Ukraine has historically been one of Europe’s biggest remittances destinations, but in the wake of Russia’s invasion in 2022, the country’s central bank has reported a quarterly decline in remittances – spanning both income for short-term workers abroad and personal transfers. We explore the figures to find out how Ukraine’s money transfers market is changing over time.

The National Bank of Ukraine defines remittances as “household income from foreign economies arising mainly from temporary or permanent migration of people to these economies”. This definition comprises two segments: the net income of short-term workers who are employed outside the Ukraine for less than one year (or are employed by a non-resident entity) and personal transfers, which includes transfers in cash or in kind received by resident households from non-resident households. Across all its figures since 2014, the country has excluded territories in Ukraine that have been temporarily occupied by Russia.

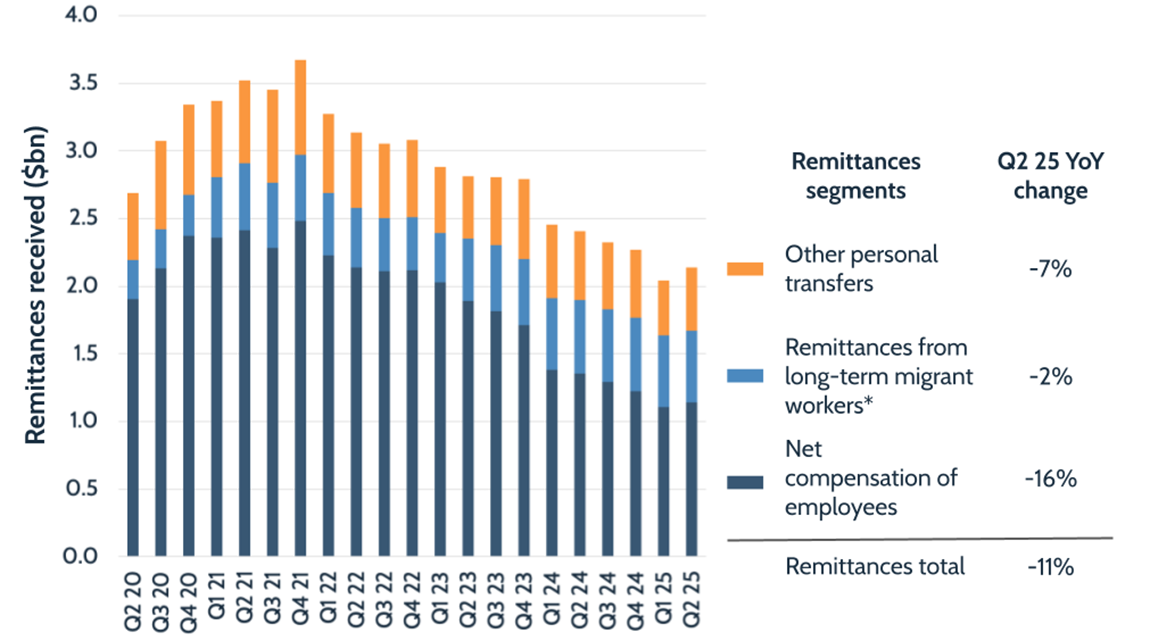

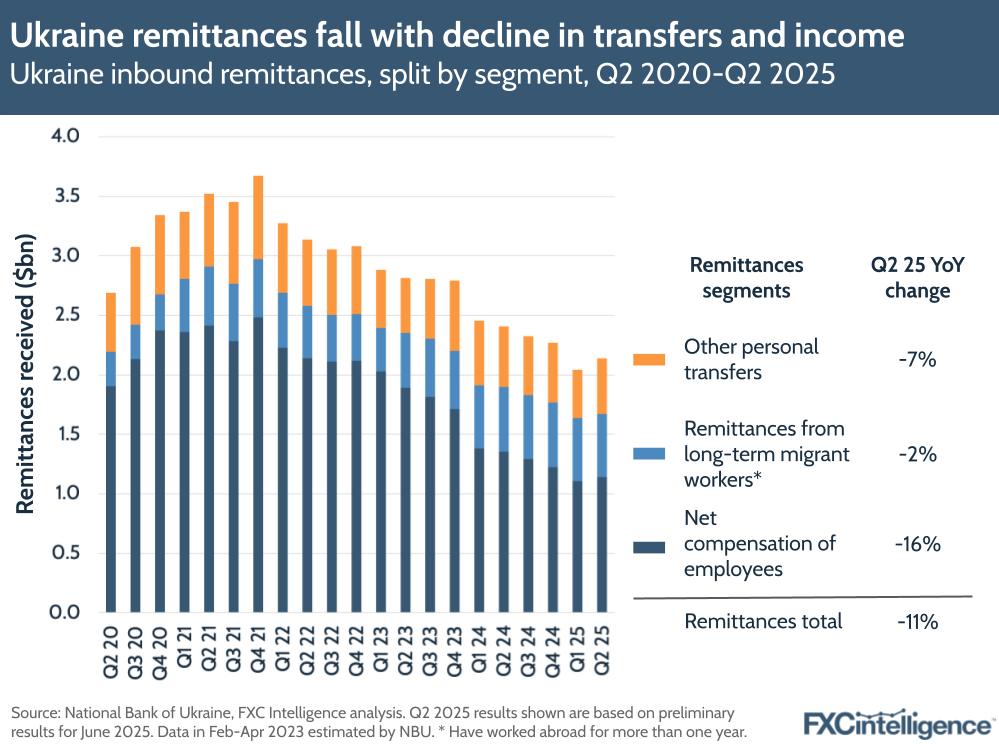

Net compensation (i.e. income) for employees fell by 16% in Q2, while personal transfers overall fell by 4%, including a 2% decline in remittances from individuals who have worked abroad more than a year, and a 7% decline in other transfers. Overall, Ukraine saw remittances decline by 11% YoY to $2.1bn in Q2 2025, based on calculations using the most recent data available (preliminary monthly figures for June 2025).

However, over time, personal transfers have been more resilient than net income and have grown their overall share of the remittances total, accounting for 47% of remittances overall in Q2 2025, versus 44% in Q2 2024 and 33% in Q2 2023. This could indicate the more permanent settling of the Ukraine diaspora abroad, with remittances coming from longer-term integration into foreign labour markets rather than seasonal work.

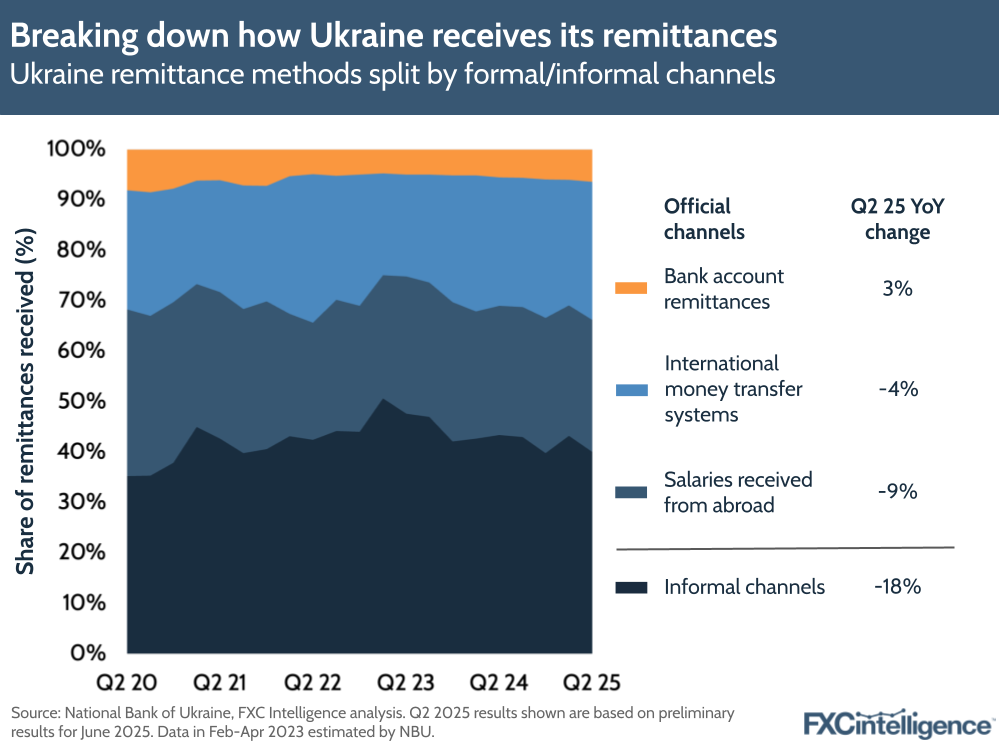

Ukraine also breaks out its overall remittances figure into ‘informal channels’ – money or goods being carried across borders – and ‘official’ channels, which includes salaries received from abroad as well as remittances through bank accounts and international money transfer systems.

Remittances through official channels fell by 6% in Q2 2025, though this was slower than an 18% drop in informal channels. Official channels currently make up around 60% of remittances to Ukraine, though this is lower than the 65% share seen in Q3 2020, when remittances through money transfer providers to the country spiked in alignment with the Covid-19 pandemic. Remittances through international money transfer systems, overall, have grown their share of the total over time, from 19% in Q1 2020 (prior to the pandemic impact) to 27% today. Over the same period, bank account-based remittances have seen their share fall from 8% to 6%.

Ukraine has also seen a shift in the countries sending remittances. Poland remained the largest sender in 2024, having contributed $3.3bn or 35% of the annual remittances total ($9.5bn). However, the amount sent was down by 21% compared to 2023.

Of the four next highest remittance senders to the Ukraine, the US, the Czech Republic and Germany all sent less in 2024, though the UK saw a 3% rise. Over time, the US and UK have become much larger contributors to Ukraine, with the US contributing 12% to remittances totals in 2024 and the UK contributing 9% – versus 8% and 4% respectively in 2018.

While Ukraine’s overall volumes have declined since the early years of the war, flows are shifting away from short-term worker income and informal channels, toward more personal transfers and official systems. The rise of international money transfer providers and the diversification of sending countries may reflect how Ukraine’s diaspora is changing, but also how remittances are formalising globally.