Slowly and steadily, we’ve seen the major UK and US players expand into Europe. Patterns are beginning to emerge…

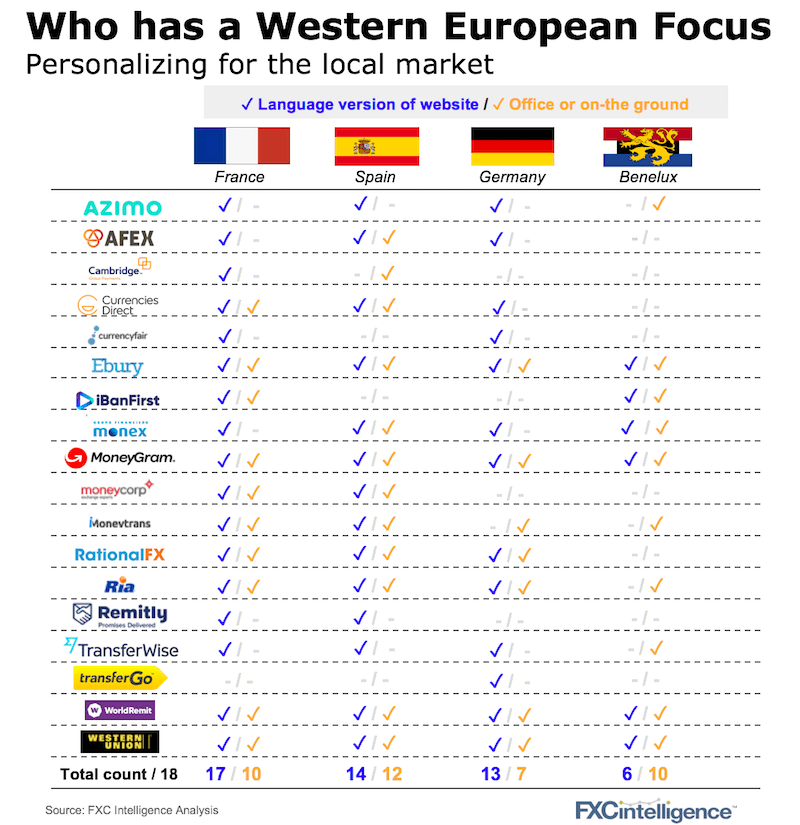

Offering language expertise (our blue check mark) is often the easiest way to test demand. Online only players tend to be fortunate to not need a physical presence. But cash remittance players, high-end private and those wanting to build real B2B relationships need to be face to face with their customers on the ground (orange check mark).

The French are in the lead

In terms of Western European coverage, France is the clear leader, with Spain not far behind. Germany with its tighter-knit regional banking network and often competitive banks has been a little harder to crack.

Belgium, Luxembourg and Holland have begun to emerge, driven by the corporate opportunity for B2B players and the Brexit back-up opportunity for some others (Belgium or Dutch registration).

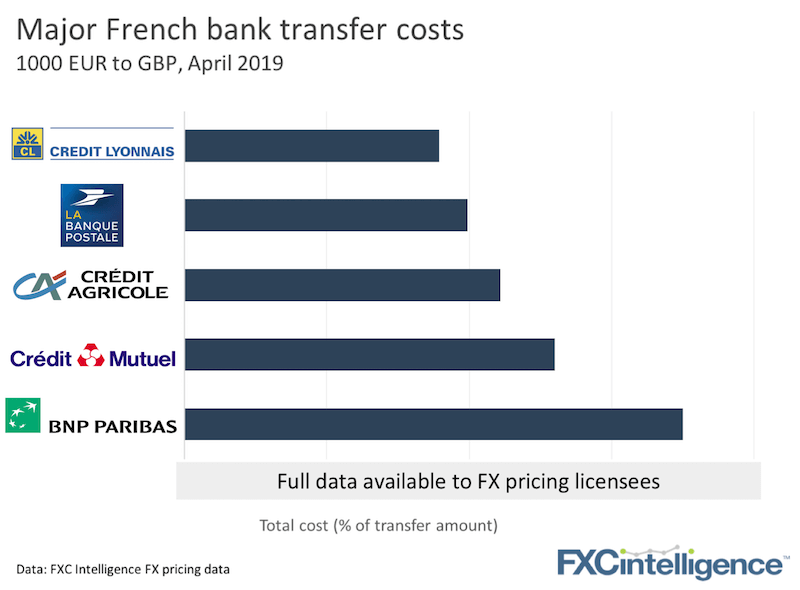

How expensive are the French banks?

As France is leading the way, we have recently added coverage of the French banking sector to our pricing products (we have some Spanish and German coverage too).

Like many Eurozone countries, French bank prices tend to be lower than in the UK, and certainly lower than the US. However, there is still a relatively wide distribution among the large banks along even major channels, such as EUR to GBP.

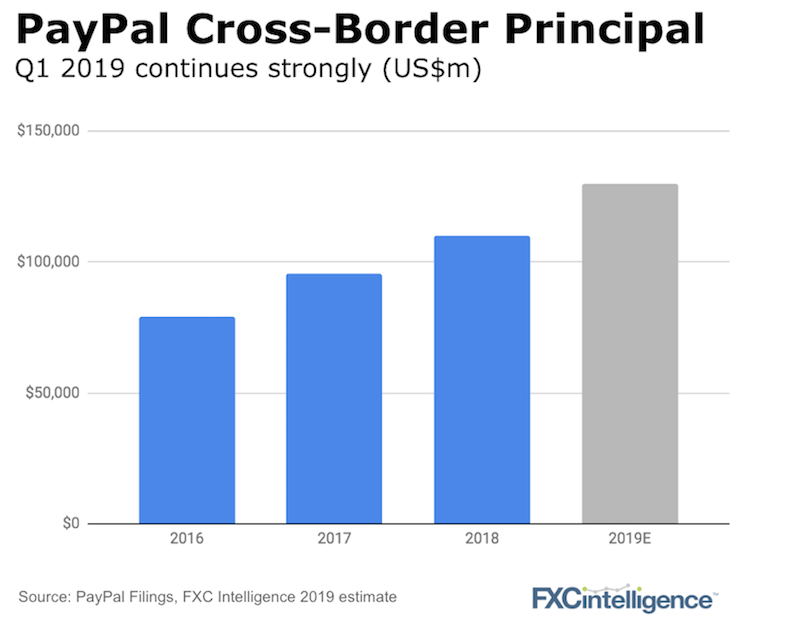

PayPal growth continues

PayPal released its Q1 results late yesterday and its numbers continue to look strong. International revenue is driving growth and we estimate that PayPal’s total cross-border principal could grow to $130bn for 2019.

The other interesting number reported was the exceptionally strong trend of Venmo, its US peer-to-peer product, reporting 73% growth and $21bn of total flow for the first quarter of 2019.

Also of note was this comment from PayPal CEO Dan Schulman’s towards the end of the Q1 earnings call: “…we see international as a tremendous opportunity space for us. And if I take a step back, we’re willing to invest in companies or acquire companies that we believe advance our strategic agenda … we do want to be the leading global digital payments platform.”

As we have repeatedly said, for many companies in the space, and especially those focusing on SMEs, PayPal may be your biggest competitor.

J.P. Morgan’s blockchain dream

An announcement of J.P. Morgan (JPM) launching the JPM Coin was initially met with a very mixed response. If it was just PR, JPM is doubling down on the blockchain. It is pushing its Interbank Information Network as a means for banks to communicate on payments messaging, specifically to improve settlements and straight through processing.

JPM claims to have 220 banks signed up, which will now put it in competition for messaging with both Ripple and Swift (who just announced a new CEO).

As JPM is building what it calls an ecosystem, it will come up against the same challenges as Ripple does, where the value in the network is the size (and reach) of the network. As our previous analysis on correspondent banking shows, there is still a long way to go.

[fxci_space class=”tailor-6332de77772e8″][/fxci_space]