The world has been abuzz about tariffs. What started as a relatively short list imposed by the US (primarily on steel and electronics) has since escalated into a 200-page document released by the US last week specifically targeting China. China has promised retaliation.

The history of tariffs in the United States is extensive, with economists still debating whether the Smoot-Hawley Tariff Act led to the Great Depression. Tariffs are designed to shift demand towards domestic producers and away from foreign ones. What does this mean for the international payments industry? Should they prepare for less business, or is it time to get creative about where new opportunities lie?

A look at steel

Trump’s 200-page list is vast, with tariffs being placed on over 1,300 Chinese products, ranging from yarn to frog legs. The electronics industry, farming and agricultural industries are especially targeted in this most recent list.

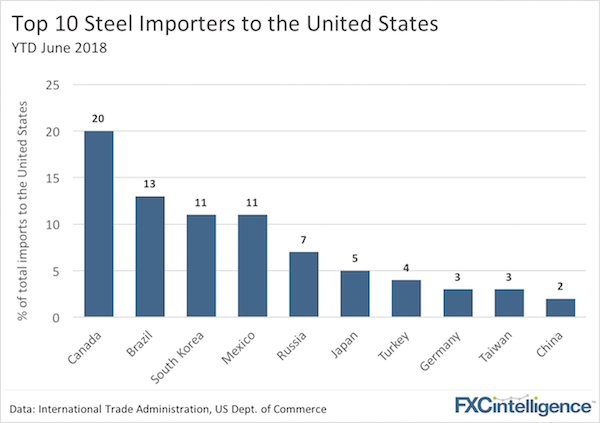

Trump’s initial tariffs on steel and aluminium in March are a good indicator as to how tariffs may impact international payments. Trump’s recent tariff list is targeted at China, but his initial tariffs extended far beyond China. Below, we have taken a look at one industry being impacted by tariffs – the steel industry.

Based on the chart above, it seems that Canada will be the hardest hit by steel tariffs. This is somewhat reflected in the CAD-USD performance as of late, with the Canadian dollar in a slump despite rising oil prices.

The knock-on effect of this is a reduction in the demand for CAD-USD international payments as US companies switch their sourcing to domestic suppliers and Canadian steel makers receivables decline.

A final knock-on effect in this chain to consider is which sectors that have products made using US steel may now see increased exports to China – the ultimate goal of the current US tariff policy.

What about international payments?

As tariffs are meant to discourage international trade, a natural result of tariffs will be less international payments. International payment companies should plan on payments slowing down, and begin exploring alternative customers and industries that escaped tariffs.

Not all hope is lost for international payment companies.

There will be countries that continue to export their goods to the US. Additionally, much of the supply chain for US industry consists of foreign-made goods. (Think: American cars with Chinese batteries).

The role of international payments companies may switch. A solid currency strategy will be an effective way to cut costs for companies that continue to trade internationally. For those countries and companies that continue to export their goods to the US, international payment companies may have found a new list of SME leads.

For international payment companies, surviving the US-China Trade War (and any broader Trade War) will be about three things:

- Finding the right targets and sectors that are less exposed to tariff risk

- Looking for opportunities on the other side of the Trade War where exports may be increased

- Understanding how much of your current book of business is exposed to tariff risk and how to mitigate this

[fxci_space class=”tailor-6331aa1bd19a8″][/fxci_space]