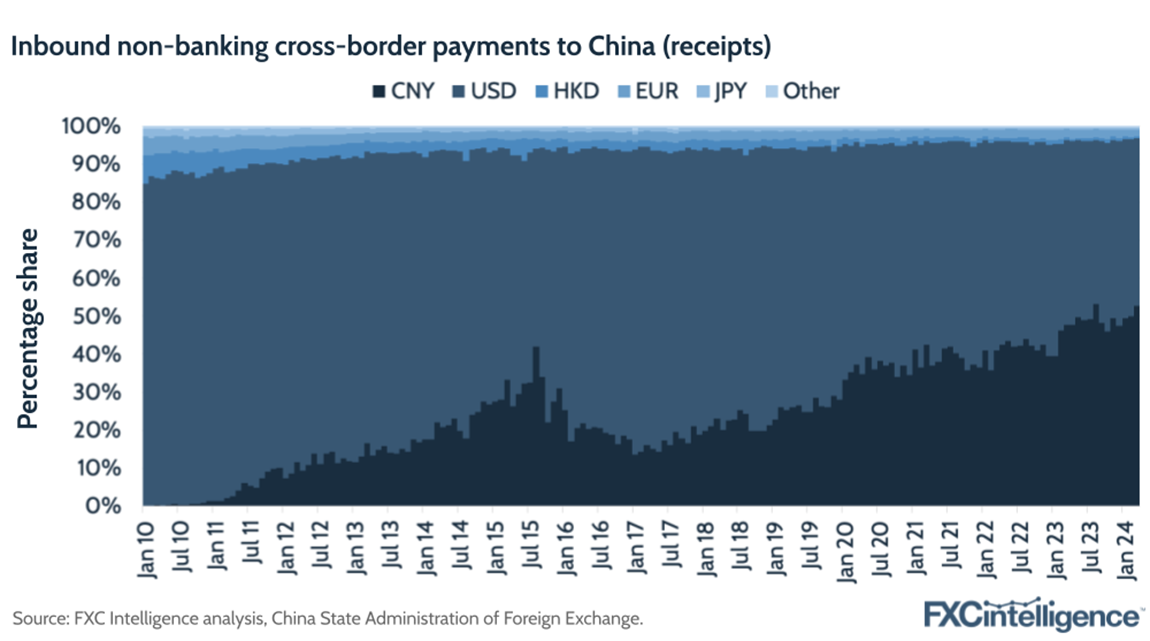

China’s State Administration of Foreign Exchange has reported that the volume of outbound cross-border payments made in yuan (RMB) outstripped those made in US dollars in April, at 48.5% of outbound volume in yuan compared to 45.2% in dollars. This is the second month in a row the yuan has exceeded the dollar in outbound payments. Meanwhile, the yuan remains narrowly behind for inbound payments – at 47.8% yuan versus 48.2% dollars – although the gap has closed significantly since the start of the year and if current trends persist, the yuan will pass the dollar within a few months.

This represents a significant increase in the share of cross-border payments made in yuan over the past 13 years. At the start of 2010, the yuan had 0.5% share of outbound cross-border payments, while the US dollar held an 80.7% share. For inbound, this was 0.2% and 84.7% respectively. However, the yuan saw significant gains in share from mid-2010 and by the start of 2012 was consistently taking over 10% of outbound volume, reaching a quarter of all outbound payments in mid-2014.

The vast majority of this share has been taken from US dollars, although the euro and Japanese yen have both been impacted. At the start of 2010, they accounted for 7.3% and 4.4% of outbound volume respectively, but by April 2023 this had dropped to 2.9% and 1.2%. Foreign currencies combined still slightly outmatch the yuan, totalling 51.5% of outbound volume for April, but are also on course to be passed within months.

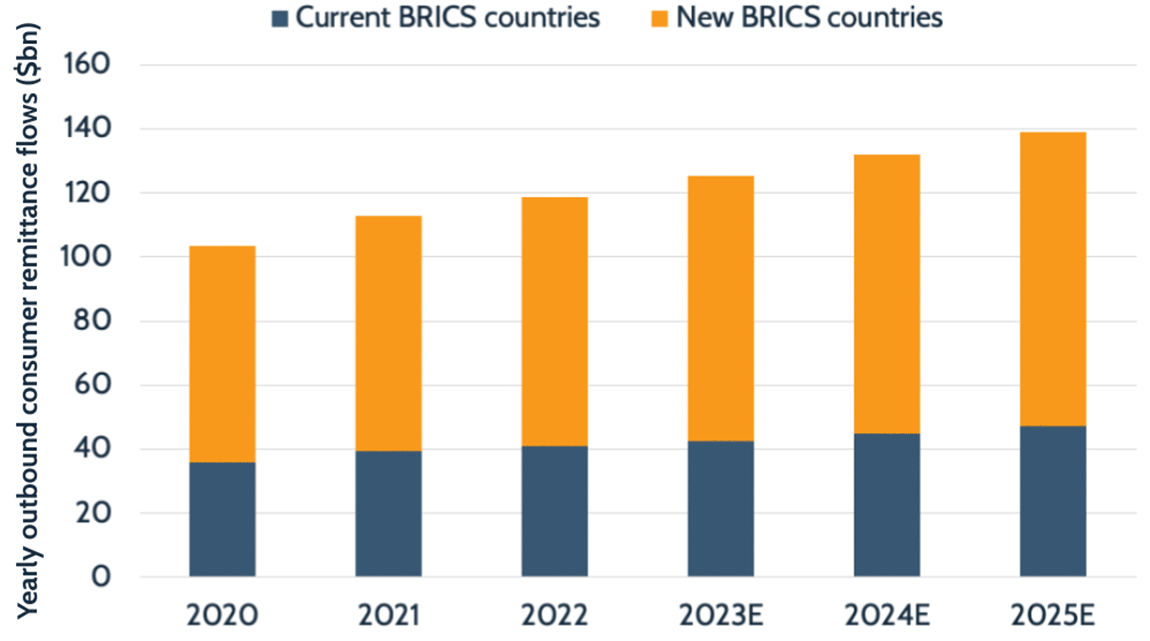

The shift comes amid wider discussions around de-dollarisation, particularly among key BRICS countries, including India and China. The Russia-Ukraine war’s impacts on the world’s financial system, and in particular the effects of the sanctions on Russia, have increased interest in reducing reliance on the US dollar and highlighted security concerns around its use as the world’s reserve currency.

Meanwhile, the end of pandemic-related restrictions in China has prompted a bounce back in travel from China, as well as related cross-border sales to the country, particularly for luxury brands. This has also been accompanied by an increased acceptance of Chinese payment types such as Alipay, as brands look to lure Chinese travellers to their products and services.