Following from Argentex’s recent earnings, we spoke to CEO Harry Adams about key revenue drivers and its recent investments.

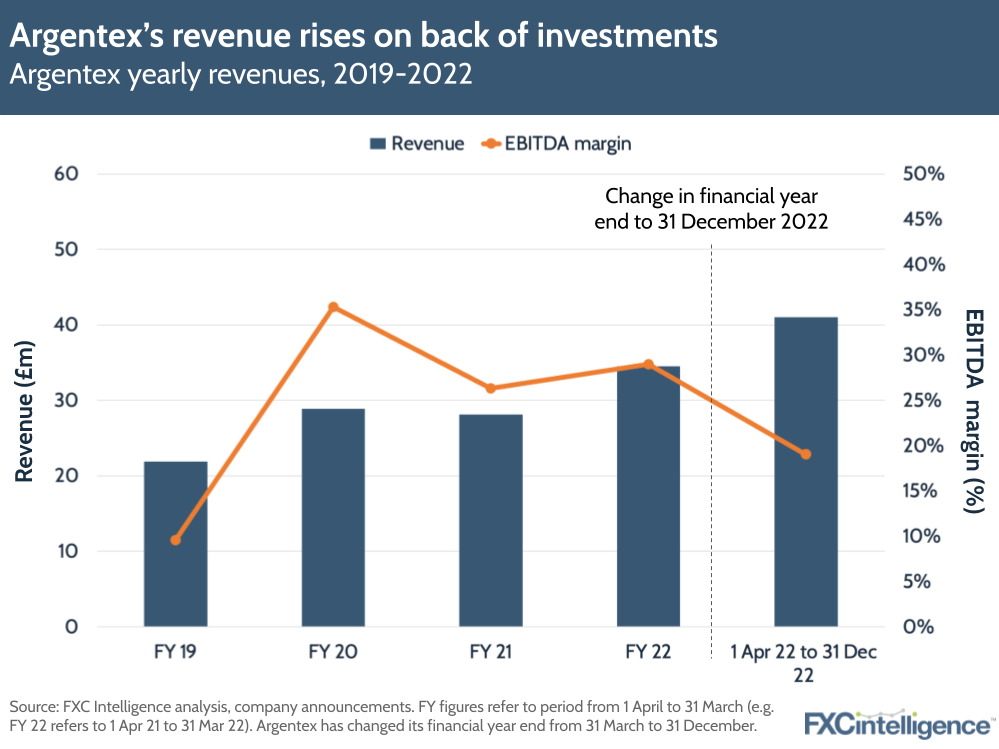

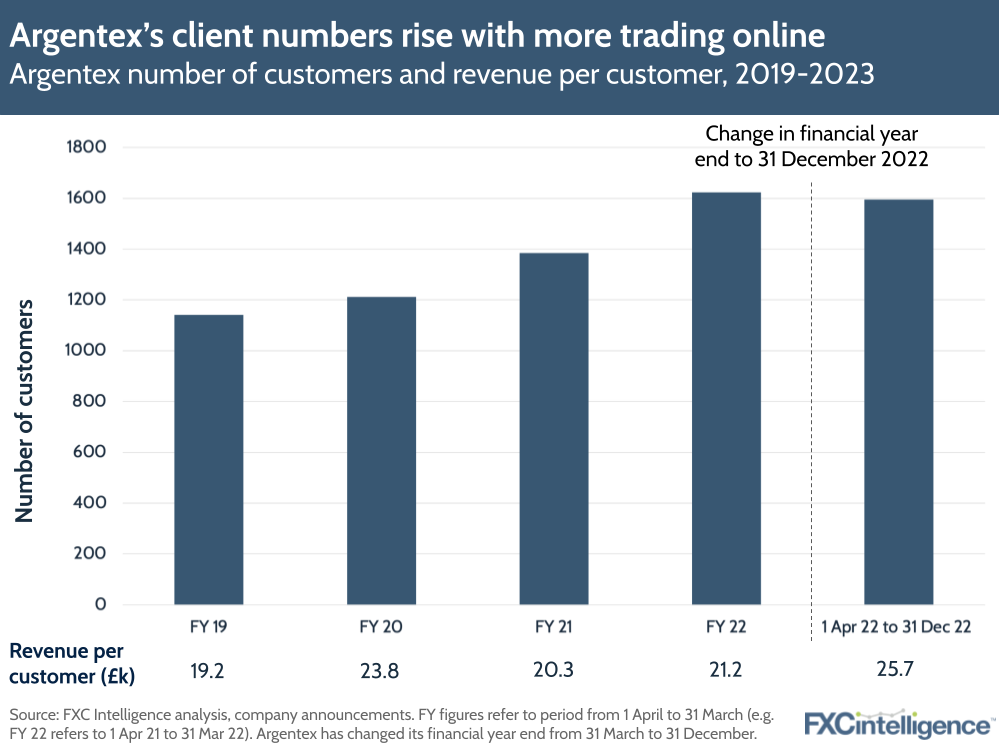

B2B payments player Argentex has reported its results for 2022, with solid growth across the business. It should be noted that Argentex has moved its year-end to 31 December, meaning that for this year, it is reporting on the nine month period ending 31 December 2022. FY 2022 refers to the period from 1 April 2021 to 31 March 2022. 2022 refers to the period from 1 April 2022 to 31 December 2022.

Group revenue increased by 63%, to £41m, compared to the same period last year, with 39% of that revenue coming from the top 20 customers. Online revenue also increased by 89% to £1.2m.

Historically, the company’s revenue mix has been a 50:50 split from spot and forward trades, but since the inception of the Structured Solutions division in FY 22, which generates higher margins than spot or future contracts, 10% of revenue was generated through this new division. Additionally, not only has the product mix diversified, but Argentex has seen a 65% increase in clients trading online for the period, like for like.

Argentex has emphasised that it is in an investment period. The company launched a new alternative banking division in March 2023 – aiming to serve as an alternative to traditional banks across the UK, Europe and Australia – and is aiming to invest in more employees and double the footprint of its UK, European and Australian headquarters in H1 2023. It also saw growth in the Netherlands, where revenue increased to £2m – against £0.7m in FY 22. The company’s Netherlands subsidiary was awarded an Electronic Money Institution licence by the Dutch National Bank in September, providing access to the domestic market.

Daniel Webber spoke to CEO Harry Adams about Argentex’s investments across 2022, as well as its expansion into new regions and products, and finding positives in an inflationary backdrop.

Argentex’s investment in product, technology and expansion

Daniel Webber:

Some really strong results and great revenue growth. What has been driving growth and the strong performance in the business?

Harry Adams:

We took the decision probably about 18 months ago to overhaul our strategy and we pivoted slightly in terms of starting to invest heavily into our product and technology. Clearly they come hand-in-hand, along with overseas expansion of people. So it is great to see the earnings showing that we generated revenue from all those initiatives and all those investments that are still in their infancy stage.

Picking out a couple, the Structured Solutions desk, which was probably generating about 0.5% of our revenue in 2020, grew to about 10% last year, so that’s great to see. Same goes for our online revenue. We’ve very much been a low-tech, high-touch broker in the past, but we’ve transitioned now to become more of a tech-enabled service provider that still has that high touch – we like to call it right tech, right touch – and seeing the revenue generation starting to come through from an online perspective is great.

These are green shoots but slowly and surely the revenue is becoming material and then, in terms of the overseas expansion, it’s great to see the Dutch and the European offices starting to start generating what we call meaningful revenue. I’m really excited about where that’s going to be going over the next year or so. Certainly a short-medium term.

Daniel Webber:

What does the mix that drives your revenue look like? How might that be changing?

Harry Adams:

We offer and give clients what they want. We’re not here to shoehorn products into the suite of hedging tools. So if a client wants to trade it forward, then we’ll let them trade it forward. So if you look at our last 12 months, it’s been broadly in line with prior years. The only difference is that Structured Solutions is starting to generate more of the overall group revenue.

Winning high-value customers from banks

Daniel Webber:

Your business is higher-value payments. Is that the group you are focusing on?

Harry Adams:

Spot on. We’ve always been focusing more on the sophisticated end of the market. It doesn’t need to be sophisticated, but when we look to onboard clients, they’re trading a few million to a few hundred million pounds of foreign exchange a year. So inherently they do tend to be a little bit more sophisticated.

They want to have their hand held through the process, they want to be able to speak to an FX specialist regarding their hedging strategies, having all of the possible outcomes presented to them is important. And therefore we do like to spend more time on the bigger number, bigger ticket item. So I think our average trade size online is about £100,000 and our average trade size offline is about £500,000-£600,000.

Daniel Webber:

Who are you winning customers from?

Harry Adams:

Banks really are our main focus right now. They’re offering poor, rigid pricing; a lack of flexibility and service; and just to onboard with the bank can now take six to nine months. So that’s really where our focus is and where we’re spending our time and resources.

In terms of non-banks, there are plenty out there but quite frankly the market is absolutely vast and it’s only growing. Still, it’s expected that around 80% of corporates are trading with their relationship bank and that’s in the UK alone. So with our credible licence in the Netherlands, that allows us to then push out towards mainland Europe, which is where I see quite a significant opportunity to take market share.

Daniel Webber:

Are there any other changes you expect to make? Every economy is having a harder time but your revenue is going up and your clients seem to be doing reasonably well.

Harry Adams:

There are a few elements to that, but ultimately an inflationary backdrop is actually positive for a business like ours. First of all, the clients should be trading more notional given inflation. You’ve seen interest rates hiked across the G7, globally really, and that creates not only volatility in the market, but there’s a cost to carry between those currencies. We are able to benefit from that and really, having FX and the economy on the front pages of the paper puts it to the front of clients’ minds.

We’re able to demonstrate that we can offer a solution to a conundrum that is often swept under the carpet in boardrooms because no one really has that expertise. Clients are willing to give us a chance and now we have that tech element to compliment that high service, that high touch that Argentex has built a very successful business from. It gives us a new opportunity to start garnering even more market share.

Offering an alternative banking product

Daniel Webber:

Talk us through the new alternative banking product.

Harry Adams:

It’s the unsexy elements of what we do. It’s there to offer clients’ a multicurrency, virtual IBAN, so one account number in the client’s name that has up to 15 currencies. Clients are able to hold and pay out of these accounts. The accounts are all held with tier one banks. It’s there to compliment our core business, which is obviously that foreign exchange element.

So we are really on that road to providing a full treasury or full global treasury solution over that short-medium term. We’re still investing heavily into the technology, we’re bringing on the new products, but we needed that alternative transaction banking element to allow clients to hold their deposits.

Daniel Webber:

It’s an interesting dynamic because in one sense you’re working closely with the banks and then there’s another division of the banks you are competing with. How do you think about that?

Harry Adams:

You’ve got to remember that the banks’ are a mile wide and an inch deep. And these tier one banks that we do partner with, we are doing them a service. They make money from us, we’re doing a lot of the leg work. Onboarding is a serious headache for these big American banks.

We are able to onboard the clients and take a lot of stress and time away from them and still give them a chunk of the foreign exchange or the transaction banking business. I think their view is that they might as well get some of the pie rather than none of it.

Argentex’s investment year

Daniel Webber:

Anything else you want to cover?

Harry Adams:

Yeah, we changed the year-end because we’re a global business now and it was one of the requests from the Dutch National Bank.

We had December as year-end and it made sense so we had to do it at some point. But I think the main takeaway is that we are on a journey. We have invested heavily into technology, people, products, our overseas expansion. We clearly articulated to the market that we were going to be in an investment year in calendar year ’22 and ’23. Nothing’s changed.

We’re sticking to the script, obviously with a bit of flexibility. The market’s absolutely enormous and so we’re looking to continue to take market share and as long as we’re onboarding more clients that are trading more currency, who are taking more of our products, clearly we will be in a good place for ’23 and ’24 and beyond.

Daniel Webber:

Thank you.

The information provided in this report is for informational purposes only, and does not constitute an offer or solicitation to sell shares or securities. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. Accordingly, this work and its contents do not constitute investment advice or counsel or solicitation for investment in any security. This report and its contents should not form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FXC Group Inc. and subsidiaries including FXC Intelligence Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this report, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting there from. This report and the data included in this report may not be used for any commercial purpose, used for comparisons by any business in the money transfer or payments space or distributed or sold to any other third parties without the expressed written permission or license granted directly by FXC Intelligence Ltd.