much better answers and much better clarity from companies responding to the RFPs,” says dLocal’s Benetti.

“It often shortens how many discovery calls you might need to have with a customer, or it might shorten some of the follow-up questions you might send. Customers that have implemented a well-written RFP process have been much more successful in making sure they’ve chosen the right partner.”

What are the right questions to ask during the RFP process?

Formal processes and consistency

However, ensuring that an RFP has a formal process that can be easily followed and compared is also important. Some companies will require specific file formats and response styles, such as an Excel spreadsheet with technical questions, combined with a written narrative document to provide more qualitative responses.

“These formalisms are absolutely necessary so that the buyer can, to the best extent possible, compare the respondents in a meaningful and consistent way,” says FIS’s Peters.

This kind of structure is key because it provides a space for respondents to adhere to your requirements and give information that can be compared across multiple providers, while also enabling them to stand out and tailor their responses to both the buyer’s needs and the seller’s capabilities.

“You cannot issue standard answers on RFP. The most important thing is to make sure you’re answering the questions, but you’re also telling a story about what you are solving with those things,” says dLocal’s Benetti.

Ultimately, strong RFPs provide clear structure for effective processing, while providing each company with the space to show off their unique capabilities.

“It’s essential to strike a balance between standardisation and flexibility to accommodate the unique needs of different industries, organisations and projects,” says Nium’s Singh.

“The objective should be to find the equilibrium between standardisation and customisation to enhance the overall efficiency, effectiveness and fairness of the RFP process.”

Provide sufficient time to respond

While well-written questions and an effective structure are important, it is also vital to ensure that the companies responding have sufficient time to provide as full and complete responses as required. In reality, some companies will try and rush the process, which can result in less-than-ideal proposals.

“We get a lot of RFPs that ask a lot and don’t actually give us a lot of time in which to respond as accurately as we would like,” says Peters.

“A lack of time works against us and also works against the customer’s interest because we’re just not able to respond as professionally as we would like.”

Follow up references

Once companies have responses, it is also important to follow up on any supplemental details such as references, as these can provide vital additional context.

“Many times you’ll see companies ask for references within the RFP process and many times those calls won’t materialise,” says Benetti.

“That’s something that gets lost within the entire process: sometimes just being asked for and maybe not being chased.”

Getting the right readers

Arguably more important, however, is making sure that the right people are reading completed RFPs. If only a small segment of the stakeholders are reviewing the documents, they may easily miss key elements or concerns that may ultimately prove critical to the successful implementation of a proposal.

“Many times RFP processes will be run at the top and a lot of these things won’t be seen by the people who operationally use the tool day-to-day,” explains Benetti.

“So many times, there’s a disconnect or there are ways that that could be much more efficient.”

Dialogue first, RFP second

Ultimately, it is vital to ensure that the structure and formality of an RFP isn’t being used in replacement for effective, engaged inter-company dialogue – because no matter what strategy is used to buy cross-border payment services, it is this that ensures their effectiveness.

“Filling in the documents is a bit of a check in the box: understanding the overall context is really where you want to do that”, says Rapyd’s Kumpf, adding that there have been times when conversations prompted large parts of an RFI to be changed completely as a customer gains a greater understanding of what is possible.

Benetti echoes this sentiment, arguing that it is vital to ensure “you’ve had conversations with the customer before the RFP” because this is key to identifying issues and problems being solved.

“It’s sometimes more limited when you’re in an official RFP stage, but there are some companies out there that do it better and really try to invest a bit more time into the RFP process.”

Buying cross-border payment services: A checklist

- Create the right scope for the services you need.

- Identify the right set of providers to assess.

- Ask the right questions about their pricing and capabilities.

- Compare all the offerings in a consistent manner.

- Ask follow up/clarifications to ensure the decision-making process is right.

- Choose the right provider(s).

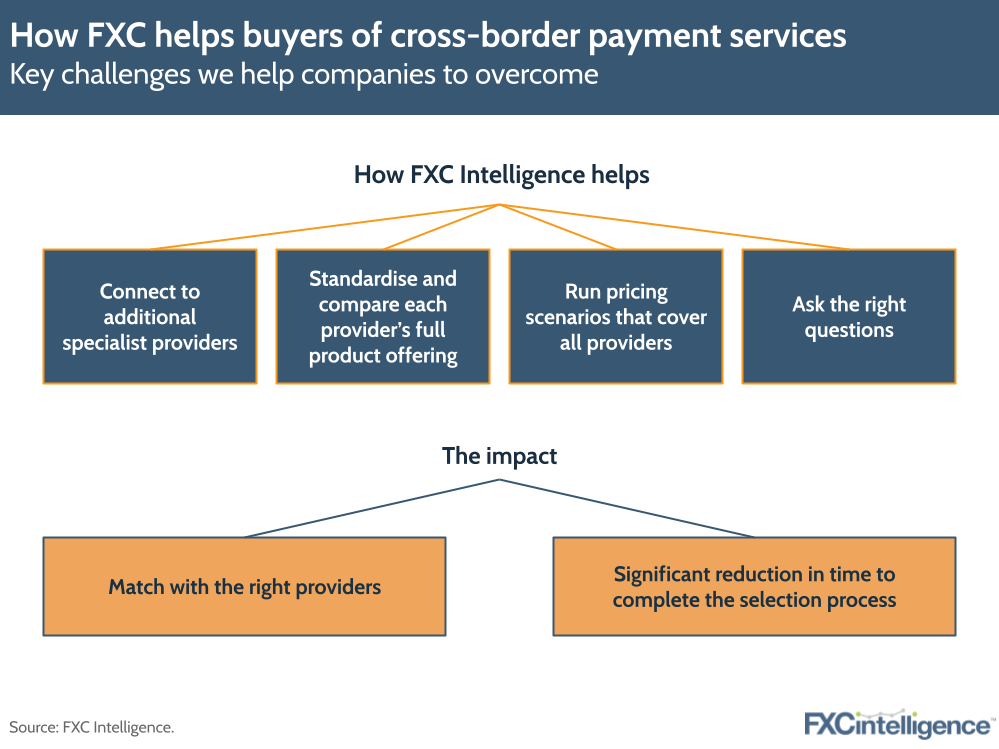

How can FXC Intelligence help support my RFP and procurement processes?