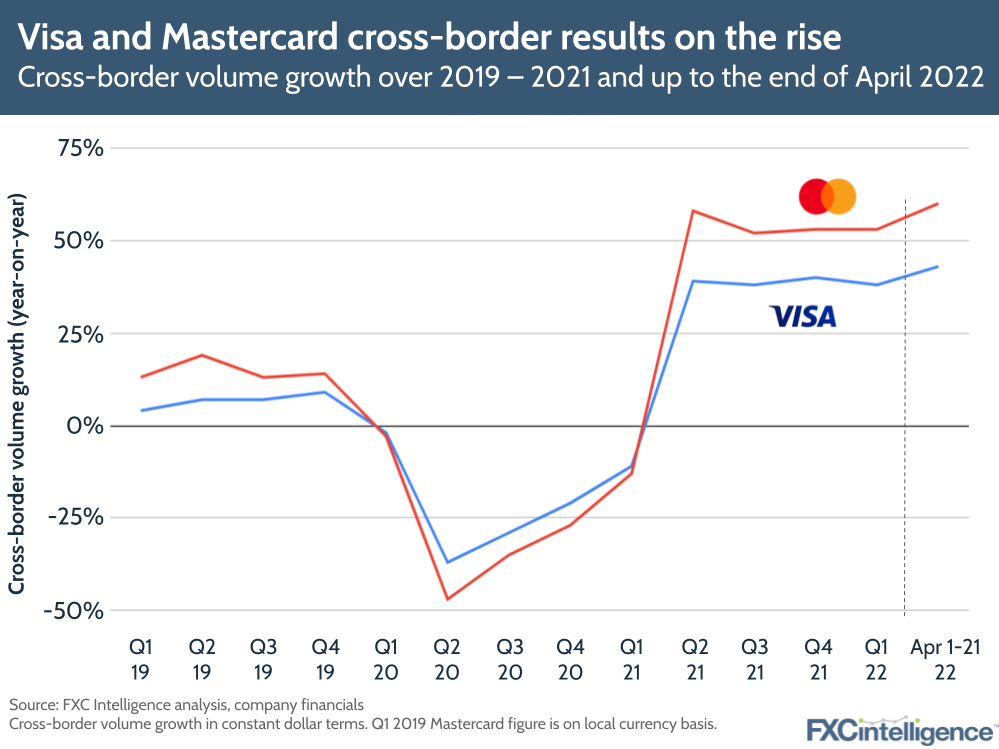

Visa and Mastercard have announced their latest earnings – Q1 2022 for Mastercard and Q2 2022 for Visa. Despite suspending services to Russia, both companies have reported strong net revenue growth, largely driven by cross-border volume increases linked to a return to travel.

Visa Q2 2022 earnings

- Visa achieved net revenue growth of 25%, driven by the year-over-year growth in payments volume, cross-border volume and processed transactions.

- Cross-border recovery has been stronger than Visa expected, with a YoY growth in cross-border volume of 38% (just shy of 40% in the previous quarter).

- After a dip in January due to Omicron, the return to travel is spurring cross-border growth, with cross-border travel-related spend (excluding intra-Europe) growing 111% year-over-year. The company now expects this to fully recover to 2019 levels by the end of its fiscal year.

- Visa Direct continues to show strong growth with transactions up 20% in the quarter. With 17% of transactions originating from Russia in 2021, that reduction is having a short-term impact but the cross-border segment overall for Visa Direct is up 50% YoY.

- Visa is no longer generating domestic or cross-border revenues in Russia, which it expects will reduce its second-half revenues by about 4%. However, the company said that the Russian invasion hasn’t dented other corridors, adding that its three growth engines (consumer payments, new flows and value-added services) all grew revenues well over 20%.

- The cash displacement trend continues, with Visa reporting there were 7.9 billion more payment transactions and 16 million fewer cash transactions across debit and credit, year-over-year.

- On crypto, the company continues to assist countries with the development of CBDCs and said that its global crypto advisory practice, launched last quarter, had seen interest from ‘hundreds of clients’ globally.

- Visa has set its sights on the Persian Gulf, partnering with Al Muzaini Exchange, Enjaz and LuLu Money to digitise remittances in the region, home to the two of the biggest remittance source countries, UAE and Saudi Arabia.

- Going forward, the company expects a strong FY22 due to accelerated digitisation of merchant payments; cash, check and wire transfer displacement and growth across value-added services.

Mastercard Q1 2022 earnings

- Mastercard saw net revenues of $5.2bn, an increase of 24% YoY, with one of the biggest drivers being its cross-border volume growth of 53% on a local currency basis.

- In the first three weeks of April, cross-border travel was up 179% YoY, up 38% versus Q1. Mastercard is capitalising on the travel boom, renewing its partnership with American Airlines and launching two new Mastercard Avios cards with Barclays and International Airlines Group, Loyalty.

- The Asia-Pacific has been slower to recover cross-border travel volumes. However, the company said that cross-border overall is still ‘very sound’.

- Mastercard excluded sanctioned Russian banks from its data, but it said that the suspension of services had had a ‘minimal impact’ on growth. This is because the loss of volume was offset by a one-time benefit of lower rebates and incentives, due to the absence of a customer incentive agreement renewal in Russia.

- Mastercard remains optimistic about cross-border payments going forward, with cross-border volumes through the first 3 weeks of April growing 60% YoY, up 7% versus Q1.

- The company is pushing harder on crypto, with a focus on helping customers safely buy crypto and spend crypto holdings via Mastercard Send, as well as providing consulting services and preparing its core network to support digital currencies. After the launch of the Gemini and Nexo cards, Mastercard mentioned it was pursuing further international crypto card partnerships in Europe and Latin America.