Western Union and MoneyGram reported their Q3 results this past week. It makes for better reading in Denver than in Dallas. WU’s shareholders pushed the stock up around 6%, while 15% was knocked off MoneyGram’s price once the earnings went public.

Why?

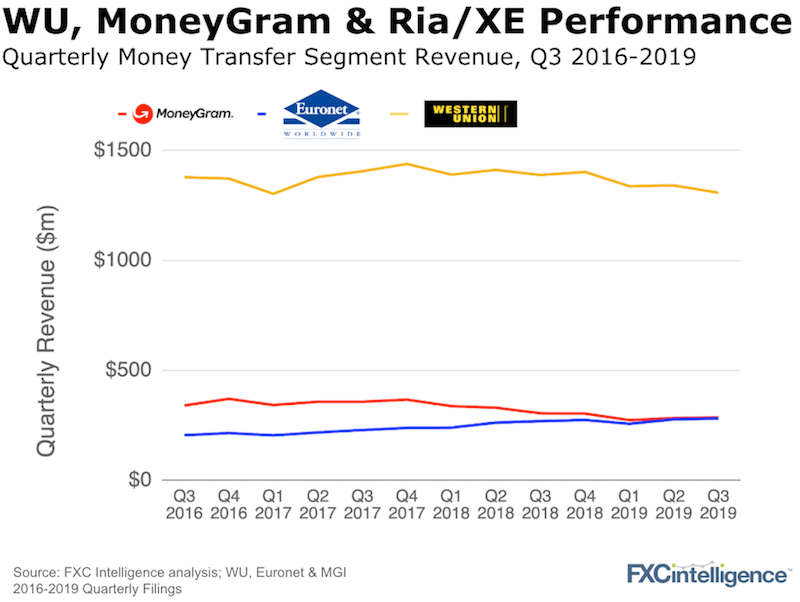

Both Western Union and MoneyGram’s core business is at best flat. Digital remains the growth area in both businesses, counter-balancing the movement away from traditional cash to cash. Western Union is also pursuing its platform play which investors are responding to. MoneyGram continues to try to right the ship and investors remain unsure.

Western Union’s results

- While the strong dollar has hurt WU’s top line revenue (especially from Argentina), its digital business and white-label deals are mostly making up for this.

- Overall consumer-to-consumer revenues grew by 1%. Digital grew 16%, and cross-border digital as a segment was up 25%. Westernunion.com’s rollout to 75 countries is helping to drive this growth.

- Western Union Business Solutions (a competitor of Ebury) was up 3% driven by stronger European demand.

MoneyGram’s results

- Downward pressure continues in the domestic US to US business and US outbound because of the cheaper alternatives such as Venmo and Zelle, the new fintechs and a tougher Walmart deal (competing with Ria).

- MoneyGram’s US products were their higher margin ones and whilst their international segment is growing again (7% year on year), margins are much tighter and scale alone may not raise them.

- Digital continues to grow at 20% year on year.

Pricing pressures

Pricing is becoming an increasingly complex and necessary tool to drive margins and acquire customers. We see both companies using a variety of different pricing strategies to fulfil these goals.

Get in touch with us to understand this pricing, as well as their competitor’s pricing data.

[fxci_space class=”tailor-63331015d77af”][/fxci_space]