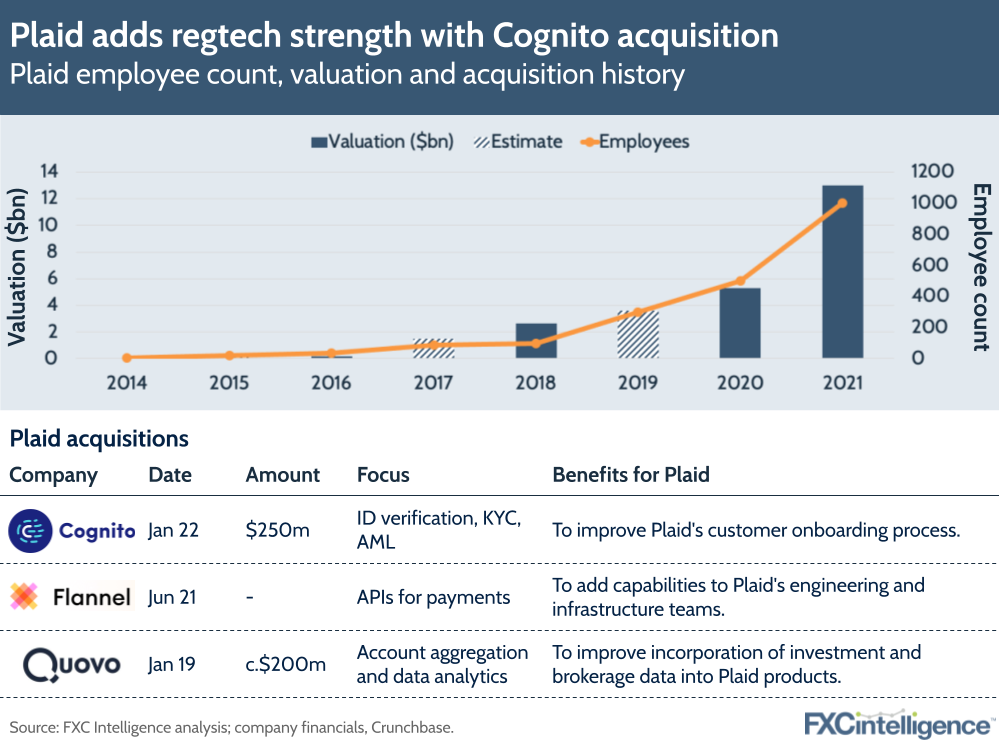

Open banking major Plaid has announced it is buying Cognito, a regtech startup, for $250m. As just the third acquisition from Plaid, it is an interesting purchase for the company – and provides a sense of its future strategy. Several years ago, regtech was all the rage, now it’s mostly just another part of the payments ecosystem.

It’s just a year since Plaid’s acquisition by Visa was blocked by US regulators, but the company has grown its value significantly in that time, and now looks to be shoring up its foundations for a long-term future as a standalone company.

Its acquisition of Cognito is potentially key to this. The regtech provides services such as identity certification all well as support for KYC and AML regulations – key challenges for Plaid’s customers and a thorny group of issues to solve. The open banking provider will be adding Cognito’s capabilities to its core offering, adding increased benefits for its clients that supplement its primary services, and so providing additional revenue per customer.

As a motive for an acquisition, it’s fairly similar to the other two Plaid has made. Last year Plaid acquired Flannel, which saw it gain new capabilities in the form of real-time payments and push-to-card APIs. It also added top-tier engineering talent as Flannel’s founders were early engineering hires at Robinhood with significant payments experience.

Meanwhile, Quovo, acquired in 2019, was added specifically to increase Plaid’s support for products incorporating investment and brokerage data.

Such acquisitions suggest Plaid is not looking to buy companies to grow into specific regions, but to allow it to better meet the needs of existing clients and increase its appeal for potential ones. It also indicates that Plaid is looking to increasingly broaden its services and becoming something of a B2B super app for its customers.