Swift has finally migrated its payments messaging system to comply with ISO 20022 – the global standard for financial messaging that is designed to enable better interoperability and data sharing between banks.

Back in March 2023, Swift enabled banks and financial organisations to begin sending and receiving ISO-compliant MX messages – its new format for the messages that essentially instruct both parties on how money should be moved for customers. The previous format for these messages, MT, isn’t standardised, meaning banks fill them in inconsistently or interpret them differently. This often results in payments delays and costly manual interventions.

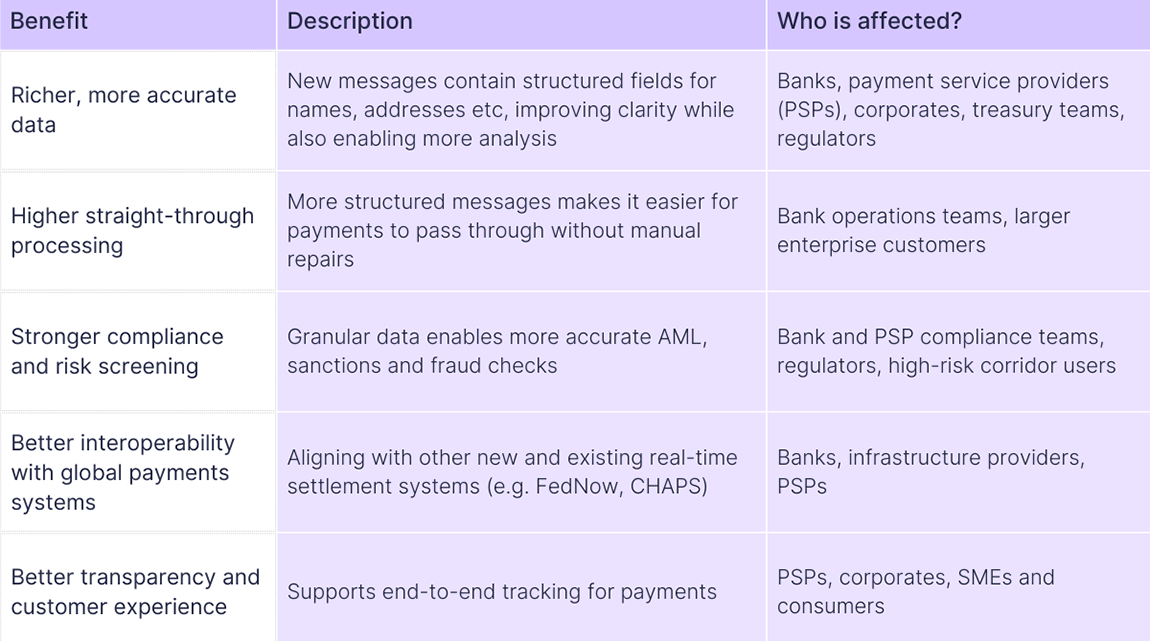

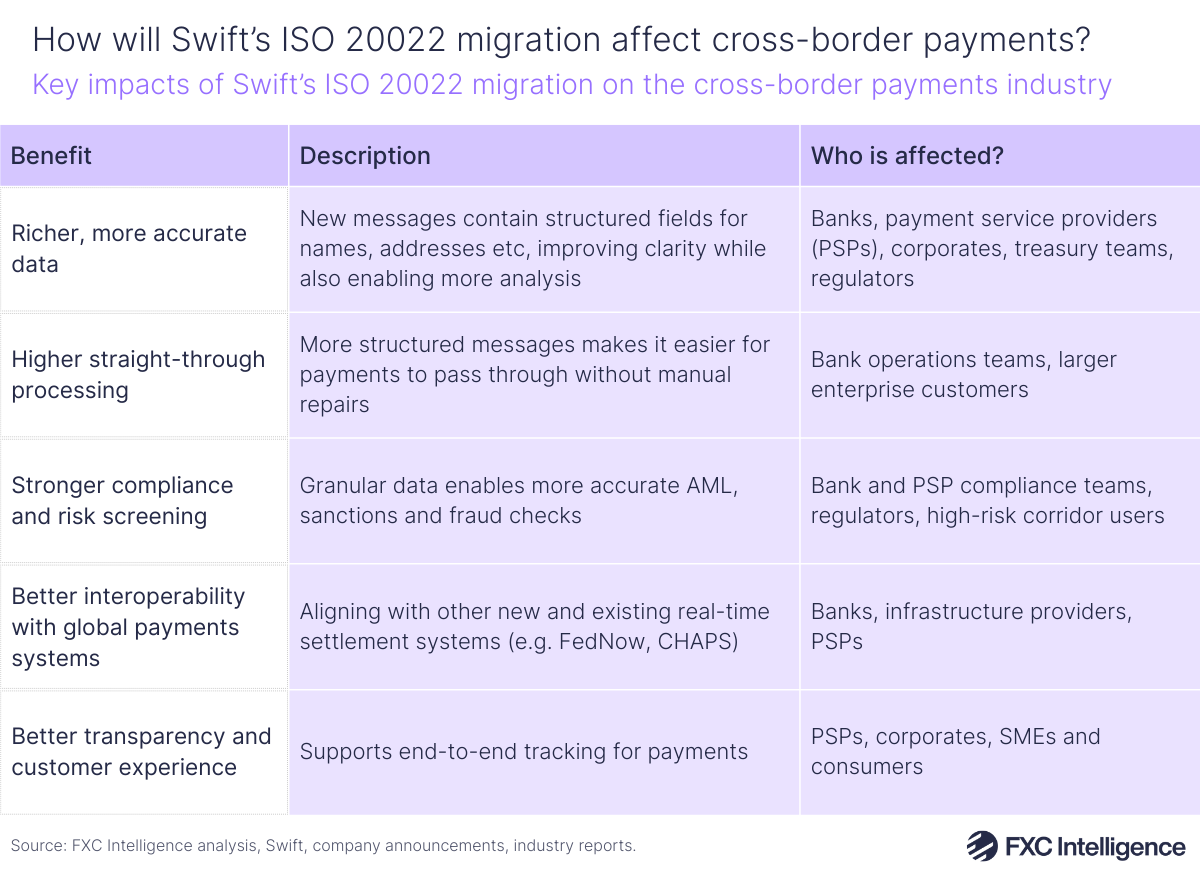

The new MX format, however, contains structured, clear and standardised information that Swift claims provide a host of benefits for banks. In short, payments can be more easily automated and settled faster, manual checking is reduced and fraud is easier to spot. Swift also says that enhanced remittances data accrued with each transaction can help banks in other ways (e.g. developing new products). As discussed in our recently updated report, the bottom line for financial institutions is more efficient, timely and less costly transfers, with other benefits stemming from this for corporates and consumers.

From 2023, Swift had enabled a ‘coexistence’ period, under which banks using its service had to be able to at least receive MX payment messages. However, from 22 November, institutions sending across borders now need to be able to both send and receive messages. Preparing for this change has been a challenge, with banks having to overhaul legacy payments infrastructure to comply with the standard. This includes changing compliance and screening, introducing new data structures and testing – all of which has cost significant time and money.

Swift delayed its migration twice to allow banks to catch up, though reports this year indicated that it was unlikely some banks would be able to complete their ISO 20022 migration by the deadline. Having said this, a press release from Swift highlighted that on 24 November, 97% of payment instructions sent through its platform were sent using ISO 20022, though banks can use a service to convert remaining MT instructions to ISO 20022 for an unspecified period of time.

Completing the migration marks a significant step for Swift, but it could take some time for the benefits to be seen as banks continue to adjust to the new system, with some inconsistencies seen across markets in the near future.